The blockchain and the IoT have immense potential, and professionals are already working to combine these technologies. This merger can enhance data security within IoT networks & support various IoT solutions.

Here’s how blockchain features can be used to enhance IoT networks:

Why do IoT networks need blockchains?

The concept of an IoT network is that smart devices gather data about the environment, wirelessly connect to the internet and other devices via gateways & routers, & share the data collected within a network.

In addition, remote devices with user interfaces control IoT devices while transmitting data to users. In this IoT network, the data flows between IoT devices & can be stored on the cloud, local database, remote device, or IoT devices.

Applications of IoT:

IoT is used in workplaces, public spaces, streets, or at home, facilitating smart home systems, security systems, smart city infrastructure, etc. IoT devices are widely used in healthcare, manufacturing, construction, agriculture, & other industries. Wireless connections make IoT technology easy to implement for home & business usage.

Benefits of integrating a blockchain into an IoT network:

Data decentralization

The distributed architecture of blockchain means there’s no central point of control. This eliminates single points of attack or failure, reducing infrastructure, reconciliation, & management while improving fault tolerance. The nodes in a blockchain network manage the distributed digital ledger and confirm new blocks.

Improved system scalability

While reducing IoT silos, blockchain IoT integration contributes to improved scalability. Decentralized networks distribute workloads over devices and provide more computing power than centralized networks.

Guaranteed data stability

The data stability in a blockchain is ensured with cryptography that makes the distributed ledger permanent and unalterable. Added cryptography to smart devices provides secure data transfer & storage. A blockchain can keep a stable history of device communications within a specific IoT network.

Stronger authentication

With a blockchain, every IoT device can be identified. A blockchain can ensure trusted authentication & authorization for smart devices, which means all data within the IoT network will be secured. The private key remains with the user and is used to prove their identity, while the public key is distributed to the network provider.

Enhanced privacy & security

Blockchain secures communication between IoT devices by storing data in transactions & validates those transactions with nodes. This ensures traceability & accountability of sensor data. By using cryptography for communications, blockchain eliminates the risks of data breaches.

Improved data management

A blockchain facilitates IoT devices to communicate without involving a server, cloud storage, or other local databases. IoT developers can use blockchains to provide device-agnostic & decoupled applications.

Grow and learn with Imarticus Learning:

Both blockchain and IoT technologies are constantly developing to solve existing problems & meeting new ones. A Blockchain course is all you need to consider for those looking for career opportunities in the tech industry.

If you wonder how I become a Blockchain software engineer, Imarticus Learning caters to your doubts and offers Blockchain courses that get you into detail.

If you wonder how I become a Blockchain software engineer, Imarticus Learning caters to your doubts and offers Blockchain courses that get you into detail.

The 9-month extensive program will help you prepare for the new-age Software Engineer role specializing in Cloud, Blockchain, and IoT.

The course allows students to build a strong foundation of Software Engineering concepts, with industry experts helping to learn the practical implementation of Cloud, Blockchain, and IoT through real-world projects from diverse industries. This course goes a long way towards helping you unlock lucrative career opportunities in the ever-growing field of Software Engineering.

For further details, reach out through the Live Chat Support system or visit our training centers in Mumbai, Thane, Pune, Chennai, Bengaluru, Hyderabad, Delhi, Gurgaon, and Ahmedabad.

Blockchain technology is still in its nascent phase. High demand, lucrative pay scale, and opportunity to work in cutting-edge technology are few notable reasons that make this career path worthwhile.

Blockchain technology is still in its nascent phase. High demand, lucrative pay scale, and opportunity to work in cutting-edge technology are few notable reasons that make this career path worthwhile. To start coding, beginners are recommended to start with Solidity. Learn to create simple blocks, blockchain, implement genesis block, add the block to the chain, validate, and perform a test run. Subsequently, proceed with advanced features like Smart contracts, build the decentralized applications.

To start coding, beginners are recommended to start with Solidity. Learn to create simple blocks, blockchain, implement genesis block, add the block to the chain, validate, and perform a test run. Subsequently, proceed with advanced features like Smart contracts, build the decentralized applications.

With embedded finance reshaping and creating new roles for technology companies in the financial world, a

With embedded finance reshaping and creating new roles for technology companies in the financial world, a

This also implies that the demand for specialists in Fintech is increasing.

This also implies that the demand for specialists in Fintech is increasing.

We recommend joining online finance courses, particularly those that offer financial analyst training and placement.

We recommend joining online finance courses, particularly those that offer financial analyst training and placement.

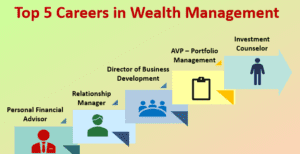

They focus on the financial relationships of his/her client. They keep analysing the market and ping their clients whenever a good investment opportunity occurs. They also work in investment banks advising clients on whether to invest in any particular venture or not.

They focus on the financial relationships of his/her client. They keep analysing the market and ping their clients whenever a good investment opportunity occurs. They also work in investment banks advising clients on whether to invest in any particular venture or not.

The technology innovation in India and the surge in usage of smartphones has helped in the growth of fintech services. The recent coronavirus outbreak has also made people shift towards online modes of transferring money. Let us see the trends and opportunities in the fintech sector in India.

The technology innovation in India and the surge in usage of smartphones has helped in the growth of fintech services. The recent coronavirus outbreak has also made people shift towards online modes of transferring money. Let us see the trends and opportunities in the fintech sector in India.

You can opt for a

You can opt for a  It provides dual certification with an

It provides dual certification with an