If you’re planning a career in finance or accounting, you’ve probably come across the CMA certification. Over the last few years, it has become one of the most popular global finance qualifications – especially among students who want strong career growth without putting their job or degree on hold.

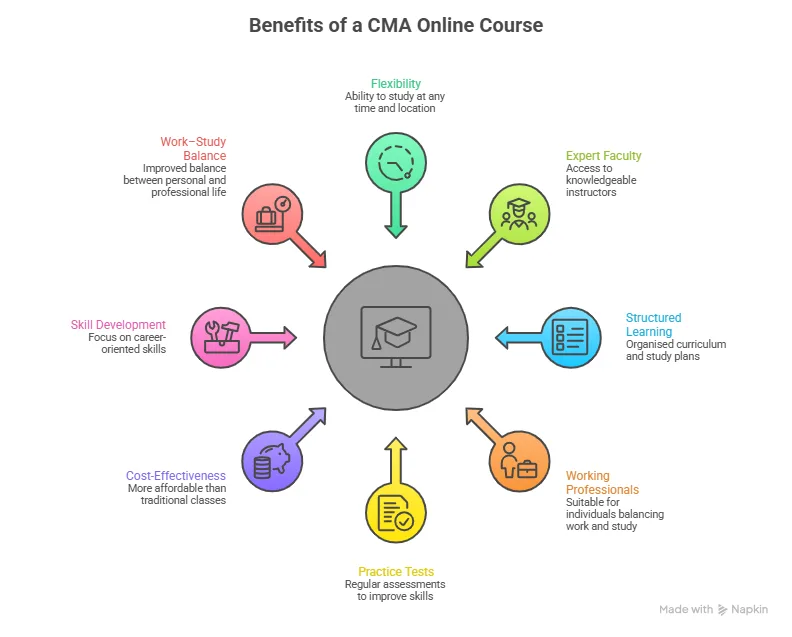

That’s where a CMA online course becomes a smart option. Instead of relocating or attending fixed classroom sessions, you can now prepare for the CMA Certification from anywhere while managing college, work or other commitments.

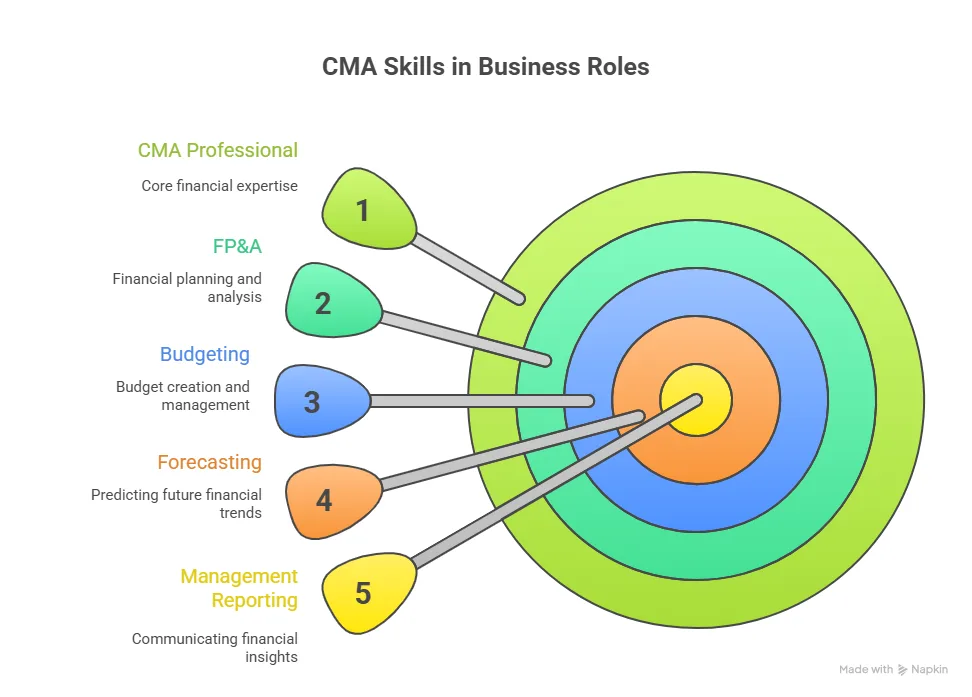

Every business depends on CMA professionals who can analyse numbers and guide strategy. They help answer questions like:

→ Where can we reduce costs without affecting quality?

→ Which product or service is most profitable?

→ How should we plan next year’s budget?

→ Are we making data-driven financial decisions?

Whether you’re exploring a US CMA online course, looking for the best CMA online course, or simply searching for a CMA course online free to get started, this guide will help you understand your options and choose the right path.

Did you know?

With flexible classes, recorded lectures and exam-focused training, many students complete the US CMA in under a year while managing their regular schedule – making it one of the fastest-growing finance certifications today.

Why Students Prefer a CMA Online Course Today

If you have searched for: what is CMA on the internet. US CMA (Certified Management Accountant) is a globally recognised certification focused on management accounting, financial planning and business strategy. The course consists of two exam parts and can be completed within 6 to 12 months. It is ideal for students and professionals seeking careers in corporate finance, accounting, and analytics, with strong global salary potential.

Let’s be honest – most students and working professionals don’t have the luxury of attending daily offline classes. A CMA online course makes preparation more practical and flexible.

With the Certified Management Accountant Online Course, you can:

- Study at your own pace with CMA books.

- Attend live or recorded lectures.

- Revisit difficult topics anytime.

- Practise with mock tests regularly.

- Balance CMA prep with college or a job.

This flexibility is one of the biggest reasons why online CMA preparation has become so popular.

Understanding the US CMA Online Course

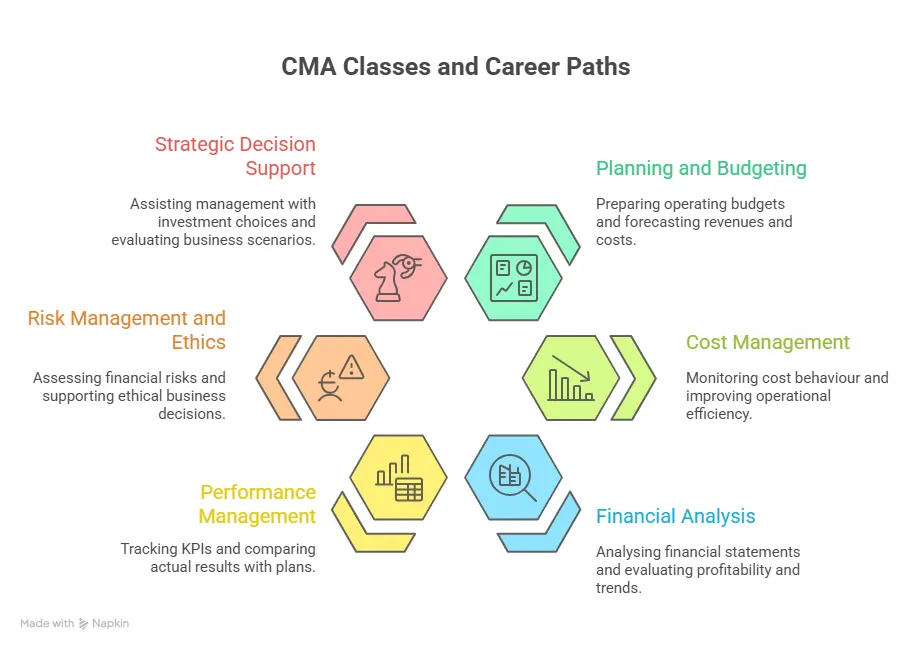

The US CMA online course focuses on management accounting, financial planning and strategic decision-making. CMA Institute prepares you for corporate finance, consulting and analytics roles.

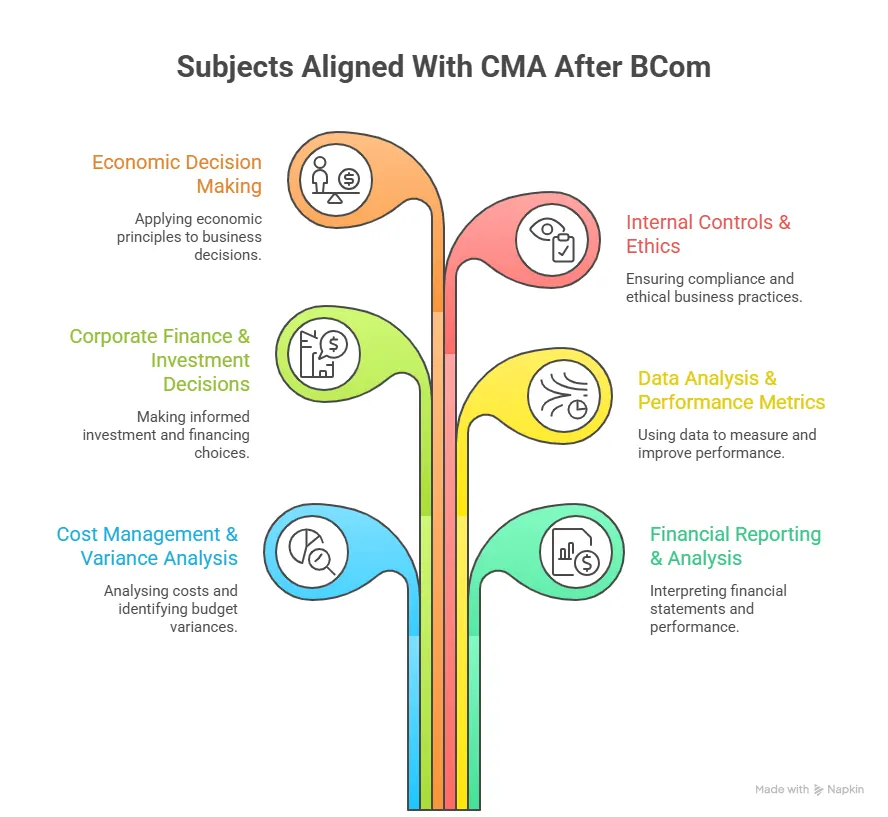

A typical CMA USA course online covers:

- Financial planning and analysis

- Cost and performance management

- Risk management

- Strategic finance

- Decision-making tools

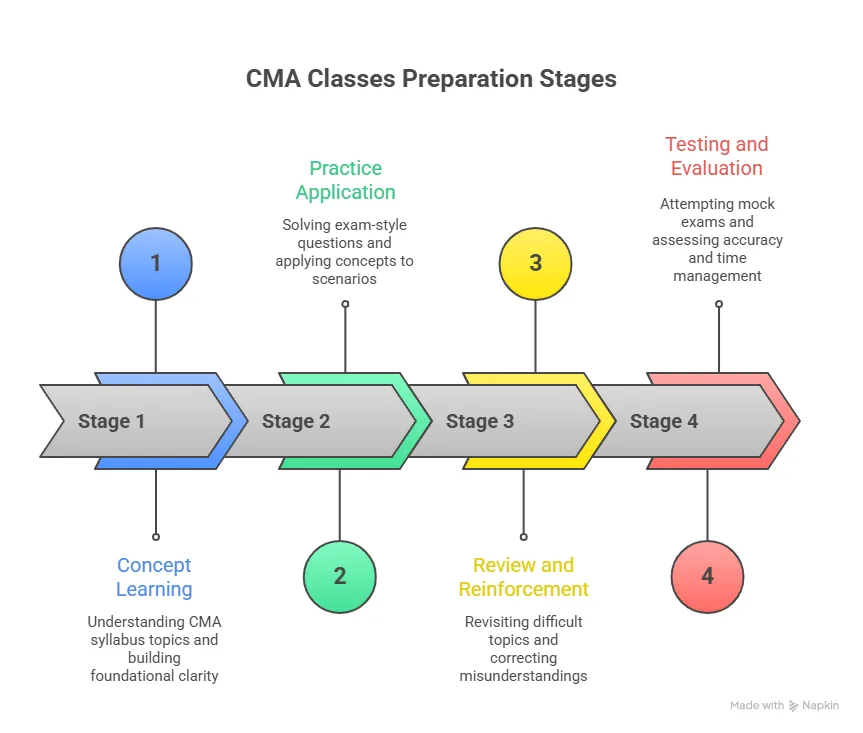

As the CMA syllabus is practical and industry-focused, many students prefer CMA online classes for structured online learning to understand concepts clearly and apply them in real scenarios.

If you’re wondering whether the CMA qualification is actually worth the effort, this quick video gives a clear and practical perspective. It explains how the US CMA certification can open doors in corporate finance, management accounting and global finance roles, along with salary potential and long-term career value.

Why the CMA Online Course in India Makes Sense

For Indian students and professionals, enrolling in a CMA online course with an India option is convenient and effective. You get access to global-quality training without leaving your city.

Studying CMA online in India allows you to:

- Learn from experienced faculty.

- Access structured CMA study materials.

- Attend live doubt-solving sessions.

- Prepare alongside college or work.

- Get CMA career guidance and placement support.

This combination of flexibility and career support makes online CMA preparation highly practical.

Also Read: Smart strategies you should know before taking the CMA papers.

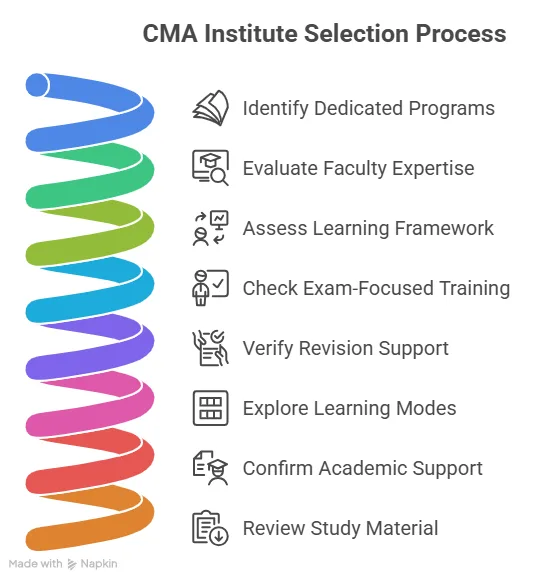

How the CMA Course Online Registration Works

The CMA course online registration process is simple. Once you decide to pursue the certification, you can register through the official body and choose your exam window.

The basic steps for registration include:

- Check CMA eligibility

- Complete registration online

- Choose exam window

- Enrol in a CMA online certificate course

- Start structured preparation

Doing the CMA Registration early gives you enough time to prepare without feeling rushed.

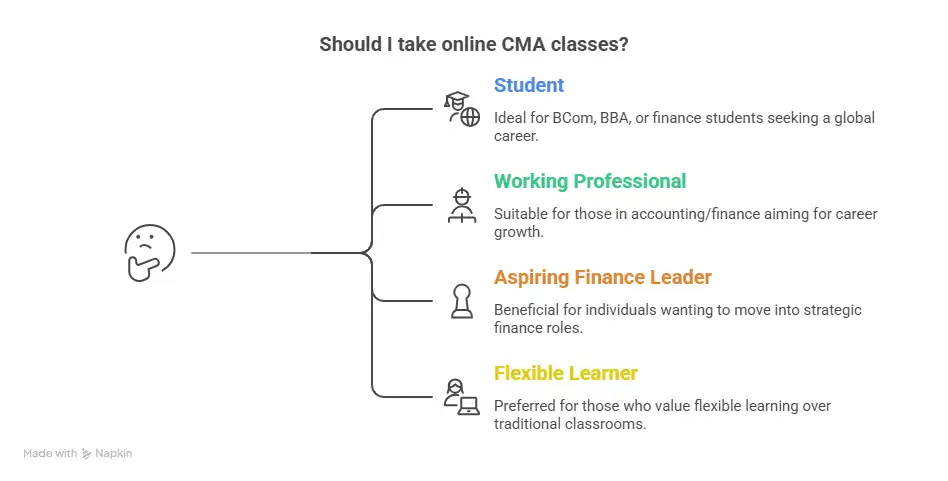

Who Should Consider a CMA Online Course?

A CMA online course can be a smart choice for anyone who wants to build strong management accounting and corporate finance skills without pausing their lives. Since most online CMA programs offer flexible schedules and structured learning, they suit a wide range of learners at different career stages, preparing for the CMA exam.

Here’s a closer look at who can benefit the most:

| Learner Profile | Why It’s a Good Fit | How It Helps Their Career |

| BCom and BBA students | Helps build strong accounting and finance fundamentals alongside graduation. | Gives an early career advantage and improves chances of internships and finance roles after college. |

| Commerce graduates | Adds a globally recognised professional qualification on top of a degree. | Opens opportunities in corporate finance, accounting and consulting roles. |

| MBA finance students | Complements MBA knowledge with practical management, accounting and cost analysis skills. | Strengthens profile for corporate finance, FP&A and strategic finance roles. |

| Working professionals in accounting | Allows professionals to upgrade skills without leaving their jobs. | Helps move into higher roles in management accounting, budgeting and financial planning. |

| Professionals switching to finance. | Provides structured learning for those moving from other domains into finance. | Builds practical skills needed for corporate finance and business analysis roles. |

| Anyone planning a corporate finance career | Focuses on real-world skills like budgeting, forecasting and performance analysis. | Prepares candidates for long-term growth in corporate finance, consulting and management roles. |

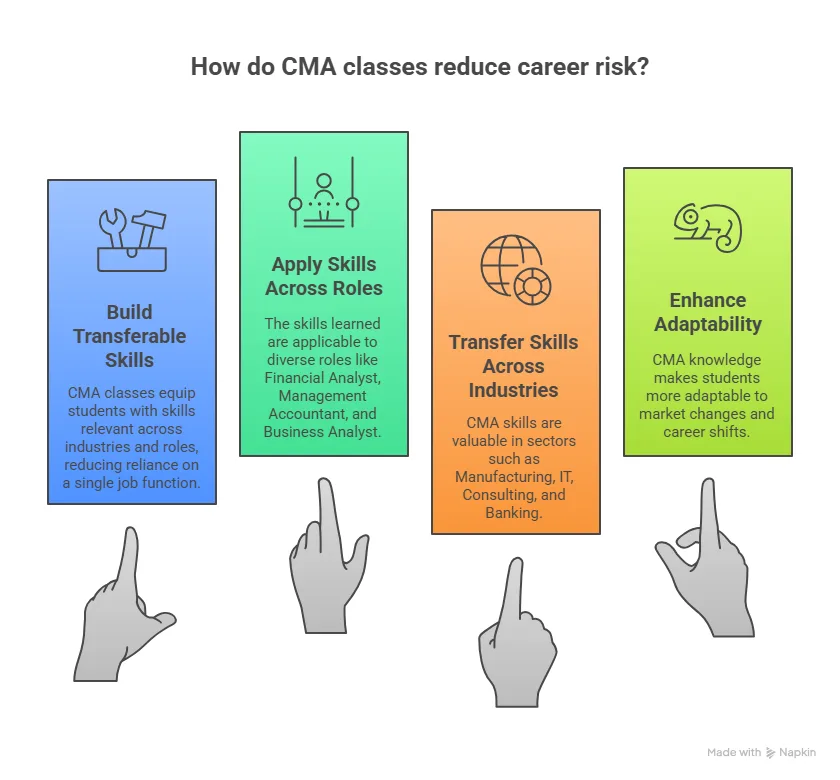

A CMA online course isn’t just about passing exams. It’s about developing practical financial and management skills that support steady career growth over time.

If you’re aiming to clear the US CMA exam on your first attempt, having the right strategy from the start can make a huge difference. This video gives a practical walkthrough from planning your study schedule to handling mock tests and revision effectively.

Can You Find a CMA Course Online for Free?

Many students initially look for a CMA course online free option or the best CMA review course. While the full certification course is paid, you can still find some useful free resources to get started.

These include:

- Introductory CMA online courses free.

- Free webinars and trial CMA classes.

- Sample study material.

- Practice questions and mock tests.

Free resources help you understand the syllabus and exam pattern before enrolling in a CMA coaching.

CMA Refresher Course Online

If you had started CMA earlier but paused your preparation, a CMA refresher course online can help you restart confidently. Refresher courses usually include:

- Quick concept revision

- Practice sessions

- Updated syllabus coverage

- Mock exams and strategy sessions

This is helpful if you’re planning to reattempt exams or want to strengthen your basics.

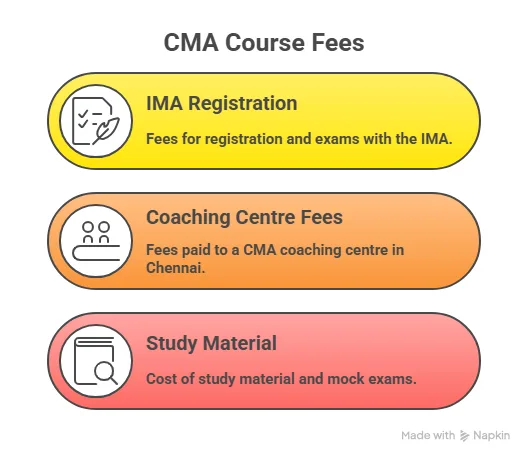

CMA Exam Fees Breakdown

Understanding the US CMA course fees structure is one of the first steps before starting your preparation.

| Fee Component | Cost (USD) | Approx Cost (INR) |

| IMA Membership Fee (students) | $49/year | ₹4,000 |

| IMA Membership Fee (professionals) | $295/year | ₹24,000 |

| CMA Entrance Fee (one-time) | $225 (student) / $300 (professional) | ₹18,500 – ₹25,000 |

| Exam Fee per Part | $370 (student) / $495 (professional) | ₹30,000 – ₹41,000 |

| Both Parts Total Exam Fee | $740 – $990 | ₹60,000 – ₹82,000 |

| Coaching Fees (India/Bangalore) | $662-$1656 | ₹60,000 – ₹1.5 lakhs |

| Total Estimated Cost | $1325-$2760 | ₹1.2 -2.5 lakhs |

Also Read: What CMA jobs can you take after clearing the Certification?

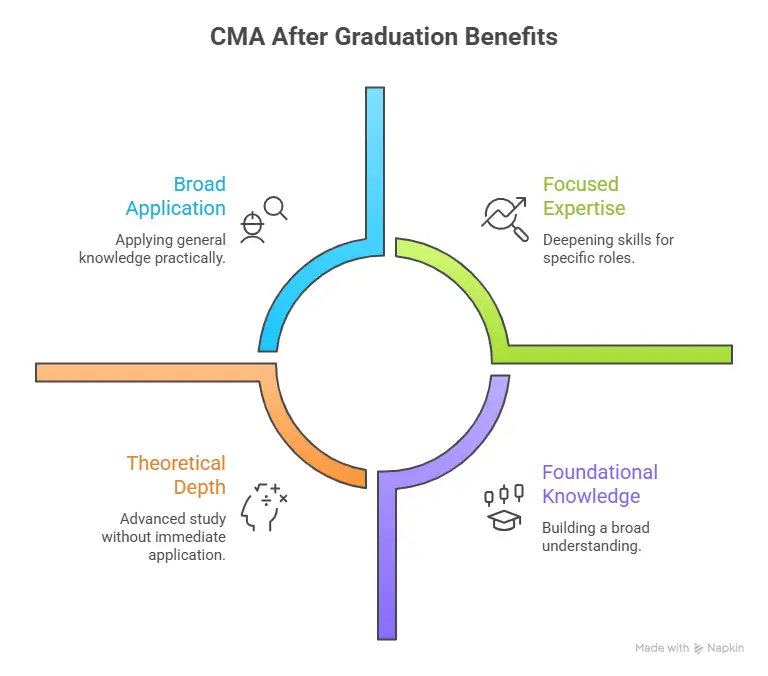

Benefits of a CMA Online Certificate Course

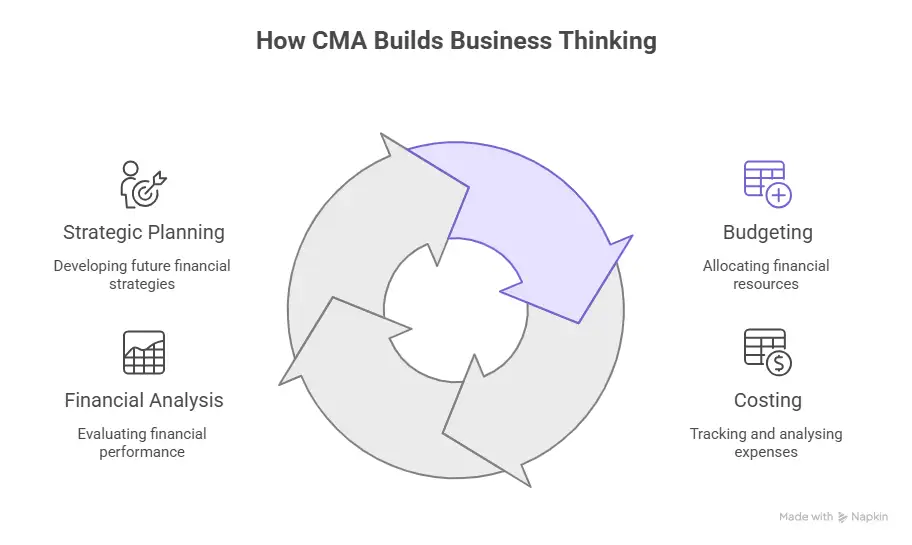

A structured CMA online certificate course does more than help you pass exams. It builds skills that are actually used in finance and CMA jobs.

| Benefit | What You Learn in a CMA Online Certificate Course | Career Advantage |

| Financial analysis | Interpret financial statements and analyse business performance. | Prepares you for financial analyst and corporate finance roles. |

| Budgeting and forecasting | Create budgets and forecast revenue for businesses. | Useful in financial planning and corporate finance careers. |

| Cost management | Control costs and improve business profitability. | Important for management accounting and consulting roles. |

| Business decision-making | Use financial data for strategic decisions. | Helps in leadership and finance strategy roles. |

| Performance evaluation | Measure KPIs and evaluate company performance. | Valuable in corporate finance and business analysis jobs. |

| Job-ready finance skills | Practical finance and management accounting knowledge. | Opens careers in corporate finance, consulting and accounting. |

These skills are valuable in corporate finance, consulting and management roles.

The video explains the complete US CMA exam fees in a simple way – including IMA membership costs, entrance fees, exam fees for both parts and additional expenses you should plan for.

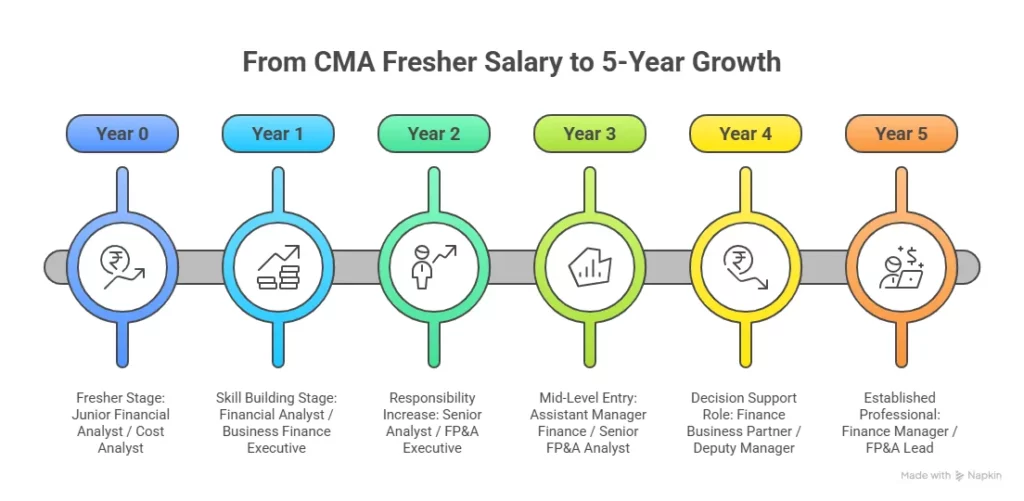

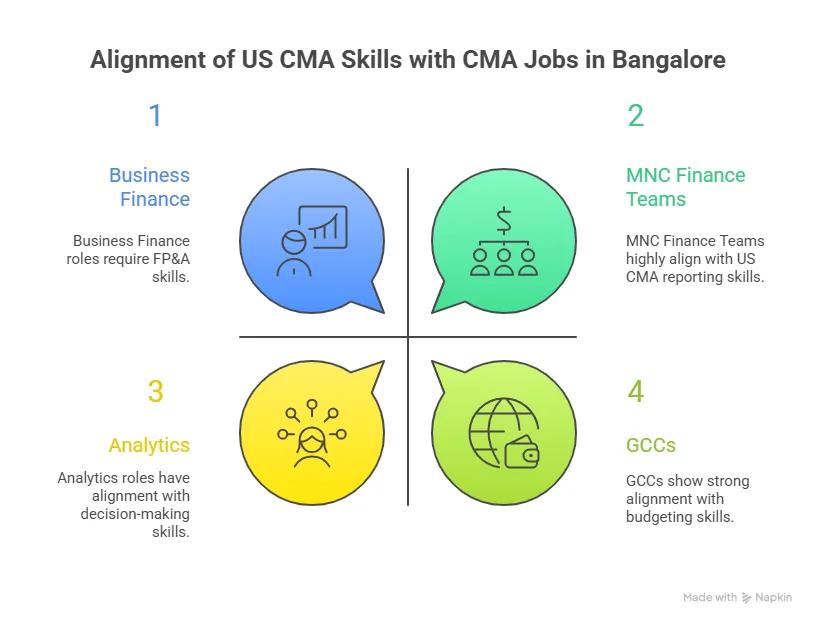

Career Opportunities After CMA

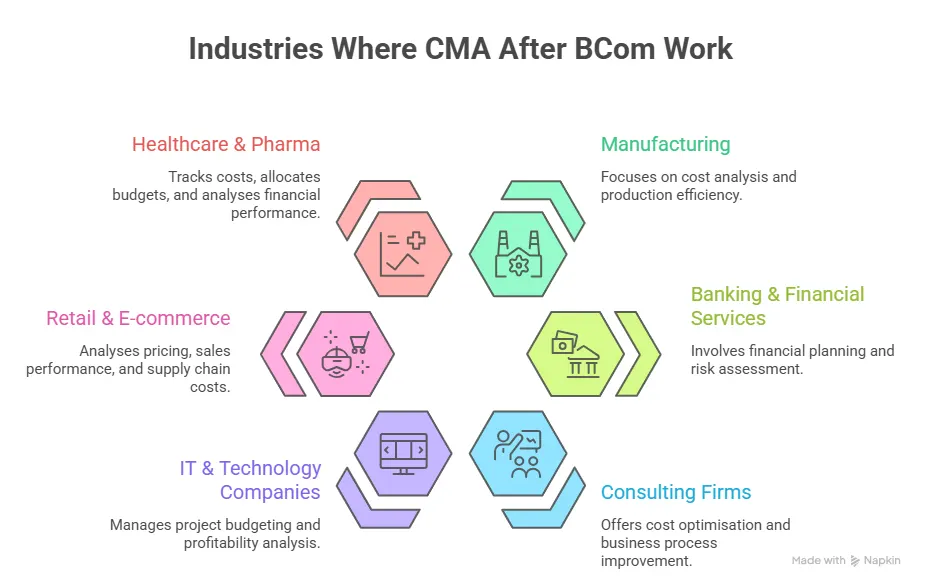

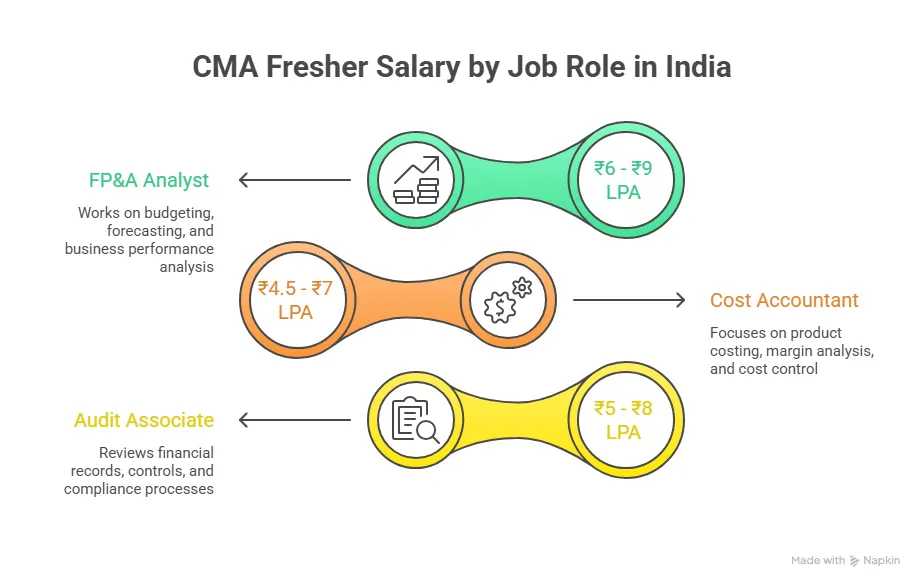

Once you complete the CMA certification, several career paths open up. Many professionals move into roles such as:

| Career Path After CMA | What You’ll Do | Where You Can Work | Growth Scope |

| Financial Analyst | Analyse financial data, prepare reports, forecasting and budget | Corporations, MNCs, consulting firms | Senior analyst, finance manager, strategy roles |

| Cost Accountant | Manage cost control, budgeting and profitability analysis | Manufacturing firms, FMCG, corporates | Cost manager, plant finance head, leadership roles |

| Finance Manager | Handle financial planning, reporting and team management | Corporations, startups, MNCs | Senior finance leadership, finance director, CFO track |

| Business Analyst | Analyse business data and support decision-making | Consulting firms, tech companies, finance teams | Strategy roles, senior analytics, consulting growth |

| Corporate Finance Professional | Manage investments, funding, and financial strategy | Financial institutions, corporates | Senior corporate finance and leadership roles |

| Management Accountant | Budgeting, performance tracking and decision support | MNCs, global capability centres | Senior management accounting and finance leadership |

Since the certification is globally recognised, it can also lead to international career opportunities over time.

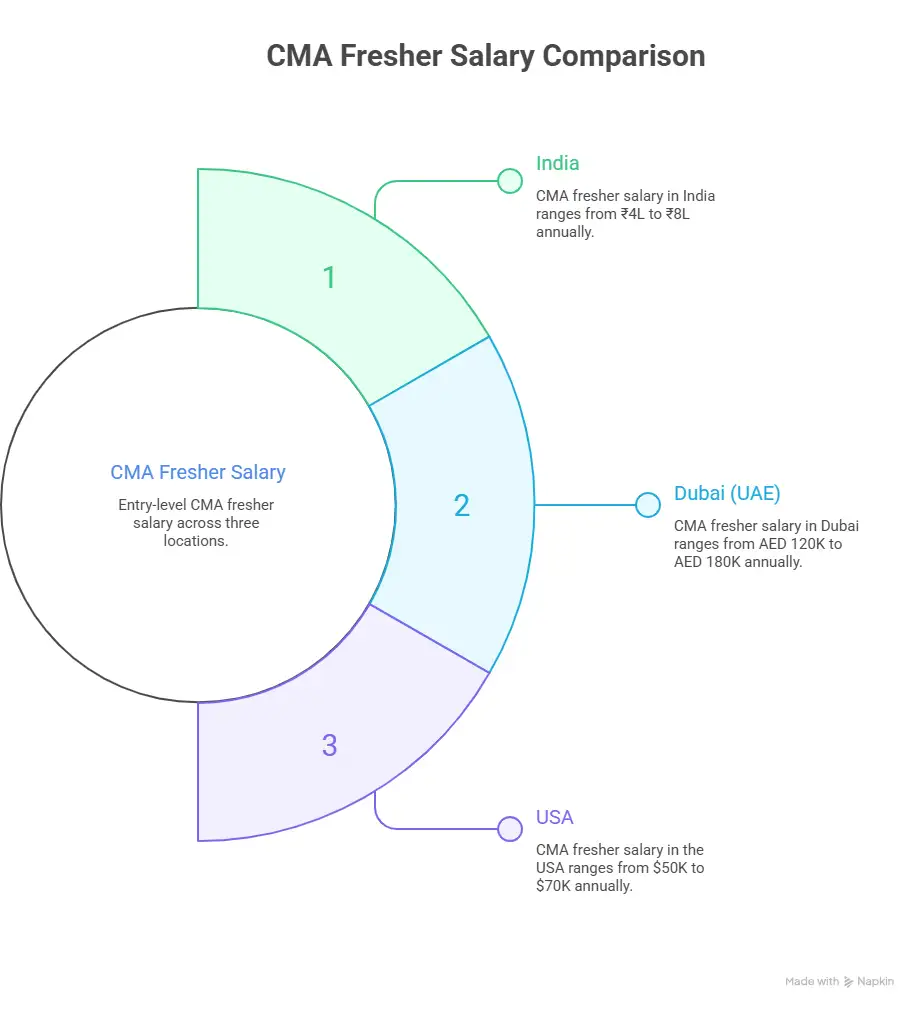

Also Read: CMA salary in India with its real earning potential.

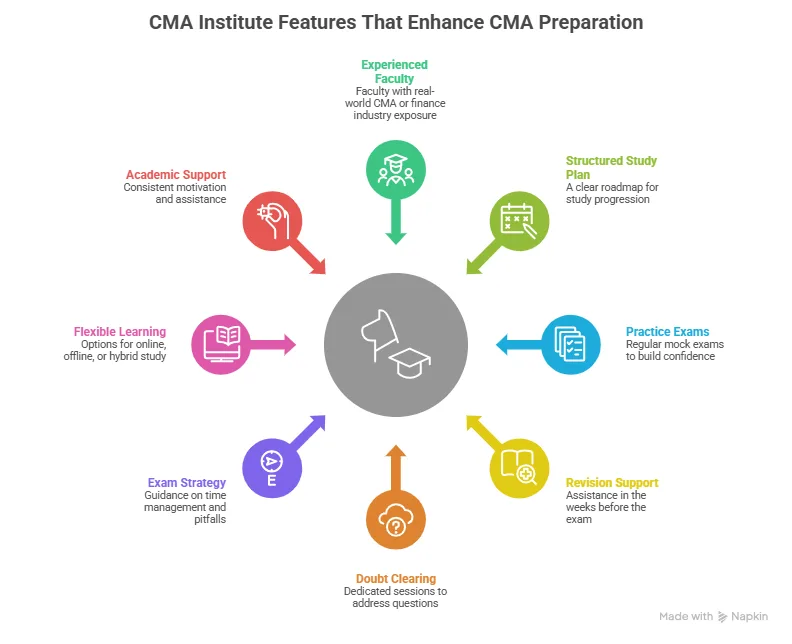

How to Choose the Best CMA Online Course

The right CMA online course can make a huge difference to how smoothly your preparation goes. Before enrolling, you should take a moment to look beyond just the fees or CMA course duration. A well-designed CMA program should help you stay organised, understand concepts clearly and remain consistent throughout your preparation.

Here are a few things worth checking before you decide:

| Key Feature | How It Helps CMA Students |

| Clear study structure | A proper timetable and structured modules help you stay organised and avoid feeling overwhelmed by the syllabus. |

| Experienced mentors | Trainers who understand the CMA exam pattern can simplify complex topics and guide you effectively throughout preparation. |

| Regular mock tests | Practice exams help you understand question patterns, improve time management and build confidence before the actual exam. |

| Concept-focused teaching | Strong conceptual clarity ensures better understanding and long-term retention instead of relying on rote learning. |

| Revision and doubt-solving sessions | Regular revision and quick doubt resolution keep your preparation consistent and stress-free. |

| Career guidance | Some courses provide career support and job guidance, helping you plan your next steps after clearing CMA exams. |

A good CMA preparation course online does more than just teach CMA course subjects. It keeps you motivated, disciplined and confident throughout the journey, making the entire learning experience much more manageable.

Why Choose Imarticus Learning for Your CMA Preparation?

Preparing for a professional qualification like CMA isn’t just about studying textbooks. It requires consistency, the right guidance and a clear preparation strategy. Many students begin with motivation but struggle to stay consistent without structured support. That’s where choosing the right training partner can make a real difference.

Imarticus Learning offers a structured CMA program preparation experience designed for both students and working professionals who want clarity, discipline and confidence throughout their journey. Instead of leaving you to figure things out alone, the program focuses on making preparation more organised and manageable.

Here’s what makes Imarticus Learning a strong choice for CMA preparation:

- Structured learning approach

- Experienced faculty and mentorship

- Flexible learning options

- Practice tests and exam-focused preparation

- Career and placement support

Choosing the right guidance can make your CMA journey far more manageable. With consistent effort, proper mentorship and structured preparation, clearing the CMA exams and building a strong finance career becomes a realistic and achievable goal.

FAQs About the CMA Online Course

If you’re considering enrolling in a CMA online course, here are some frequently asked questions that can guide you as you begin your CMA journey, right from eligibility and preparation time to career opportunities after completion.

What is a CMA online course?

A CMA online course is a structured training program that helps students prepare for the CMA certification online through live or recorded online classes. It allows you to study from anywhere while covering the complete syllabus with expert guidance and practice tests.

Is a US CMA online course valid in India?

Yes, the US CMA certification is globally recognised and valid in India. Many multinational companies, consulting firms and corporate organisations value CMA-qualified professionals for finance and accounting roles. You can take online learning options from reputed institutes like Imarticus Learning that help you to get job and internship opportunities beyond academic learning.

How long does it take to complete CMA online preparation?

Most students take around 6-12 months to prepare for the CMA exams, depending on their study schedule and consistency. A structured online course helps you complete the syllabus in a planned manner. Working professionals can attend live sessions, watch recorded lectures and study during weekends or after office hours without leaving their jobs.

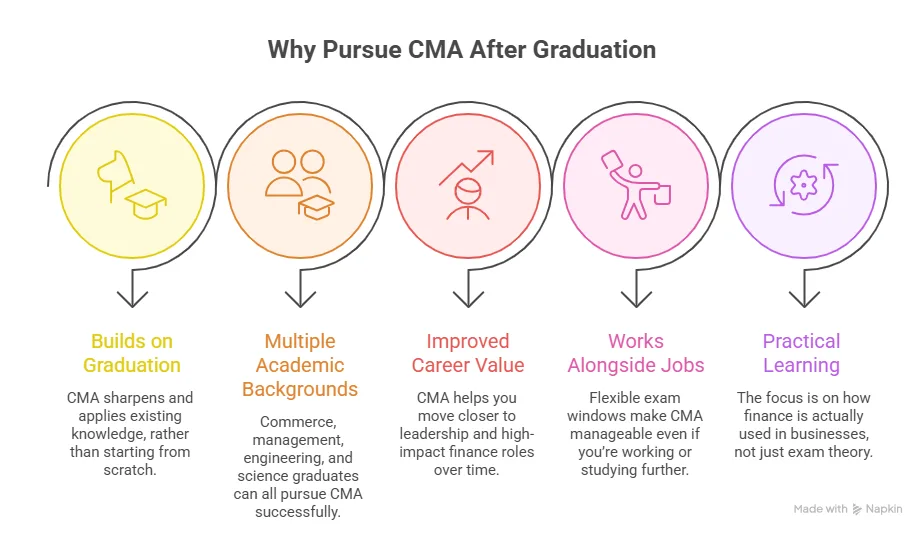

Who can join a CMA online course?

Students from commerce, BBA, BCom, MBA finance, and even working professionals in accounting or finance can join a CMA online course. Anyone interested in building a career in corporate finance or management accounting can pursue the CMA.

Is the CMA online course worth it for finance careers?

Yes, if you want to build a long-term career in finance, accounting or corporate roles, a CMA online course is definitely worth it. It helps you gain practical financial skills, global recognition and better career opportunities over time.

Is CMA difficult to pass through online preparation?

CMA exams require consistent effort and concept clarity. With regular study, practice tests and proper guidance from a structured online course, many students successfully clear the exams on their first attempt.

What is covered in a CMA preparation course online?

A CMA preparation course online typically covers financial planning, cost management, performance analysis, budgeting, strategic finance and risk management. It also includes mock tests, revision sessions and exam strategies.

What career opportunities are available after CMA?

After completing CMA, professionals can work as financial analysts, cost accountants, finance managers, business analysts or corporate finance professionals. The certification also opens opportunities in multinational companies and global markets.

Building Your Finance Career with a CMA Online Course

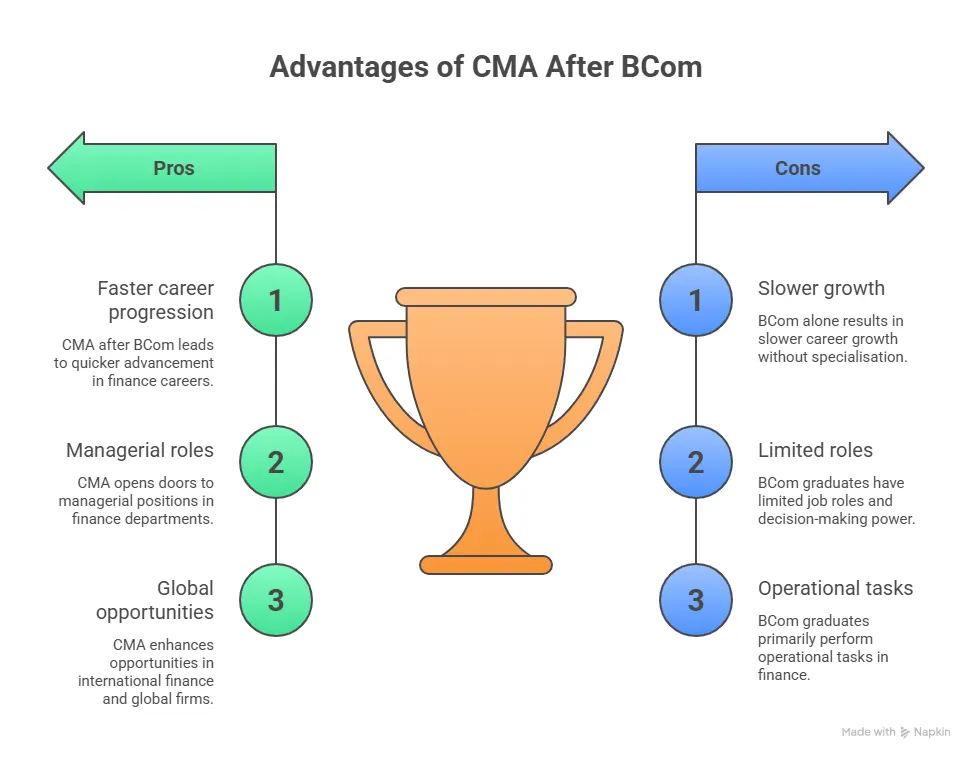

Choosing a CMA online course is less about convenience and more about making a smart career decision. Today, finance and accounting roles demand professionals who understand numbers, strategy and business decisions – and the CMA certification helps you build exactly those skills.

One of the biggest advantages of choosing a CMA online course is the flexibility it offers. You don’t have to put your degree on hold, quit your job or move to another city just to prepare for the exam. You can study at your own pace, go back to concepts whenever needed and build a routine that actually works for you. Over time, this steady and consistent preparation is what helps most students clear the CMA exams with confidence.

If you stay consistent and committed to the process, the online CMA course can turn into one of the smartest investments you make for stronger career growth and long-term opportunities in finance and accounting.