Welcome to the world of finance, where numbers dance and figures sing!

If you've ever dreamt of the best careers in finance where strategic thinking meets problem-solving, analysis intertwines with creativity, and every day is a new challenge, you're in the right place.

This blog post will explore the 7 Essential Skills for Finance Career. These are not just skills but the secret ingredients that can transform an ordinary finance professional into an extraordinary one.

Whether you're a recent graduate looking to enter the finance industry or an experienced professional aiming to acquire certain skills for finance career that can significantly boost your chances of success, this comprehensive guide will explore the seven important skills in finance, providing valuable insights and actionable tips to help you thrive in this competitive landscape.

Overview Of The Finance Industry

In the grand scheme, a significant chunk of our economy relies on something quite interesting: mortgages and loans. It's like a seesaw – when interest rates go down, these loans become more valuable, and that's good news for the economy. Think of it this way: the stronger our financial sector is, the healthier our economy becomes.

Financial services, the lifeblood of our economic landscape, represent various offerings within the dynamic finance sector. This multifaceted industry comprises diverse service-oriented organizations that expertly manage our financial affairs.

Among these financial custodians, you'll find credit unions, venerable banks, innovative credit-card companies, trusted insurance providers, savvy accountancy firms, customer-focused consumer-finance enterprises, dynamic stock brokerages, visionary investment funds, skilled individual asset managers, and even some enterprising government-backed entities. Together, they form the mosaic of financial services, shaping and safeguarding our monetary world.

Conversely, if the financial sector isn't doing so hot, it's usually a sign that the economy feels under the weather. Now, you might associate the financial sector with Wall Street and the bustling exchanges that light up our screens. But it's more than that. The financial sector is like the engine room of our developed economies.

Advanced Financial Modeling Techniques: The Secret Weapon Of Successful Analysts

It comprises all sorts of folks – brokers, financial institutions, and money markets. They're behind the scenes, ensuring Main Street can continue its daily business. This sector does some important stuff, like giving loans to businesses so they can grow, handing out mortgages to folks who want to own homes, and providing insurance to keep people, companies, and their stuff safe. It even helps folks save up for retirement and provides jobs for millions of people.

Here's an interesting tidbit: the financial sector gets a good chunk of its money from loans and mortgages. And when interest rates take a nosedive, these loans become more valuable. When that happens, it's like opening a treasure chest of opportunities and benefits for building skills for finance career.

More people and businesses can afford big projects and investments. And when the financial sector thrives, it's like a booster shot for the economy, leading to more growth and prosperity.

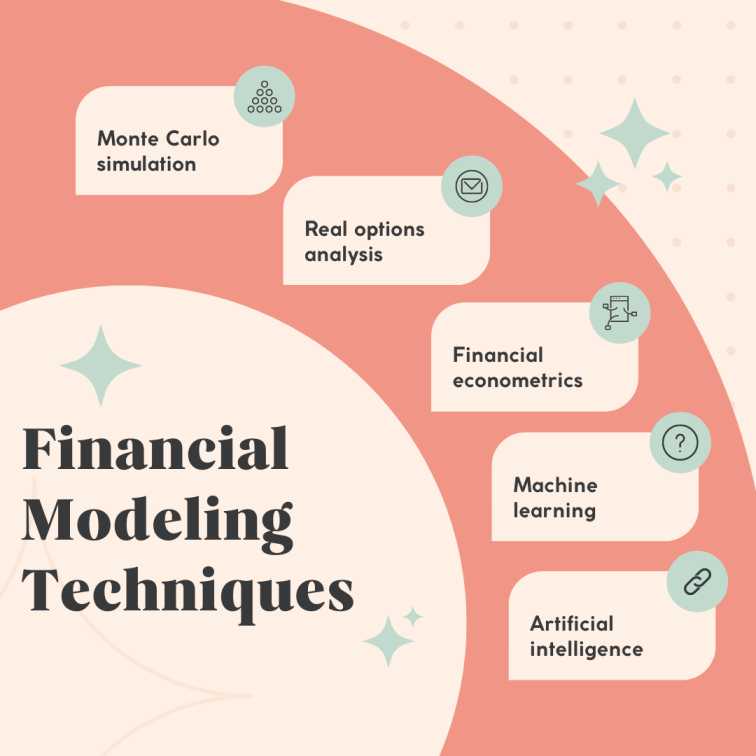

Some examples of how these techniques can be used in financial modeling:

- Monte Carlo simulation: It can also be used to model complex financial systems and to assess the risk of different scenarios. For example, it can be used to model the performance of a stock portfolio or the risk of a corporate default.

- Real options analysis: Real options analysis is a method for valuing the flexibility of financial contracts and corporate investments. For example, it can be used to value expanding a business or delaying a project.

- Financial econometrics: Financial econometrics is a field of study that uses statistical methods to analyze financial data. It can also be used to develop models that predict future market movements, asset returns, and risk.

- Machine learning: Machine learning (ML) enables computers to learn without explicit programming. It may be used to create financial models that can find links and patterns in data that would be hard or impossible to find using conventional techniques. For example, machine learning can be used to develop models that predict creditworthiness or fraud.

- Artificial intelligence: Artificial intelligence (AI) is a broad field of study encompassing machine learning and other skills that enable computers to perform tasks that normally require human intelligence. AI can be used to develop financial models that can learn and adapt over time and make decisions based on incomplete or noisy data. For example, AI can be used to develop models that can trade stocks or manage portfolios.

Advanced financial modeling techniques are becoming increasingly important as financial markets become more complex and competitive. By mastering these techniques, financial professionals can gain a significant career advantage.

What are the Essential Skills for Finance Career Success?

Mastering the Art of Financial Evaluation

Financial analysis is the cornerstone of successful skills for finance career. Professionals in this field must be adept at interpreting financial statements, assessing investment opportunities, and evaluating risks. Financial technology trends are revolutionizing the way we manage our money.

These skills for finance career involve:

- Ratio Analysis: Understanding and interpreting key financial ratios like liquidity, profitability, and leverage ratios to gauge a company's financial health

- Cash Flow Analysis: Analyzing cash flow statements to assess the cash-generating capacity of a business.

- Valuation Techniques: Learning various valuation methods such as discounted cash flow (DCF) and comparable company analysis (CCA) to determine the intrinsic value of assets or companies.

Crunching Numbers with Confidence

A strong numerical aptitude is indispensable in the finance industry. Finance professionals regularly work with complex mathematical model, large datasets, and intricate calculations. Numerical aptitude involves:

- Quantitative Analysis: Applying mathematical concepts to solve financial problems and make data-driven decisions

- Statistics: Understanding statistical tools to analyze data and draw meaningful conclusions

- Excel Proficiency: Mastering Microsoft Excel for data analysis, modeling, and financial reporting.

Attention to Detail

In finance, even the smallest oversight can have significant consequences. Attention to detail is a skill that ensures accuracy and minimizes errors in financial transactions, reporting, and analysis. Key aspects of these important skills for finance career include:

- Data Accuracy: Ensuring data integrity and precision in financial documents.

- Thoroughness: Conducting meticulous reviews of financial statements and reports.

- Compliance: Adhering to regulatory requirements and ethical standards in financial practices

Problem-Solving

Finance professionals encounter a myriad of complex problems daily. Problem-solving skills are essential for identifying issues, devising solutions, and mitigating risks. Effective problem-solving skills for finance career includes:

- Critical Thinking: Analyzing problems from multiple angles to arrive at well-reasoned solutions.

- Risk Assessment: Evaluating potential risks and developing strategies to manage them.

- Adaptability: Being flexible and creative in finding solutions as financial landscapes evolve.

Communication Skills

Finance is not just about numbers; it's also about effective communication. Finance professionals often need to convey complex financial information to non-finance stakeholders. Strong communication skills for finance career encompass:

- Clarity: Communicating financial concepts clearly and understandably.

- Presentation: Creating compelling presentations and reports to convey financial insights.

- Active Listening: Understanding the needs and concerns of clients and colleagues.

Analytical Thinking

Analytical thinking is dissecting data, identifying trends, and extracting valuable insights. These skills for finance career enable finance professionals to make data-driven decisions and provide strategic guidance. Key aspects of analytical thinking include:

- Data Interpretation: Extracting meaningful information from financial data sets.

- Forecasting: Using historical data to make future predictions and plan accordingly.

- Risk Analysis: Identifying potential risks and their impact on financial outcomes.

Ethical Judgment

Ethical judgment is paramount in the finance industry. Finance professionals are entrusted with sensitive financial information and must adhere to ethical standards. Ethical judgment skills for finance career involve:

- Integrity: Acting honestly and transparently in all financial dealings.

- Confidentiality: Safeguarding sensitive financial information.

- Compliance: Adhering to legal and regulatory requirements.

The Final Words

A successful career in finance requires combining these seven skills: financial analysis, numerical aptitude, attention to detail, problem-solving, communication skills, analytical thinking, and ethical judgment. By honing these skills for finance career, professionals can navigate the industry's complexities, make informed decisions, and contribute to their organizations' success.

Introducing the Imarticus Learning financial analysis certification program – Your Gateway to the best careers in finance. Step into a world of opportunity with the program, which equips you with essential skills for finance career and offers an exclusive job guarantee. They connect you with over 500 prestigious partner organizations actively seeking candidates for various roles.

Elevate your expertise in these important skills in finance - financial statement analysis, modeling, valuation, equity research, and transaction execution. Dive into the world of Excel and PowerPoint mastery, making you indispensable in today's competitive job market. Experience a cutting-edge learning journey with the latest engagement solutions, including immersive simulation tools.

Walk in the shoes of industry professionals and immerse yourself in live workplace scenarios. Seal your knowledge with a capstone project that challenges you to apply your learnings to a real-world problem statement. This safe, simulated environment ensures you're well-prepared for the demands of the professional world.

Whether you're just starting your finance journey or looking to advance your career, these skills for finance career will be your guiding compass in the ever-evolving world of finance. Embrace them, nurture them, and watch your finance career flourish.

Unlock your potential and seize the future with the finance course. Your success story starts here!