Investment banking can be regarded as one of the best finance-related jobs all across the world. Mostly dealing with individuals as well as organizations, the role is to raise capital through security procedures, be it debt or equity. A career in investment banking can be considered a viable option as it is always used in every dimension and has zero chances of fading out as a field of business.

Investment banking can be viewed as a suitable career option since it helps you to build a safe and prosperous life at your early stages. So, if you are considering it as one of your professional choices, then the first step should be to find an eligible course on finance.

Imarticus Executive Program in Investment Banking and Capital Markets will offer you the best teachings by the distinguished faculty of IIM Calcutta. This program will provide you with courses on financial managerial skills, technical knowledge, and practicalities. This course will also help you communicate with industrial leaders and invest you in projects such as the Capstone Project.

There are a few tips you should consider to begin with an IIM Calcutta Finance course.

5 important tips to join an IIM Calcutta Finance Course:

This course can be an ideal fit for you as it will live up to all your expectations. Here are the following reasons on how to join this program:

Check on the timings: This course takes place for over 1 year, with classes every Saturday from 6 pm – 9 pm. With such a feasible timing, you will be able to balance your mainstream courses or your full-time jobs. Enhancing your CV will be simple with just spending only 3 hours of a single day.

Searching for a unique curriculum: The IIM course consists of unique modules at different segments such as the intermediary and advanced levels, unlike other available courses. The intermediary level deals with modules such as financial management, accounting, and financial economics to strengthen your basics. The next step is to clear the exams to join the expert-level classes. The expert-level teachings mostly contain modules such as debt capital markets and equity capital markets. The course also accommodates various case studies, security market research, portfolio fund management, and other regulations.

Checking the selection criteria: You can be eligible for this course if you score a minimum of 50% in your graduation/post-graduation. A work experience of a minimum of 2 years is also required to enroll in the course. After passing the needful, an online selection test is conducted in order to check if you are finally eligible for the course. This can be regarded as your beginning step to being a part of the investment banking sector. Qualification in this program would enhance your knowledge and required skills.

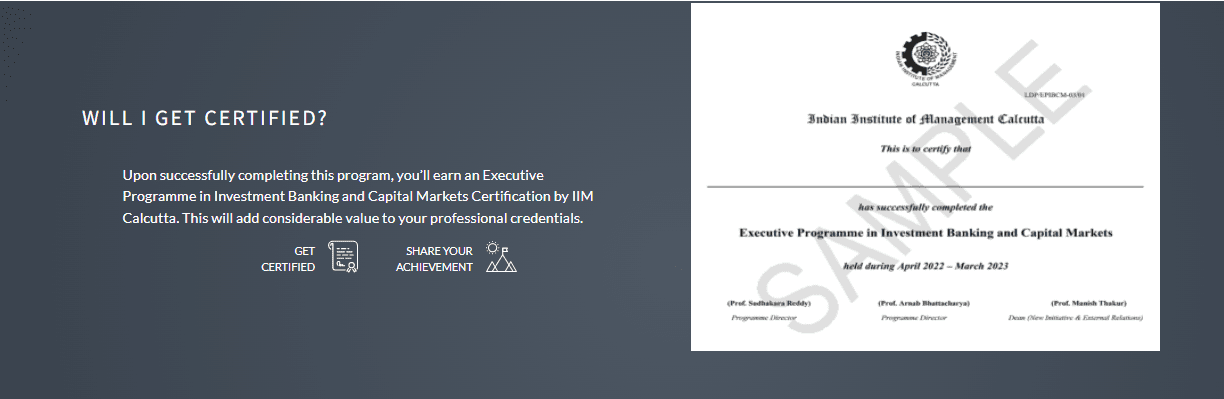

Certification from IIM Calcutta: Since this course is conducted by IIM Calcutta, a prestigious certificate will be rewarded if you qualify for the course. The faculty also conducts a 30 hours in-house program at the campus, with field surveys in various segments. During the course, you will also be taken for field visits and offline sessions inside the campus, which is an absolute delight to be a part of. It will help to boost up your personal experience and can also be reflected in your resume as an academic qualification.

Networking with new peer groups: It can be regarded as a unique online course as it will help to create new ties with several people. Professional and personal relations take place if you join this course, leading to better networking groups in the present and future. This program helps you to build up ties with banking and industrial tycoons, making your knowledge about this domain crystal clear.

Conclusion:

Imarticus Executive Program in Investment Banking and Capital Markets with IIM Calcutta as its faculty hence proves to be the best online course you can find in the scope of finance and management.

chnical skills and effective understanding of investment banking and capital markets as well as their practical application.

chnical skills and effective understanding of investment banking and capital markets as well as their practical application.