Making a career change can be difficult, but it’s not impossible. If you’re feeling stuck and don’t know what to do next, consider enrolling in an Executive Program in Investment Management.

This program can help you make better career decisions and give you the necessary skills to succeed. This blog will discuss five steps to help you make the most of your investment management education.

Define your goals

The initial step is to define your goals. What do you want to achieve with your education? Do you like to learn about financial planning and investment analysis? Or do you want to become a portfolio manager or investment advisor? Define your goals and make sure the program you choose aligns with them.

Research different programs

Once you have defined your goals, it’s the right time to research different programs. Many investment management programs are available, so it’s essential to do your homework and find the right one for you. Make sure to compare the curriculum, faculty, and other features of each program.

Evaluate your skills and interests.

It is essential to consider your skills and interests when making a career decision. What do you enjoy doing? The Executive Program in Investment Management can help you build on your skills and explore new interests. It is the perfect opportunity to gain knowledge and experience in the investment management industry.

If you are not sure what you want to do, take some time to evaluate your skills and interests. Look online for career assessments to help you identify your strengths and interests. The more you know about yourself, the easier it will be to find the right career for you.

Evaluate your option

One of the essential steps in making a career decision is evaluating your options. It also means looking at the different opportunities available to you and assessing which one would be the perfect fit for your goals and interests. Take some time to research all of your options, and then compare and contrast them to figure out the best fit for you.

Consider the risks and rewards of each path.

One of the most important things to consider when making a career decision is the risks and rewards of each path. What are you giving up by selecting one option over another? And what can you gain? Weighing these factors will help you make a more informed decision.

If you’re considering an Executive Program in Investment Management, it’s essential to understand the risks and rewards of this decision.

The Executive Program in Investment Management is an excellent way to make better career decisions.

Discover IIM investment banking and Capital market course with Imarticus Learning

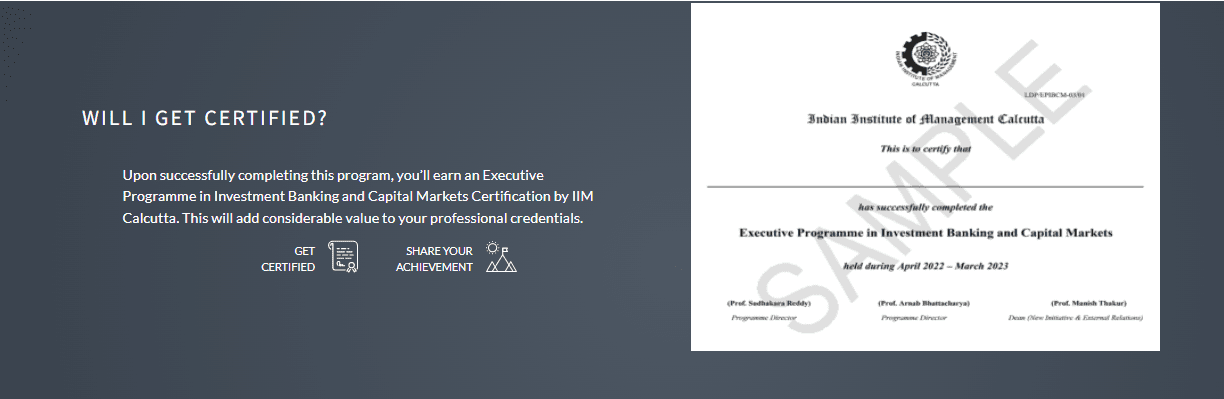

Our Executive Program in Investment Banking and Capital Markets collaborates with the prestigious IIM Calcutta. Students will master the foundations of mergers and acquisitions, debt and equity capital markets, portfolio management, sales and trading, and securities legislation for finance professionals with at least two years of experience.

Course Benefits for Learners:

- This IIM Calcutta executive program will help students achieve their goals and develop a solid career in the financial sector.

- This comprehensive one-year curriculum will provide students with a fundamental and advanced understanding of global capital markets and investment banking.

- The IIM Calcutta Investment banking certification is ideal for professionals who wish to further their careers in the finance industry.

chnical skills and effective understanding of investment banking and capital markets as well as their practical application.

chnical skills and effective understanding of investment banking and capital markets as well as their practical application.