The capital market plays an important role in the economy of any country. The investors and the businesses they invest in, both benefit from capital markets.

Investment banking also plays a very important role as it facilitates transactions between the supply and demand in the capital markets. Here are some answers you may seek to understand the capital markets better.

What is Capital Market?

In the simplest of terms, capital markets are platforms that facilitate the transfer of capital or savings from investors who want to employ their investments to businesses that need the excess capital to finance various projects.

How is Capital Market related to Investment Banking?

Investment banking goes hand in hand with capital markets. Capital markets consist of a lot of technicalities like debt capital markets, leveraged finance and equity capital markets that only an investment banker can understand and deal with.

Investment bankers know the market of their products inside out; and if you’re interested in becoming one of them, then you can apply for any investment banking course after graduation.

How do Capital Markets work?

Capital markets allow the free exchange of wealth and are the basis of a free-market economy. They work by bringing buyers and sellers together so that they can trade in currencies, bonds, stocks and other financial assets.

Who benefits from Capital Markets?

The capital market helps small businesses and entrepreneurs to grow into big companies. It also helps people to save and invest to secure their future. The capital market training allows individuals to make personal gains by leveraging the profit-generating potential of larger entities.

What is the difference between a primary market and a secondary market?

What is the difference between a primary market and a secondary market?

The capital market is divided into two categories – primary market and secondary market. The primary market deals with new stocks and securities whereas the secondary market deals with existing securities which have been previously issued.

What Financial Instruments are used in Capital Markets?

The different financial instruments that can be used in capital markets include –

- Stocks

- Bonds

- Forex (Foreign Exchange)

- Commodities

- Derivatives

How to make a career in Capital Markets?

There are many investment banking courses online that one can pursue to make a successful investment banker and work right in the capital markets. To pursue one of the best investment banking courses after graduation, you can apply for the Post Graduate Program in New Age Banking and effectively start or boost your career prospects in the domain. You can check out this certificate in investment banking course details here.

What is the difference between capital markets and financial markets?

What is the difference between capital markets and financial markets?

Although they may seem the same and there are overlaps, capital markets and financial markets are fundamentally distinctive. Financial markets are broader in range and encompass various businesses and organizations exchanging contracts, securities and assets with each other.

On the contrary, capital markets are primarily used to raise and increase funding for projects and operations of a company. To understand this distinction better, you can check out the certificate in investment banking course details and enrol.

Conclusion

Capital markets help businesses, investors and the government, and they need investment bankers to guide them. Investment banking courses can be pursued online to understand the dynamic of capital markets and make a lucrative career in the domain.

Related Article:

https://imarticus.org/trade-life-cycle/

Currently, job trends in the market are thriving in the field of banking. Hence, comprehensive Banking and Finance Courses can be extremely beneficial for women.

Currently, job trends in the market are thriving in the field of banking. Hence, comprehensive Banking and Finance Courses can be extremely beneficial for women. Hence, a great opportunity for any woman would be to take a course in Fintech online training. Going forward, this comprehensive

Hence, a great opportunity for any woman would be to take a course in Fintech online training. Going forward, this comprehensive  Imarticus provides a

Imarticus provides a  We have already seen the use of AI in computers and mobiles so why not study something which will be mainstream in the coming years? A comprehensive

We have already seen the use of AI in computers and mobiles so why not study something which will be mainstream in the coming years? A comprehensive  For a woman who is determined to take a step forward towards success, a

For a woman who is determined to take a step forward towards success, a

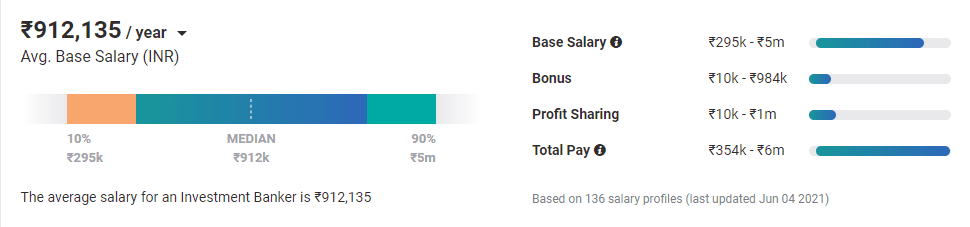

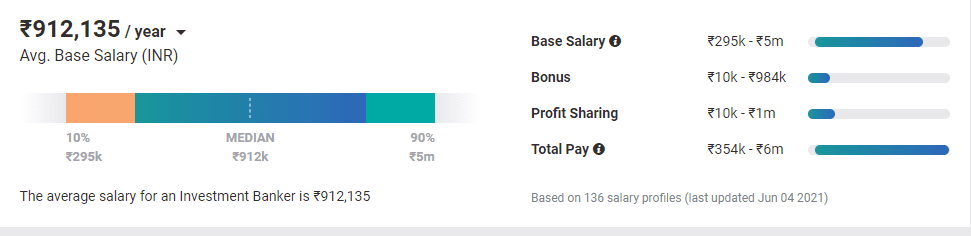

You can easily bag a high-paying salary in this field as you gain experience. The average salary of an investment banker with five to nine years of professional experience is ₹20 lakhs per year. Apart from the lucrative pay package, you will also have the opportunity to work with senior executives, investors, venture capitalists, and other highly esteemed individuals when you will be working as an investment banker.

You can easily bag a high-paying salary in this field as you gain experience. The average salary of an investment banker with five to nine years of professional experience is ₹20 lakhs per year. Apart from the lucrative pay package, you will also have the opportunity to work with senior executives, investors, venture capitalists, and other highly esteemed individuals when you will be working as an investment banker. Further, becoming an investment banker would provide you with a stable and secure career path. Investment bankers are regarded as one of the best-paying jobs globally, so it is certainly worth the effort and time.

Further, becoming an investment banker would provide you with a stable and secure career path. Investment bankers are regarded as one of the best-paying jobs globally, so it is certainly worth the effort and time.