In the world of finance, managing risk is a fundamental aspect of investment gubanking. As an investment banker, you play a crucial role in assessing and mitigating risks associated with various financial transactions. To excel in this field, you must understand the fundamental principles of risk management. This article explores the art of managing risk. It outlines the essential principles you should embrace to navigate the complex finance world successfully.

Principles For Risk Management Process

Due Diligence and Research

Thorough due diligence and extensive research are essential components of an effective risk management process in investment banking. You must diligently investigate and analyse potential risks associated with your investment opportunities, corporate mergers, or financial transactions. In-depth research helps you identify red flags, evaluate market conditions, assess regulatory compliance, and make informed decisions.

Diversification

Diversification is a time-tested principle that helps you in the risk management process. By spreading your investments across different asset classes, industries, and regions, you can reduce the impact of potential losses. By diversifying your portfolios, you can mitigate risks associated with specific sectors or economic fluctuations. This ensures a more balanced and resilient investment strategy.

Risk-Reward Tradeoff

As an investment banker, you understand the crucial relationship between risk and reward. Higher returns often come with higher risks. Balancing risk and reward is crucial. You assess the potential gains against the associated risks to determine whether an investment is worth pursuing. This guides your decision-making process, ensuring that the potential rewards justify risks.

Constant Monitoring and Surveillance

Proactive monitoring and surveillance are critical to managing risk effectively. You must continuously monitor market trends, regulatory changes, and the financial health of companies. By staying vigilant and alert, you can identify potential risks quickly and take appropriate actions to reduce them. Regular monitoring helps you avoid emerging threats and adapt your strategies accordingly.

Stress Testing and Scenario Analysis

You employ stress testing and scenario analysis to assess the impact of adverse market conditions on your investment portfolios. By simulating various scenarios, you can evaluate the resilience of your investments and identify potential vulnerabilities. This principle helps you understand the potential risks in extreme market conditions. You can develop contingency plans to mitigate them.

Certified Investment Banking Operations Professional Course by Imarticus Learning

Imarticus Learning offers a comprehensive Certified Investment Banking Operations Professional program to equip you with job-specific skills and knowledge. This 150+ hours online course provides a solid foundation in investment banking operations and risk management. The course focuses on developing the practical skills required for investment banking operations. This includes risk assessment, trade settlement, reconciliation, and regulatory compliance. You will gain hands-on experience through real-world projects and case studies. Following are the various benefits of the Certified Investment Banking Operations Professional course:

The course curriculum is designed by industry experts. This ensures alignment with the current practices and demands of the investment banking sector. It covers key concepts, regulations, and industry best practices. This provides a comprehensive understanding of investment banking operations.

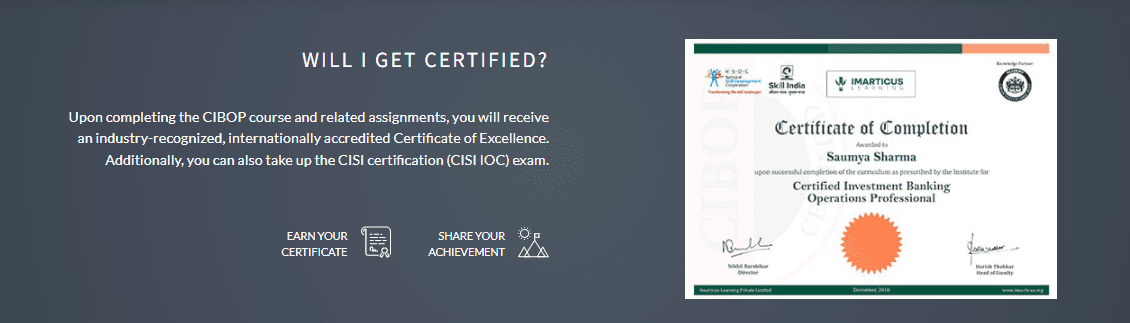

Upon successful completion of the course, you receive a certification that is recognized by the industry. This certification validates your expertise and enhances your employability in the competitive job market.

Imarticus Learning provides a 100% job interview guarantee to participants of the Certified Investment Banking Operations Professional course. The program offers placement assistance and prepares you for interviews. This increases your chances of securing rewarding job opportunities.

The course boasts an extensive alumni network of professionals working with top companies in the investment banking sector, such as UBS, JP Morgan, Morgan Stanley, Citi Bank, and Genpact. You benefit from the network’s support and industry connections. This can provide valuable insights, networking opportunities, and potential career prospects in top organizations.

The Certified Investment Banking Operations Professional course emphasizes practical learning through real-world projects and case studies. You gain hands-on experience in applying risk management principles, analyzing investment opportunities, and managing operational processes. This prepares you for the challenges of the investment banking industry.

Final Thoughts

Effective risk management is a critical skill for investment bankers. You can ensure the protection of investments and the achievement of desired financial outcomes. You embrace key principles such as due diligence, diversification, risk-reward tradeoff, constant monitoring, stress testing, and scenario analysis. This guides you to navigate the complexities of the financial landscape with confidence.

The Certified Investment Banking Operations Professional course by Imarticus Learning equips you with the necessary skills and knowledge to excel in investment banking operations and risk management. This course has industry-oriented curriculum, industry-recognized certification, job interview guarantee, practical learning approach, and alumni network working in leading companies. It also offers a comprehensive pathway to a successful career in investment banking. By mastering the art of risk management, you can thrive in the dynamic world of finance. You can contribute to the growth and stability of financial institutions.

To obtain

To obtain

Investment banking courses can surely help you gain the knowledge you need to become an investment banker but you need to have a lot of patience to work under pressure if you want to excel at this job.

Investment banking courses can surely help you gain the knowledge you need to become an investment banker but you need to have a lot of patience to work under pressure if you want to excel at this job.