Transitioning from sales to investment banking (IB) can be quite hard to do. Especially, when as a sales analyst it is already presumed that you will be completing a two-year term. So, if halfway through your first year you declare that you will be moving to investment banking, then it will raise certain questions about your sincerity and work ethics. There is, however, a more practical problem related to it.

That would be the lack of training as an investment banking analyst. Since the training programs required for a sales analyst and investment banking analyst are completely different, the transition would be hard to make. And obviously, the teams within the IB department will look for a candidate who already has proper training. So, they will be reluctant to take you on.

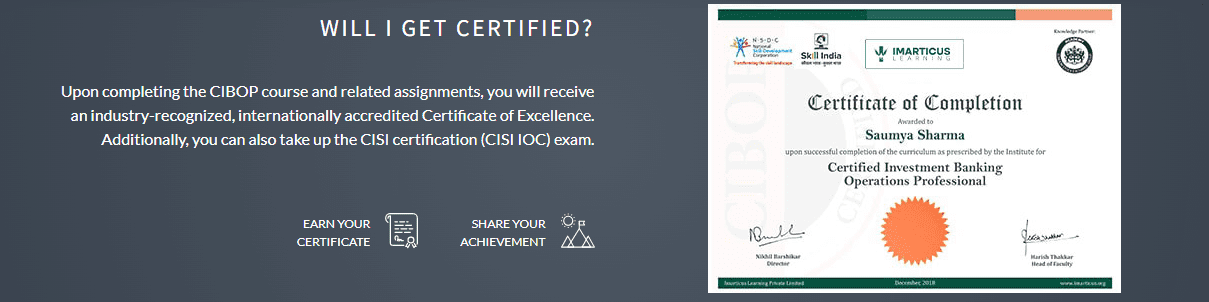

In this situation, the best thing to do would be to wait and complete your two-year term as a sales analyst. In the meantime, you can do a proper course that will help you prepare for your investment banking career path. Now, there are a lot of institutions in India that provide short-term investment banking courses. Imarticus Learnings is a leading one among them.

With its CIBOP course, you will not only get tremendous exposure but also placement support that will put you leagues ahead in your career in investment banking. Here, we are going to discuss the way to become an investment banker in detail.

Way to Become an Investment Banker

There are a few steps you need to follow that will help you to land better jobs and get ahead in your career.

- Build connections: This is the primary thing you need to follow for a career in investment banking. Especially, if you want to work in any specific firm. If you know someone working there, like college alumni, then make sure to talk to them and learn about the internal processes. If not, then LinkedIn is your best friend. Find people there or find someone who can introduce you to someone working there. This will help you a lot in the long run.

- Build a good resume: Interviewers look for past interest and experience with finance in your resume. Try to join finance clubs or other banking-related activities in your institutes. This will make your resume even more appealing.

- Prepare extensively for the interview: Notably, interviews mostly revolve around technical, problem solving, and behavioral questions. So, the thing that will probably help you best is if you prepare for said questions beforehand. Questions asking to introduce yourself and why do you want to work in investment banking are common behavioral questions.Now what matters is how much of a good answer you can provide. You should aim to prepare a few personal stories that can get reused and restructured to answer all of these. Technical questions are where your skills are tested. So, prepare early for questions related to DCF, LBO, and other technical aspects.

At the end of it, the best thing you can do for yourself is to learn from the best to prepare for your investment banking career path. So, do check out Imarticus Learnings’ CIBOP course to get ahead in your career in investment banking.

Any disruption in securities settlement has the potential to spill over to any of the payment systems used by the SSS or to any payment system used by the SSS to transfer collateral.

Any disruption in securities settlement has the potential to spill over to any of the payment systems used by the SSS or to any payment system used by the SSS to transfer collateral.

The most important one being ‘is it worth becoming an investment banker?’. Or ‘what could be the pros and cons of investment banking?’.

The most important one being ‘is it worth becoming an investment banker?’. Or ‘what could be the pros and cons of investment banking?’.

Some course USP:

Some course USP: