With everything becoming dependent on technology, why not money? Monetary transactions have slowly gone digital too. With this form of digitalization, cryptocurrency was also developed which evolved into a medium of exchange.

Bitcoin became the first cryptocurrency that began back in 2009. Now, businesses are looking towards this exchange medium, with the likes of Elon Musk investing $1.5 billion in Bitcoin. Hence, it would be wise to know what cryptocurrency is and why it has already taken the world by storm.

What is cryptocurrency?

The meaning of cryptocurrency lies in its name itself. It is a kind of digital currency that is encrypted for security purposes. As it is encrypted, it becomes impossible to counterfeit like real money or even hack virtually. It comes in the form of digital coins and tokens that one can buy with real money.

Or, if someone has the expertise in technology, they can ‘mine’ it for themselves via a strong graphics processing unit (GPU).

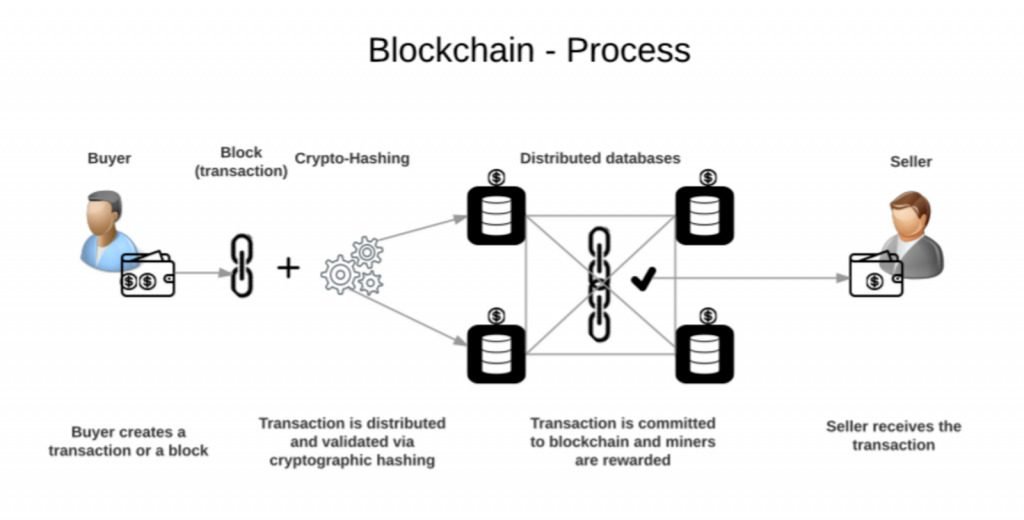

Most of the cryptocurrencies use Blockchain technology, which is decentralized and records transactions among computers. Cryptocurrencies are mainly used for trade finance. People usually use it to buy goods and services for many beneficial reasons.

Most of the cryptocurrencies use Blockchain technology, which is decentralized and records transactions among computers. Cryptocurrencies are mainly used for trade finance. People usually use it to buy goods and services for many beneficial reasons.

Different types of cryptocurrencies

Bitcoin is the most popular among all cryptocurrencies and currently, there are at least 18.5 million tokens being used. Besides Bitcoin, there are more than 6,700 kinds of cryptocurrencies being used in the market nowadays. And, some of them are:

Ethereum: Ethereum uses a token named Ether and it mainly promotes free access. But mostly, it is for developers to get rid of middlemen and control their apps.

Litecoin: Litecoin was created in the light of Bitcoin to improve upon it. It is basically the same as Bitcoin other than faster time for transactions and a few more benefits.

Stellar: Stellar’s currency is Lumen and its uniqueness lies in people being able to transact between different countries. Also, huge transactions can be made with little to no hassle.

How to buy cryptocurrencies?

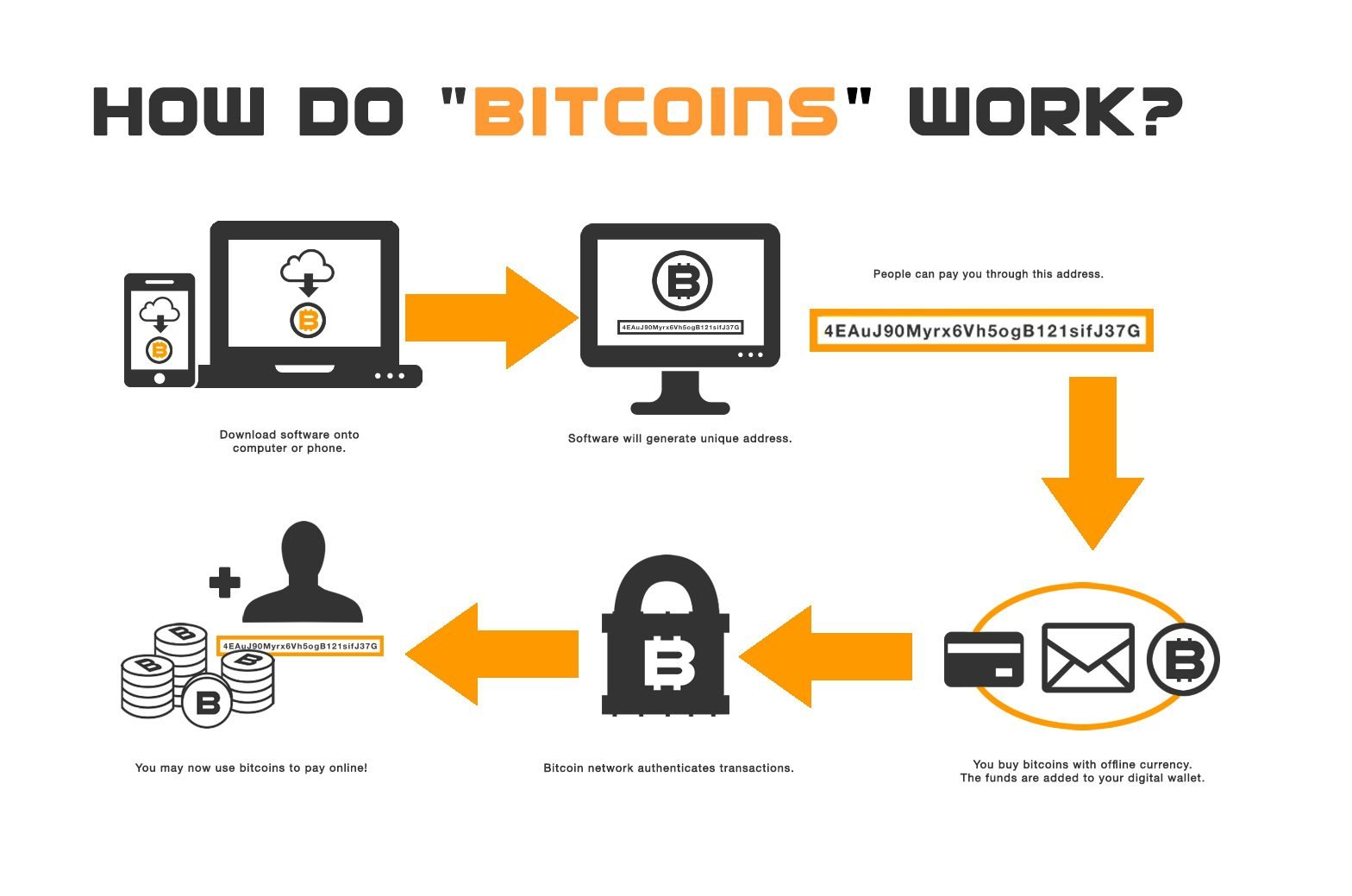

If someone wants to buy some cryptocurrencies for themselves, they will need an app where they can hold the currency like a ‘wallet’. Then, they can create an account and transfer real money to buy cryptocurrencies. Some online brokers are also selling cryptocurrencies. Notably, the exchange rate for cryptocurrencies can fluctuate at any time due to its decentralized nature.

Further, cryptocurrencies are very much transparent. They have zero possibility of being stolen. The transactions can also be quicker and made with minimal transaction fees compared to banks or other financial organizations, which makes trade finance a much easier process.

Further, cryptocurrencies are very much transparent. They have zero possibility of being stolen. The transactions can also be quicker and made with minimal transaction fees compared to banks or other financial organizations, which makes trade finance a much easier process.

By and large, cryptocurrencies are a little risky but as online transactions are increasing day by day, their importance is increasing too. One should only go along with purchasing cryptocurrencies with their advantages and risks all in mind.

On the other hand, if a digital ledger is created through

On the other hand, if a digital ledger is created through

Enterprise Ethereum Alliance (EEA) is a support group formed by more than 200 market leaders such as Microsoft, Wipro, Intel, Accenture, JP Morgan, Thomson Reuters, Credit Suisse along with many start-ups and subject matter experts. They are all bound by a common factor; all of them believe in the potential of blockchain.

Enterprise Ethereum Alliance (EEA) is a support group formed by more than 200 market leaders such as Microsoft, Wipro, Intel, Accenture, JP Morgan, Thomson Reuters, Credit Suisse along with many start-ups and subject matter experts. They are all bound by a common factor; all of them believe in the potential of blockchain.

Now one of the major challenges faced by the traditional banking systems is that it takes more than the necessary time to settle financial transactions carried out between two parties. The average time taken earlier was between 1to 3 days.

Now one of the major challenges faced by the traditional banking systems is that it takes more than the necessary time to settle financial transactions carried out between two parties. The average time taken earlier was between 1to 3 days. Identity theft is also a common problem in the modern digital age. Banks need better protection against these cybercriminals to detect fraud and eliminate the chances of data leakage.

Identity theft is also a common problem in the modern digital age. Banks need better protection against these cybercriminals to detect fraud and eliminate the chances of data leakage. This allows easy data manipulation without any repercussions but given the blockchain highly decentralized structure it is almost impossible to manipulate data without being caught.

This allows easy data manipulation without any repercussions but given the blockchain highly decentralized structure it is almost impossible to manipulate data without being caught.

The technology innovation in India and the surge in usage of smartphones has helped in the growth of fintech services. The recent coronavirus outbreak has also made people shift towards online modes of transferring money. Let us see the trends and opportunities in the fintech sector in India.

The technology innovation in India and the surge in usage of smartphones has helped in the growth of fintech services. The recent coronavirus outbreak has also made people shift towards online modes of transferring money. Let us see the trends and opportunities in the fintech sector in India.

You will get to know about the operations in digital banks via this course. It will help you in understanding the practices involved in the current fintech industry. This project provided by Imarticus is good for creating business ideas & start-ups.

You will get to know about the operations in digital banks via this course. It will help you in understanding the practices involved in the current fintech industry. This project provided by Imarticus is good for creating business ideas & start-ups.

There are many

There are many