The climb to senior leadership is a challenging but rewarding journey. It demands a unique set of skills that go beyond technical expertise. To thrive at the top, you need to be not only a master of your craft but also an inspiring leader who can navigate complex situations, motivate teams, and steer the organization towards success.

Only 16% of organizations in the Global Human Capital Trends survey said their leaders are very prepared to use online tools to boost employee productivity and performance. Additionally, only 23% of respondents believe their leaders can handle the changing needs of the workplace and workforce.

Leaders must develop senior leadership skills, but it’s just as important for them to improve their technical and software skills. These skills are necessary for managing teams spread out in different locations and keeping remote workers engaged.

This blog post unveils the 10 must-have essential skills that define a successful senior leader. We’ll delve into each skill, explore its significance, and provide practical tips on how you can cultivate them in your leadership journey. So, are you ready to discover your leadership potential & reach the C-suite? Let’s begin!

What are the most important skills for senior leadership?

Leadership is a journey. It requires continuous growth and adaptation. To succeed at a senior level, leaders must hone a diverse set of skills that go beyond basic management. Whether you are aiming to enhance your leadership capabilities, mastering these ten essential skills will set you on the path to success.

Here are 10 Must Have Skills For Every Senior Leader:

Strategic Thinking

Strategic thinking is crucial for senior leaders. It also involves seeing the big picture, anticipating future challenges, and planning accordingly. To develop this skill:

- Stay Informed: Keep up with industry trends and market shifts.

- Long-Term Planning: Focus on long-term goals and create detailed plans to achieve them.

- Scenario Planning: Practice imagining various future scenarios and how you would respond to them.

Effective Communication

Strong leaders are also strong communicators. Effective communication involves not only conveying your message clearly but also listening actively and empathetically. Here’s how to improve:

- Public Speaking: Take courses or join groups like Toastmasters to enhance your public speaking skills.

- Active Listening: Practice active listening by fully focusing on the speaker, understanding their message, and responding thoughtfully.

- Non-Verbal Communication: Be mindful of your tone of speech, facial expressions, and body language.

Emotional Intelligence

Emotional intelligence (EI) is the ability to understand & manage your emotions and those of others. High EI helps in managing stress, resolving conflicts, and leading teams effectively.

- Self-Awareness: Reflect on your emotions and their impact on your work and relationships.

- Self-Regulation: Practice staying calm and positive, especially in stressful situations.

- Empathy: Put yourself in others’ shoes to understand their feelings and perspectives.

Decision-Making

Senior leaders often face complex decisions that can impact the entire organization. Effective decision-making involves:

- Data Analysis: Base your decisions on data and evidence rather than assumptions.

- Risk Management: Evaluate the benefits and potential risks of each decision.

- Consultation: Seek input from others to gain different perspectives and make more informed choices.

Delegation

Delegation is a critical skill for maximizing productivity and developing your team. Effective delegation involves:

- Trust: Trust your team to complete tasks without micromanaging.

- Clarity: Clearly communicate the task, expectations, and deadlines.

- Support: Provide the necessary resources and support for your team to succeed.

Adaptability

The ability to adapt to change is vital for senior leadership. Here’s how to enhance your adaptability:

- Embrace Change: View change as an opportunity for growth rather than a threat.

- Continuous Learning: Keep learning new skills and stay updated with industry developments.

- Flexibility: Be open to new ideas and approaches and be willing to pivot when necessary.

Conflict Resolution

Conflicts are inevitable in any workplace. Effective leaders can navigate and resolve conflicts to maintain a positive work environment.

- Address Issues Early: Don’t let conflicts fester. Address them as soon as they arise.

- Mediation: Act as a mediator to help parties find a mutually acceptable solution.

- Focus on Solutions: Concentrate on finding solutions rather than assigning blame.

Vision and Inspiration

Leaders must have a clear vision for the future and be able to inspire others to follow it.

- Vision Development: Create a compelling vision that aligns with the organization’s goals and values.

- Motivation: Use storytelling and personal passion to inspire and motivate your team.

- Recognition: Recognize and celebrate achievements to maintain high morale and motivation.

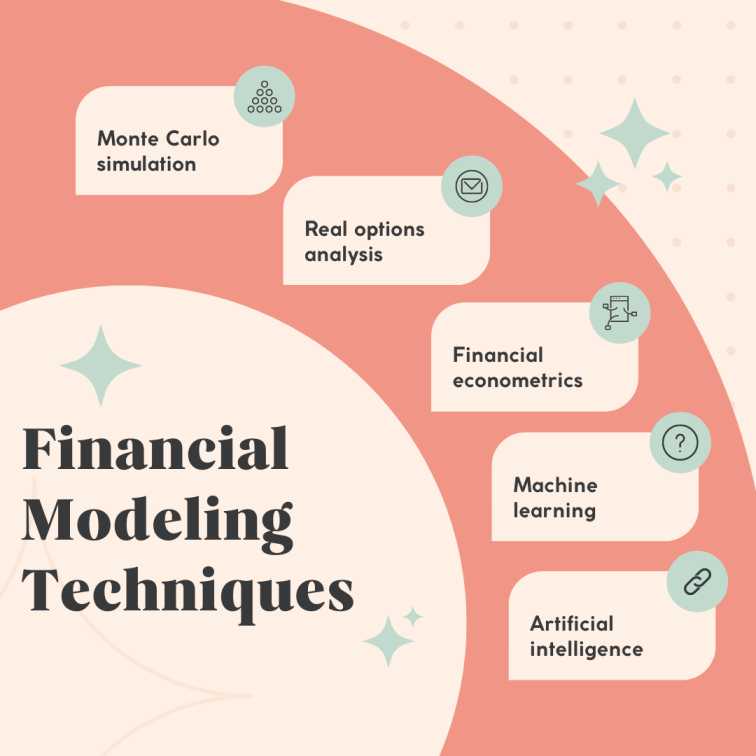

Financial Acumen

Senior leaders must understand the financial aspects of their organization to make informed decisions.

- Financial Literacy: Learn to read & interpret financial statements and reports.

- Budget Management: Develop skills in creating and managing budgets.

- Investment Decisions: Understand the principles of investment and risk management.

Mentorship and Development

Developing your team is just as important as your growth. Effective leaders act as mentors and focus on developing their team’s potential.

- Coaching: Provide regular feedback & coaching to help your team improve.

- Career Development: Support your team’s career aspirations and provide opportunities for growth.

- Knowledge Sharing: Share your knowledge and experiences to help others learn and grow.

The Final Words

Developing these ten must-have skills requires dedication and a commitment to continuous improvement. By focusing on these areas, you can become a more effective and successful senior leader, capable of navigating complex challenges and driving your organization forward.

If you’re ready to take your leadership skills to the next level, start by assessing where you stand in each of these areas. Identify your strengths and areas for improvement, and make a plan to develop each skill.

Transform Your Leadership Skills with Imarticus Learning

This 12-month Postgraduate Certificate in Senior Leadership program from Imarticus Learning is designed for professionals aiming to excel in senior management roles. With a curriculum rooted in real-world challenges and insights, this programme offers hands-on skill development.

Participants will explore strategic thinking, corporate value creation, digital transformation, conflict management, and cultivating high-performance teams. This course will empower professionals to lead confidently and competently in today’s fast-paced and competitive corporate world.

This senior leadership course from Imarticus Learning and XLRI equips applicants with an inside perspective on the day-to-day functioning of business activities. It comprehensively covers dimensions like strategy, sustainability, and digital transformation that are intrinsic to senior leadership roles.

Attend sessions on conflict resolution, fostering innovation, shaping dynamic cultures, and more to become a transformational leader. Discover and acquire the new-age skills needed to lead your organization confidently in current times.

Enrol now to start your journey towards becoming a confident and competent leader!