With the progress of the blockchain system over the years, a lot of new features have started coming into play. Initially a manual system, it has now progressed to the point where transactions can be made completely automatically. That is, without involving any third parties at all. This is where smart contracts come into play. It ensures that the agreement between two people stays firm without the threat of any one of them backing out or delaying the process.

Here we are going to discuss what smart contracts are, how they work and what the benefits of using them are. The reason why the blockchain system has progressed so far is because of the highly adaptable nature of this industry. This is the reason why it has continued to remain afloat while others could not.

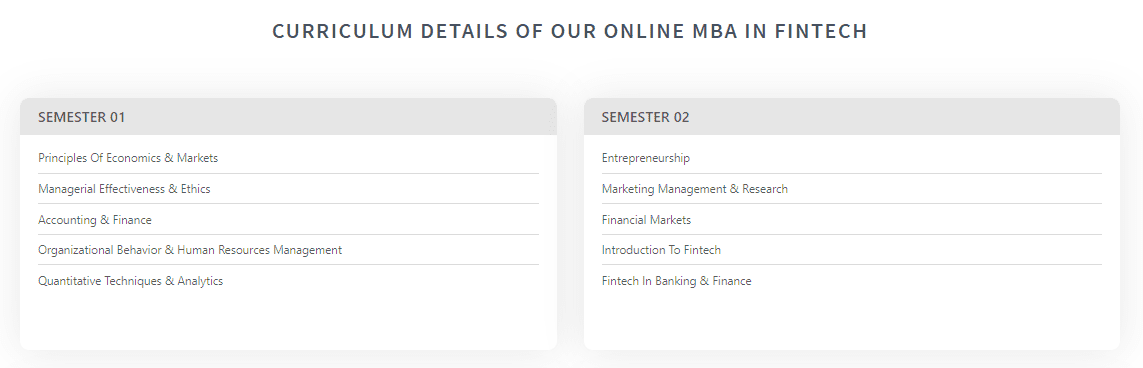

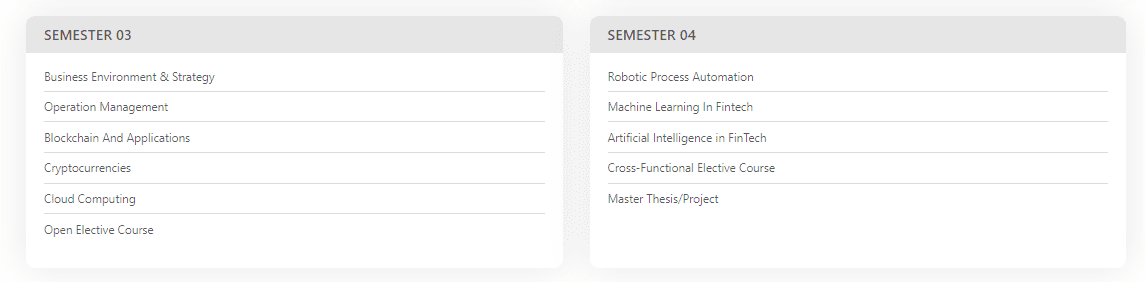

So it is only plausible that this industry has also demanded professional opportunities recently. If you are someone wondering what to do with your career in the future, a Fintech course might just be what you need. A lot of institutions in India offer good courses.

Imarticus Learnings is one of the best among them. They have a compact Fintech MBA degree with a blockchain and cryptocurrency course included in the curriculum. It will not only teach you all you need to get ahead in the game but would also provide good placement opportunities that will put you leagues ahead of your peers.

What are smart contracts?

Smart contracts are basically an agreement made between two parties recorded in a blockchain system. They are absolute and obviously, due to the extremely secure blockchain system, they can not be hacked into or tampered with in any way. These contracts function automatically, as in if an agreement is made of a transaction happening at a certain date if certain conditions are met, then given all goes according to plan, the transaction will be made automatically.

With no involvement required of a third party or even the parties involved in the first place, the system completes the transaction automatically, with cryptocurrency being the mode of payment that gets transferred to the respective payee’s digital wallet.

How do they function?

Basically in a blockchain system, two parties agree. For example, Rachel will buy a car from Monica with 150 Bitcoins on 18th October. And the ownership of the car will be transferred to Rachel when the amount is paid. Now, on 18th October, the amount gets credited to Monica automatically without Rachel having to do it manually at all. And just like that with the conditions met, the ownership of the car is now transferred to Rachel.

Benefits of using them

There are some serious benefits of using smart contracts. A few of them are listed here:

- No need to involve any third parties, including brokers, lawyers, or even the bank.

- Both parties are secure in their knowledge that the terms are absolute and the amount, as well as the goods, will be transferred to them without any delay. Which negates the chance of fraud completely.

- Saves precious time as well as extra expenses on both ends.

Conclusion

Blockchain is a system that is now being used in or introduced to almost all sectors of business, education, and even health. So a degree in Fintech is the best possible course to take for career aspirants these days. Do check out Imarticus Learnings’ Fintech MBA program to get the boost you need in your career.

While making a

While making a