Trade life cycle is a basic investment banking process covering all of the phases between origination and settlement of trades. Reconciliation also plays an essential role to provide accurate transactions, minimize risk, and uphold the integrity of the financial market. Knowledge regarding trade life cycle within investment banking assumes a prime function in serving people who would be interested to become a career specialist in investment banking because this would make managing tricky trade flow and differences really straightforward.

The rise in demand for reconciliation professionals has rendered investment banking courses like the Certified Investment Banking Operations Professional (CIBOP™) course priceless. The blog will include a detailed study of the trade life cycle, its major stages, and the contribution of reconciliation to the finance sector.

Understanding the Trade Life Cycle in Investment Banking

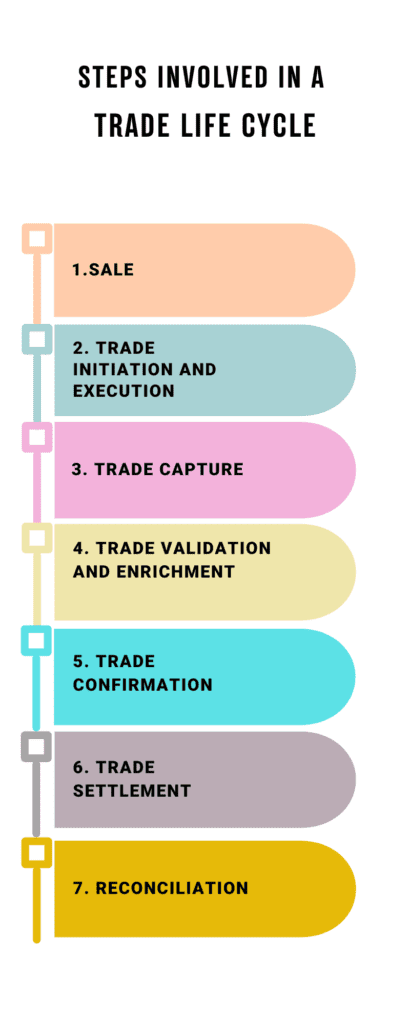

1. Trade Initiation

Trade initiation is the initial stage in the life of a trade, when there is a trade between a buyer and a seller. It is carried out through exchanges, electronic trading platforms, or OTC transactions. In this phase, information regarding the trade such as the asset type, amount, price, and counterparty details are documented. Proper documentation and correctness of information are of utmost importance in order to prevent discrepancies and errors at the latter part of a trade’s life cycle.

2. Trade Capture

The trade is captured in the financial institution’s front-office systems when it is finalized. This means capturing the trade details in electronic databases such that all the parameters are consistent with the agreement that the parties have reached. Automated systems are utilized on a day-to-day basis to prevent human errors and ensure the integrity of the transaction process.

3. Trade Validation

Validation ensures all trade information to be correct and in line with in-house process as well as regulatory standards. Discrepancies identified here are resolved prior to going forward further. Transparency and potential loss or risk of processing the wrong trade at a consequential loss of money or regulatory reprisal is ensured through a process like that.

4. Trade Enrichment

Trade enrichment is a trade enrichment procedure of enriching incomplete information like settlement instructions, fees, taxes, and currency conversion in a way that the trade is effectively executed. Counterparty confirmation, regulatory validation, and risk control are included in this procedure as well to maximize processing as well as reduce efficiency.

5. Trade Confirmation and Affirmation

Trade terms are agreed and confirmed between the two parties to the trade. This is typically on electronic platforms, with confirmation agreed prior to settlement. Automated confirmation systems enable real-time verification and avoidance of failure of trade. Affirmation also assists in avoidance of misunderstandings between parties and financial regulatory compliance.

6. Trade Settlement

Settlement is the execution of the transfer of the asset’s ownership and cash exchange between parties. T+1 and T+2 settlement cycles regulate the settlement rate after execution of trades. Delayed settlements can lead to financial charges, high counterparty risk, and operational inefficiencies. Effective settlement mechanisms ensure market stability and smooth financial transaction operations.

7. Trade Reconciliation

Reconciliation is the most significant phase of a trade’s life. Reconciliation checks trade accounts to be synonymous both inside and outside an organization in order to avoid error and inconsistency in finance. Comparison of custodian reports, statements, and booking trades for divergence are a part of reconciliation. Periodic audit and reconciliation tests identify fraudulent trades, buggy booking, and lost trades, and thus contribute to the financial market safety.

The Importance of Reconciliation in the Trade Life Cycle

Reconciliation verifies the trade records, controls risk to finances, and imposes regulatory requirements. A few of them are mentioned below:

- Identification of Errors & Correction: It identifies the mismatches in the trade records and closes them on time.

- Regulatory Compliance: Gives the financial institution the compliance responsibility by maintaining actual trades.

- Operational Effectiveness: Eliminates human error and enhances the overall process flow.

- Risk Reduction: Reduces financial loss due to misdirected reported trades.

- Transparency & Accountability: Provides transparent audit trail of transactions and trades.

- Fraud Prevention: Stops fraud and other abuse of trading activity.

- Increased Investor Confidence: Enables transactions to be traceable and accurate, thus fostering confidence in financial institutions.

How an Investment Banking Course Can Help?

If you’re looking to build a successful career in investment banking, enrolling in a structured program like the Certified Investment Banking Operations Professional (CIBOP™) course can be a game-changer. This program offers:

- 100% Job Assurance with salaries up to ₹9 LPA

- 7 Guaranteed Interviews

- 60% Salary Hike on average

- Industry-Aligned Training covering securities operations, risk management, and AML

- 1000+ Hiring Partners offering lucrative roles

- Live and Classroom Training with flexible learning schedules

- Real-life Case Studies and Practicum Exposure to complement learning

- Industry-veteran Expert Faculty

- Soft Skills and Resume Building Sessions to enhance employability

FAQs

What is investment banking trade life cycle?

Trade life cycle entails several stages of a trade processing from beginning to settlement in order to ensure and regulate.

Why is trade reconciliation important?

Reconciliation provides accurate records of trade, avoids financial risk, and promotes institutions’ regulatory adherence.

What are the skills employed in trade reconciliation?

Experts need to have good analytical abilities, attention to detail, knowledge of financial markets, and experience in reconciliation software.

How long is the trade life cycle process?

Settlement cycles differ, generally following T+1 or T+2 processes, depending on asset type and regulation.

What are the career prospects after completing an investment banking course?

Graduates can be recruited as trade analysts, risk managers, operation specialists, and reconciliation specialists in top financial institutions.

What is the remuneration package for trade reconciliation professionals?

Recruits can be given approximately ₹4-6 LPA, while experienced professionals can be given up to ₹9-12 LPA.

How do I register for an investment banking course?

You can enroll with the CIBOP™ program at Imarticus Learning and acquire skills to be successful in investment banking.

How does reconciliation minimize financial risks?

Reconciliation reduces differences in trade records to minimize the risk of error, fraud, and financial misstatement.

Conclusion

It is absolutely necessary that an individual who would like to get into the career of investment banking must know about trade life cycle and reconciliation process. As markets become more sophisticated, knowledge about trade operations and reconciliation is very much in demand. Organizations are keenly looking for individuals with the ability to provide precision, regulatory compliance, and speed of trade operations.

With investment banking training in a program such as CIBOP™, you will be well equipped with the finance skills that will land you a high-paying job in leading financial institutions. With formal education, hands-on experience, and employment guarantee, CIBOP™ training gives you the perfect set of skills to address the demands of the financial marketplace.

If you want to enter the exciting world of finance, then now is the time to begin your career. Invest in the appropriate knowledge, build your skills, and begin on the path to a successful investment banking career today!

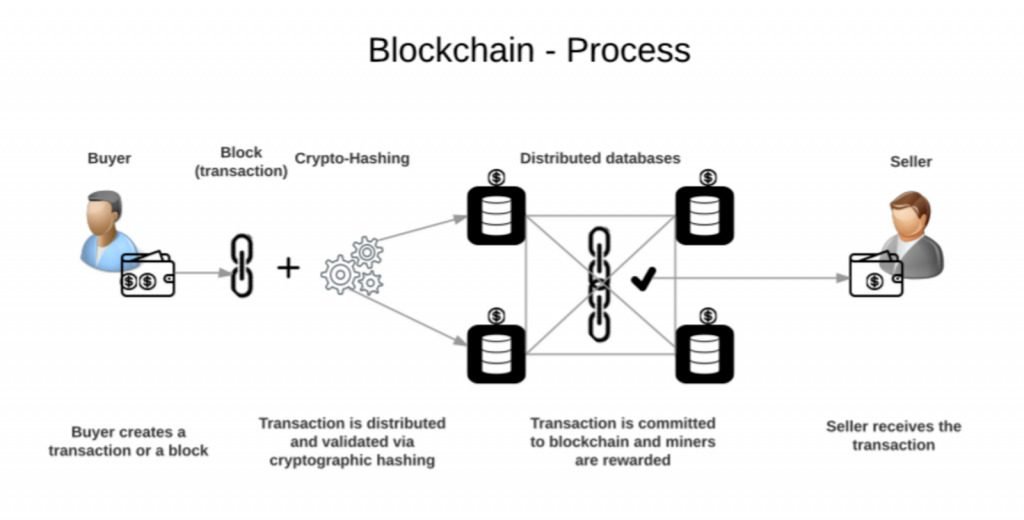

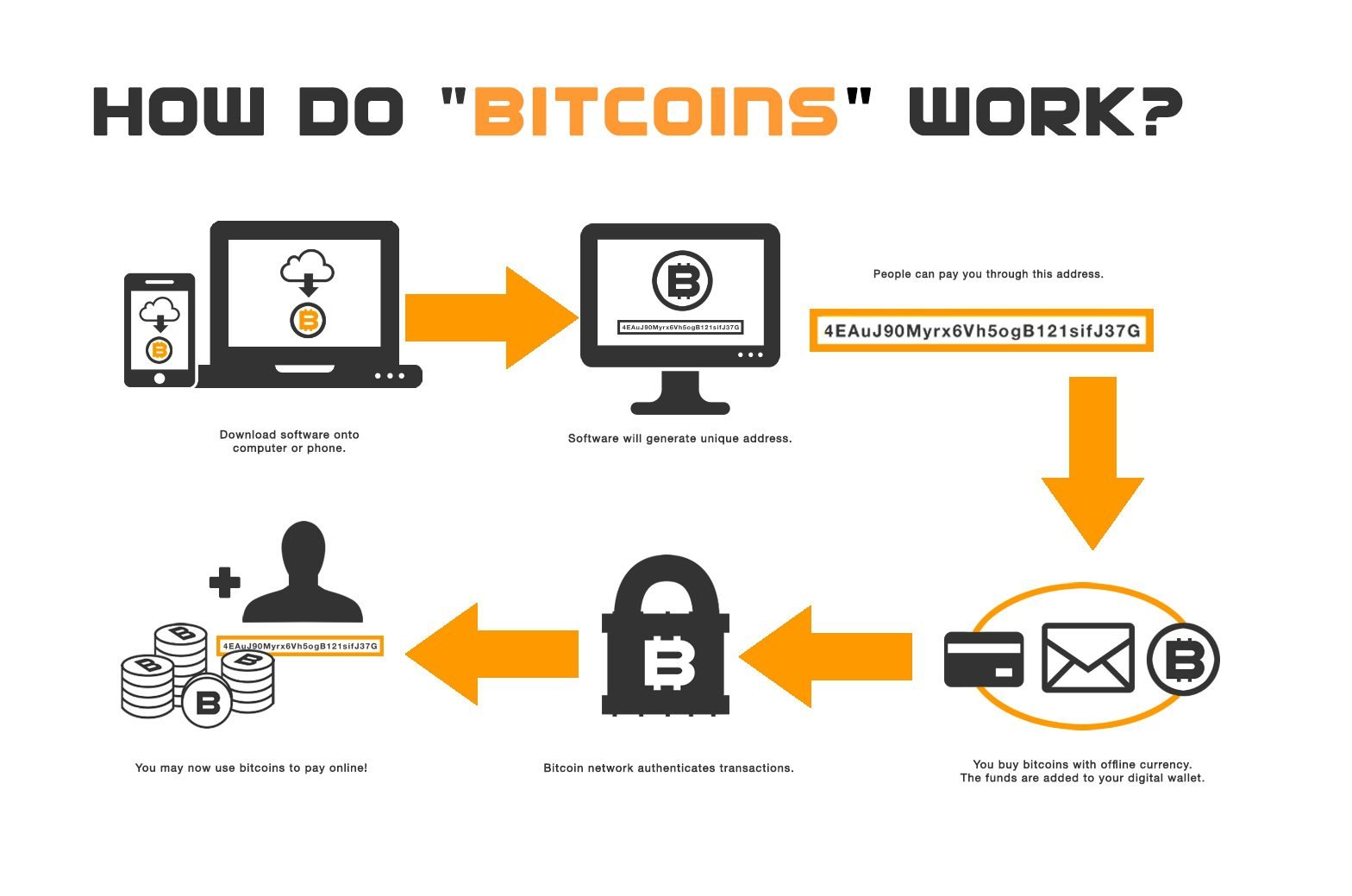

Most of the cryptocurrencies use Blockchain technology, which is decentralized and records transactions among computers. Cryptocurrencies are mainly used for

Most of the cryptocurrencies use Blockchain technology, which is decentralized and records transactions among computers. Cryptocurrencies are mainly used for  Further, cryptocurrencies are very much transparent. They have zero possibility of being stolen. The transactions can also be quicker and made with minimal transaction fees compared to banks or other financial organizations, which makes trade finance a much easier process.

Further, cryptocurrencies are very much transparent. They have zero possibility of being stolen. The transactions can also be quicker and made with minimal transaction fees compared to banks or other financial organizations, which makes trade finance a much easier process.

Underlying assets are used to find the value of financial instruments. Such instruments are called derivatives. The underlying asset that is used to calculate the value of derivatives can be bonds, stocks, or currency.

Underlying assets are used to find the value of financial instruments. Such instruments are called derivatives. The underlying asset that is used to calculate the value of derivatives can be bonds, stocks, or currency. Conclusion

Conclusion