Beginner In Trading In Derivatives Markets?

What are derivatives?

Derivatives are financial assets that are linked to an underlying stock, bond, currency, exchange rate, commodities, or market indices. Their value is derived from the underlying asset to which they are linked. Before you start trading in derivatives, you must understand what they are, what the risks associated with them are, and the mechanics of trading in them.

Derivatives prices normally move in the direction of the underlying security or financial instrument to which it is linked. For instance, if it is an equity-linked instrument, then it will move in the direction of the equity share. Derivatives have gearing.

This means that their price movements will be multiplied exponentially in either direction. That is why we are required to trade derivatives cautiously. If you want to develop an investment banking career for yourself, doing an investment banking course that specializes in derivative markets with Imarticus learning Pvt Ltd. is the guaranteed path to success.

Types of derivative securities

The types of derivative securities are given below:

-

Futures

This is a contract between two parties to buy or sell a particular asset at a pre-determined price at a future date. This represents an obligation on the part of the two parties to settle the contract. The oldest form of a derivative contract is the futures contract. Future contracts are linked to stock indices, interest rates, and commodities including oil and gold. Futures contracts are settled either by delivery of the physical commodity or by the payment of the difference.

-

Options

In contrast to a future, an option only gives a choice or opportunity to the buyer to settle or not settle the contract. If the buyer does not exercise the option, the option expires worthless. Options are either bullish bets or bearish bets on the price direction of the underlying commodity. When you buy a call option, you pay a small premium to obtain the right to get a large exposure to the underlying stock.

As your capital outlay, when you purchase a relatively small call option, options are said to have leverage. Leverage or gearing in options means there is a high risk of volatility or violent fluctuations in prices. When you sell a put option, you protect your capital losses from price levels below the strike of the put option. Options have both time value and intrinsic value. As options approach maturity, the time value of the option expires.

-

Swaps and Forward contracts

These contracts exist in currency markets and are usually used to hedge currency risk, especially by import-export companies. They are also sometimes used for speculative purposes to profit from interest rate and exchange rate movements. Future contracts are over-the-counter contracts, and in swap contracts, one type of cash flow is swapped for another. Swap contracts are used to exchange currency exchange rate risk and also default risk on a cash flow or a loan or cash flows from business transactions.

-

Commodity futures

This is one of the largest futures markets and is linked to metals, oil, and agricultural commodities.

What are derivative contracts used for?

Hedging: Derivative contracts are used to protect from adverse movements in the security markets and commodity markets. You already hold positions in the underlying instrument. To hedge against the risk, you take opposite positions in the derivatives market. Violent fluctuations in the physical securities market are canceled out by opposite movements in the derivative market so that the portfolio impact is minimized.

If you have a large stock portfolio, this can be hedged by selling the underlying index futures or options in the derivatives market. Bear in mind that the stock portfolio should mirror the stock index components as much as possible. Only then this strategy would be useful.

Speculation: When options and futures are traded without any exposure to the underlying physical instrument, it becomes a speculative trade. Due to the innate leverage present in options, the potential for violent fluctuations and large losses exists.

Leverage: To capitalize on the opportunity to leverage a small amount of capital to get a big payoff.

Advantages and disadvantages of derivatives

Derivatives can help to hedge portfolio risks, lock in prices of contracts and mitigate risks. On the flip side, derivatives have the potential to create large losses due to their gearing and are exposed to counterparty and interest rate risk.

Key takeaways

If you are a beginner in derivatives trading, make sure that you trade derivatives cautiously after you develop a complete understanding of the instruments. You should prudently step into the derivative markets after you do an investment banking course. Understanding derivatives will also help you in having an investment banking career. The first step in this direction is completing the investment banking course.

Visit Imarticus Learning Pvt Ltd. to understand all about learning to use derivatives. Our Investment banking courses are structured to meet your learning requirements. Contact us through chat support, or drive to our training centers in Mumbai, Thane, Pune, Chennai, Bengaluru, Delhi, and Gurgaon.

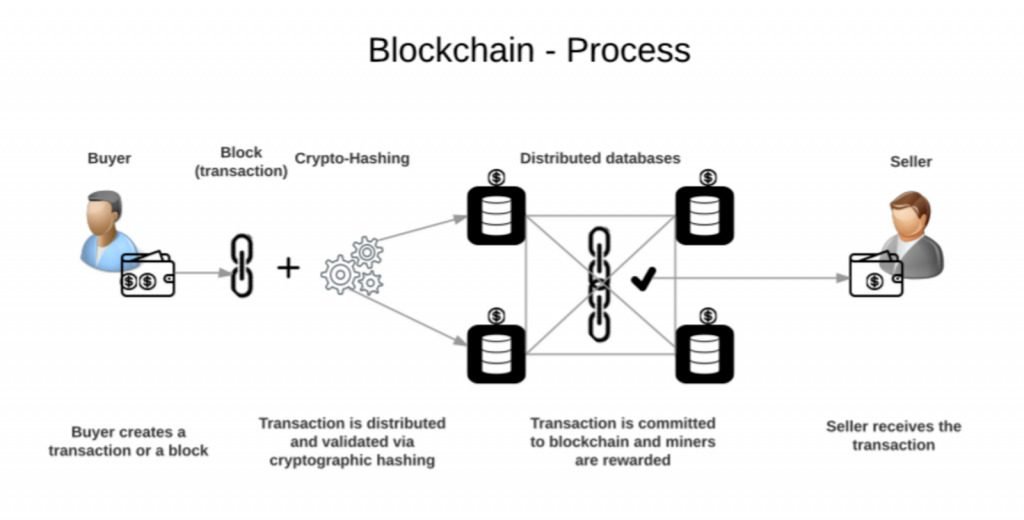

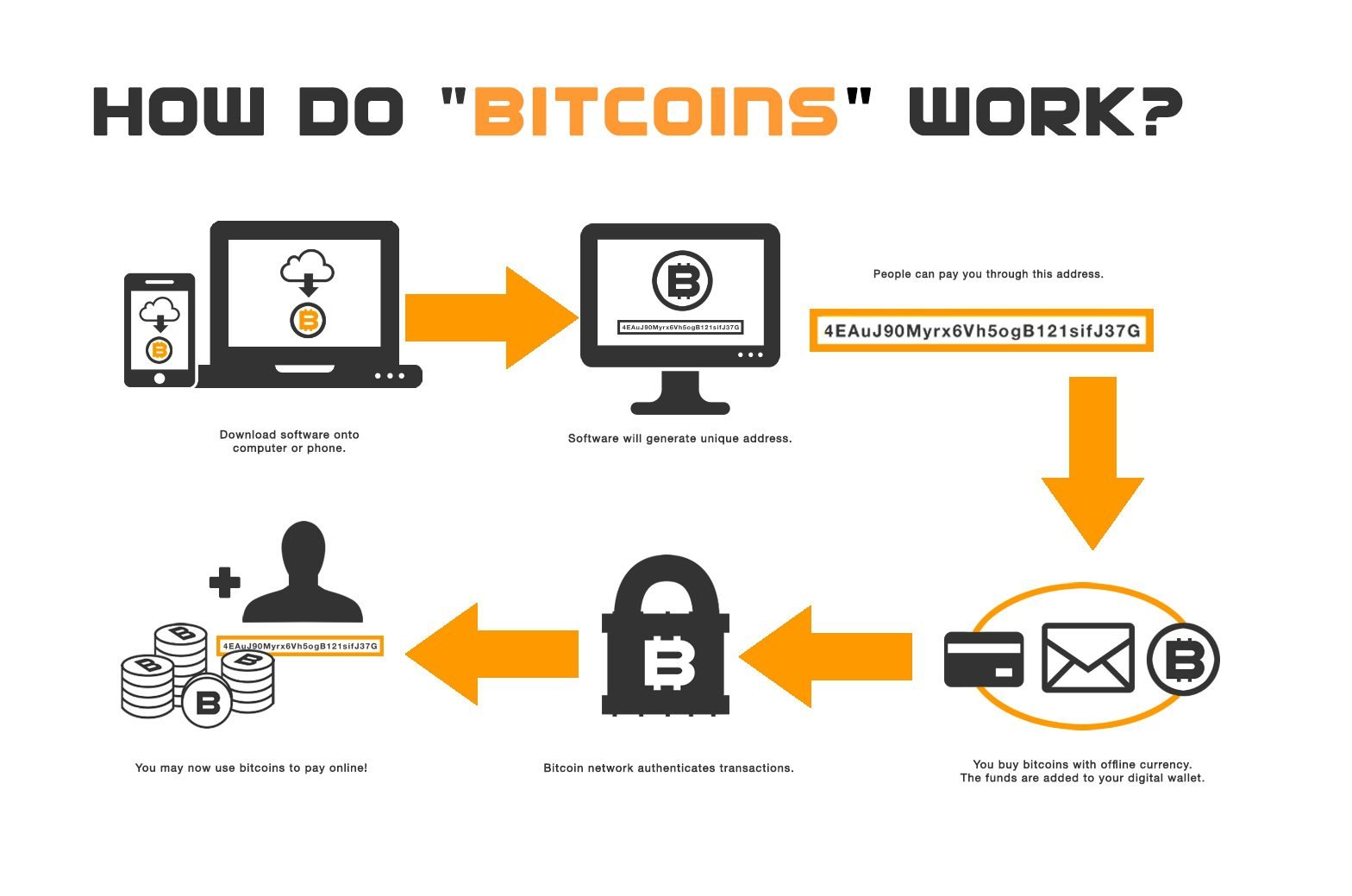

Most of the cryptocurrencies use Blockchain technology, which is decentralized and records transactions among computers. Cryptocurrencies are mainly used for

Most of the cryptocurrencies use Blockchain technology, which is decentralized and records transactions among computers. Cryptocurrencies are mainly used for  Further, cryptocurrencies are very much transparent. They have zero possibility of being stolen. The transactions can also be quicker and made with minimal transaction fees compared to banks or other financial organizations, which makes trade finance a much easier process.

Further, cryptocurrencies are very much transparent. They have zero possibility of being stolen. The transactions can also be quicker and made with minimal transaction fees compared to banks or other financial organizations, which makes trade finance a much easier process.

The end result is disruption of costs, increased rules and regulations on both exports and imports not just globally but also domestically. This is why a career in finance has always been sought after in this country.

The end result is disruption of costs, increased rules and regulations on both exports and imports not just globally but also domestically. This is why a career in finance has always been sought after in this country.

In addition, investment bankers may also advise clients about mergers and acquisitions that could benefit their company’s bottom line.

In addition, investment bankers may also advise clients about mergers and acquisitions that could benefit their company’s bottom line.