If you’re planning a global career in management accounting, it’s natural to look at cities that offer strong academic support and real job exposure. CMA in Chennai has steadily become one of the most practical and promising starting points for the CMA journey. Over the last few years, Chennai has emerged as one of India’s strongest hubs for CMA aspirants, particularly for roles in FP&A, business finance, shared services, and global accounting teams.

That’s why students searching for the CMA course in Chennai often find much more than just exam preparation here. From structured CMA classes in Chennai and specialised CMA coaching in Chennai, to strong hiring demand from MNCs and GCCs, the city offers a solid ecosystem for CMA professionals at every stage.

While comparing coaching options, many aspirants come across terms like CMA Institute Chennai during their initial research, especially when trying to understand how the CMA ecosystem operates locally.

Whether you’re trying to understand the CMA certification, comparing a CMA institute in Chennai, trying to understand CMA course fees in Chennai, or exploring real CMA jobs in Chennai, in this guide, I’ll break it all down – CMA course details, coaching options, fees, internships, jobs, salary expectations, and long-term career growth in Chennai – clearly, honestly, and without any confusion.

Understanding CMA and Why Location Matters

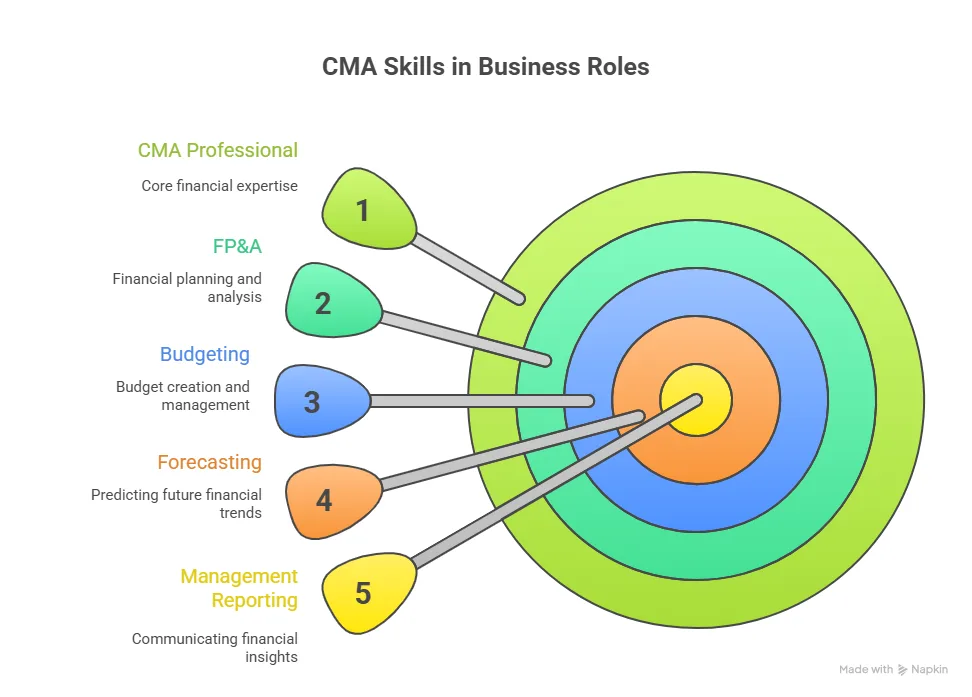

Before choosing where to pursue the CMA, it’s essential to understand what is CMA and why it holds strong global value. The Certified Management Accountant offered by the IMA focuses on management accounting, financial planning, analysis, control, and strategic decision-making skills that are in high demand across modern finance teams.

Unlike traditional accounting roles, CMA professionals work closely with business leaders in areas such as financial planning & analysis, management reporting, budgeting, forecasting, and business finance. This makes the qualification especially relevant for MNCs, shared services, and global capability centres.

Once you clearly understand what CMA is and the careers it leads to, the role of the right city becomes obvious. CMA career grows fastest in locations with strong corporate finance ecosystems, which is why Chennai is a preferred city for CMA aspirants.

If you’ve ever wondered, Is US CMA difficult?, you’re not alone. Many CMA aspirants ask this early in their journey – especially when balancing studies, work, or coaching. To give you a clear and realistic perspective, here’s a video that explains the exam’s structure, the reasoning behind its difficulty level, and tips on how to approach it with confidence:

Why Chennai Is the Right City for CMA Aspirants

Chennai’s advantage lies in its industry mix. The city hosts manufacturing giants, IT services firms, global capability centres, and consulting teams – all of which actively hire CMA professionals.

This is why CMA Chennai continues to attract both students and working professionals. Key reasons include:

- A strong presence of CMA firms in Chennai alongside global finance and shared services teams.

- Growing availability of CMA institutes in Chennai and specialised private coaching academies.

- Consistent CMA job opportunities in Chennai across FP&A, reporting, project selection methods, and business finance roles.

- An active Chennai CMA chapter ecosystem with networking events and professional programs that translate into real hiring outcomes.

For many students, this directly opens doors to CMA internships in Chennai, CMA fresher jobs in Chennai, and CMA jobs in Chennai for freshers, particularly in FP&A, business finance, and global accounting roles.

CMA Course in Chennai: Structure & Eligibility

Unlike Indian professional courses, the CMA course in Chennai follows a simple and focused structure with just two exam parts:

| US CMA Part | Key Focus Areas |

| Part 1 | Financial Planning, Performance & Analytics |

| Part 2 | Strategic Financial Management |

There is no articleship requirement, which makes CMA USA in Chennai especially popular among graduates and working professionals. Many candidates complete the exams alongside internships or full-time roles.

If you’re searching for CMA course details in Chennai, this simplicity is one of the biggest advantages. The clearly defined CMA course subjects ensure that each part builds practical skills in planning, analysis, and strategic finance, making it easier for candidates to relate exam preparation to real business roles.

Overview of CMA Eligibility

Before getting into preparation, fees, or coaching options for CMA in Chennai, it’s important to understand CMA eligibility – who can apply, when you’re allowed to start the US CMA course, and what basic academic and work-experience requirements you need to plan for.

| Requirement | Details |

| Education | Graduation (any stream) or final-year student |

| Exams | 2 parts (Part 1 & Part 2) |

| Experience | 2 years of relevant finance/accounting experience |

| Study Mode | Classroom or online CMA coaching in Chennai |

Preparing for CMA interviews can feel just as important as clearing the exams. This US CMA mock interview video gives a quick look at the kind of questions recruiters ask and how to approach your answers with confidence:

CMA Course Fees in Chennai: What You’re Really Paying For

One of the most common searches is CMA course fees in Chennai, and rightly so.

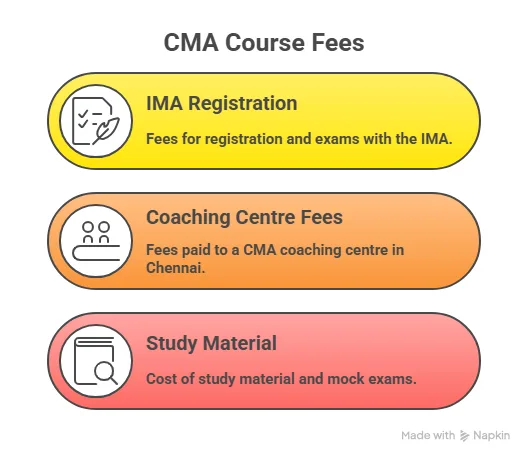

The total CMA fees structure in Chennai usually includes:

- IMA registration & exam fees

- Coaching fees from a CMA coaching centre in Chennai

- Study material, mock exams, and revision support

When students compare CMA course fees details in Chennai, the variation usually comes from coaching quality, faculty experience, and career support – not the exam itself.

A well-structured CMA course institute in Chennai may charge more, but it often saves time by reducing repeat attempts and improving job readiness.

Did You Know?

Searches for the CMA USA course in Chennai have grown steadily as more students realise they can pursue a globally recognised management accounting qualification while studying or working full-time in the city.

Where to Study CMA in Chennai: Institutes & Coaching

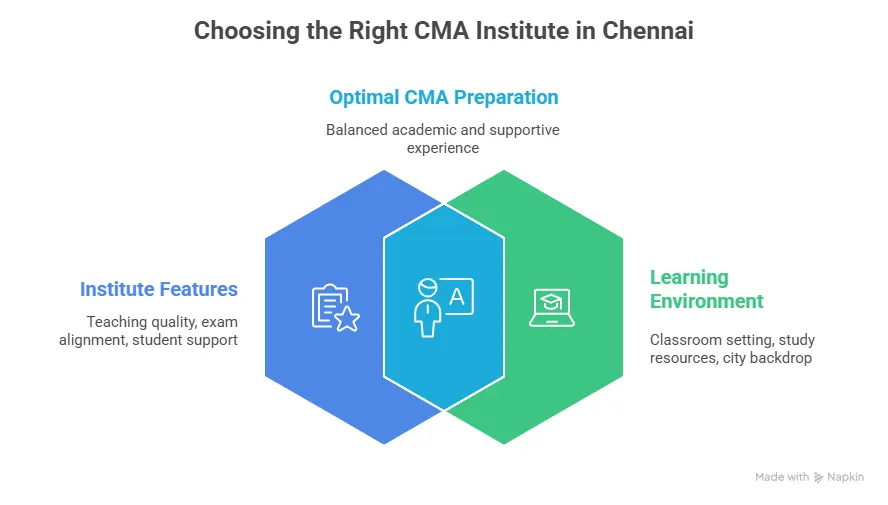

During this stage, students often search for terms like the best CMA academy in Chennai, not necessarily to find a single answer, but to understand which institutes are known for structured teaching, exam alignment, and consistent student support.

Students often begin by browsing lists such as the top 10 CMA institute in Chennai to get an overview of available options, before narrowing down what actually fits their learning style and schedule.

Chennai today has a healthy mix of established coaching centres and newer entrants, each positioning itself as a CMA academy in Chennai with its own teaching approach and student support model.

Rather than chasing claims around the best CMA institute in Chennai, it’s usually more practical to focus on how well an institute supports exam preparation, revision discipline, and career alignment.

Along with coaching centres, many students also look up the CMA office Chennai to understand where official coordination, chapter events, and professional networking activities take place during their CMA certification journey.

CMA Bhavan Chennai

When starting their CMA journey, students often try to understand the official CMA presence in Chennai, like the CMA office in Chennai or CMA Bhavan, mainly to know where exams are coordinated, where chapter events take place, and how professional networking works through the Chennai CMA chapter.

These offices don’t teach you for the exams, but they matter. They’re where students attend events, meet working CMAs, and stay connected to the professional side of the qualification.

For exam preparation, most students turn to reliable CMA books and private coaching providers. This is where students begin comparing coaching options in the city. Most of them want to figure out which institute teaches well, explains concepts clearly, offers flexible class schedules, and genuinely supports both working professionals and freshers through the CMA journey.

In practice, most CMA aspirants in Chennai use both the official CMA ecosystem with the best CMA review course for exposure and credibility, and a private coaching institute for day-to-day exam preparation.

CMA Colleges in Chennai: Is CMA a Degree?

This is one of the most common confusions I get asked by aspirants. The CMA course in Chennai is not offered as a college degree. Students typically:

- Complete graduation from regular CMA colleges in Chennai.

- Pursue the CMA Certification through a CMA training institute in Chennai or a coaching academy.

- Some institutions offer integrated support, but certification is awarded directly by IMA, USA.

Did You Know?

CMA US Chennai has steadily gained traction among students and professionals who want global exposure in management accounting while building their careers from a strong local finance ecosystem.

CMA Classes & Coaching in Chennai

The quality of coaching plays a big role in how smoothly your CMA preparation goes. In Chennai, students usually realise early that clearing the exam isn’t about memorising content – it’s about understanding how concepts are tested and applied in real business scenarios.

Good CMA coaching focuses on building that foundation first, and then gradually shifting toward exam readiness and career relevance. This structured approach also helps students manage the CMA course duration more effectively, avoiding rushed attempts and allowing enough time to build confidence before each exam.

Most well-structured CMA classes in Chennai typically emphasise the following:

| What Good CMA Coaching Focuses On | Why It Matters |

| Strong concept clarity | Helps you handle application-based IMA exam questions with confidence. |

| Case-based learning | Trains you to think like a management accountant, not just an exam candidate. |

| Regular mock tests | Builds exam temperament and highlights weak areas early. |

| Exam strategy & revision planning | Ensures you’re prepared for the format, time pressure, and scoring approach. |

| Career guidance beyond exams | Helps students connect CMA knowledge with real FP&A and finance roles. |

Most students look for coaching that brings structure to their preparation – classes that fit around exam windows, study plans that feel realistic, and regular assessments to track progress. This matters even more for working professionals and final-year students who need predictability without feeling overwhelmed.

In reality, the best CMA coaching in Chennai isn’t about big claims or marketing. It’s about steady teaching, disciplined preparation, and guidance that supports you right up to exam day – and as you start thinking about what comes next.

Access to well-organised CMA study material also plays a key role here, as it helps students revise consistently, practise effectively, and stay aligned with exam expectations without last-minute confusion.

Did You Know?

Demand for US CMA coaching in Chennai has grown as more aspirants look for guided preparation that not only helps them clear exams but also prepares them for real-world finance and FP&A roles.

CMA Jobs, Internships & Career Growth in Chennai

Chennai offers CMA opportunities across different stages of the qualification, making it easier to enter the field early and grow steadily.

CMA internship in Chennai

These roles are usually taken up by students preparing for Part 1 or Part 2 and focus on exposure to FP&A support, reporting, or cost analysis. Internships help bridge the gap between exam concepts and real corporate work.

CMA fresher jobs in Chennai

Freshers who have cleared one or both parts of the CMA often enter roles in business finance teams, shared services, or reporting functions. These positions focus on learning processes, tools, and real-world financial analysis. The concepts tested in each CMA paper directly show up in these early roles, helping freshers connect exam learning with real-world finance processes from day one.

CMA vacancies in Chennai

Job openings for CMAs appear regularly across industries like manufacturing, IT services, and global capability centres. Many of these roles are aligned with budgeting, planning, management, reporting, and cost management strategies.

CMA jobs in Chennai in FP&A, reporting, and business finance

These are core CMA-aligned roles where professionals work closely with business teams on forecasting, performance tracking, and financial decision support. Much of this work directly reflects the CMA syllabus, which is designed around real-world activities like budgeting, forecasting, performance analysis, and decision support.

CMA US jobs in Chennai within MNCs and GCCs

Several multinational companies and global finance centres hire CMA professionals in Chennai for global reporting, COSO Framework, FP&A, and regional finance roles supporting overseas markets.

Alongside full qualification roles, Chennai also offers strong options for partially qualified candidates.

CMA inter jobs in Chennai

Students who have cleared one part of the CMA often take up analyst or finance support roles while continuing their preparation. These jobs help maintain momentum and practical exposure. In fact, many of these roles are part of broader CMA jobs in India, where employers actively hire semi-qualified candidates who can contribute while completing the remaining exam requirements.

Jobs for CMA inter-qualified fresher in Chennai

While the US CMA does not mandate articleship, some students still explore practical exposure through listings like a CMA articleship vacancy in Chennai, mainly to gain early finance experience alongside exam preparation. These roles are designed for freshers who are part-qualified and usually focus on reporting support, cost tracking, or MIS functions under senior finance teams.

CMA semi-qualified jobs in Chennai

These semi-qualified roles also help candidates build experience that directly improves earning potential over time, especially when viewed in the context of CMA salary in India as professionals progress toward full qualification.

CMA training vacancy in Chennai

Training roles are structured positions where candidates learn finance processes, tools, and reporting standards on the job. They are commonly used as entry points into long-term CMA-aligned careers.

The CMA fresher’s salary in Chennai often improves faster in FP&A and global reporting roles compared to traditional accounting jobs. Here’s a concise overview of the CMA salary in Chennai based on years of experience:

| Level | CMA Salary in Chennai (Indicative Range) |

| Fresher | ₹4-7 LPA |

| 2-5 years | ₹7-12 LPA |

| 5+ years | ₹12-20 LPA |

Lesser Known Insight:

The US CMA course in Chennai is increasingly seen as a gateway to global finance roles, allowing aspirants to build internationally relevant careers without having to relocate or step away from their current commitments.

CMA Exam Centres in Chennai

As the exam date approaches, students pursuing CMA in Chennai often start searching for CMA exam centres in Chennai to understand where they might be writing the exam and how convenient the location will be. While the exam centres are officially assigned by the IMA during CMA registration and cannot be chosen, having clarity on how exam centres work helps reduce last-minute stress for CMA candidates in Chennai.

For many aspirants preparing for CMA in Chennai, knowing the exam process in advance – centre location, reporting time, and exam-day rules – adds a layer of confidence and allows them to focus fully on performance rather than logistics.

Quick CMA Exam-Day Checklist

No matter whether you pursue the CMA in Chennai or any other city, following these steps will help you avoid the last-minute hassle for reaching cma exam centres in Chennai or your exam city:

- Check your exam centre address and reporting time a day in advance.

- Carry a valid photo ID as mentioned in your exam confirmation.

- Reach the centre early to allow time for security and check-in.

- Avoid last-minute studying – focus on staying calm and rested.

- Follow the centre instructions closely once the exam begins.

Why Imarticus for CMA in Chennai

Preparing for the CMA in Chennai often means balancing studies with college or work. While books and materials are important, most students realise that clearing the CMA depends more on structured learning than on self-study alone.

At Imarticus, CMA preparation focuses on helping students understand how the exam works and how concepts apply in real finance roles. The approach is built around clarity, relevance, and steady progress.

What students typically benefit from:

- A clear study structure that removes guesswork – This structure is especially useful for working professionals and final-year students in Chennai who need predictability.

- Concepts taught with a practical business context – This mirrors how CMA questions are framed and helps students think beyond memorisation.

- Focused preparation for CMA MCQs and essays – This reduces surprises and builds confidence closer to exam day.

- Ongoing academic support through revisions and mock tests – Doubt-solving, revision sessions, mock tests, and guidance are part of the learning process.

- Alignment with the CMA USA exam framework – Coverage, practice, and assessment follow the CMA USA exam framework, helping students prepare with relevance rather than guesswork.

- For CMA aspirants in Chennai who want organised preparation without unnecessary pressure, Imarticus aims to support both exam readiness and long-term career thinking.

When preparation feels organised and supported, the CMA journey becomes less overwhelming – and far more manageable.

FAQs About CMA in Chennai

Planning to pursue CMA in Chennai? In these frequently asked questions, I’ve tried to answer the most common questions around eligibility, coaching, fees, and career opportunities for CMA aspirants.

Is CMA in Chennai worth it for freshers?

Yes. Chennai offers strong entry-level opportunities for CMA freshers, especially in FP&A, reporting, shared services, and global accounting teams. The city’s mix of MNCs, GCCs, and manufacturing firms makes it easier to gain early exposure and grow steadily.

Which college is best for CMA in Chennai?

CMA in Chennai is not offered as a college degree. Students usually complete graduation from any recognised college or university and pursue the CMA course through a specialised CMA institute in Chennai or a CMA coaching centre in Chennai. The quality of coaching matters far more than the college name when preparing for CMA.

What is the salary of a CMA in Chennai?

In Chennai, CMA salaries usually grow with experience based on the role you grow into, not just the qualification itself. As a fresher, you can expect something around ₹4-7 LPA in entry-level finance or analyst roles. With 2-5 years of experience, the pay often moves to ₹7-12 LPA in mid-senior roles, and senior professionals working in FP&A or global finance teams can earn ₹12-20 LPA or even more over time.

Which is the best US CMA institute in Chennai?

There’s no single best institute – it really comes down to how well the training supports your preparation. Clear teaching, exam-focused planning, regular revisions, and career guidance matter far more than just lectures. This is where institutes like Imarticus Learning stand out for many students, as they focus on structured preparation and practical understanding alongside the CMA curriculum.

Who is eligible for CMA in Chennai?

You can start CMA in Chennai if you’re a graduate or in your final year of college. The work experience requirement can be completed after clearing the exams, which makes it flexible for students and early professionals.

Are there classroom-based CMA classes in Chennai or only online options?

CMA classes in Chennai are available in both options – online as well as in-person options. Some students prefer classroom sessions for structure, while others choose online classes for flexibility.

What is the CMA course duration in Chennai?

The course duration for CMA in Chennai lasts from 12 to 18 months for most candidates. This timeline depends on how you plan your exam attempts, your preparation pace, and whether you’re studying alongside college or a full-time job. Opting for institutes like Imarticus Learning often boosts your preparation and reduces the number of attempts required, which results in clearing the CMA exams early.

How much are the CMA course fees in Chennai?

Fees vary based on registration and coaching choices. Overall, CMA in Chennai remains far more affordable than long-term degrees, especially considering the career outcomes.

Do companies in Chennai hire US CMA professionals?

Yes. Chennai offers steady demand for CMAs in finance, analytics, reporting, and business support roles across industries. Many MNCs, GCCs and consulting teams in Chennai actively hire US CMA professionals for global finance roles. Common roles include FP&A analyst, management accountant, finance analyst, and business finance associate.

CMA in Chennai: What the Journey Looks Like Over Time

Pursuing CMA isn’t just about clearing two exams and adding a certification to your resume. Over time, the CMA journey changes how you think about finance itself – how you analyse numbers, question assumptions, support business decisions, and communicate financial insights with clarity and confidence.

With the right CMA training in Chennai, a structured study plan, and consistent preparation, many students find that the transition from classroom learning to real finance roles becomes far smoother. Early exposure to budgeting, forecasting, performance analysis, and strategic thinking helps bridge the gap between studying finance and actually working in finance.

What makes CMA particularly powerful in Chennai is the strong ecosystem around it. The city offers access to global companies, finance teams, and growing FP&A roles – allowing aspirants to build internationally relevant careers while staying in India. When preparation is aligned with how the CMA is tested and how finance roles actually function, progress feels more intentional and less overwhelming.

If you’re serious about building a long-term career in management accounting or business finance, the next step isn’t just registering for the exam – it’s choosing a preparation path that keeps you focused, supported, and moving forward. Done right, CMA in Chennai isn’t just a qualification you earn – it’s a career direction you grow into.

FinTech provides its users with an ability to perform all their important financial operations through their smart-phones or computers and these are processed in a matter of seconds.

FinTech provides its users with an ability to perform all their important financial operations through their smart-phones or computers and these are processed in a matter of seconds.

In addition to this, you need to assess the performance and risk of various financial assets before making a recommendation. You also need to assess the changing market circumstances before providing any advice to your clients.

In addition to this, you need to assess the performance and risk of various financial assets before making a recommendation. You also need to assess the changing market circumstances before providing any advice to your clients.

On the other hand, if a digital ledger is created through

On the other hand, if a digital ledger is created through

Enterprise Ethereum Alliance (EEA) is a support group formed by more than 200 market leaders such as Microsoft, Wipro, Intel, Accenture, JP Morgan, Thomson Reuters, Credit Suisse along with many start-ups and subject matter experts. They are all bound by a common factor; all of them believe in the potential of blockchain.

Enterprise Ethereum Alliance (EEA) is a support group formed by more than 200 market leaders such as Microsoft, Wipro, Intel, Accenture, JP Morgan, Thomson Reuters, Credit Suisse along with many start-ups and subject matter experts. They are all bound by a common factor; all of them believe in the potential of blockchain.

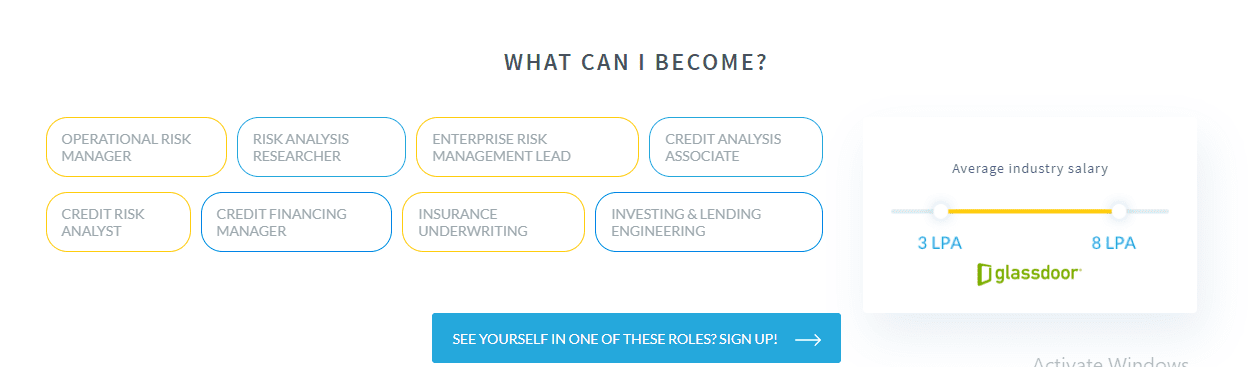

Let us understand why credit underwriting is such a fascinating career option.

Let us understand why credit underwriting is such a fascinating career option. You get to work with the latest technology:

You get to work with the latest technology:  Conclusion:

Conclusion:

If a country experiences a fiscal deficit (expenditures are more than revenue), it will also hamper the continuity of businesses.

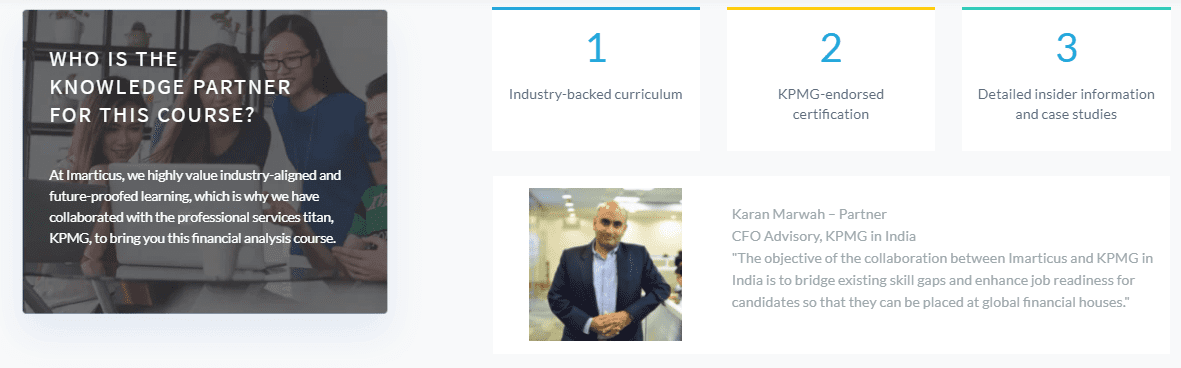

If a country experiences a fiscal deficit (expenditures are more than revenue), it will also hamper the continuity of businesses. It is a type of chartered financial analyst course that is self-paced and tech-aided. You will also be eligible for the placement assistance provided by Imarticus towards the end of the financial analysis course. Imarticus has successfully helped around 2400 enthusiasts to build their careers with their courses.

It is a type of chartered financial analyst course that is self-paced and tech-aided. You will also be eligible for the placement assistance provided by Imarticus towards the end of the financial analysis course. Imarticus has successfully helped around 2400 enthusiasts to build their careers with their courses.

When you

When you  Are you looking for a

Are you looking for a