With a passion for learning, some people start a journey that leads them to never-ending growth. Idealizing ‘A Winner never quits, and a Quitter never wins,’ Abhilash Chatterjee paved a path for him in one of the most challenging industries.

With a passion for learning, some people start a journey that leads them to never-ending growth. Idealizing ‘A Winner never quits, and a Quitter never wins,’ Abhilash Chatterjee paved a path for him in one of the most challenging industries.

Abhilash is a professional and a seasoned Techno-Commercial Professional with 20+ years of professional experience in the BFSI/Fintech, Mobile Entertainment domain.

Find out more about Abhilash’s journey and his experience at Imarticus from this recent interview with Team Imarticus.

- Could you tell us a bit about yourself and your professional background?

Abhilash: Sure, to start with, I am a Mumbaikar and have done my Bachelors in Electronics Engineering.

I have 20 plus years of experience in the IT/Telecom and BFSI industry and have worked in various positions and roles (International Business Development, Product Management, Presales) over these years.

I had the opportunity to work with Various Industry Bigwigs and multinationals like Huawei, First Rand SA, Aditya Birla, Reliance, Essar, Bharti, Spice Group, etc.

Also, being in Presales/Business Development for a reasonable period, I had the opportunity to visit almost 44 countries Globally and live and work as an NRE in South Africa, Kenya, Ghana, and Nigeria. This helped me work with people of various cultures and ethnicities and have a global outlook and approach.

- What are your thoughts about India’s Fintech Revolution?

Abhilash: India has emerged as one of the fastest-growing fintech hubs in recent years. Concepts like paperless lending, mobile-first banking, secure payment gateways, mobile wallets, etc., are no longer a distant dream; it’s already happening.

Thanks to fintech companies for understanding consumer requirements, pain points and serving them more seamlessly than ever before. A recent report by Boston Consulting Group (BCG) and Ficci that India would realize a fintech sector valuation of USD 150-160 billion by 2025 further reinstates the country’s strong growth potential in the coming years.

The report, titled ‘India FinTech: A USD 100 Billion opportunity’, noted that over the past five years, Indian fintech companies had raised about USD 10 billion from investors all over the world, catapulting the sector’s total valuation to an estimated USD 50-60 billion The rise and rise of fintech startups India has seen a sharp rise in the number of fintech firms – that too in a short period.

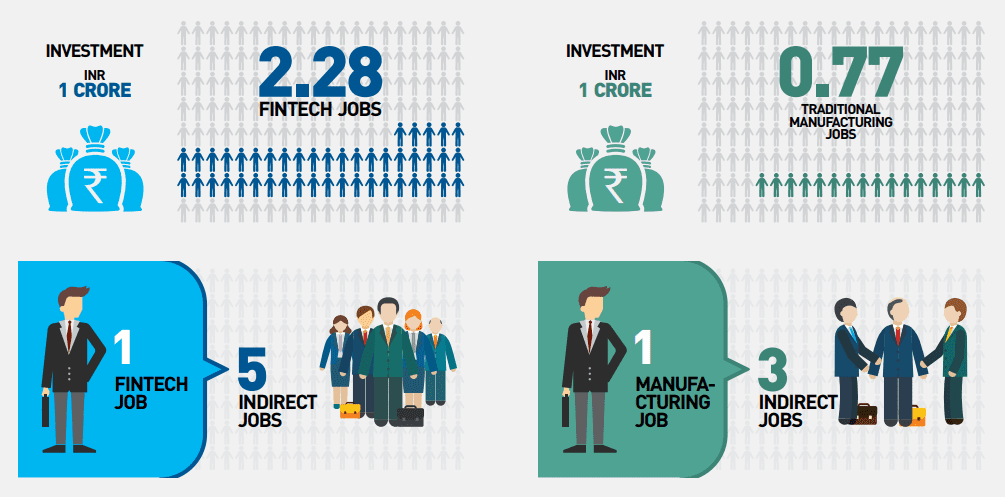

Of the over 2,100 fintech firms existing in India, 67% have been set up in the past five years. India’s FinTech ecosystem continues to be aided by strong customer demand, the country’s diverse capital flows strong tech talent, and enabling policy frameworks. I Strongly feel that India is at the Cusp of the Fintech Revolution and opportunities for professionals are simply immense in this field.

- Can you elaborate on your professional experience in the BFSI/Fintech, and What do you think is the future of Fintech in India?

Abhilash: Having seen and been part of both the Internet and Mobile Revolution, in addition to this Fintech Revolution, I have been lucky to be a part of a lot of initiatives, be it mobile wallets, digital banking, Payment systems like Each/UPI, etc., Pay later, Digital Lending, etc.

With IoT-enabled devices and AI/ML-based lending and collection systems, I see many Digital transformations happening in India. We have already started with Digital Transformation, and I guess that the entire process will be paper-free for the next 5 to 10 years.

I see the Digital revolution, especially with Whats app banking touching the masses, and also rural MFI/NBFC will soon adapt and embrace. We will see more digital branches and less need for physically going to branches to get the services executed.

Also, in the Space of Regtech, Insuretech, I see a similar Revolution. With the help of digital Identities, people would be able to Purchase and Transact Financial products in a more seamless manner without any human intervention.

- How does your day at your workplace look like?

Abhilash: To be frank, very hectic. Due to the current covid crisis being unable to Travel or meet people physically, it does become challenging to get things going. But slowly but surely, getting adjusted to the new norm of Zoom/Google meet, etc., and adapting to the new way of executing things.

- What keeps you busy while you are away from work?

Abhilash: Well, Frankly, nowadays, it’s my Daily reading habit, especially the current affairs and what’s happening globally related to Fintech/Crypto/BFSI and 30 to 45 minutes at night before sleeping watching Nat Geo/Discovery/Netflix.

Abhilash: Well, It’s Bill gates. I am genuinely inspired by the Bill Melinda Gates Foundation, which works tirelessly and across the globe in various countries as a non-Profit Organization transforming the lives of people and help in Financial Inclusion and banking the Unbanked/Underbanked. I believe they contribute a lot to society in terms of Bringing Financial products to the underprivileged masses.

- Can you share your experience of SP Jain School of Global Management and Imarticus Learning’s Professional Certification in Fintech? How has it helped you in your professional life?

Abhilash: The best time and money investment I could make after spending 20 years in various fields and positions to upgrade my Skill sets and be at par with the best professionals in the industry. I had researched a lot about the professional courses available in the market but ultimately squared in on Imarticus because I had got excellent feedback from the previous cohorts. Also, one thing that made my decision easy was the informal approach and attitude of all the staff concerned with the course.

I felt different in this program because the guest faculty were all from the Industry and had rich global experience with hands-on experience on Real-time projects executed in BFSI/Fintech. Thereby the information and knowledge gained from them are not like it happens in the conventional courses from conventional professors but from real-time working Industry Professionals.

Also, with the help of FLP (Future learning program), even after the batch is over, can attend lectures by various industrial professionals on recent topics and Fintech Developments. This continuous learning program is simply fabulous for the ever-evolving world of Fintech; it helps me keep up to date. As a professional, I truly feel delighted with the decision of having enrolled in this course.

Abhilash: I enjoyed all sessions and used to wait for weekends to get going. However, if I still had to pick, I would say sessions on AI/ML, Deep learning By Rajat, Neo/Digital Banking By Shrikant, and the one-on-one mentorship By Vikram in getting the basics in place.

- Did you receive adequate support from the SP Jain and Imarticus Learning Faculty?

Abhilash: Without exaggerating, it was 24*7*365. Simply amazing. It has never happened that I have raised a doubt/query during the course, be it during the course or as an afterthought later, and it has not been answered. The faculty is just a Whatsapp/call away. I liked the informal and Happy to help (always a one-on-one) approach by all the faculty members.

- Do you have any tips for people who want to become a part of the Fintech industry?

Abhilash: Fintech is huge. There are various components: Regtech, Insuretech, Lending & Payments, Blockchain/Crypto, IoT, and AI/ML.

I suggest one needs to understand all at a basic core level but pick up one or two of these components and specialize.

I personally (with my experience) would suggest professionals who want to take up or upgrade to a Fintech career should attend a professional course and try and specialize in one of the above, whichever interests him/her the most.

In this article, we’ll discuss how to get into a career in FinTech and take an overview of some great online classes for those looking to sharpen their skills at one of today’s hottest industries!

In this article, we’ll discuss how to get into a career in FinTech and take an overview of some great online classes for those looking to sharpen their skills at one of today’s hottest industries!

With embedded finance reshaping and creating new roles for technology companies in the financial world, a

With embedded finance reshaping and creating new roles for technology companies in the financial world, a

With a passion for learning, some people start a journey that leads them to never-ending growth. Idealizing ‘A Winner never quits, and a Quitter never wins,’ Abhilash Chatterjee paved a path for him in one of the most challenging industries.

With a passion for learning, some people start a journey that leads them to never-ending growth. Idealizing ‘A Winner never quits, and a Quitter never wins,’ Abhilash Chatterjee paved a path for him in one of the most challenging industries.

It covers a broad overview of FinTech, which includes:

It covers a broad overview of FinTech, which includes: Career Path in FinTech

Career Path in FinTech

If you’re seeking to get educated on-line in the equal fields, you’re inside the right area. If you’re still at the fence about on-line publications in popular, here is a complete list of advantages that you may expect to gain:

If you’re seeking to get educated on-line in the equal fields, you’re inside the right area. If you’re still at the fence about on-line publications in popular, here is a complete list of advantages that you may expect to gain: Our modern-day #CEOseries functions attractive commercial enterprise conversations with prominent industry leaders as we delve into professional insights from a number of the maximum reputable names within the corporate world.

Our modern-day #CEOseries functions attractive commercial enterprise conversations with prominent industry leaders as we delve into professional insights from a number of the maximum reputable names within the corporate world. Listen Mr. Srinivasan

Listen Mr. Srinivasan

It has widely been seen that people have very positively accepted fintech as their new normal. Unlike the usual times where people used to visit banks for even their balance inquiries, people nowadays have gained trust in the applications and portals under fintech.

It has widely been seen that people have very positively accepted fintech as their new normal. Unlike the usual times where people used to visit banks for even their balance inquiries, people nowadays have gained trust in the applications and portals under fintech. To illustrate, earlier many amazon orders were booked with cash on delivery but people want to have their limited cash reserves with them and hence are paying online.

To illustrate, earlier many amazon orders were booked with cash on delivery but people want to have their limited cash reserves with them and hence are paying online.