Are you looking for a job in the Indian Fintech industry? Fintech exams for recruitment or certification can be tough and you need to have the required skills to crack it. There are many online certification courses on the internet but many of them do not provide an in-depth learning curriculum.

The SP Jain’s Fintech program provide by Imarticus Learning will provide you industry-oriented learning. It will help you in building a successful career in the fintech industry. Read on to know more about the interesting format of SP Jain’s fintech program.

Course Overview

The Professional Certification in Fintech is provided by Imarticus & SP Jain School of Global Management. Along with in-depth coverage of fintech aspects, this course will also provide you experimental learning. This course comes in two formats i.e. CORE Modules & PRO Modules.

The CORE Modules will cover various tools & technologies used in the fintech sector. The PRO Modules include the topics covered in CORE Modules plus extra learning. Let us see the detailed curriculum of both modules.

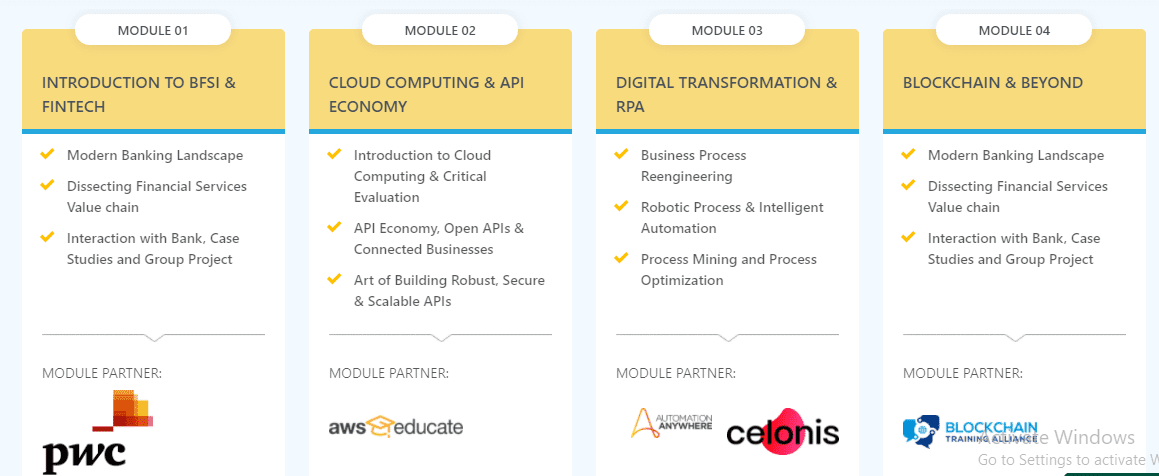

CORE Modules

The topics covered in the CORE Modules are as follows:

• Introduction to BFSI & Fintech – You will go through various case studies to understand the modern banking landscape. You will also get to work on a group project under this module.

• Cloud Computing & API Economy – Recruiters in the fintech industry look for candidates who are experts in modern-day technologies like cloud computing, big data analysis, etc. You will learn about APIs, open APIs & connected businesses. You will learn about API management in the fintech industry.

• Data Transformation and RPA – RPA (Robotic Process Automation) is used to automate many processes in the fintech industry. This course will help you in learning about process mining & optimization. It will also cover various aspects of business process reengineering.

• Blockchain & Beyond – This topic in CORE Modules will cover the usage of blockchain in the current fintech industry. You will also learn about various tools & applications used to provide fintech services to consumers.

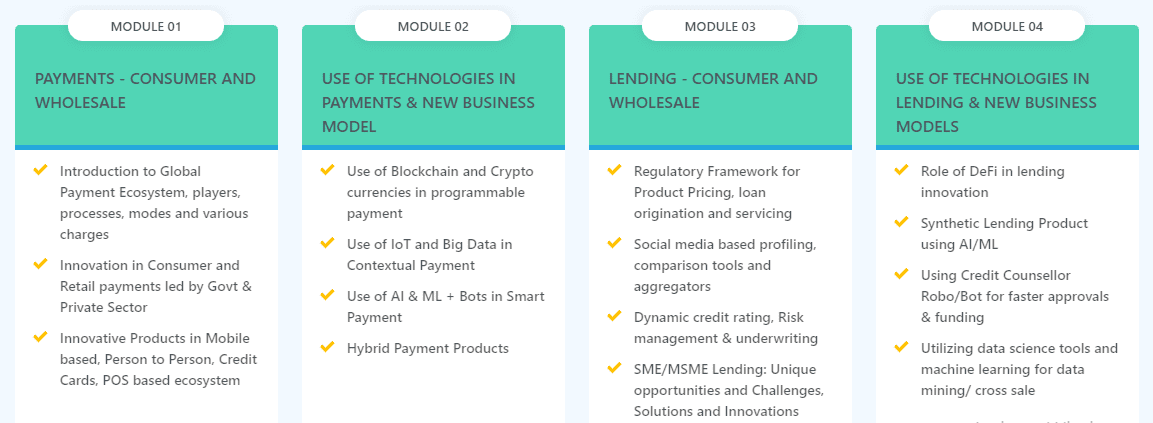

PRO Modules

The topics covered in PRO Modules (140 hours) are:

• Payments – Consumer & Wholesale – You will get to know about modern-day payment practices. This module will also help you in understanding various innovations in the payments & lending market led by the government/private sector.

• Use of Technologies in Payments & New Business Model – You will get to know about programmable payment systems. This module will cover various aspects like the use of AI/ML bots, cryptocurrency management, hybrid payment products, IoT in fintech, etc.

• Lending – Consumer and Wholesale – This sub-module covers various aspects of the fintech industry like social media-based profiling, comparison tools, regulatory frameworks, SME/MSME lending. You will get to know about the innovations in the lending/loan industry.

• Use of Technologies in Lending & New Business Models – This sub-module will focus on the use of data science & machine learning for cross-selling. It will also teach you about synthetic lending products using AI/ML & DeFi lending.

Benefits of the SP Jain’s Fintech Program

• You can get your hands on the Project: Paradigm shift under this course. It will help you in working on a visionary fintech business idea/project.

• Your final examination will be open-book and you will have to make business decisions in this simulated test as a CXO. Upon the completion of the course, you will be handed the fintech certificate.

• You will also get to be a part of the Singapore Immersion Program and can meet fintech professionals from more than 140 different countries.

• You will be a part of the Perpetual Learning Program (PLP) giving you lifetime access to webinars from various industry experts.

• You will also gain access to the SP Jain’s laboratories along with becoming an alumnus of the SP Jain School of Global Management.

In a Nutshell

The in-depth course curriculum of SP Jain’s fintech course will help you in learning the practices in the fintech industry. You will also learn about the role of modern-day technologies in fintech. You can download the course brochure from the Imarticus website.

You will be able to know the operations involved in digital banks. Start your fintech course now!

One can know more about the fintech sector via

One can know more about the fintech sector via