Financial analysis is the process in which business data like budgets, projects, and transactions are analyzed to check the feasibility or sustenance of the projects or businesses. Professional financial analysts are required for this process.

There’s no doubt that financial analysis lies at the core of business decisions and management. There may be questions like- what does a financial analyst do, what skills they possess, and how you can become one.

Read on to find out more:

What does a financial analyst do

Financial analysts are responsible for performing financial reporting, forecasting, tracking operational metrics, and creating financial models to analyze investments or companies. They have to analyze historical data, organize information, and gather necessary data to meet their organization’s needs. They advise companies on how to split stock, issue bonds, and other critical financial decisions.

A financial analyst can earn up to INR 10 lakh per year in India with sufficient experience and skills.

Prerequisites for financial analysts

To become a financial analyst, you must have certain skills:

Analytical abilities

Being able to plan, rank, and identify financial problems is the most important skill a financial analyst can possess. Analytical skills will help you find issues and understand them better. It would also help you plan strategically and analyze financial markets, products, and resources more effectively.

Communication skills

Financial analysts must have good communication skills as they help one collaborate better. You’d work with other financial analysts and professionals. Having good communication skills would ensure that you can share your insights with much clarity.

Leadership

Financial analysts work in teams, sometimes leading it. Hence, you should be great at leadership skills. Leadership skills consist of multiple soft skills including interpersonal skills and instilling confidence. You should know how to inspire your team and direct them such that they achieve the best results.

You should also be a team player and work in coordination with your team members and their expectations.

Attention to detail

You must have a strong eye for finding details as a financial analyst. It’s among the most important soft skills for conducting effective financial analysis training because it helps you mitigate errors and stay efficient. It would also help you find outliers in the data more effectively that can play a huge role in creating financial reports and aid you in making decisions.

Accounting

You must be well-versed in accounting, including financial accounting, the branch of accounting that focuses on determining the monetary value of a company. You must be familiar with accounting principles, techniques, and industry standards. This includes knowing about cash flow statements, balance sheets, ledgers, and the mathematical formulas used in accounting.

Financial knowledge

As a finance professional, it’s imperative for you to be well-versed in different financial subjects and concepts. This includes familiarity with various investments, basics of finance, current industry rates and other related concepts. You should stay on top of the financial current events as a financial analyst to perform efficiently.

How to start a career as a financial analyst

A financial analyst must be familiar with many technologies. That’s why companies look for certified professionals as a certification assures them of the candidate’s expertise over the relevant subjects and skills.

We recommend joining online finance courses, particularly those that offer financial analyst training and placement.

We recommend joining online finance courses, particularly those that offer financial analyst training and placement.

Joining such online financial courses will help you start your career quickly and provide you with real-world experience.

Conclusion

Financial analysts must be experts in many domains. If you want a program that offers financial analyst training and placement, be sure to check out this program: Financial Analysis Prodegree.

A BBA degree or Bachelor of Business Administration is a post-graduate level degree that will give you the skills and knowledge to enter the business world. An

A BBA degree or Bachelor of Business Administration is a post-graduate level degree that will give you the skills and knowledge to enter the business world. An

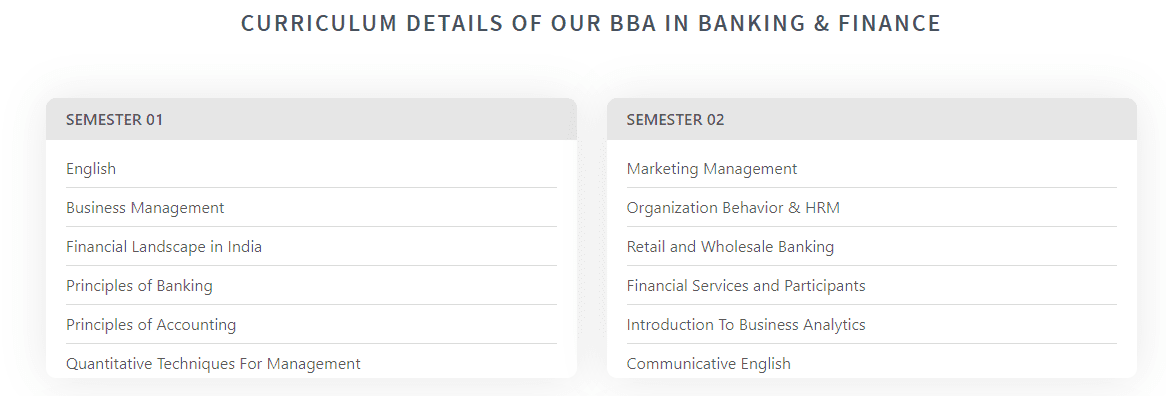

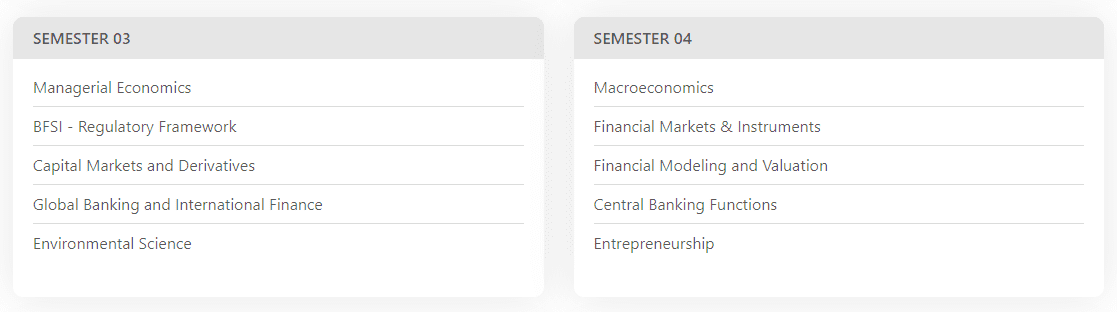

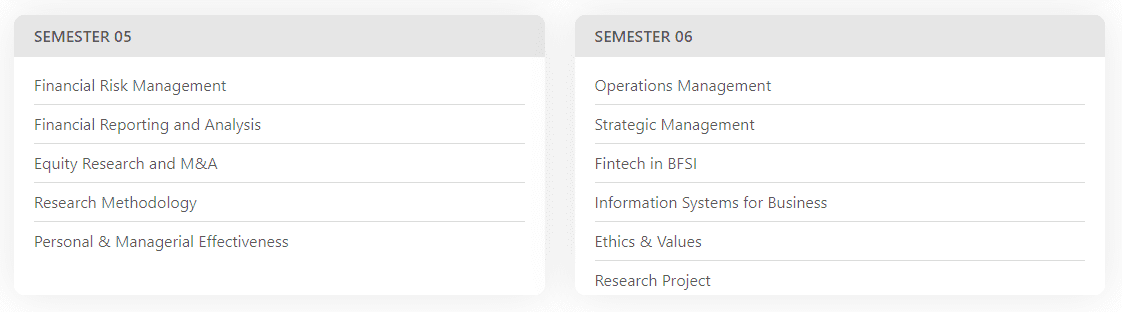

What all BBA courses are available?

What all BBA courses are available?

Here’s what makes the Imarticus

Here’s what makes the Imarticus  With a sea of data science courses available out there, make sure that you choose a

With a sea of data science courses available out there, make sure that you choose a

In addition, investment bankers may also advise clients about mergers and acquisitions that could benefit their company’s bottom line.

In addition, investment bankers may also advise clients about mergers and acquisitions that could benefit their company’s bottom line.