The industry of financial services is one that has expanded at an exponential rate over the past couple of years and by the looks of it, it doesn’t look like its growth is going to slow down any time soon. With the establishment and growth of mobile payment, cryptocurrencies as well as online banking, a question that is largely being asked is whether digital systems such as these pose a threat to us while we go about our daily businesses.

There is an element of uncertainty to any revolutionary idea and FinTech is no different. FinTech has been finding a place in industries and organizations belonging to a variety of sectors, reaching almost all areas thus inspiring further change as well as innovation within it.

However, it is important to be careful and take measures to diminish the potential for this technology to be utilised as a tool for malpractice.

The inadequate performance of banks is among the several reasons contributing to the growth and popularity of FinTech. Banks seem to be having difficulty in gaining their cost of capital and thus are looking for newer business models as an aid. In order to remain competitive, banks are looking for various strategies that will help them evolve.

Banks need to slowly start coming to terms with FinTech technology as well as its potential to start operating over a large number of sectors, thus not being limited to just financial services. An issue that is being posed at present is the development and use of blockchain technology.

The technology meets all the vital requirements for durable media, thus guaranteeing integrity as well as the confidentiality of the various documents sent to the client. This increases its appeal for potential use by banks. Customer empowerment is another key factor in the development of FinTech.

Advantages of FinTech

There are several advantages that FinTech provides its users with. FinTech improves efficiency, is faster and provides an improved experience in general for its clients as well as end-users. People do not have to be at the mercy of banks in dealing with various international payments as well as transactions.

FinTech provides its users with an ability to perform all their important financial operations through their smart-phones or computers and these are processed in a matter of seconds.

FinTech provides its users with an ability to perform all their important financial operations through their smart-phones or computers and these are processed in a matter of seconds.

Risks Posed By FinTech

Even though FinTech is advantageous in a large number of ways, like any other technology, FinTech also poses a few risks in its use. The first concern when talking about FinTech is the various risks posed by third-party services like cloud vendors. There is a level of operational risk posed by a third-party governance system.

Procyclicality is a possible risk which could come out of a number of sources and lead to various systematic risks. This becomes very important particularly when there is a high number or concentration in a platform or a market segment.

Another thing that may pose as a concern is various cross-border legal issues and various other regulatory issues which would need to be taken into account as well. When it comes to computation of big data and algorithm complexity, the lack of clarity makes regulatory disclosures all the more challenging.

Cyber risk is the most obvious threat that people worry about when it comes to any technology. The more we move towards digitalizing our world, the more we need to ensure that everything is up to date and mitigate security risks.

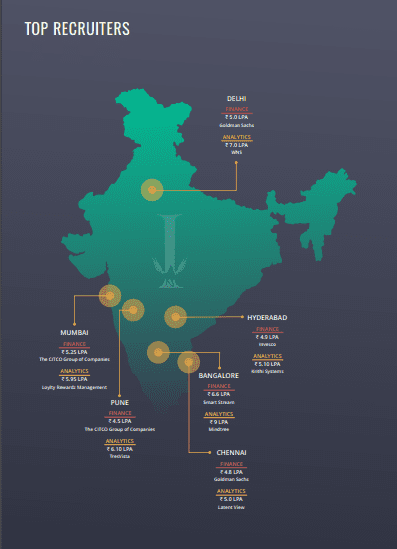

A career in FinTech right now is the smartest choice to make. FinTech courses would help in equipping with information and details required to succeed in this field. It is important to learn blockchain before stepping foot into the world of FinTech.

Let us understand why credit underwriting is such a fascinating career option.

Let us understand why credit underwriting is such a fascinating career option. You get to work with the latest technology:

You get to work with the latest technology:  Conclusion:

Conclusion:

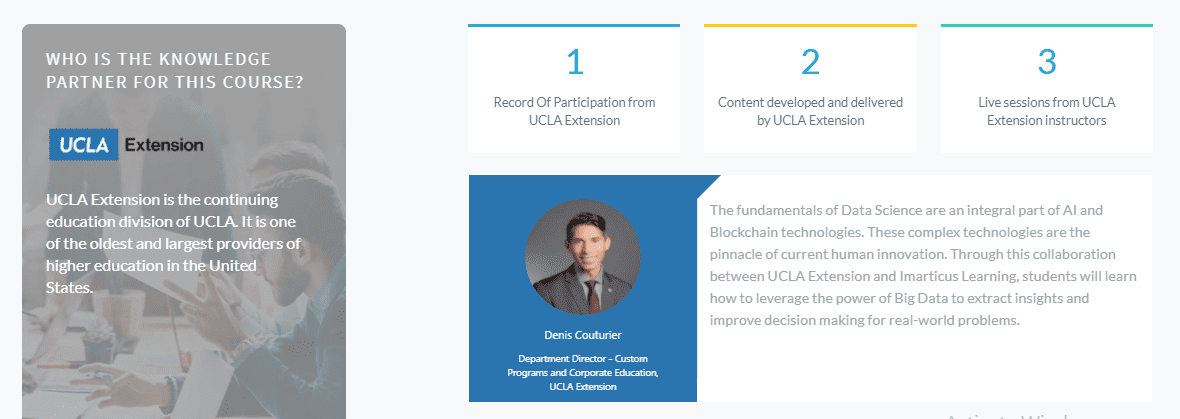

You will get dual certification from two reputed sources if you opt for this course. Many individuals have built their

You will get dual certification from two reputed sources if you opt for this course. Many individuals have built their  The pros of opting for this Imarticu’s

The pros of opting for this Imarticu’s

This is because the company might have made many important investments on assets and it is important to have someone to represent the management.

This is because the company might have made many important investments on assets and it is important to have someone to represent the management. This requires a technology that could effectively capture the requisite data at every stage.

This requires a technology that could effectively capture the requisite data at every stage. Asset Management is a key focus area in business and is independent of industries. To be a successful asset manager, you need to acquire certain skills.

Asset Management is a key focus area in business and is independent of industries. To be a successful asset manager, you need to acquire certain skills.

With embedded finance reshaping and creating new roles for technology companies in the financial world, a

With embedded finance reshaping and creating new roles for technology companies in the financial world, a

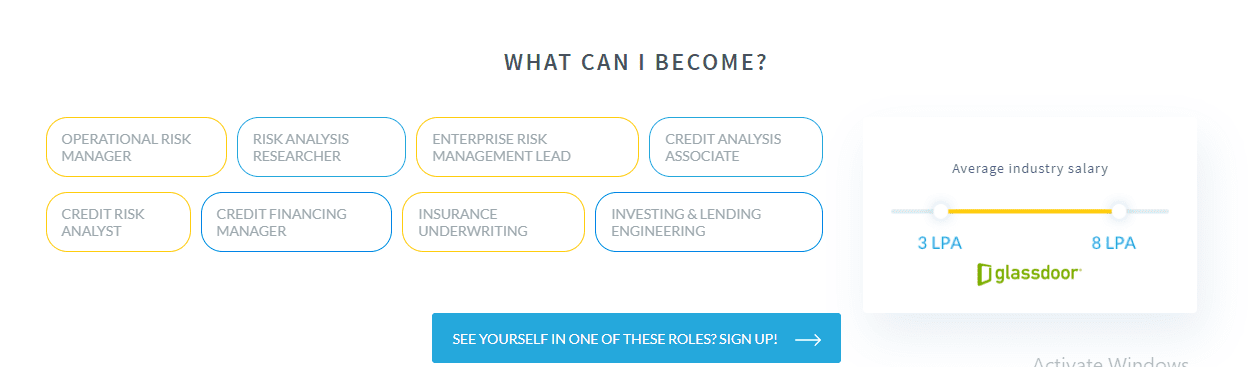

Comfort with Financial/Statistical software: Credit analysis requires risk analysis using statistical software. Knowledge & comfort working on such platforms is an advantage.

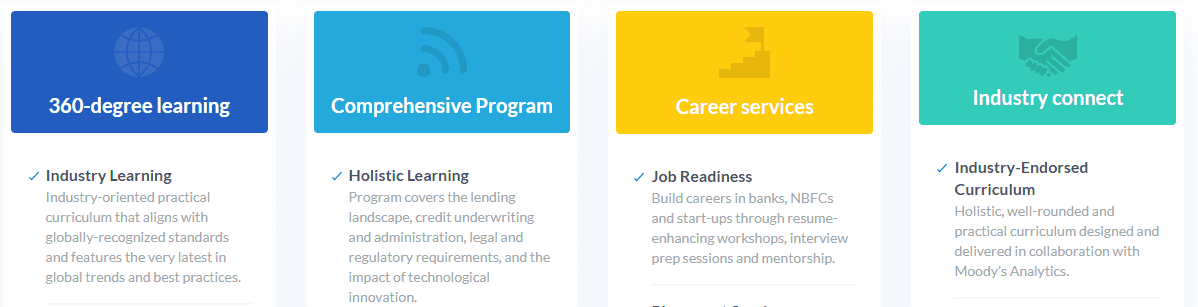

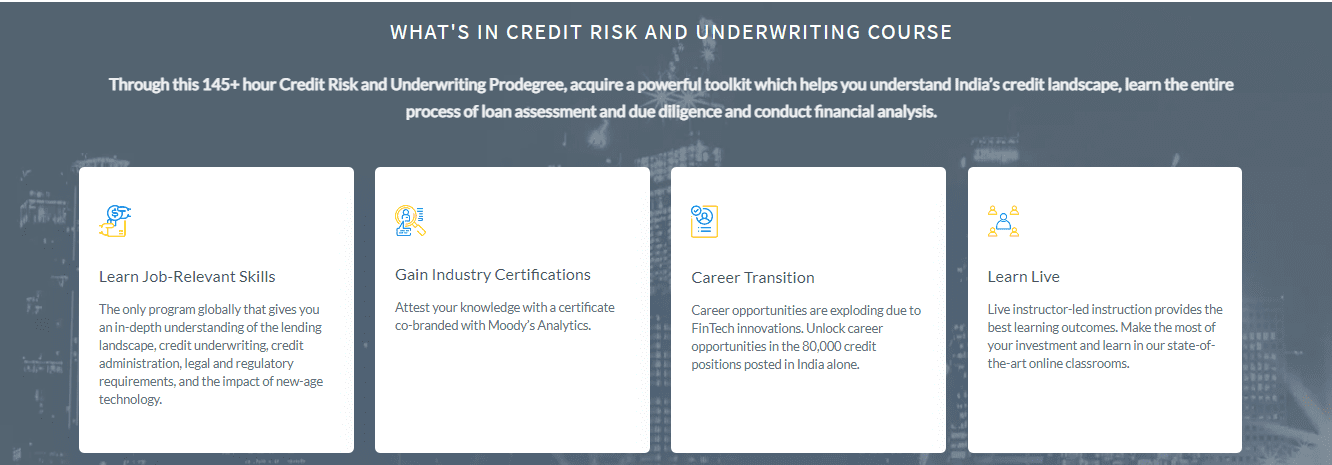

Comfort with Financial/Statistical software: Credit analysis requires risk analysis using statistical software. Knowledge & comfort working on such platforms is an advantage. Through this Credit Risk and Underwriting Prodegree, students acquire a powerful toolkit that helps them understand the credit landscape, learn the entire process of loan assessment and due diligence and conduct financial analysis. The students get hands-on learning experience and explore five comprehensive case studies linked to different aspects of the curriculum.

Through this Credit Risk and Underwriting Prodegree, students acquire a powerful toolkit that helps them understand the credit landscape, learn the entire process of loan assessment and due diligence and conduct financial analysis. The students get hands-on learning experience and explore five comprehensive case studies linked to different aspects of the curriculum.

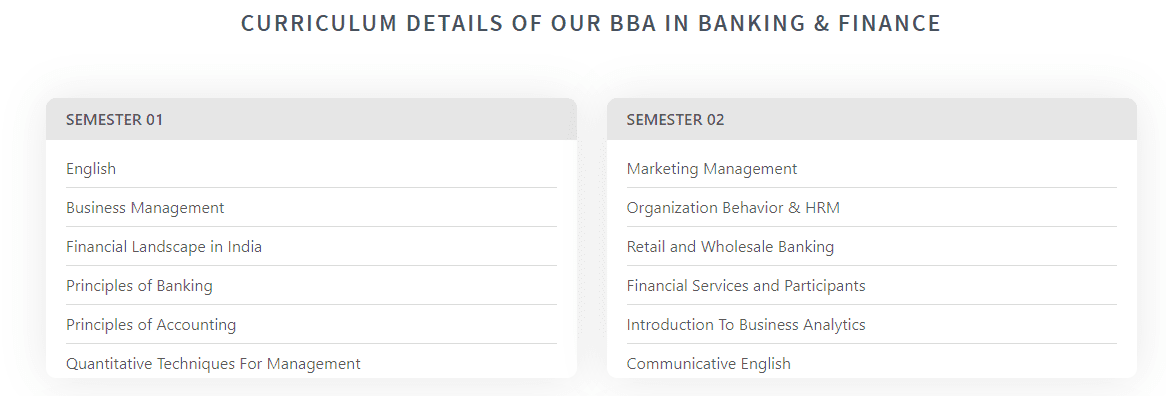

A BBA degree or Bachelor of Business Administration is a post-graduate level degree that will give you the skills and knowledge to enter the business world. An

A BBA degree or Bachelor of Business Administration is a post-graduate level degree that will give you the skills and knowledge to enter the business world. An

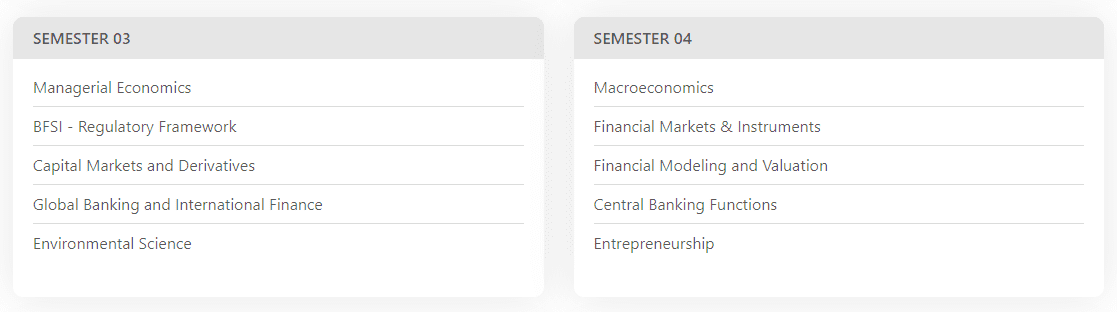

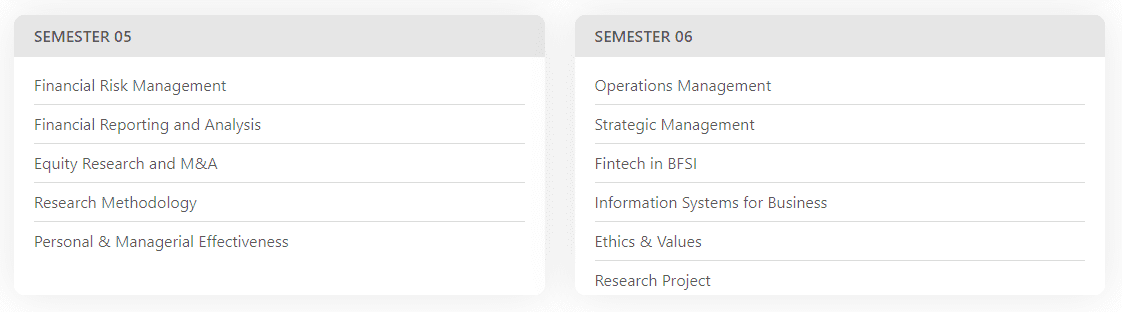

What all BBA courses are available?

What all BBA courses are available?