Risk management is a critical component of any business. To protect your company’s assets, you need to have adequately trained employees in risk management.

If you’re searching for an exciting career that offers risk management training, then you should consider becoming a risk manager. This post will explain the primary role of a risk manager and the benefits of risk management training.

An overview of risk management

Risk management is the method of identifying, assessing, and managing risks. It can include anything from natural disasters to business failures. Risk management aims to minimize the negative impacts of any potential risks and ensure that the organization can continue to operate effectively, even under challenging circumstances.

Risk management is a vital part of any organization. It plays a primary role in helping businesses identify potential risks before they occur, so you can take that appropriate measures to reduce any negative impacts.

Risk management is a broad term that covers many different disciplines and skillsets. These include financial risk management, operational risk management, enterprise risk management, and information security risk management.

Each of these areas requires specific skills and knowledge, which is why it’s crucial to choose the right risk management training program for you.

What is the role of the risk manager?

These threats, or risks, can come from various sources, including financial uncertainty, legal liabilities, and strategic management errors. Risk managers use their knowledge of an organization’s business objectives and appetite for risk to help shape the risk management strategy.

Risk managers typically have a degree in business administration, economics, or a related field. They also need strong analytical skills and experience in data analysis.

The benefits of pursuing a career in risk management

Here are the benefits of pursuing a career in risk management:

- Risk management is a rapidly growing field, and there are many opportunities for advancement.

- You’ll be responsible for protecting your company’s assets and ensuring its safety.

- You’ll be able to provide your family with financial security for years to come.

- You’ll learn how to identify risks, develop strategies for addressing them, and manage your team’s response to those threats.

Many companies are looking for risk management professionals who can think critically and strategically. They want employees to identify potential risks and develop plans to mitigate them. If you want a career in risk management, now is the time to start preparing yourself.

Discover Financial Services and Capital Markets course with Imarticus Learning

A diploma in Finance Management is for those students who want a thorough understanding of the fields related to investment banking, capital markets, and risk management. It provides best-in-class education for high-performing middle management professionals with at least two years of experience who want to relaunch their careers in financial services.

Course Benefits For Learners:

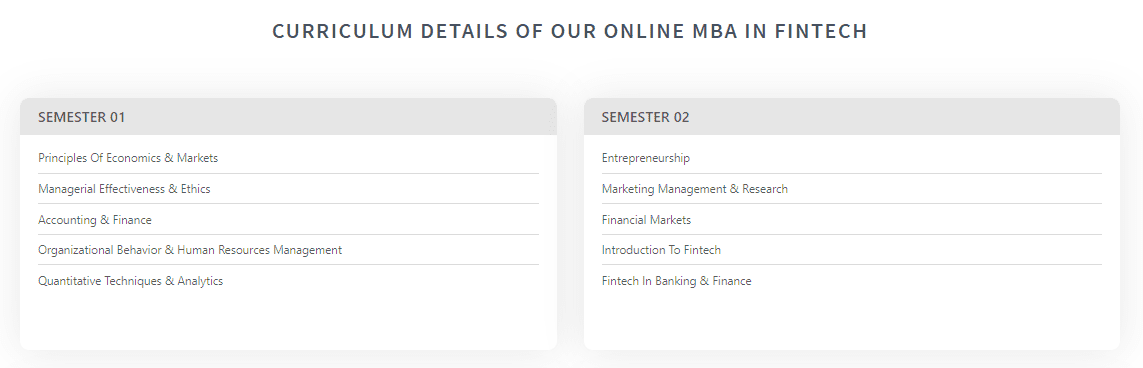

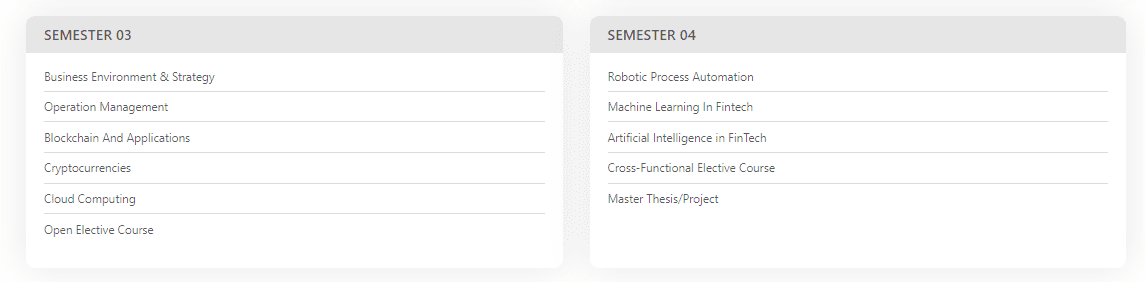

- Learn with an outcome-focused curriculum and practical learning method that will allow students to build competence in critical domains such as capital markets, risk, and fintech.

- Our capital markets training program provides the student with a cutting-edge curriculum that will teach the principles of corporate finance, risk management and compliance, capital markets, valuation, and equity research.

- As part of this program, students will have the chance to meet and connect with their classmates and industry professionals.

Tip 3: Use the Most Trusted Material

Tip 3: Use the Most Trusted Material

The journey begins with upskilling oneself to suit the requirements of an investment banking operations career.

The journey begins with upskilling oneself to suit the requirements of an investment banking operations career.

In this article, we discuss what an

In this article, we discuss what an  One can pursue voluntary certifications like the

One can pursue voluntary certifications like the

It helps corporations and governments in managing the financial aspects of large projects.

It helps corporations and governments in managing the financial aspects of large projects.  If you’re paying the investment banking course fees, you should choose a course that gives you a job assurance and provides industry interactions to prepare you for the field.

If you’re paying the investment banking course fees, you should choose a course that gives you a job assurance and provides industry interactions to prepare you for the field.