Fintech is the gateway to automated financial services. It assists businesses and customers alike. Technological assistance for financial operations includes machine learning, internet of things (IoT), blockchain, digital currency, cloud computing, and more.

Before delving deeper into the intricacies of technological advancement, it is crucial to know what fintech is all about. Automated banking, cryptocurrency, investment, trading, and loans fall under the realm of fintech. Anything that involves moving funds with technological aid can be considered under fintech.

This industry is not new but has evolved rapidly over recent years. Flexibility is critical to more contemporary fintech propositions, as more platforms are trying to mould themselves to the customer’s needs.

The revenue generated by fintechs is expected to reach 188 billion euros by 2024. Keeping in touch with the latest technology and what it has to offer can ensure a healthy financial return in the near future.

Take a look at the top five emerging technologies in fintech.

Blockchain

While blockchain might come across as a dated technology, it is constantly evolving.

Blockchain simplifies financial transactions, secures them, and makes banking more accessible.

It can be applied for more consumer-friendly applications related to banking. Blockchain as a Service or BaaS is used to develop third-party services to operate services related to it. BaaS handles the complexities of technology while the client focuses entirely on the operation. Companies are slowly catching up on the advantages of progressive blockchain technologies.

Blockchain offers transparency, making it possible to track each transaction to its source. Additionally, any change in the record is virtually impossible without changing subsequent blocks. Thus, the chances of committing fraudulent activities are almost negligible. It is heavily utilised for cryptocurrency transactions.

Cloud Computing

Security is foremost in any financial situation. Cloud computing excels at securing your financial data with increasing risks associated with more significant transactions. Unlike local servers, it provides de-centralised data storage, significantly reducing the risk of data theft.

Cloud computing offers geographically flexible cloud storage to reduce the risk of data loss and aid data migration in case of disruptions. Developers have worked on technology to create self-service applications that are easily accessible and resourceful.

It is cost-effective and provides data on demand. This greatly empowers clients who prefer micromanaging their organisation’s resources instead of a dedicated department. Clients may also take advantage of the global network that cloud computing offers.

Cryptocurrency

Cryptocurrency is a familiar name in the realm of fintech. However, its increasing popularity is eventually steering it toward the mainstream market. Areas with unstable finances opt for cryptocurrencies.

The use of cryptocurrency involves going through a secure process involving blockchain, reducing common hazards like fraud and data theft. Its decentralised data collection system is a great way to monitor and track transactional records.

According to Fortune Business Insights, cryptocurrency is estimated to have a growth rate of 11.1% in the 2021-28 window. It is evident that cryptocurrency is set to dominate the market in the coming years.

AI Trading and Investment

Artificial intelligence (AI) is gradually taking over fintech. It is a boon for stock market newbies as it provides a secure and convenient trading experience. Artificial intelligence has become an indispensable tool for predicting the market and pointing toward the right investment opportunities.

Increasing instances of mobile trading applications have paved the way for accessible trading opportunities. Artificial intelligence almost instantaneously analyses several thousands of data to provide recommendations before investing in a stock. It easily outshines human capacity for stock market analysis with the sheer amount of data processed.

Internet of Things

The Internet of Things, popularly known as IoT, is a network of devices that share data with each other. This includes devices that can collect data with minimum human intervention. IoT includes cloud computation, machine learning and artificial intelligence.

IoT helps to collect and monitor the huge influx of data involved in banking and finance. It uses its vast network and sensors installed in its devices for convenient contactless transactions. IoT also secures data and detects malware or phishing attempts. In a nutshell, IoT delivers convenience with security, a desirable combination.

Fintech is moving towards a more secure, convenient and contactless mode of fund transfer. The technology employed strives to make financial management more accessible to the public with an attempt at transparency.

Conclusion

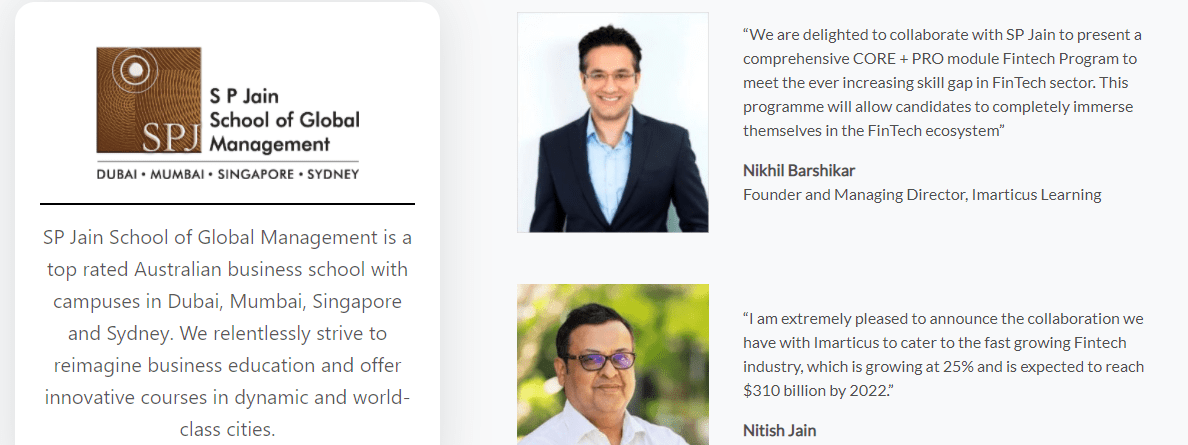

Imarticus has collaborated with the finest academic partner to offer the best fintech certification course.

SP Jain Fintech certification empowers you with hands-on training and case studies. Decode the technological side of fintech with an extensive curriculum and specialisation in automated technology. This course covers all the critical aspects of fintech and gives students access to Imarticus’s premium fintech community. Students can also experience the perks of an SP Jain alumni status with a taste of global learning.