COVID-19 or coronavirus is spreading like wildfire throughout the world. And, this even forced the World Health Organization (WHO) to declare it a pandemic. Ever since this disease was spotted, countermeasures have been set to curb its spread effectively. One such way is social distancing.

Because of social distancing and worldwide lockdown, the world’s foundations shook from within. And, it wasn’t late until this shockwave reached the stock market. In fact, both the trade life cycle and banking courses after graduation have taken a huge hit as well.

To do their bit, financial institutions like the New York Stock Exchange (NYSE) have closed their doors to traders for the first time in history. Things are only slowly returning to normal, and a few traders are allowed on NYSE. However, most of the traders are forced to trade from home and find online alternatives for conventional processes.

Cloud offers a lucrative opportunity for anyone looking to trade online. Traditional problems like lack of storage space, security concerns, and connectivity issues have all but disappeared in the cloud era. Statistics state the same. With an online chatting interface, apps providing a secure interface for traders have seen a substantial rise during the pandemic. Let us see how traders are using cloud services in great detail.

How are traders using the cloud?

Stock trading should never come to a halt because it has the power of crumbling economies. The COVID-19 outbreak can thus be considered a major test. Thankfully, traders are armed with the power of the cloud in today’s world.

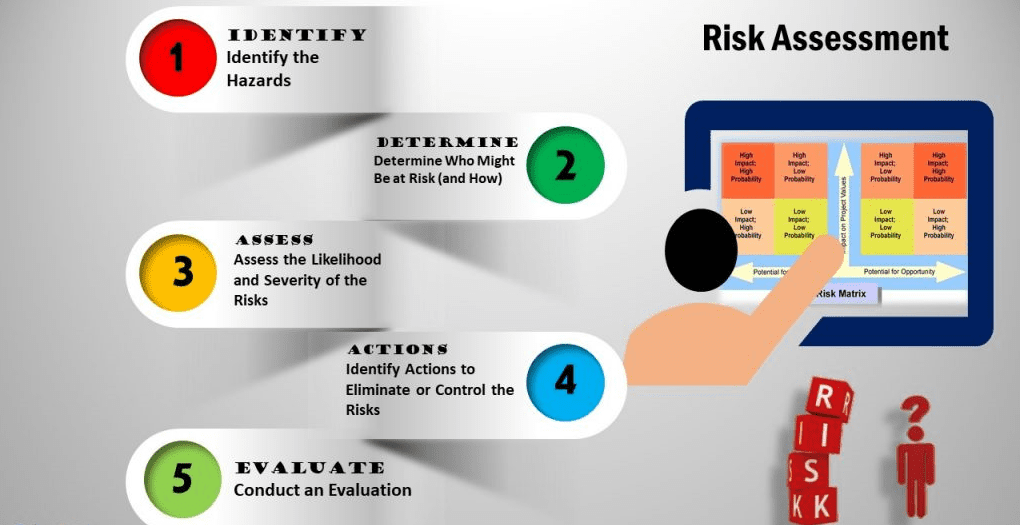

Data is the central part of any trader’s life. It is even more important to store and analyze the information correctly. Traders are increasingly using cloud solutions to store their data and run their models. The processing power of cloud computing allows them to quickly run multiple analyses like risk assessment within a matter of minutes as opposed to hours or even days from conventional means.

Data is the central part of any trader’s life. It is even more important to store and analyze the information correctly. Traders are increasingly using cloud solutions to store their data and run their models. The processing power of cloud computing allows them to quickly run multiple analyses like risk assessment within a matter of minutes as opposed to hours or even days from conventional means.

Cloud also allows for better traffic management. Traders can be seen leveraging the cloud to tackle any amount of traffic effectively. Mainly because the cloud is a scalable entity, it can quickly go up and down depending on the actual amount of people using it. Moreover, cloud computing offers a cheaper solution to many problems associated with stock trading.

Cloud also allows for better traffic management. Traders can be seen leveraging the cloud to tackle any amount of traffic effectively. Mainly because the cloud is a scalable entity, it can quickly go up and down depending on the actual amount of people using it. Moreover, cloud computing offers a cheaper solution to many problems associated with stock trading.

Not to mention, it provides the ability to analyze customer demographics, which allows for targeted solutions for a particular section. So, not only does the cloud act as a cheaper alternative but on top of that, it also improves profit margins.

In the search for normalcy, traders are looking towards the cloud to provide them with solutions. We are fortunate enough to live in a time where we have enough computing prowess to shift the base of operations online. Not only does it allow us to fight the virus but it also provides some benefits overall. In the future, we can expect cloud computing to take up a major role in the trading market.

For this, students can join vocational programs in Finance and Analytics from reputed institutions. Imarticus is one such renowned organization that is offering courses in these subjects to train students and make them job-ready for the business world. By learning these courses students get:

For this, students can join vocational programs in Finance and Analytics from reputed institutions. Imarticus is one such renowned organization that is offering courses in these subjects to train students and make them job-ready for the business world. By learning these courses students get: Fee Waiver on PG Classroom Programs – Up to 25% off

Fee Waiver on PG Classroom Programs – Up to 25% off

Imarticus Learning’s

Imarticus Learning’s