Last updated on June 27th, 2024 at 01:28 pm

Financial modelling can be a vast term for those indulging in it for the first time. However, it is extremely beneficial and holds a vast amount of scope for enthusiasts. An investment banking course can be the right fit for professionals looking to upgrade in this field.

At the same time, it encompasses multiple areas such as historical data processing, assumptions, and forecasting the financial future.

Although financial modelling involves a multitude of options, it is always advisable to experiment and go for the best model for one’s business. When it comes to investment banking, financial modelling offers a clear pathway to calculate and predict a business’s finances.

Although the modelling styles may differ, it all comes down to making informed decisions on areas such as the allocation of budget, and resources. The primary goal of investment banking, however, remains planning for the near and far future.

But how does one know if they’re cut out for financial modelling? Buckle up to understand how an investment banking course can benefit you. Additionally, you can invest in financial modelling to reap the best benefits.

What is Financial Modelling?

Financial modelling includes reasoning and planning for the future based on current records and market conditions. It includes all facets of investment including allocation of budget, assigning different models, and predicting an output.

Financial modelling is a vital measure when it comes to planning out a proposed project. Through financial modelling, companies can benefit from previously-tested models of forecasting profit. At the same time, it can act as a soothsayer for new companies joining the market.

Let’s say a company is planning to invest in stocks but lacks the tools to do that. Financial modelling can prove to be essential at such a juncture. With financial modelling, executives can easily predict the outcome of a specific action as well as work towards the same thing.

To understand more about the intricacies of this job, opt for certification in investment banking.

Purpose and Importance of Financial Modelling in Investment Banking

Financial modelling is the perfect fit when it comes to investment banking. A career in investment banking can be rewarding depending on the multitude of projects at hand. Remember, that it includes decision-making, valuation, forecasting, capital budgeting, and investor relations. Here are just some of the reasons why they go hand in hand.

- Valuation: When valuation is in the picture, it is easier to predict for companies to move forward with a clear-cut picture of their past performances.

In a situation where the company is planning to invest in further outcomes, it is best to start with the valuation itself. But how does financial modelling help with valuation?

It incorporates different variables like financial statements, and growth projections, concerning market conditions. In turn, companies can negotiate with definite figures.

- Forecasting: It is no suspense that financial modelling can aid in forecasting investment returns in no time. Forecasting essentially helps out with a list of things such as projecting revenue, cash flows, and expenses. Apart from this, other important metrics are implemented for predicting future outcomes.

- Scenario analysis: Scenario analysis involves the prediction of an occurrence in the future marked by existing trends. It tells the investors about the areas in which their company is making a notable difference.

This is ideal when assessing problematic situations and coming up with contingency plans. Imarticus’s Investment banking courses deal with troubleshooting as part of their curriculum.

Key Concepts in Financial Modelling

One of the advantages of going for investment banking internships is that it prepares you for the key concepts surrounding the job. The fundamental concepts of financial modelling include creating a process for determining expenses and earnings. These are further divided into these models:

Time Value of Money (TVM): The Time Value of Money concept constitutes one of the primary models of investment banking. The idea of TVM lies in the trend that a note worth 1$ in the market will transform multiple-fold more in the upcoming years.

It is a popular principle in finance and is used to represent the present value of future cash flows and calculate loan repayments. Additionally, it serves as an essential testament to investing the right way.

Forecasting and Projection Techniques: Banking courses teach about the various types of techniques used by investment bankers in financial modelling including forecasting and projections models.

These models include the straight-line method, simple linear regression, multiple linear regression, moving average, time series analysis, regression analysis, scenario and sensitivity analysis, and the Monte-Carlos simulation technique.

Discounted Cash Flow (DCF) Analysis: DCF analysis focuses on a popular technique that estimates future cash inflows and discounts them to their present-day value. It starts by estimating the revenue, expenses, and capital expenditures after which it exercises the weighted average cost of capital (WACC) or the capital asset pricing model (CAPM).

Sensitivity Analysis: Sensitivity analysis involves the part where the key figures in the financial model such as interest, and exchange rates are taken into account. These are then run using multiple scenarios with different sets of variables to determine the possible outcome of a model. A career in banking can require more of this type of analysis.

Scenario Analysis: Scenario analysis is another technique in financial modelling that determines the overall impact of a market condition on the business’s future. This technique involves enabling different scenarios to understand the financial results.

The scenario analysis method helps professionals determine the impact of potential outcomes while making informed decisions at the same time. To do scenario analysis, one has to identify the key variables and change the assumptions with different financial models.

Monte Carlo Simulation: The Monte Carlo model is a computational simulation technique involving the usage of statistics to analyse complex systems. Its main objective is to rely on random events rather than calculated ones. For the Monte Carlo model to work, the numbers have to be randomised and chosen by an automated system and are repeated multiple times.

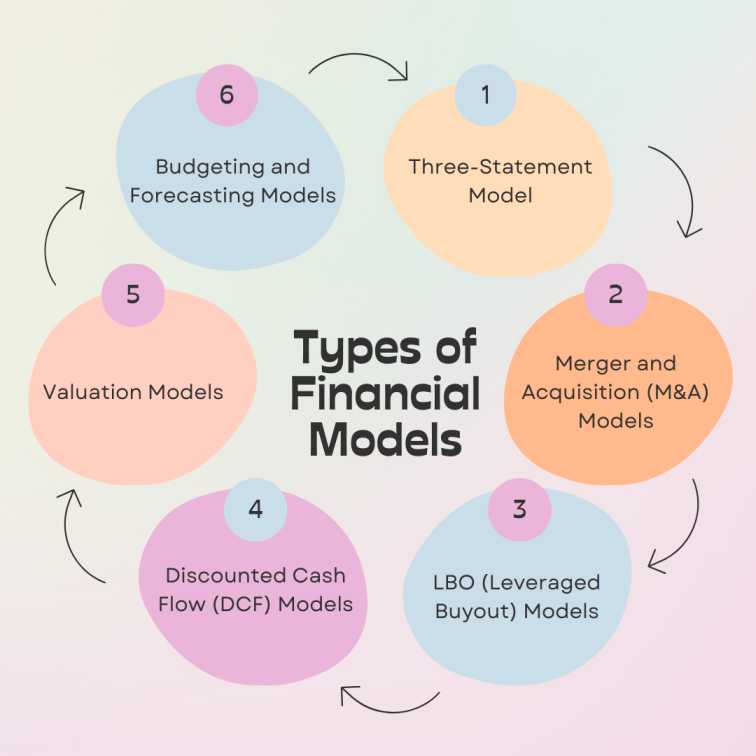

Types of Financial Models

Financial models can be separated using multiple factors some of which include financial planning and analysis. Others include valuation, forecasting, risk management, and merger & acquisitions. Here are our top picks for the financial models currently in use globally.

Three-Statement Model: The three-statement financial model is a model that predicts the outcome of financial statements like income, cash flow, and balance sheets.

Starting with income statements, it overlooks the revenues, expenses, and net income over a certain period. The balance sheet offers an overview of the company’s financial position at any given period while showcasing the company’s assets and liabilities.

The cash flow statement provides a tracking of the cash inflows and outflows in a specified time as well.

Merger and Acquisition (M&A) Models: To understand how mergers and acquisitions work, several models need to be understood. These include the Comparable Company Analysis (CCA), Discounted Cash Flow (DCF) model, merger consequences analysis and Leveraged Buyout(LBO) analysis. Others include transaction multiples analysis, accretion/dilution analysis, break-even analysis, and sensitivity analysis.

LBO (Leveraged Buyout) Models: The LBO model of financial analysis falls under the merger and acquisition model. It undertakes the analysis of the balance sheet, and the company’s inflows and outflows to determine the overall impact.

The LBO model works with historical financial statements, purchase price and financing structure, debt schedules, and operating assumptions.

Discounted Cash Flow (DCF) Models: Discounted cash flow, as discussed above, is a financial model that offers valuation for a company by investigating future cash flows. It does so by discounting them from the current price. Its main tenets include forecasting future cash flows, determining the discount rates as well as the future cash flows, and calculating the terminal value.

Valuation Models: Financial modelling is made easier using valuation models such as the Comparable Company Analysis (CCA), and Precedent Transaction Analysis (PTA).

Although both models are used in evaluating the value of the company, CCA primarily focuses on comparing financial metrics with other companies. On the other hand, PTA examines historical mergers or acquisitions to determine the current valuation of the company.

Budgeting and Forecasting Models: Several types of budgeting and forecasting models

exist for appropriate prediction of the company’s future.

These include but aren’t limited to traditional budgeting models, rolling forecast models, zero-based budgeting models, driver-based budgeting models, and Monte Carlo simulation. With these models, investment banking careers look bright for enthusiasts.

Building a Financial Model

Working with a financial model is the first way to move towards building a successful company and establishing its rapport. An investment banking course with placement can teach about the various duties related to the job.

Data Collection and Assumptions: The first step to establishing a financial model is to collect all relevant data and make appropriate assumptions about the future. These include gathering past financial statements —income, cash flow-inflow and outflow, and balance sheet. Establishing these three helps give way to the entire process.

Setting Up Historical Financial Statements: After setting up data collection and making assumptions, it is now time to gather it and place it in sections. These should be done with the historical financial statements with the required format and structure for a clear presentation.

Projecting Future Financial Statements: Once the setting up process is established, companies can then move to a future financial activity. In doing so, the historical data, and assumptions are compiled to calculate the future revenues, cash flows, and all other expenses. The main idea of projection is to measure factors such as customer demand, competitive trends, and pricing.

Implementing Growth Drivers and Key Metrics: This is the part where growth drivers come into the picture. Several types of drivers are incorporated — new products, market share expansion, cost reduction techniques, and geographic expansion.

Incorporating Debt and Equity Financing: It is seen in most cases that companies often rely on both debt and equity financing to fund their growth. Given the impact that these two can create, they can be beneficial to the growth drivers. Furthermore, businesses can easily access their capital structure, shareholder returns, and interest expense.

Calculating Valuation Metrics: Valuation metrics are one of the most-talked factors when it comes to investment banking. Some popular validation metrics include price-to-earnings ratio (P/E ratio), price-to-sales ratio (P/S ratio), and enterprise value-to-EBITDA (EV/EBITDA ratio). An investment banking certification teaches about the different metrics which can be utilised for better outcomes.

Financial Modelling Best Practices

Financial modelling can be a crucial set of tools and techniques for businesses. However, with time, it has been proven that finding the right financial modelling can require rigorous detailing and adherence. Here are some key points for finding the most effective model for any business:

Consistency and Clarity in Formulas and Formatting: Use only clear and consistent formulas throughout the chosen model. Go for cell references instead of hardcoding values, and other related calculations. Lastly, use straightforward labels and headings for easier navigation.

Using Sensitivity Tables and Data Tables: Sensitivity and data tables are two things that can be implemented to allow quicker access to different variables. Companies can utilise these tools for overall versatility and robustness.

Avoiding Circular References: Circular references are essentially going around in loops with no action. This occurs when the formulas keep referring to their cells thereby resulting in an infinite loop. It is best to maintain clarity by identifying and resolving circular references throughout the financial model.

Properly Structuring Input and Output Sections: One sign of a good structuring format is to separate both inputs and outputs according to the financial model. Input sections include things like revenues, costs, growth rates, and interest rates. On the other hand, output sections include results based on inputs.

Error Checking and Debugging: Financial models ideally include error-checking at multiple points. This is done in multiple regards —input values, and error alerts on incomplete and incorrect formulas.

Documenting Assumptions and Methodology: Clear documentation paves the way for faster presentation and access to the financial model’s activity. This includes retaining source data, the rationale used behind assumptions, and all of the formulas and calculations used through the model.

Excel Tips and Functions for Financial Modelling

Some of the Excel tips and functions for understanding how financial modelling works are discussed below. Keep in mind that these can be highly efficient for making the most out of financial models.

Essential Excel Functions

The essential Excel functions used in most financial models are:

- SUM: The SUM function allows you to add a range of cells without manual counting.

- IF: The IF function allows for better logical testing. In return, it returns values for each outcome.

- VLOOKUP: VLOOKUP allows users to search for a value in a particular column and return a corresponding value from a different column.

- INDEX-MATCH: Like VLOOKUP, it is a combination of functions for generating the value in a certain range.

Advanced Excel Functions for Modelling

Investment banking fundamentals include advanced Excel functions which are mentioned below with their functions:

- NPV: To calculate the net present value of an investment or project by discounting future cash flows

- IRR: To calculate the internal rate of return

- XNPV: For calculating the net present value of cash flows that occur at irregular intervals

- XIRR: To calculate the internal rate of return of cash flows that occur at irregular intervals

Data Validation and Auditing Tools

The different data validation and auditing tools included are:

- Data validation: To ensure that the data meets certain criteria

- Conditional formatting: For applying instant formatting to cells based on specific criteria

- Error checking: For in-built error-checking provided by Excel; for additional troubleshooting

Excel Add-ins for Financial Modelling

Some essential Excel Add-ins for financial modelling include:

- Solver Add-in: For finding the best possible values for different variables

- Analysis ToolPak: For performing complex calculations and statistical analysis

- Power Pivot: For creating data models and performing advanced data analysis

Financial Modelling for Different Industries

Financial modelling is a crucial aspect of valuation and forecasting in multiple industries. One of the best things about financial modelling is that it can be used in almost all industries because of its multidimensional functions. Let us learn more about how it is used in various industries with some financial modelling examples in different domains.

Technology and Startups: Startups rely on financial modelling for understanding the pattern and trends they must adapt to apart from relying on it for tracking balance sheets. Investment banking firms look for startups in the same way they do for larger tech companies.

Real Estate and Property Development: The real estate and property development business is outgrowing the current market. As a professional working in the real estate department, it is ideal to go for financial modelling to detect and analyse cash flows, RPIs, and net income.

These financial models for property development involve various factors ranging from financing options, and rental rates to occupancy levels.

Energy and Utilities: Energy and utilities are one such area where financial modelling is effective. Starting with the financial impact held by rising energy prices, production volumes, and capital expenditures, it moves forward with ROIs and energy infrastructure projects.

Healthcare and Pharmaceuticals: The healthcare sector seeks financial modelling in terms of financial viability presented by drug development, healthcare services, and clinical trials. These financial models can trace costs related to research and development costs, patent life, reimbursement rates, along with demand forecasts.

Retail and Consumer Goods: Financial modelling can be of great help to retail and consumer goods in that it helps with assessing inventory management, and maintaining optional strategies throughout various activities.

Careers in Financial Modelling

Financial modelling plays a significantly large role in making informed decisions. Let’s discuss how one can make a potential career out of financial modelling in multiple fields.

Financial Modelling Roles in Investment Banking: The crux of investment banking is financial modelling. As a result, investment bankers use it to analyse and evaluate financial data related to corporate finance transactions.

Financial Analyst and Financial Planning Roles: The roles and responsibilities of a financial analyst and financial planner go hand in hand. Both of these roles require generous functioning of forecasting, valuation, and developing strategies.

Financial Modelling for Private Equity and Venture Capital:

Private equity firms and venture capital funds heavily rely on the financial modeling and evaluation of the viability of projects as well as for assessing ROIs.

Financial Modelling in Corporate Finance and Strategy: In the corporate finance sector, financial modelling can aid analysis of different situations including forecasts.

Conclusion

Financial modelling can be extremely beneficial to those looking for an enriching experience when it comes to the investment banking market.

The market is never too dull for an investment banker as it encompasses several unique experiences surrounding market trends and changing statistics.

Now that we have established the importance of financial modelling, let’s move over to the investment banking training offered by Imarticus Learning for finance graduates. The Certified Investment Banking Operations Professional course incorporates some of the most sought-after parameters in investment banking.

For instance, it encompasses chapters focusing on risk management, regulatory compliance, valuation, and trade life cycles within the financial models. The USP of this program is that it relies on a practical approach as opposed to a strictly theoretical approach.

Go for the program today and become an investment banker today!

FAQs

Three-way financial modelling involves creating a comprehensive spreadsheet that integrates the income statement, balance sheet and cash flow statement, the three main financial statements, to project a company’s future financial performance and position.

To start financial modelling, you can start gathering financial data that is available and build spreadsheets that link income, balance, and cash flow, and then analyse the results to make informed business decisions. You will also need to learn data visualization in Excel as well as the fundamentals of accounting.

Financial modelling for MBA involves learning how to use quantitative techniques for analysing and projecting a company’s financial performance, thus aiding in decision-making and strategy formulation.

Excel is one of the most used tools for financial modelling. It is great for data visualisation as well.

This truly depends on your career goals. CFA is more recognised for investment and financial analysis, while financial modelling offers specific skills in projecting financial scenarios, financial feasibility and analysing business situations.

Yes, but it depends on the type of MBA the student is going for. For example, an MBA in marketing might not cover financial modelling but an MBA in Finance will cover the principles of financial modelling.