As the name suggests, Business System Analysis is the analysis of business systems. Different processes like team performance, the performance of business tools, human resource evaluation, etc. are analyzed by a business system analyst. A business system analyst finds ways to enhance the processes in a business.

A business system analyst works with both people and the resources available in the business. He or she interacts with the various team leaders within an organization and makes sure that every system is running properly. Problem detection is also done with the help of Business System Analysis and is managed.

The main focus of a business system analyst is to work on people, tools, systems, work environments, and optimise them. It helps in creating a better business strategy which will eventually help in growing of any particular business. Let us have some more insights into Business System Analysis.

Pros of Business System Analysis

- The theoretical model created via Business System Analysis helps in creating a practical SDLC (Systems Development Life Cycle) model which is implemented to increase the effectiveness of business processes. SDLC includes planning, designing, development, maintenance, etc.

- It helps in finding the shortcomings faced by the employees in terms of resources and tools. If the requirements for any particular job can be identified at the right time and employees are provided with the right guidance, they can produce better results.

- It helps in finding tools, workers, initiatives which are taking more investment but are not producing expected results. Such processes, systems can be given a second thought form the administration. It will also help in cost optimization.

- Business System Analysis helps in adapting to new changes. A good business system analyst can forecast and stay ahead of others in terms of working culture, technology, and resources.

- A business analyst suggests companies/firms in finding out the best web application, software, and hardware tools which can increase speed and accuracy.

- Risks in businesses are identified via Business System Analysis and are managed.

- They also help in maintaining a good office culture. It helps in increasing employee satisfaction.

- Business analysts help in meeting the market requirement. They monitor any particular process and make sure that it fulfils its objective. They try to maintain communication within employees which helps in increasing clarity.

- They also help in proper documentation and analysis of required chores and processes and monitor them from time to time. There are many sub-processes in a business that is to be interconnected to achieve the company goal which can be done with the help of a business system analyst.

Skills Required to Be a Good Business System Analyst

- Good communication skills are required to communicate and understand the problems of the employees.

- A good business system analyst has good problem-solving skills. He/she can find the faulty areas within a business and can work on it.

- Good business analysis skills are required where you can understand the processes and their architecture. A business system analyst must be able to work on various business analysis software. He/she should be able to create various analysis models like Process Flow Diagram, Data Mapping, Entity-Relationship model, etc.

- A good business system analyst can connect to people and find out the loopholes. He/she is an excellent relationship manager and has good presentation skills. A business system analyst must be good in information systems, maths, computer science, etc. One can learn from Business Analysis courses available on the internet.

Conclusion

A company/business can generate revenue using their investments and technology but to maintain it for a longer time, trusted employees, tools are required.

A business system analyst helps any particular company in interconnecting the business processes and optimising it in such a way that it gives a maximum result. This article was all about Business System Analysis and its importance. I hope it helps!

Now one of the major challenges faced by the traditional banking systems is that it takes more than the necessary time to settle financial transactions carried out between two parties. The average time taken earlier was between 1to 3 days.

Now one of the major challenges faced by the traditional banking systems is that it takes more than the necessary time to settle financial transactions carried out between two parties. The average time taken earlier was between 1to 3 days. Identity theft is also a common problem in the modern digital age. Banks need better protection against these cybercriminals to detect fraud and eliminate the chances of data leakage.

Identity theft is also a common problem in the modern digital age. Banks need better protection against these cybercriminals to detect fraud and eliminate the chances of data leakage. This allows easy data manipulation without any repercussions but given the blockchain highly decentralized structure it is almost impossible to manipulate data without being caught.

This allows easy data manipulation without any repercussions but given the blockchain highly decentralized structure it is almost impossible to manipulate data without being caught.

Instilling the habit of saving up funds for emergencies or for the future while curbing on your ‘wants’ has proven to be a tried and tested strategy for financial management. If you are deciding on buying something expensive, try to think if you would use that product even 3-5 years from that time to check if it is a necessity or a luxury.

Instilling the habit of saving up funds for emergencies or for the future while curbing on your ‘wants’ has proven to be a tried and tested strategy for financial management. If you are deciding on buying something expensive, try to think if you would use that product even 3-5 years from that time to check if it is a necessity or a luxury. You should also have life insurance and other things in place to help your future generations as much as possible. At this point, one should also strive for financial independence. Even when you retire, you should have enough funds to see you comfortably to the end.

You should also have life insurance and other things in place to help your future generations as much as possible. At this point, one should also strive for financial independence. Even when you retire, you should have enough funds to see you comfortably to the end.

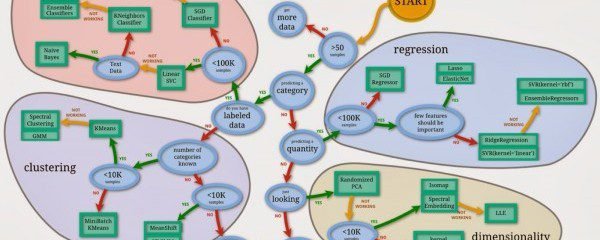

Sklearn precisely works as a one-stop solution that helps with importing, preprocessing, plotting, and predicting data.

Sklearn precisely works as a one-stop solution that helps with importing, preprocessing, plotting, and predicting data.