If you’re planning an international accounting or finance career, one question naturally comes up: What is the ACCA salary in USA? It’s a fair question – because salary potential often decides whether a course is truly worth the effort.

The accounting and finance landscape in the US has changed significantly over the last decade. Companies today aren’t just looking for professionals who can handle bookkeeping or basic accounting. They want people who can analyse financial data, support business decisions, and work in global environments. That’s where ACCA professionals come in.

The United States is one of the most attractive destinations for finance professionals. With global companies, strong demand for skilled accountants, and competitive pay packages, many students and affiliates today look at ACCA Certification as a pathway to build a global career – and eventually work in markets like the US.

But you might be wondering: how much can you really earn?

What is the starting salary of ACCA in the USA?

Does the salary grow with experience?

Will you be able to progress to the top roles?

And can Indian ACCAs actually work in the US?

In this guide, I’ll break down everything you need to know about ACCA salary in USA, including starting pay, monthly earnings, role-wise salaries, career prospects, and long-term growth opportunities.

Did you know?

The ACCA Salary in USA goes upto $100,000+ annually wth 5 to 8 years of experience for ACCA professionals working in FP&A, audit, or finance management roles.

Why ACCA Professionals Are in Demand in the USA

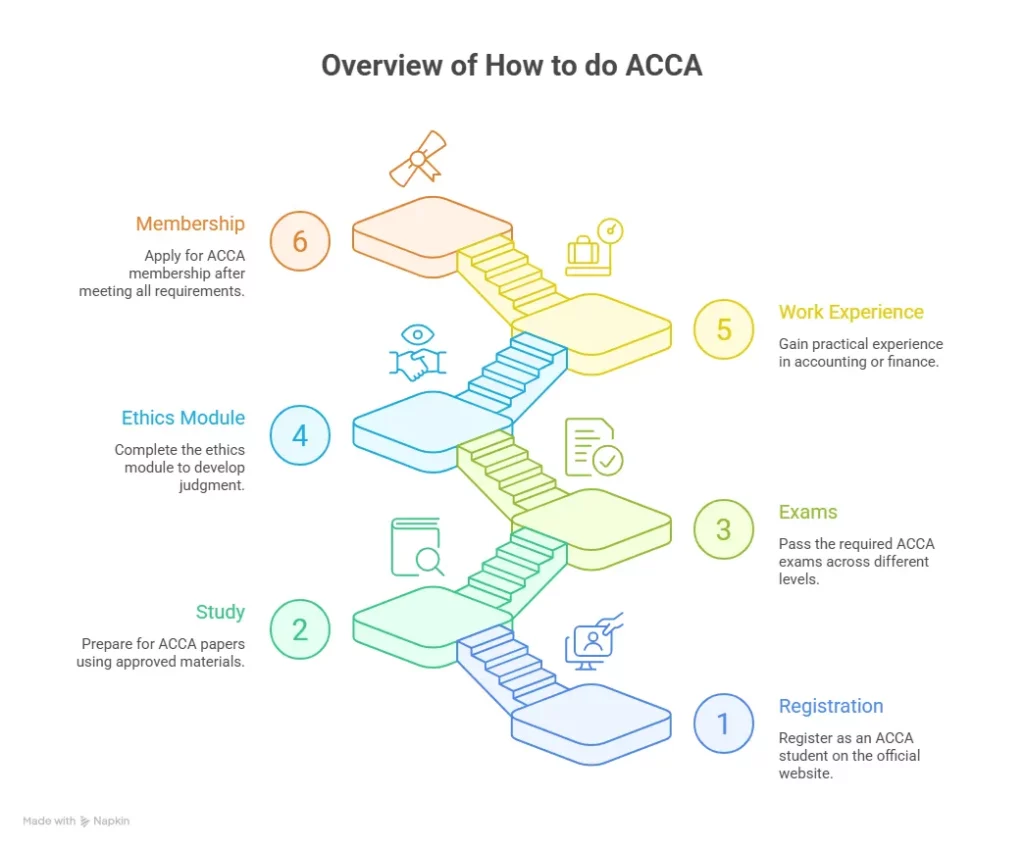

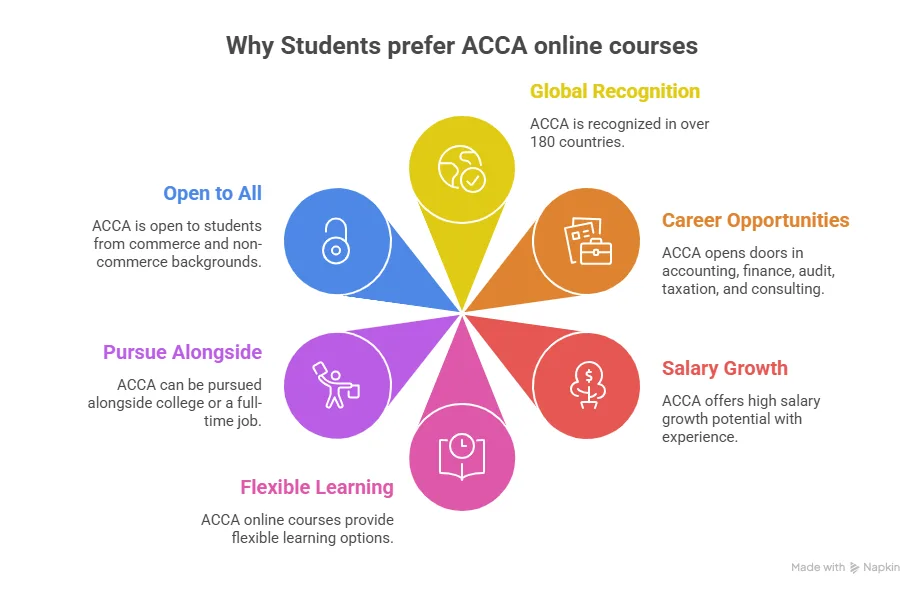

If you’re exploring global finance careers and wondering – What is ACCA? It’s a global accounting qualification that focuses on financial reporting, audit, taxation, and business strategy. The ACCA professionals are trained to work in multinational environments from day one.

And today, most large companies in the US operate globally. They have clients, teams, and offices across different countries. So they naturally prefer finance professionals who understand international accounting standards and can work across markets – not just within one country.

There’s also another reality today: many companies are facing a shortage of skilled accounting and finance professionals. As finance roles evolve and become more analytical and strategy-focused, businesses are no longer looking for people who can only handle basic accounting tasks.

The ACCA qualification prepares professionals to go beyond routine accounting and develop strong analytical and business skills.

Companies today want finance professionals:

- Who can interpret numbers

- Explain what they mean for the business

- Contribute to smarter decision-making – not just prepare reports.

This quick video helps to understand how the ACCA qualification is evolving globally and what the ACCA pattern change 2027 means to plan your preparation well.

Overview of ACCA Salary in USA

Let’s start with a quick snapshot of ACCA salary insights. While salaries vary based on role, experience, and location, ACCA professionals in the US generally earn competitive packages, especially as they gain experience.

| Level | Average ACCA Salary in USA Annually | Typical Salary Range |

| Entry-level | $55,000 – $70,000 | ₹45-58 LPA |

| Mid-level | $75,000 – $100,000 | ₹62-83 LPA |

| Senior-level | $110,000 – $150,000 | ₹90 LPA – ₹1.25 Crore per annum |

| Leadership roles | $160,000+ | 1.30 Crore per annum + |

Many students in India often try to understand the ACCA salary in USA in rupees to get a clearer picture of the earning potential compared to local salaries. While exact figures vary depending on exchange rates, converting US salaries into INR helps put things into perspective.

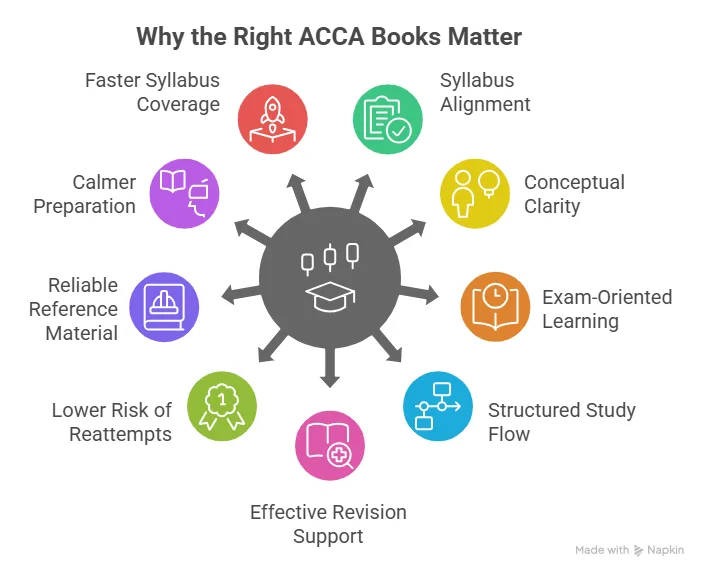

The ACCA curriculum is designed to build strong finance and accounting foundations, and understanding the ACCA course subjects gives students a clearer idea of the skills they develop throughout the qualification. The ACCA average salary in USA depends heavily on skills, experience, and job role, but overall, it offers strong earning potential and steady growth.

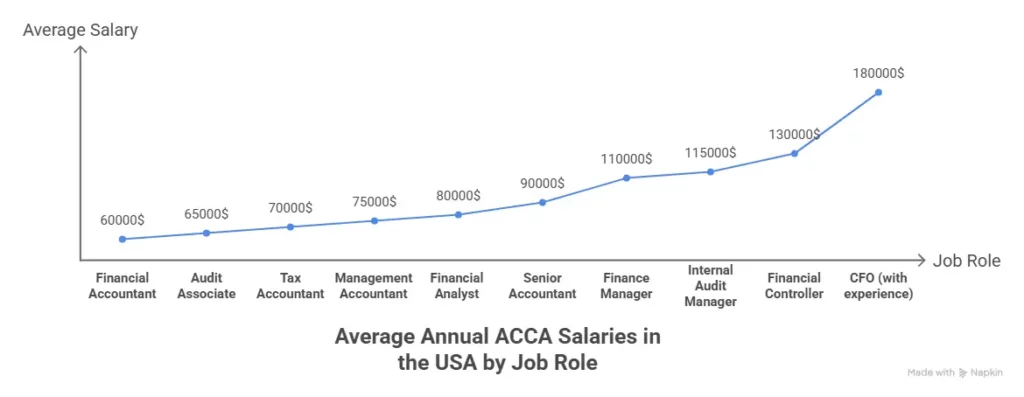

Role-wise ACCA Salary in USA

Here’s a closer look at ACCA jobs in the USA, including salaries across different roles.

| Job Role | Average ACCA Salary in USA Annually |

| Financial Accountant | $65,000 |

| Auditor | $70,000 |

| Tax Associate | $75,000 |

| Financial Analyst | $80,000 |

| Senior Accountant | $90,000 |

| Finance Manager | $110,000 |

| Financial Controller | $130,000 |

| CFO | $170,000+ |

As you move into senior and leadership roles, the salary of an ACCA in USA can increase significantly.

Also Read: The best ACCA online courses to start your journey confidently.

ACCA Starting Salary in USA

Understanding each ACCA subject helps students build strong foundations in accounting, finance, and business, which eventually supports higher-paying global career advancement opportunities.

For many students, the biggest question is: what is the starting salary of ACCA in USA? Freshers or entry-level professionals typically earn between $55,000 and $70,000 per year.

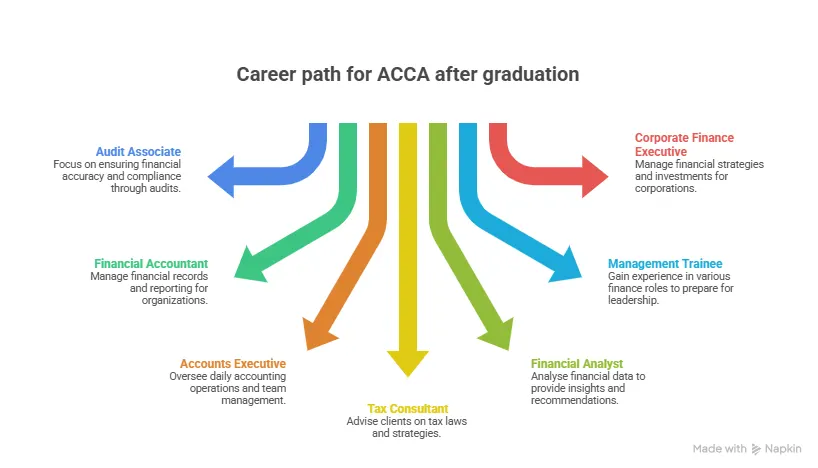

This applies to roles such as:

- Junior accountant

- Audit associate

- Accounts executive

- Financial analyst (entry-level)

Your starting salary can be higher if you:

- Have internship experience.

- Possess strong Excel/financial skills.

- Have good communication abilities.

- Work in major cities or large firms.

The starting salary in usa for ACCA professionals is considered competitive, especially for early-career roles.

For students planning long-term global careers, starting ACCA after graduation can be a practical step toward building the skills and experience needed for international accounting and finance roles.

Interesting Fact: Most ACCA-qualified professionals earn between $65,000 and $95,000 per year at the early to mid-career level, depending on role and location.

ACCA Salary Per Month in USA

The ACCA salary per month in USA grows steadily as professionals gain experience and move into higher positions. Looking at monthly earnings gives a clearer picture of take-home potential.

| Experience Level | Monthly ACCA Salary in USA |

| Entry-level | $4,500 – $5,800 |

| Mid-level | $6,500 – $8,500 |

| Senior-level | $9,000 – $12,000 |

| Leadership roles | $13,000+ |

Also Read: Detailed breakdown of ACCA course fees and cost structure.

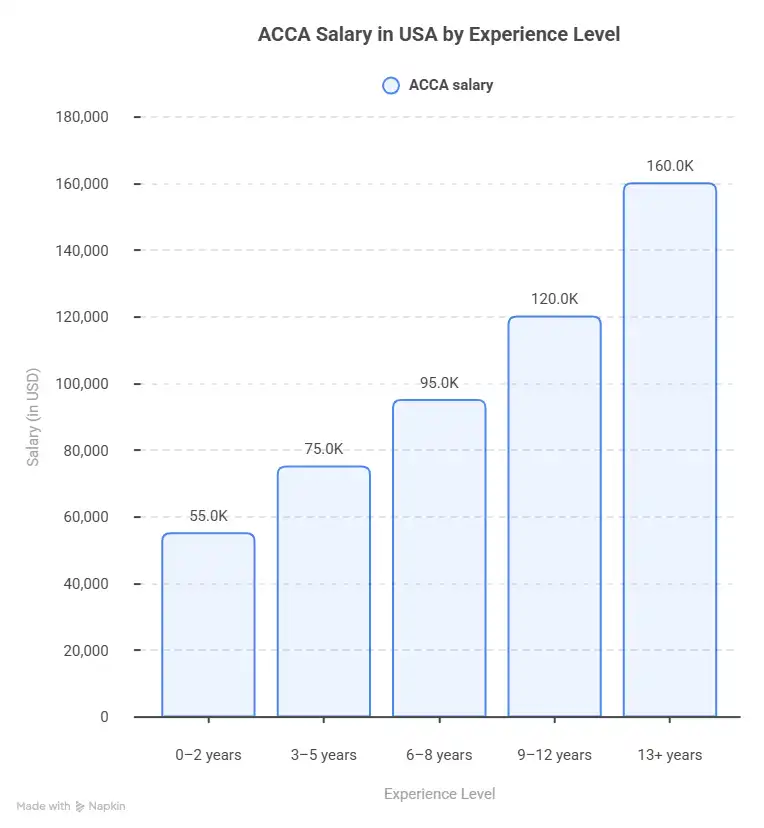

ACCA Salary in US by Experience

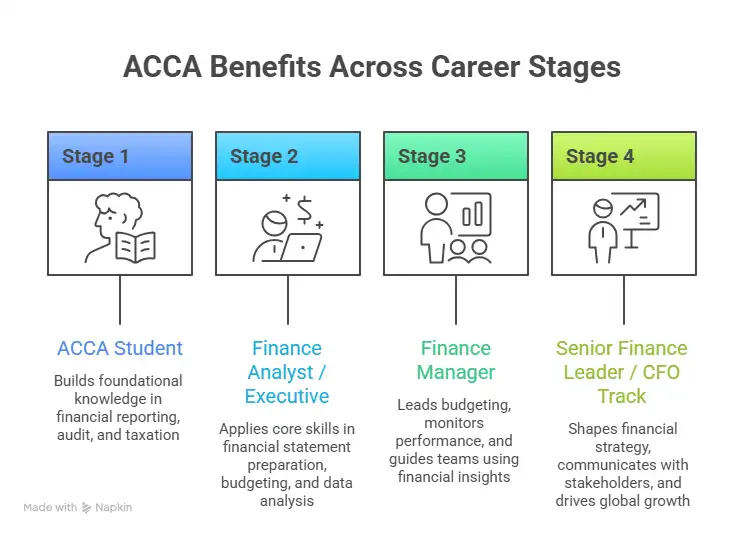

ACCA-qualified professionals are trained with this broader perspective. It shows that with the right skills and experience, ACCA can open doors to global finance roles – including opportunities connected to the US market.

Experience plays a huge role in determining how much you can earn.

| Experience | ACCA Salary in USA Range/year |

| 0-2 years | $55,000 – $70,000 |

| 3-5 years | $75,000 – $95,000 |

| 6-10 years | $100,000 – $130,000 |

| 10+ years | $140,000 – $180,000 |

With consistent growth, many professionals see their ACCA salary in US double within the first 8 to 10 years of their ACCA career.

Highest Paying Jobs After ACCA in USA

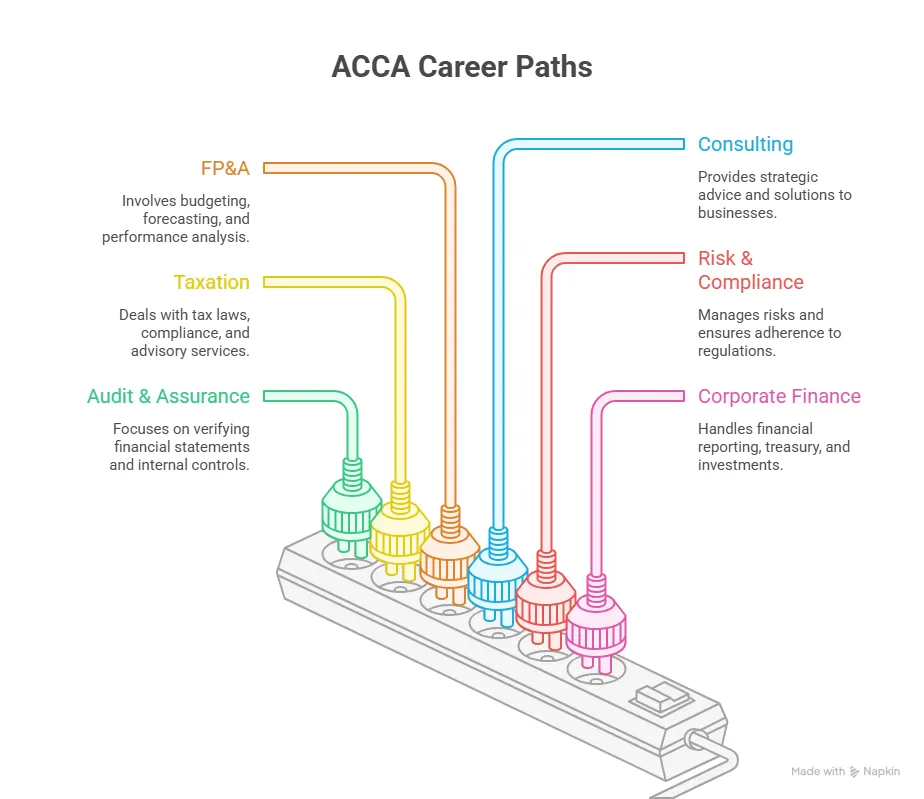

To truly understand where this qualification can take you, it helps to first look at the long-term ACCA benefits and how they translate into some of the highest-paying roles in global finance.

| Job Role | High Paying Role | Industry |

| Financial Controller | ✅ | Corporate & Multinational Companies |

| Finance Manager | ✅ | Corporate Finance & Consulting |

| Investment Banking Analyst | ✅ | Investment Banking & Financial Services |

| Senior Financial Analyst | ✅ | Banking, Tech & Corporate Firms |

| Risk Manager | ✅ | Banking & Financial Services |

| Internal Audit Manager | ✅ | Consulting & Audit Firms |

| Finance Director | ✅ | Large Corporations & MNCs |

| Chief Financial Officer (CFO) | ✅ | All Industries (Senior Leadership) |

The image below gives a brief idea about the salary based on job roles in the USA.

Did you know?

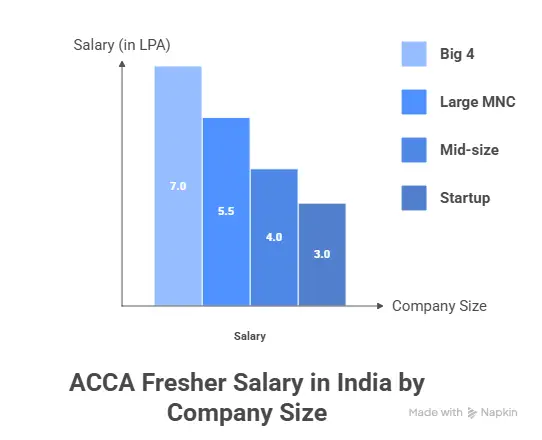

Salaries are typically higher in finance hubs like New York, Chicago, and California, where demand for global accounting professionals is strong.

ACCA Salary in USA vs India vs UK

When comparing global career opportunities, salary alone doesn’t tell the full story. Taxes, cost of living, savings potential, and career growth all play a major role. Here’s a realistic comparison of ACCA salaries across the USA, India, and the UK.

| Factor | USA | UK | India |

| Average ACCA Salary (Annual) | $75,000 – $120,000 | £35,000 – £60,000 | ₹6-15 LPA |

| Entry-Level Salary | $55,000 – $70,000 | £28,000 – £35,000 | ₹4-8 LPA |

| Mid-Level Salary | $80,000 – $100,000 | £45,000 – £55,000 | ₹8-18 LPA |

| Senior-Level Salary | $120,000 – $160,000+ | £65,000 – £90,000 | ₹20-40 LPA |

| Tax Rates (Approx.) | 22-35% | 20- 40% | 10-30% |

| Monthly Take-Home (Mid-level) | $5,500 – $7,000 | £2,800 – £3,500 | ₹60,000 – ₹1.2LPA |

| Cost of Living | Very high | High | Moderate |

| Savings Potential | High (after experience) | Moderate | High (relative to cost) |

| Demand for ACCA | Growing in MNCs | Very strong | Very strong |

| Work Visa Difficulty | High | Moderate | Not required for Indian residents |

| Global Exposure | Excellent | Excellent | Growing |

| Career Growth Speed | Fast in MNCs | Stable & structured | Fast for skilled professionals |

- The ACCA salary in USA is the highest in absolute terms, but taxes and living costs are also higher.

- ACCA salary in UK displays strong demand and stable career growth for ACCA professionals.

- ACCA salary in India has lower starting salaries but strong growth and high savings potential relative to the cost of living.

For many students, the best path is to build experience in India or the Middle East first, then move to global roles in the US or UK through multinational companies.

If you’re planning your ACCA journey, understanding the full cost is just as important as understanding the syllabus. From registration and exam fees to exemptions and annual subscriptions, this quick video breaks down the complete ACCA exam fees structure that helps you plan better.

Factors That Affect ACCA Salary in USA

Getting a good ACCA salary in USA isn’t just about completing the qualification and hoping the right opportunity shows up. What really makes the difference is what you do after that – the skills you build, the roles you take on, and how seriously you plan your career.

You’ll notice that some professionals see their salaries grow much faster than others. Usually, it’s because they keep learning, move into better opportunities when the time is right, and focus on building practical finance skills that companies actually value.

Over time, these choices make a big difference to how quickly their career and salary move forward. Others stay in the same type of work for years and don’t see much change in their pay. The difference usually comes down to the choices they make after completing ACCA.

If your goal is to earn well and grow in the US finance market, it helps to know what actually pushes salaries up – and what can slow your growth down. The table below breaks this down in a simple, practical way so you know where to focus.

| Skill / Factor | What Helps Increase Salary | What Can Limit Salary Growth |

| Relevant work experience | Gain experience in multinational companies and global finance teams | Stay limited to routine bookkeeping or entry-level roles |

| Specialisation | Move into high-growth areas like FP&A, consulting, or corporate finance | Stay in the same role without developing expertise |

| Networking | Build professional connections within the global finance industry | Ignore networking and industry exposure |

| Additional certifications | Consider certifications like CPA, CFA, or analytics courses | Depend only on one qualification throughout your career |

| Communication skills | Improve business communication and presentation skills | Focus only on technical work without soft skills |

| Career planning | Set clear long-term salary and career growth goals | Leave career progression completely to chance |

| Continuous learning | Regularly upgrade finance and technology skills | Stop learning after completing ACCA |

Also Read: ACCA vs MBA – which is better for your career?

How to Increase Your ACCA Salary in USA

Getting a strong ACCA salary in USA isn’t just about completing the qualification and waiting for the right opportunity. What really makes the difference is how you build your skills, the roles you choose, and how actively you plan your career after ACCA.

Some professionals see their salaries grow quickly because they keep upgrading their skills, move into better roles at the right time, and gain exposure to global finance work. Others stay in the same type of work for years and don’t see much change in their pay. The difference usually comes down to the choices they make after completing the ACCA course.

If your goal is to earn well and grow in the US finance market, it helps to know what actually pushes salaries up and what can slow your growth down. The table below breaks this down in a simple, practical way so you know where to focus.

| Skill Area | Why It Matters for Salary Growth |

| Advanced Excel & Financial Modelling | Essential for analysis-heavy roles; highly valued in US finance teams |

| US GAAP Knowledge | Critical for accounting roles in the US; increases job opportunities |

| Data Analytics (Power BI, SQL) | Helps interpret financial data and support business decisions |

| Financial Planning & Analysis (FP&A) | In-demand skill that leads to higher-paying strategic roles |

| Audit & Risk Management | Strong demand in Big4 and consulting firms |

| Taxation (US Tax Basics) | Opens doors to specialised and better-paying roles |

| ERP Systems (SAP, Oracle) | Companies prefer candidates with practical system experience |

| Business Communication Skills | Important for client-facing and leadership roles |

| Global Reporting & IFRS | Useful in multinational companies and global teams |

| Leadership & Team Management | Required to move into managerial and high-salary positions |

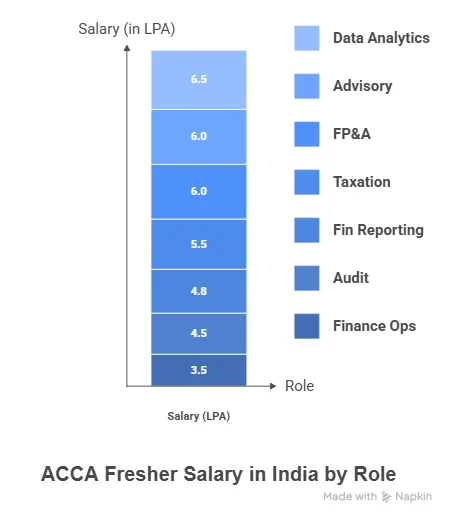

While the ACCA salary in USA is higher overall, many students first explore the ACCA fresher salary in India to understand their starting point before planning international career moves.

Skills can increase pay significantly:

Professionals with US GAAP, financial analysis, data analytics, and ERP skills often see faster salary growth and better job opportunities in the US market.

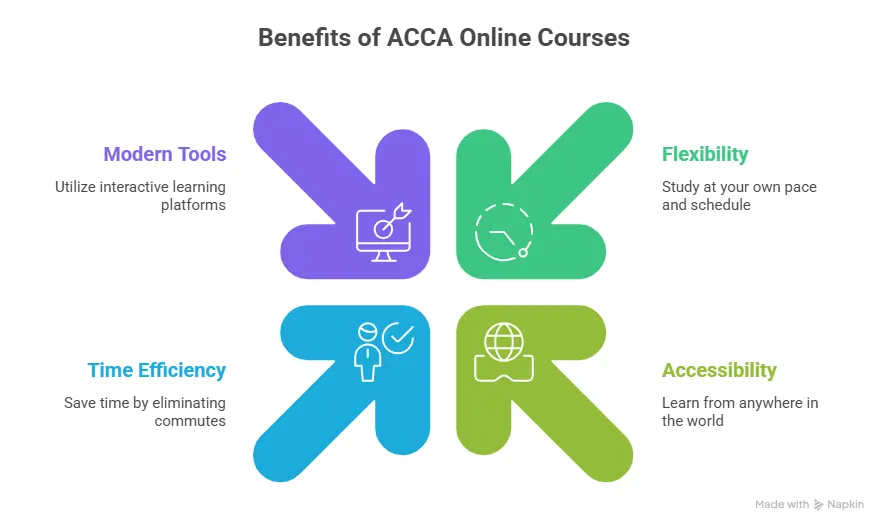

Why Students Choose Imarticus Learning for ACCA

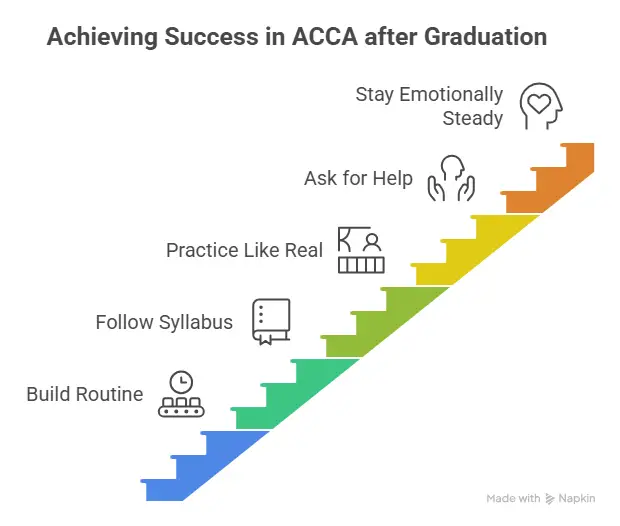

Choosing the right place to prepare for the ACCA program can make a big difference in how confident and consistent you feel throughout the journey. At Imarticus Learning, the focus isn’t just on helping students clear exams – it’s on helping them build a strong global finance career.

- Structured study plan that keeps your preparation clear and organised.

- Concepts explained in a simple, practical way – not just theoretical learning.

- Faculty with both teaching experience and real industry exposure.

- Focus on building skills needed for global finance roles, not just exams.

- Regular mock tests and practice sessions to build exam confidence.

- Continuous doubt-solving and academic support whenever needed.

- Flexible learning that helps you stay consistent and avoid burnout.

- Career-focused training aligned with global accounting opportunities.

- Internship and placement support to help you move into the right role.

Choosing ACCA is a long-term career decision, and having the right learning environment can make that journey much smoother.

FAQs on ACCA Salary in USA

Here are some of the most frequently asked questions students and professionals ask about ACCA salary in the USA and what you can expect as your career progresses.

Can Indian ACCAs work in the USA?

Yes, Indian ACCA professionals can work in the USA, especially in multinational companies and global finance teams. While moving immediately after qualification may not always be easy, many professionals gain relevant experience in India or other international markets first and then move into US-based roles through global companies.

What is the starting salary of ACCA in USA for freshers?

The starting salary usually falls in the $55,000 to $70,000 range. It depends on where you’re working, the company, and the kind of skills you bring. If you’ve done internships, have strong Excel or financial skills, or join a large firm, you may start at a higher package.

How much do ACCA professionals earn per month in the USA?

Monthly earnings can vary based on experience. In the beginning, most professionals earn around $4,500-$5,800 per month. As you move ahead in your career and take on more responsibility, that number can rise to $7,000-$10,000 or more.

Can Indian students achieve high salaries after ACCA?

Yes, absolutely. Many Indian ACCA professionals build strong careers in multinational companies and gradually move into global roles. With the right experience and consistent skill development, it’s possible to reach competitive salary levels both in India and internationally.

Does ACCA salary in USA increase with experience?

Yes, salary growth after ACCA is strongly linked to experience and skill development. Many professionals see their income grow significantly within 5–8 years as they move into senior accounting, finance manager, or leadership roles. With consistent growth, salaries can even double over time.

Which jobs offer the highest salaries after ACCA in the USA?

Roles like Financial Controller, Finance Manager, Finance Director, and CFO tend to offer the highest salaries in USA. These positions usually come after several years of experience but can be very rewarding in terms of both salary and career growth.

What kind of salary can you expect after ACCA in the USA?

If you’re working in the US after ACCA, salaries are generally quite competitive. Most professionals start somewhere around $55,000–$70,000 a year and then grow from there. Once you gain a few years of experience and move into better roles, it’s common to see salaries cross $80,000–$100,000 and continue increasing over time.

Is ACCA recognised by companies in the USA?

Yes, especially by multinational companies and global finance teams. ACCA is well known as a global accounting qualification. While some roles specifically prefer CPA, many organisations still value ACCA professionals for their global accounting knowledge and practical finance skills.

Is ACCA Worth It for a Career in the USA?

If you’re aiming for a global career in accounting or finance, the ACCA course can be a strong stepping stone. It builds the kind of financial, analytical, and business skills that companies across the world value, including those in the United States.

By now, you have probably got a realistic idea of ACCA salary in USA and how the ACCA qualification can translate into financial growth and global career stability.

ACCA is a great choice if you’re looking to build a career that goes beyond basic accounting and opens up global opportunities. It gives you strong technical knowledge, international recognition, and the flexibility to work in different industries and roles. But like any serious qualification, the journey takes time, effort, and consistency.

If you’re thinking about starting ACCA, take it one step at a time. Stay consistent, focus on understanding the concepts, and choose guidance that keeps you on track. Done right, the ACCA course can be the foundation of a stable, well-paying, and truly global finance career.