The supply chain encompasses all of the actions, people, organizations, information, and resources required to transport a product from conception to client. In the consumer goods industry, this is likely to include raw materials, production, packaging, shipping, warehousing, delivery, and retailing. The end goal is straightforward: fulfill the customer’s desire.

Further, supply chain management is the process of combining supply and managing demand not only within the firm but also across all of the supply chain’s innumerable units and channels so that they function together quickly and productively.

Supply chain management is critical for any firm since it can introduce various benefits. But, inadequate supply chain management can result in very expensive delays, quality concerns, or reputation issues. Poor supply chain management can also lead to legal concerns in some circumstances if vendors or processes are not compliant. Technology advancements have opened enormous possibilities for supply chain management, allowing supply chain managers to collaborate intimately and in real-time with supply chain participants.

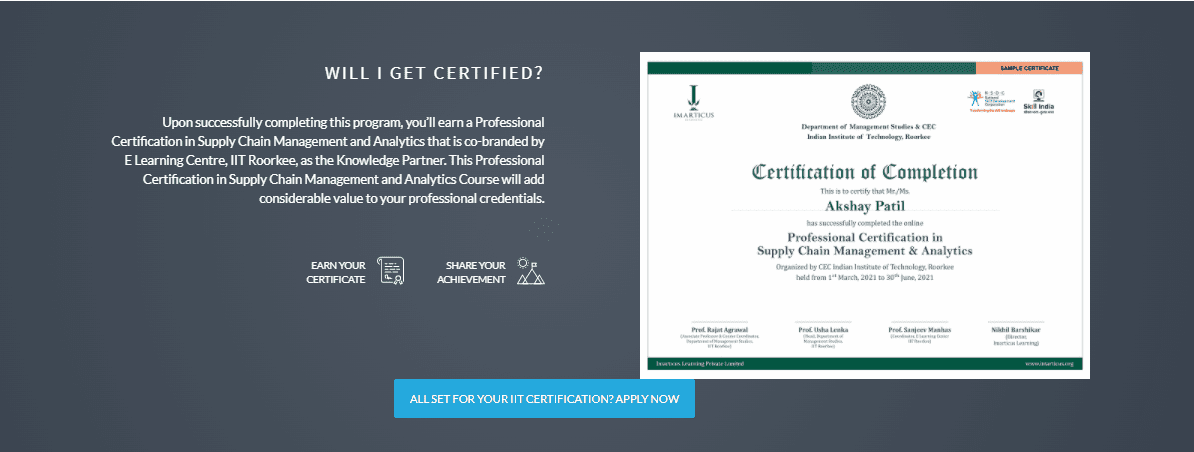

A certified supply chain analyst has a very important role in every industry that involves the supply chain. A supply chain management career can guarantee you a high-salary job in various sectors. The IIT Supply Chain Program is the best and comes with some exclusive benefits.

This 6-month supply chain management online course has been specially prepared by IIT faculty and industry professionals to assist you in learning. With the ever-increasing trend of e-commerce, the number of products in transit has also increased. The number of supply chain management employees has increased disproportionately across industries. This training will prepare you to capitalize on this opportunity.

This 6-month supply chain management online course has been specially prepared by IIT faculty and industry professionals to assist you in learning. With the ever-increasing trend of e-commerce, the number of products in transit has also increased. The number of supply chain management employees has increased disproportionately across industries. This training will prepare you to capitalize on this opportunity.

Why Pursue IIT Supply Chain Management Course?

The benefits of IIT certified supply chain analyst course are as follows:

- Discover supply chain management knowledge and much-required analytical skills with this program built by IIT Roorkee’s DoMS & E-Learning Centre. This course will assist you to become more data-centric and improve supply chain selection by using the strength of Python.

- This supply chain management online course will assist you to learn from one of India’s greatest faculties via live online sessions and conversations. IIT faculty workshops will help you construct essential concepts in SCM, while industry specialists will provide hands-on learning for SCM processes, tools, and strategies. This course will teach you how to construct a solid SCM foundation and use analytics through engaging live sessions with renowned trainers and industry professionals.

- Participate in a three-day campus immersion session to tour the IIT Roorkee campus. During the campus immersion, you will connect with your peers and learn from IIT academics. You will get the opportunity to go to the Delhi or Noida campus and work on the Capstone Project with the help of expert mentors.

- Tackle tough real-world challenges that necessitate a full understanding of principles, mastery of skills, and comprehension of the business context. With these real-world SCM projects, you can boost your resume and stand out. You will be able to create your own project portfolio and dazzle potential employers. Through rigorous in-class exercises and SCM projects, industry experts teach you crucial job-relevant skills.

- Massive volumes of data are generated by supply chains – Big Data, to be more explicit. Prepare to participate in the creation of smarter, more strategic, and tactical global supply chains of the future by merging traditional supply chain methodologies with data-driven judgment.It is very evident that the demand for a certified supply chain analyst is increasing by the day. In such a situation, certification can give your career the right boost and help you bag your dream job in your desired company. Enrolling in this course can be a game-changer for you!

While making a

While making a

The job of a marketing manager is to prepare a proper marketing strategy to bring the product and service offerings to potential customers.

The job of a marketing manager is to prepare a proper marketing strategy to bring the product and service offerings to potential customers.

This role comes into the picture in an organization that deals with different clients regularly. Account managers represent the entire company in front of the client. They are responsible for building relationships with clients. Also, they act as the face of the organization as they become the pivot of the two-way interaction.

This role comes into the picture in an organization that deals with different clients regularly. Account managers represent the entire company in front of the client. They are responsible for building relationships with clients. Also, they act as the face of the organization as they become the pivot of the two-way interaction.

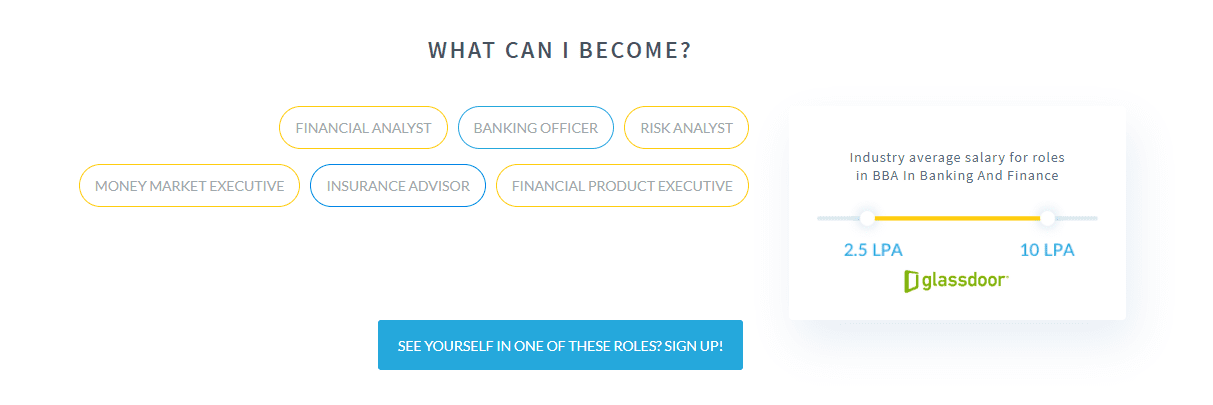

In addition to this, you need to assess the performance and risk of various financial assets before making a recommendation. You also need to assess the changing market circumstances before providing any advice to your clients.

In addition to this, you need to assess the performance and risk of various financial assets before making a recommendation. You also need to assess the changing market circumstances before providing any advice to your clients.

Every

Every  A good

A good