Fintech is an industry that deals with finance technology. At its roots, technology in the finance industry can be traced back to when traders were writing on blackboards to show what sales they made in the stock market on any given day. From there, it has expanded into much more technologically advanced areas.

What Is a Fintech Festival?

Fintech Festival is an event for financial technology popping up around the world in recent years. As an industry grows and changes, so does its need for innovations and technologies.

It’s a platform where technology companies, enthusiasts, investors, and more celebrate innovations in the financial sector. A lack of exploration has led to a lot of work for people in finance technology. Another aspect of this industry’s growth is how quickly it has expanded in recent years.

The organizer of this festival is usually a technology company that specializes in the finance industry. During this festival, multiple booths display any new developments and other recent things they have been working on, allowing them to connect with potential investors and even their existing customers.

Why Do People Attend a Fintech Festival?

There are many reasons why people attend a fintech festival.

- Many of these events attract entrepreneurs, industry leaders, and technology enthusiasts.

- Of course, people who work in finance and technology will attend because they can learn about the latest advancements and meet like-minded professionals.

- Other people might be interested in specific areas of Fintech such as blockchain, cryptocurrency, investments, banking, etc.

When is Fintech Festival 2022?

FinTech Festival India 2022 will play a vital role in bolstering the environment and promoting cooperation between Key global FinTechs. FinTech Festival in India would be followed by a series of ten Hybridized Micro Experience in eight Indian cities from February 2022 to March 2022, culminating in a Strong Global presence in New Delhi in March 2022.

How Much Do Fintech Festival Tickets Cost?

The price of fintech festival tickets varies depending on which one you attend and where it gets located. Most of these festivals are open to the public, but there is usually a small fee involved for you to register. Fortunately, many of them offer discounts on tickets if you buy multiple days’ worths or they have a special promotion going on at the time.

Explore and learn with Imarticus Learning

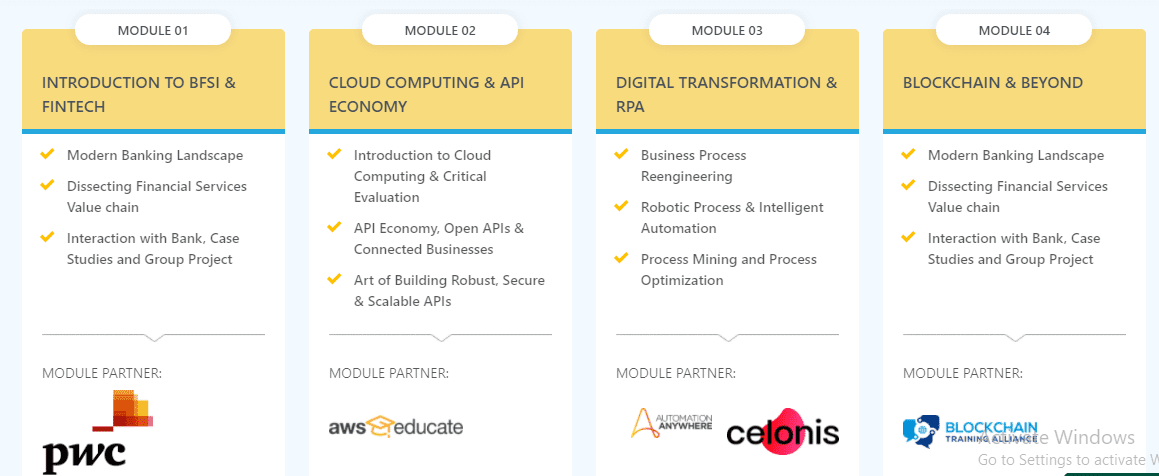

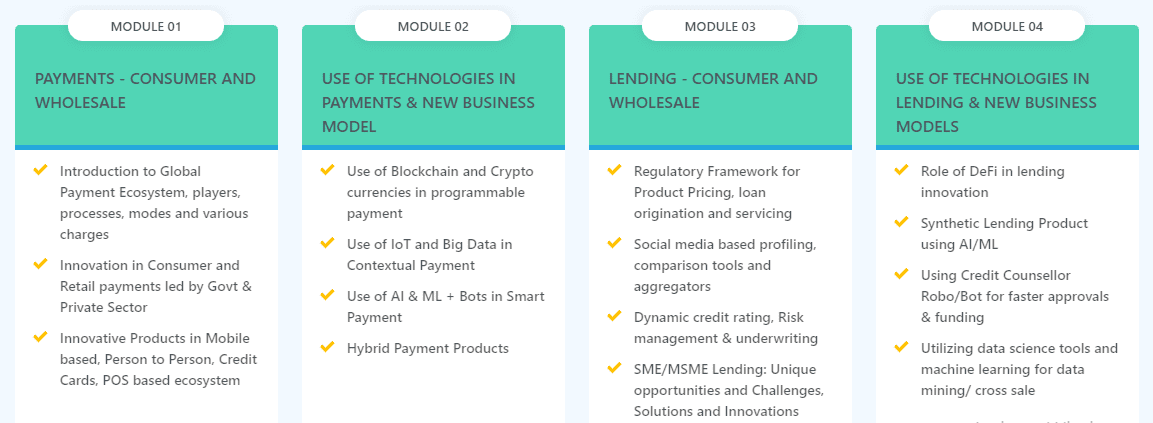

This one-of-a-kind FinTech course combines practical learning instruction with cutting-edge innovations like APIs, Blockchain, Cloud Computing, AI, Machine Learning, RPA, IoT, and Big Data to cover every essential element of FinTech. If students want to become a FinTech specialist and boost their job chances, their quest stops here, and a fantastic FinTech learning experience begins.

Fintech is an industry that deals with finance technology. At its roots, technology in the finance industry can be traced back to when traders were writing on blackboards to show what sales they made in the stock market on any given day. From there, it has expanded into much more technologically advanced areas.

What Is a Fintech Festival?

Fintech Festival is an event for financial technology popping up around the world in recent years. As an industry grows and changes, so does its need for innovations and technologies.

It’s a platform where technology companies, enthusiasts, investors, and more celebrate innovations in the financial sector. A lack of exploration has led to a lot of work for people in finance technology. Another aspect of this industry’s growth is how quickly it has expanded in recent years.

The organizer of this festival is usually a technology company that specializes in the finance industry. During this festival, multiple booths display any new developments and other recent things they have been working on, allowing them to connect with potential investors and even their existing customers.

Why Do People Attend a Fintech Festival?

There are many reasons why people attend a fintech festival.

- Many of these events attract entrepreneurs, industry leaders, and technology enthusiasts.

- Of course, people who work in finance and technology will attend because they can learn about the latest advancements and meet like-minded professionals.

- Other people might be interested in specific areas of Fintech such as blockchain, cryptocurrency, investments, banking, etc.

When is Fintech Festival 2022?

FinTech Festival India 2022 will play a vital role in bolstering the environment and promoting cooperation between Key global FinTechs. FinTech Festival in India would be followed by a series of ten Hybridized Micro Experience in eight Indian cities from February 2022 to March 2022, culminating in a Strong Global presence in New Delhi in March 2022.

How Much Do Fintech Festival Tickets Cost?

The price of fintech festival tickets varies depending on which one you attend and where it gets located. Most of these festivals are open to the public, but there is usually a small fee involved for you to register. Fortunately, many of them offer discounts on tickets if you buy multiple days’ worths or they have a special promotion going on at the time.

Explore and learn with Imarticus Learning

This one-of-a-kind FinTech course combines practical learning instruction with cutting-edge innovations like APIs, Blockchain, Cloud Computing, AI, Machine Learning, RPA, IoT, and Big Data to cover every essential element of FinTech. If students want to become a FinTech specialist and boost their job chances, their quest stops here, and a fantastic FinTech learning experience begins.

Some course USP:

- This Fintech training aids the students to learn job-relevant skills that prepare them for an exciting career in Fintech.

- Impress employers & showcase skills with a certification endorsed by India’s most prestigious academic collaborations.

- World-Class Academic Professors to learn from through live online sessions and discussions. It will help students understand the 360-degree practical learning implementation with assignments.

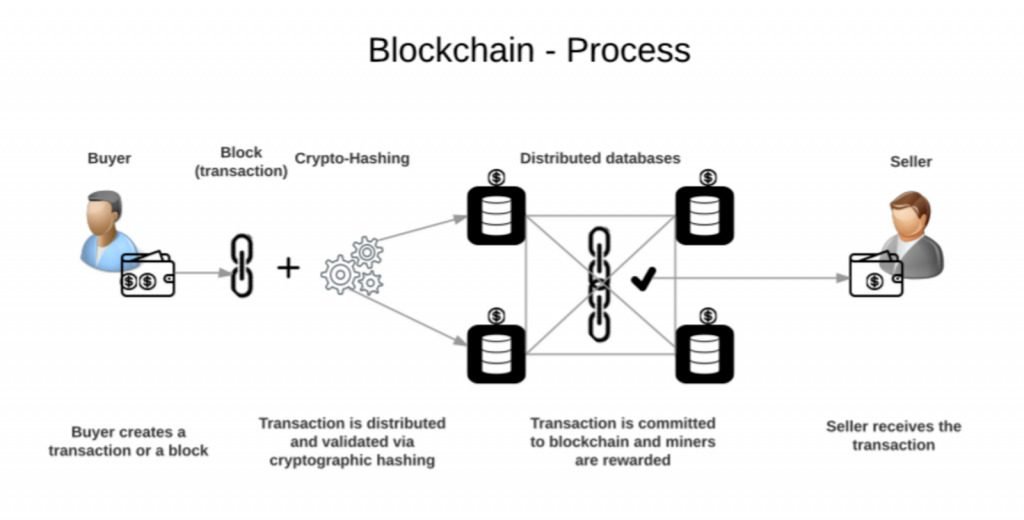

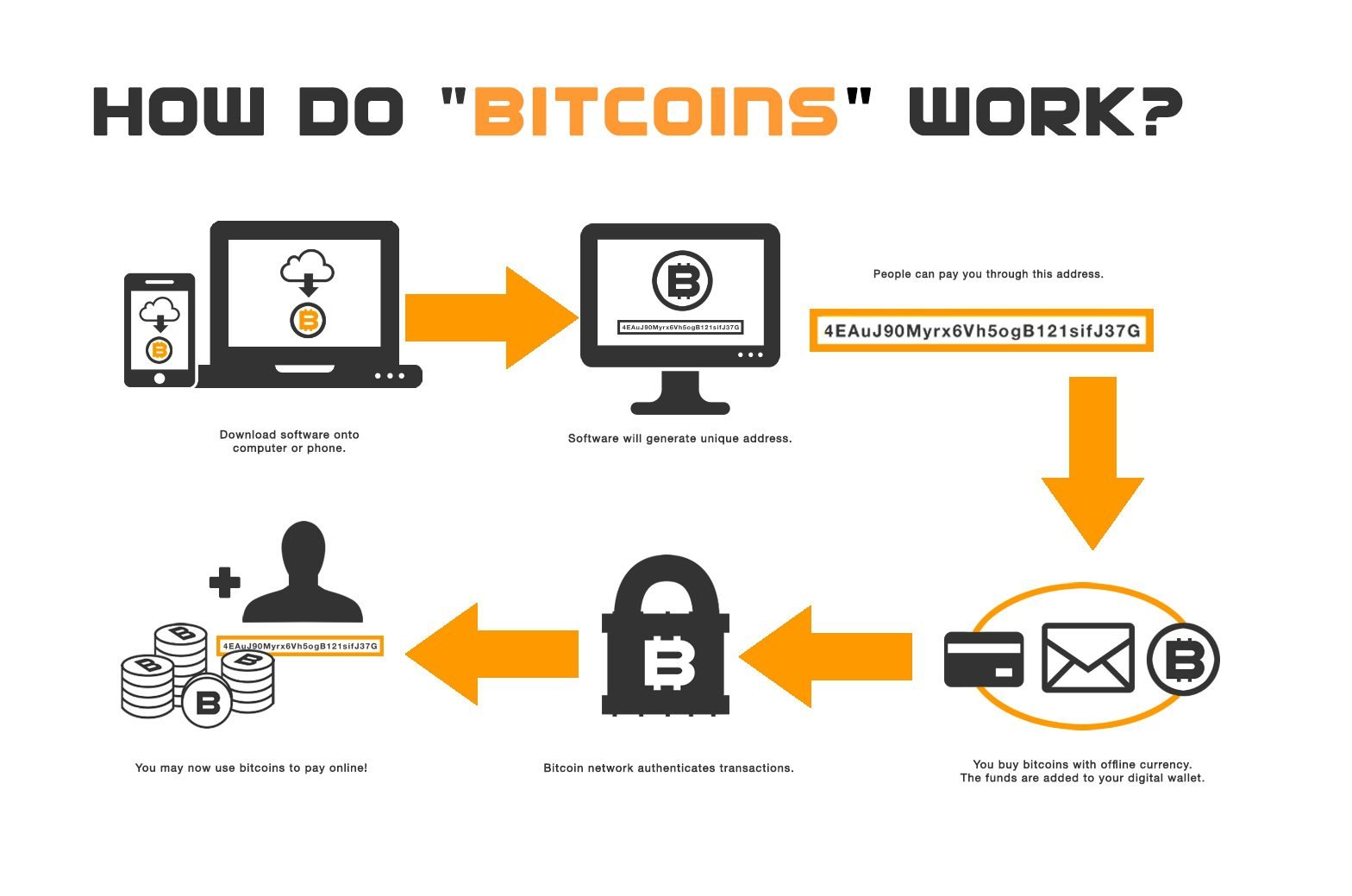

Most of the cryptocurrencies use Blockchain technology, which is decentralized and records transactions among computers. Cryptocurrencies are mainly used for trade finance. People usually use it to buy goods and services for many beneficial reasons.

Most of the cryptocurrencies use Blockchain technology, which is decentralized and records transactions among computers. Cryptocurrencies are mainly used for trade finance. People usually use it to buy goods and services for many beneficial reasons. Further, cryptocurrencies are very much transparent. They have zero possibility of being stolen. The transactions can also be quicker and made with minimal transaction fees compared to banks or other financial organizations, which makes trade finance a much easier process.

Further, cryptocurrencies are very much transparent. They have zero possibility of being stolen. The transactions can also be quicker and made with minimal transaction fees compared to banks or other financial organizations, which makes trade finance a much easier process.

FinTech provides its users with an ability to perform all their important financial operations through their smart-phones or computers and these are processed in a matter of seconds.

FinTech provides its users with an ability to perform all their important financial operations through their smart-phones or computers and these are processed in a matter of seconds.

Some course USP:

Some course USP:

Enterprise Ethereum Alliance (EEA) is a support group formed by more than 200 market leaders such as Microsoft, Wipro, Intel, Accenture, JP Morgan, Thomson Reuters, Credit Suisse along with many start-ups and subject matter experts. They are all bound by a common factor; all of them believe in the potential of blockchain.

Enterprise Ethereum Alliance (EEA) is a support group formed by more than 200 market leaders such as Microsoft, Wipro, Intel, Accenture, JP Morgan, Thomson Reuters, Credit Suisse along with many start-ups and subject matter experts. They are all bound by a common factor; all of them believe in the potential of blockchain.