Capital markets are regarded as one of the most influential markets worldwide. The debt capital markets alone constitute about $1,1821 trillion of the total rate globally. The number indicates the market’s position as a valuable career path.

A career in capital market can prove both lucrative and immensely satisfying. However, to what extent can it be fruitful, or to what depth can it benefit your interests, is a question that needs some pondering.

Keep reading as we explore how the capital market works and the steps to build a successful career.

Understanding the Capital Market

The capital market is a one-stop market for buyers and sellers where they trade stocks, bonds, derivatives, and financial assets to raise funds. It deals with two separate entities— lenders and borrowers.

The lenders include bankers and investors. Investors are entities like governments, privatised companies, and even individuals.

Components of the capital market

- Primary market

The role of the primary market is to accommodate securities. Underwriting groups take care of primary markets and mainly comprise investment banks.

- Secondary market

The secondary markets deal with the purchase and selling of securities. This market facilitates direct trading between investors and traders rather than between companies issuing securities.

Types of financial instruments traded in the capital market

- Stocks: Stocks are instruments representing your ownership of the company.

- Bonds: Bonds are debt securities borrowed by the lender and given out with a periodic interest rate. They are traded in the bond market.

- Derivatives: Derivatives represent financial contracts like futures, options, and swaps. These are traded on derivative exchanges.

- Commodities: Commodities comprise raw materials and agricultural goods. Goods that come under commodities range from wheat, rice and natural gas to precious metals like platinum, gold, and silver, exchanged over ETFs and futures contracts.

- Mutual funds: A mutual fund accumulates money from multiple investors and diversifies it into stocks, bonds, and diverse other assets.

Tips To Build an Amazing Career in the Capital Market

A career in capital market can be especially satisfying if you have a penchant for trading. Follow the below-mentioned steps to build your dream career within the bounds of the capital market.

Educational qualifications

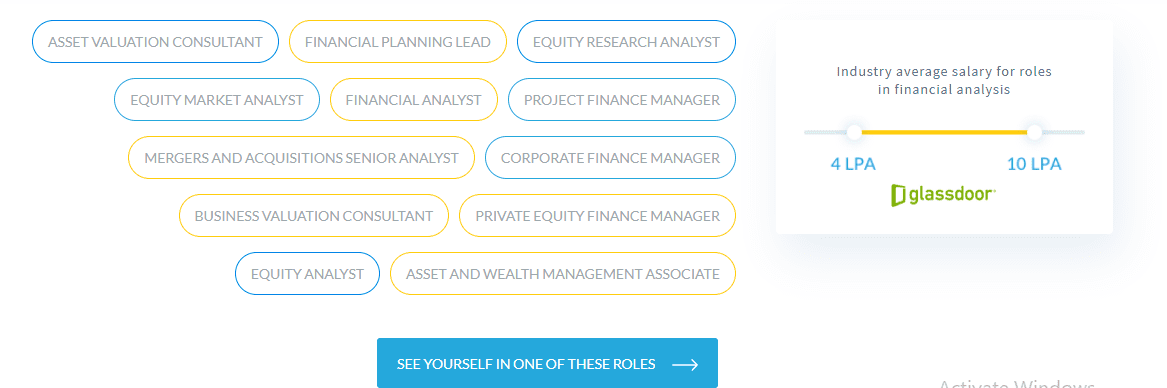

The relevant educational qualification can help you acquire a fundamental understanding of financial markets work. IIM finance courses can help you in this regard, covering various topics, including financial analysis, investment strategies, risk management and market trends.

Gain practical experience

Practical experiences can enhance your readiness to make sound choices. It is also a great place to test your problem-solving skills and demonstrate your expertise.

Leverage technology and innovation

If you’re in the capital market, you must know about the traditional techniques and learn from previous examples. However, staying updated with the latest tools in the market is an essential tenet of advancing in the field. Take advantage of the software, and don’t let algorithms slide by you.

Embrace financial regulations and compliance

Maintaining compliance with the regulatory bodies ensures you have transparency and uphold the integrity of the job. Additionally, ensuring ethical standards and codes of conduct gives you the upper hand in landing a deal.

Look for professional developments

Continuous professional development is paramount in moving forward in the capital market. For instance, staying up-to-date with the latest market trends and investment strategies can pay well and position you as a valuable asset to your organisation. Opting for a capital market course can help you upskill and maintain your relevance in the industry. By actively engaging in a course, you can understand the advantages and drawbacks associated with the market.

Navigate the market

To overcome financial challenges, you must gain market experience and hone your instincts. Individuals must understand the long-standing impact of their actions in the trade market. They must also understand vital terms like volatility, risk and uncertainty and develop a long-term philosophy. After all, effective risk management involves diversifying and maintaining a well-balanced portfolio.

Conclusion

Navigating the capital market requires immense dedication that can only be achieved through thorough theoretical knowledge and practical experience. The crux of the capital market lies in people taking risks and making informed decisions despite having many available options.

Master the most vital aspects of the capital market by enrolling in reputable online courses. Consider signing up for IIM Lucknow online certificate courses focusing on a collective learning experience. Gain IIM Lucknow alumni status and boost your career prospects.

Enrol in a course and see for yourself to know more about the market. Sign up today!

Understanding the role of an equity researcher

Understanding the role of an equity researcher