In the rapidly evolving world of finance, the term ‘Fintech’ has become more than just a buzzword. It’s a revolution that’s transforming how we handle our money, making financial services more accessible, efficient, and user-friendly. But with the plethora of Fintech certification courses available today, how do you choose the one that’s right for you?

Welcome to our guide on choosing the right Fintech certification course. This guide is designed to navigate you through the sea of options, helping you understand what to look for in a course, how to evaluate its credibility, and, ultimately, make an informed decision about your Fintech education.

So whether you’re a seasoned finance professional looking to upskill or a tech enthusiast wanting to break into the Fintech industry, this Fintech credential selection guide is your roadmap to success. Let’s embark on this journey together!

Overview of the Fintech Industry

Fintech, short for Financial Technology, encompasses a wide array of technologies and innovations aimed at enhancing and automating financial services. It includes areas such as digital payments, blockchain, peer-to-peer lending, robo-advisors, and more. Familiarizing yourself with the various segments of the Fintech industry will help you identify where your interests and career goals align.

The Fintech Frontier: Where Innovation Meets Prosperity

In the thrilling realm of global Fintech, the year 2022 witnessed a financial spectacle as the market dazzled with a staggering value, approaching a monumental USD 194.1 billion. Brace yourself for what lies ahead as we cast our gaze into the horizon of 2023-2028. Here, the stage is set for a captivating performance, a crescendo in the making, as the fintech market embarks on a journey of exponential growth.

With each passing year, the fintech market is projected to choreograph an impressive CAGR of 16.8%. Picture this journey as a thrilling race, a relentless sprint towards a coveted prize. And what is this grand prize? A remarkable destination worth USD 492.81 billion by the year 2028.

In this dynamic landscape, innovation knows no bounds, and prosperity beckons on the fintech frontier. Stay tuned as we witness the unfolding saga of Fintech’s ascendancy, where every step forward is a testament to the power of technology, innovation, and global financial evolution.

In the world of Fintech certification, 2023 is a canvas brimming with innovative strokes, each trend a brushstroke that adds depth to your financial artistry. As you consider your Fintech certification journey, envision the exciting possibilities these trends offer, and choose the path that aligns with your aspirations in this ever-advancing realm of finance and technology.

Why choose a Fintech certification course?

A Fintech certification is your ticket to mastering a specific realm where finance and technology converge. It is a captivating journey where you acquire a specialized skill set. These courses span a spectrum, from concise weekend intensives to comprehensive programs demanding both a significant time commitment and financial investment.

Fintech educational programs are as diverse as the ever-evolving financial landscape they serve. They come in a myriad of forms, tailored to various niches and levels of expertise.

In the world of Fintech, you’ll find certifications meticulously crafted for a wide array of professionals. Whether you’re a savvy manager, a number-crunching accountant, a coding wizard behind the scenes, a data-savvy financial analyst, a meticulous compliance officer, or even a complete newcomer to the field, there’s a Fintech certification designed to elevate your skills and knowledge.

How to pick the right Fintech certification program

1) Identify Your Career Goals and Interests

Selecting an ideal Fintech certification course begins with introspection. Ask yourself: What are your career goals? What aspects of the Fintech industry intrigue you the most? Are you interested in blockchain technology, digital banking, or data analytics? Understanding your aspirations and interests will steer you in the right direction when it comes to selecting a specialization within Fintech.

2) Research Accredited Programs

Now that you have a clearer vision of your career goals and interests, it’s time to start researching accredited Fintech programs. Accreditation ensures that the course meets specific quality standards and is recognized within the industry. Look for programs offered by renowned universities, online platforms, or specialized Fintech institutions. Consider factors such as program duration, flexibility, and whether it offers a certificate, diploma, or degree.

3) Review Curriculum and Specializations

Once you’ve identified potential programs, delve into their curriculum and specializations. A well-structured curriculum is essential for gaining comprehensive knowledge in the Fintech field. Check if the course covers topics that align with your interests. Look for modules on blockchain technology, financial data analysis, cybersecurity, and other relevant subjects. Specializations within the course can help you tailor your learning to specific career paths.

4) Examine Quality and Credibility of the Institute

The quality and credibility of the institute offering the Fintech certification course are paramount. Investigate the institute’s reputation within the industry. Read reviews from current and past students and seek recommendations from professionals working in Fintech. Consider factors such as faculty expertise, industry partnerships, and the institute’s track record in producing successful Fintech professionals.

5) Explore the Placement Report of the Institute

One of the key indicators of a program’s success is the placement report of the institute. Look for statistics on job placements, internship opportunities, and the average salary of graduates. A strong placement record indicates that the program equips students with the skills and knowledge sought after by Fintech employers. Additionally, reach out to alumni to gain insights into their career trajectories after completing the course.

2023 Fintech Certification Trends: Navigating the Future of Financial Education

Staying ahead of the curve is key in the always-changing world of finance and technology. As we step into 2023, the Fintech certification arena is buzzing with exciting trends that promise to reshape how individuals prepare for a career in this dynamic field.

Let’s dive into these trends with a creative twist and some informative pointers:

-

Decentralized Finance (DeFi) Dominance

DeFi-related certifications are on the rise, reflecting the growing prominence of decentralized financial ecosystems.

-

AI and Machine Learning Magic

Fintech professionals are flocking to courses that explore the enchanting world of artificial intelligence and machine learning in finance.

-

Sustainable Finance Specializations

Green finance and sustainable investment certifications are in demand, reflecting the industry’s commitment to environmental and social responsibility.

-

Cybersecurity as the Shield of Fintech

Cybersecurity certifications are vital in a world where digital threats loom large, safeguarding Fintech innovations and transactions. Consider yourself as the guardian of the digital realm, armed with the sword of cybersecurity, protecting financial data from the clutches of hackers. Fintech certifications are blending disciplines like finance, technology, and data science, producing holistic professionals. Visualize yourself as a Fintech alchemist, seamlessly fusing financial acumen with technological prowess to create innovative solutions.

-

Customized Learning Paths

Imagine yourself as the captain of your Fintech ship, charting a course that matches your unique career aspiration.

-

Hands-On Practical Experience

In the world of Fintech certification, 2023 is a canvas brimming with innovative strokes, each trend a brushstroke that adds depth to your financial artistry.

The Final Words

Choosing the right Fintech certification course is a critical step towards building a successful career in the booming Fintech industry. Learn Financial technology, identify your career goals and interests, and research accredited programs.

Review the curriculum and specializations offered by each program and assess the quality and credibility of the institute. Finally, explore the institute’s placement record to ensure that your investment in the course leads to rewarding career opportunities.

By following these steps and conducting thorough research, you can make an informed decision that not only enhances your knowledge and skills but also opens doors to exciting Fintech career prospects. Stay updated with the latest trends and technologies in the Fintech industry as it continues to evolve, and adapt your career path accordingly. Your journey in the world of Fintech begins with the right certification course, so choose wisely.

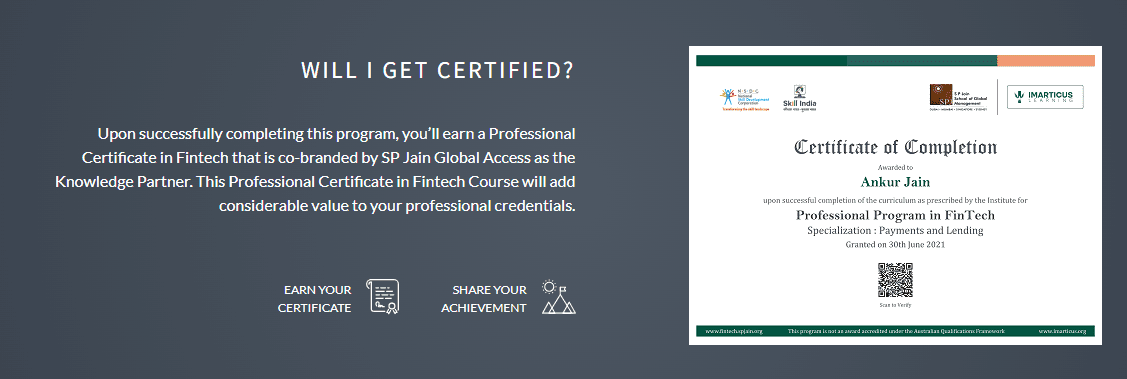

In a groundbreaking collaboration that’s set to redefine Fintech education, SP Jain School of Global Management and Imarticus Learning have joined forces to craft an unparalleled masterpiece – Asia’s foremost Fintech certification course, known as “The Professional Certificate in Fintech.”

This course is not just an educational endeavor; it’s an empowering journey that immerses you in the world of Fintech like never before. Think of it as a thrilling adventure guided by the sharpest minds in the industry.

Remember, the Fintech industry thrives on innovation and adaptability, so stay curious and keep learning throughout your career to remain competitive and relevant in this dynamic field. Best of luck on your journey to becoming a Fintech expert!

The Final Word

The Final Word

Here’s help in the form of a starter guide about the 5 most in-demand skills in the industry.

Here’s help in the form of a starter guide about the 5 most in-demand skills in the industry. Some of the most common languages used in fintech are JavaScript, Python, and SQL. You can learn more about them through easily available

Some of the most common languages used in fintech are JavaScript, Python, and SQL. You can learn more about them through easily available

You will get to know about the operations in digital banks via this course. It will help you in understanding the practices involved in the current fintech industry. This project provided by Imarticus is good for creating business ideas & start-ups.

You will get to know about the operations in digital banks via this course. It will help you in understanding the practices involved in the current fintech industry. This project provided by Imarticus is good for creating business ideas & start-ups.