Introduction

A financial planner and a wealth manager both come under financial advisory jobs. A financial planner helps in managing day to day finances of their clients whereas a wealth manager helps in preserving the current wealth and adopting sustainable development so that the financial resources may be preserved for the future.

There are a lot of differences in both these job roles and similarities too. It is up to one’s interests and capabilities that which one he/she chooses. Let us see both these careers in detail and compare them.

Job Roles

Financial planners are concerned with lifestyle planning. Their target audience is generally middle-class people or low-level companies. They help people in meeting the ends and give them advice on how to invest money in their lifestyle while saving too.

Their job duties include saving money for college, budgeting, retirement planning, insurance planning, etc. Their clients are normal people who want to use their income in a planned way so that they could achieve their life goals or some short-term goals.

Their job duties include saving money for college, budgeting, retirement planning, insurance planning, etc. Their clients are normal people who want to use their income in a planned way so that they could achieve their life goals or some short-term goals.

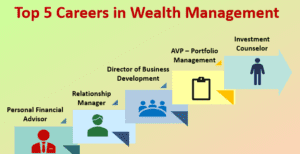

A wealth manager on the other hand deals with HNI (High Networth Individuals) clients or Ultra HNI clients. A wealth manager helps rich businessmen/people to preserve their wealth and adopt a sustainable development process. A wealth manager analyses the market and advises his/her clients on investment opportunities. They are involved in chores like capital/revenue planning, estate planning, risk identification & management, etc. They help their clients in identifying the risks of investing in any new venture. They help in sustainably using financial resources & services.

Education & Skills Required

Wealth managers & financial planners tend to do a bachelor’s degree in economics, accounts, finance, or mathematics. However, the certification courses vary for them. A wealth manager generally does a CPA (Certified Public Accountant) course whereas a financial planner prefers a CFP (Certified Financial Planner).

There are a plethora of Wealth Management Courses available on the internet. However, any professional in the wealth management or financial planning sector can do both of these certification courses as there is no necessity for any one of them for getting a job. These certification courses boost your skills.

There are a plethora of Wealth Management Courses available on the internet. However, any professional in the wealth management or financial planning sector can do both of these certification courses as there is no necessity for any one of them for getting a job. These certification courses boost your skills.

The skills needed are almost identical in both sectors. The major skills needed in the wealth management & financial planning sector are analytical skills, market analysis skills, communication skills, forecasting skills, networking skills, etc. As a wealth manager, you will need to have a large network of HNI or Ultra HNI clients in the market as compared to a financial planner.

What to choose?

If you have a natural market of HNI/Ultra HNI clients, then go for a Wealth Management Career otherwise you can opt for financial planning. Wealth management requires more networking skills than a financial planner. The salaries of wealth managers are also higher than those of financial planners.

The best criteria would be to aim for a wealth manager and if things don’t work out then go for financial planning because the skills & education required are almost identical in both fields. This was all about career advice related to wealth management & financial planning.

They also conduct skill assessments and competency mapping so as to create a comprehensive learning framework to prepare the new employees and also the existing employees with relevant future skills, dedicated delivery analysts, and account managers to ensure seamless delivery of training.

They also conduct skill assessments and competency mapping so as to create a comprehensive learning framework to prepare the new employees and also the existing employees with relevant future skills, dedicated delivery analysts, and account managers to ensure seamless delivery of training.

They focus on the financial relationships of his/her client. They keep analysing the market and ping their clients whenever a good investment opportunity occurs. They also work in investment banks advising clients on whether to invest in any particular venture or not.

They focus on the financial relationships of his/her client. They keep analysing the market and ping their clients whenever a good investment opportunity occurs. They also work in investment banks advising clients on whether to invest in any particular venture or not.

The technology innovation in India and the surge in usage of smartphones has helped in the growth of fintech services. The recent coronavirus outbreak has also made people shift towards online modes of transferring money. Let us see the trends and opportunities in the fintech sector in India.

The technology innovation in India and the surge in usage of smartphones has helped in the growth of fintech services. The recent coronavirus outbreak has also made people shift towards online modes of transferring money. Let us see the trends and opportunities in the fintech sector in India.

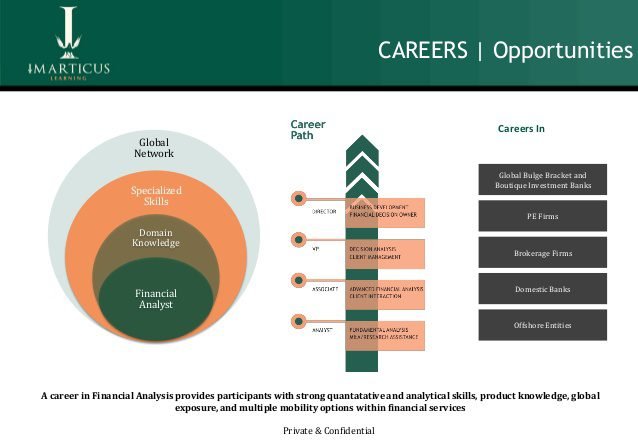

Investment banking courses are specially curated for financial analyst professionals. It takes a comprehensive approach to impart knowledge related to the financial markets. It also helps you understand the complexities involved in a

Investment banking courses are specially curated for financial analyst professionals. It takes a comprehensive approach to impart knowledge related to the financial markets. It also helps you understand the complexities involved in a

Explore more

Explore more

Why do you want to be a financial analyst?

Why do you want to be a financial analyst?