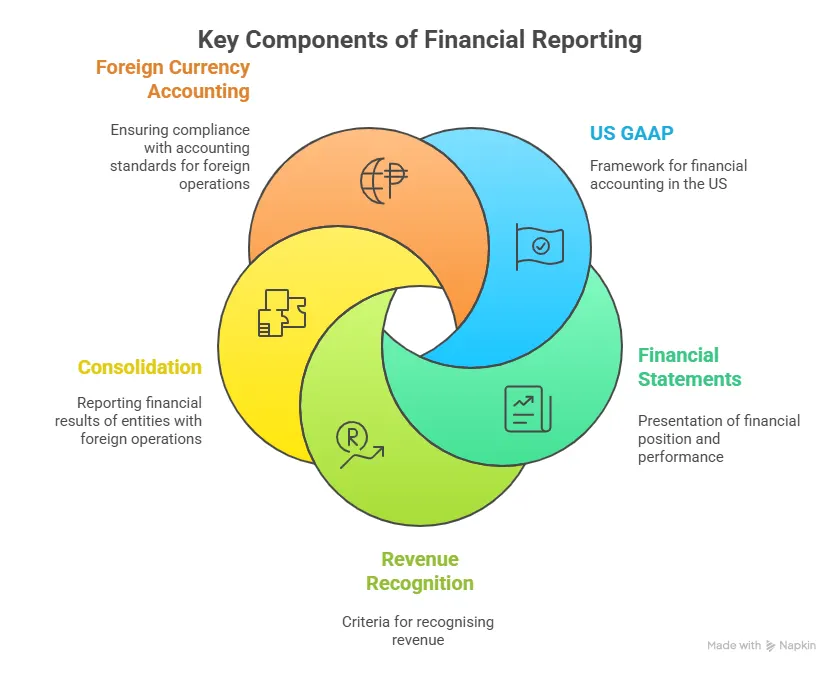

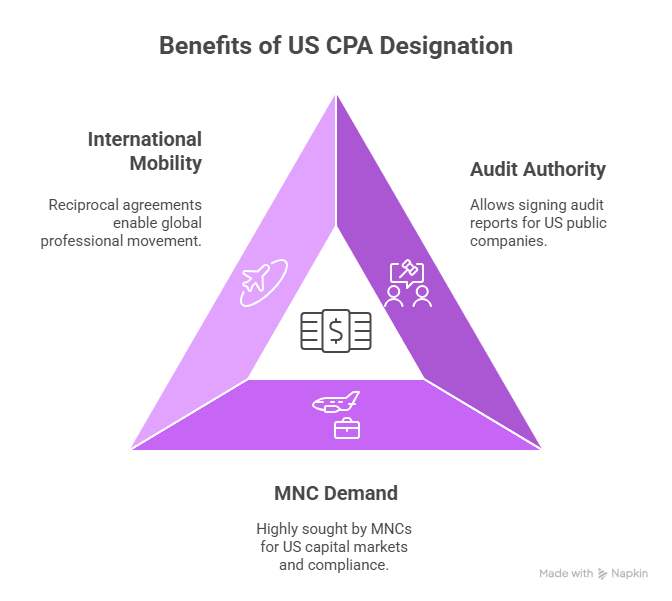

Finance is changing fast, and companies today don’t just want accountants who understand local compliance. They want professionals who can work across borders, understand US GAAP, handle international taxation, and support global reporting.

That’s where the CPA qualification is gaining serious attention among Indian finance students and professionals. With businesses expanding and multinational companies growing their teams in India, the demand for CPA professionals is rising quickly.

If you’re planning a career in accounting or finance, you have probably already thought of taking the CPA exam. Over the past few years, it has become one of the most sought-after finance qualifications for Indian students seeking to work with multinational companies, Big 4 firms, or finance teams.

But before you start preparing, you likely might have a lot of questions around the CPA Certification. In this guide, I’ll answer all of these questions in a clear, practical way. Whether you’re a commerce student, working professional, CA aspirant, or someone exploring global accounting careers, this blog will help you understand everything about the CPA exam in India.

Did you know?

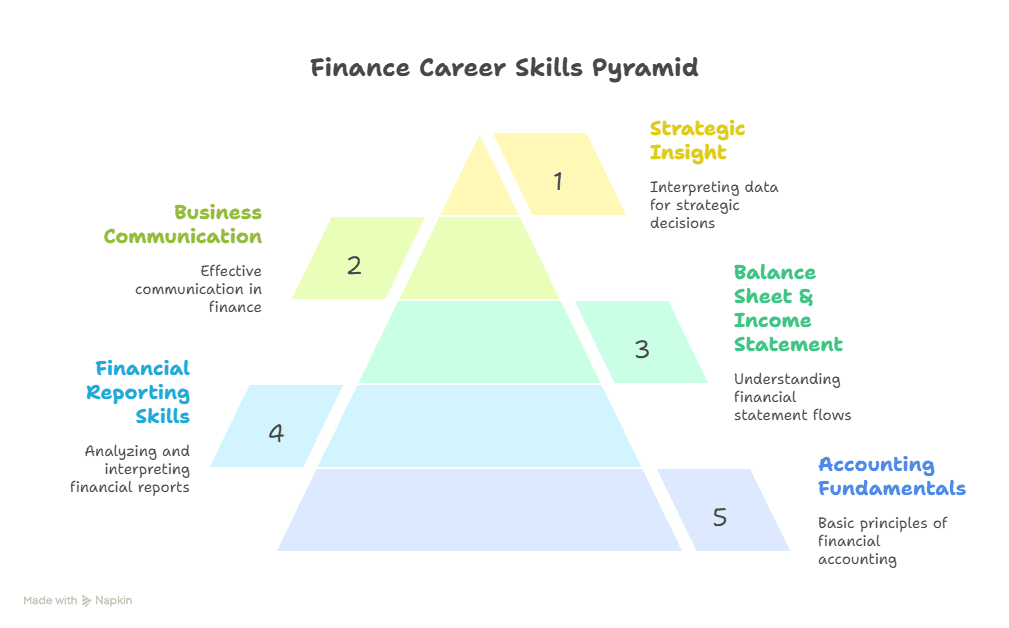

Unlike traditional paths that focus mainly on Indian compliance, CPA prepares you for international finance roles and gives you the skills needed to work with top clients, understand cross-border financial systems, and contribute to strategic business decisions.

What is the CPA Exam and Why It Matters in 2026

Professionals who want to build careers in accounting, auditing, taxation, or financial reporting at a global level often search for what is CPA and whether it’s the right qualification for them.

This table gives a brief overview of what CPA is:

| CPA Overview | Details |

| Full form | Certified Public Accountant (CPA) |

| Awarded by | American Institute of Certified Public Accountants (AICPA) |

| Ideal for | Professionals aiming for international accounting and finance careers |

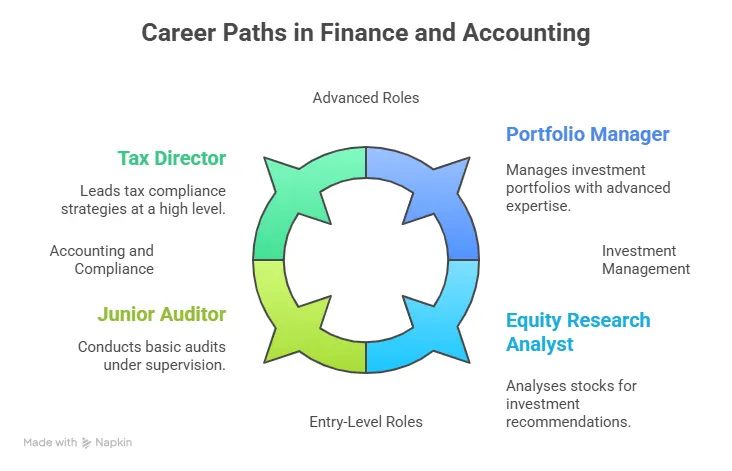

| Career scope | Roles in accounting, audit, taxation, and financial reporting |

| Top hiring employers | Big 4 firms, MNCs, and GCCs |

| High-demand cities in India | Mumbai, Bangalore, Hyderabad, Gurgaon |

The CPA doesn’t just add a credential to your resume. It signals that you can work in global accounting and finance environments, understand global standards, and adapt to evolving business needs.

For many Indian students, that combination – global recognition, practical skills, and strong career growth – is exactly why the CPA continues to gain relevance year after year.

Who Should Do the CPA Course

The CPA qualification is ideal for students and professionals who want a strong career in accounting and finance. You should strongly consider the CPA if you are:

| Who Should Consider CPA | Career Advantage |

| B.Com / M.Com students | Access top accounting and finance roles |

| CA aspirants or dropouts | A faster alternative to enter core finance careers |

| MBA Finance students | Adds specialised accounting expertise |

| Accounting & audit professionals | Better pay and international career growth |

| Big 4 / MNC aspirants | Strong demand for CPA-qualified candidates |

| Those targeting US-based roles | Expertise in US GAAP and reporting |

CPA is especially valuable if your goal is to work in multinational environments rather than only within India.

Who CPA May Not Be the Best Fit For

CPA is powerful, but not for everyone. It may not be ideal if:

- You only want to practise accounting in India long-term.

- You are not comfortable with accounting concepts.

- You are not ready to study consistently for 6-12 months.

- You prefer theoretical learning over practical application.

Being honest about this helps you choose the right career path.

If you’re preparing for CPA, watch this quick video that breaks down practical strategies, study tips, and common mistakes to avoid while preparing to pass the CPA exam and understand what successful candidates do differently, from planning their study schedule to tackling each exam section with confidence.

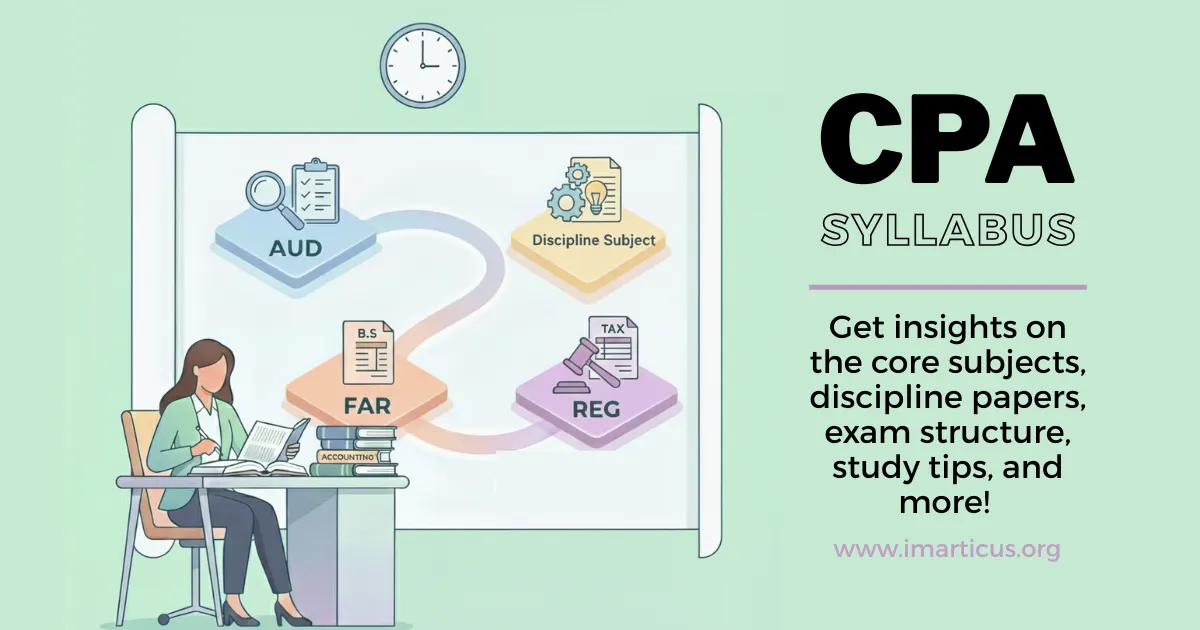

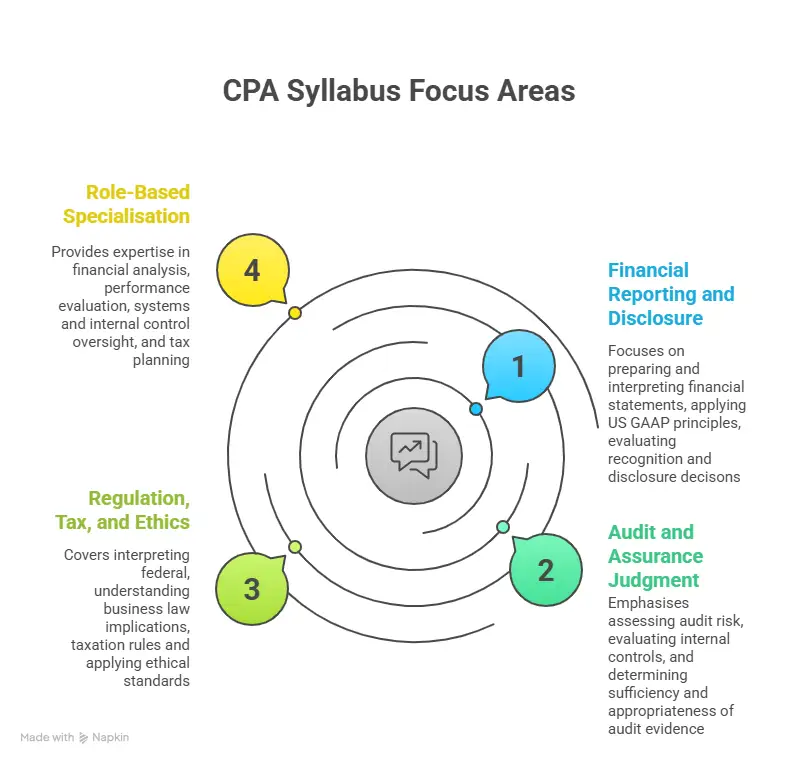

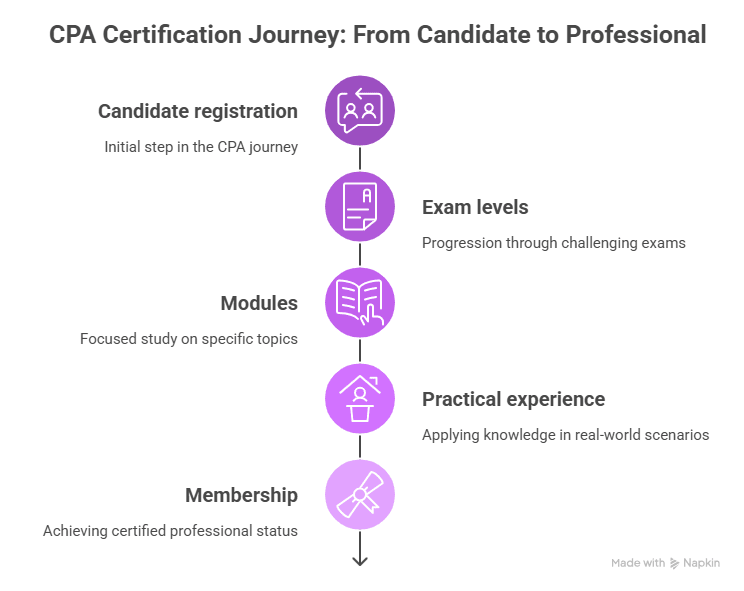

CPA Exam Structure and Subjects

Understanding the CPA exam structure helps you prepare strategically.

CPA exam format

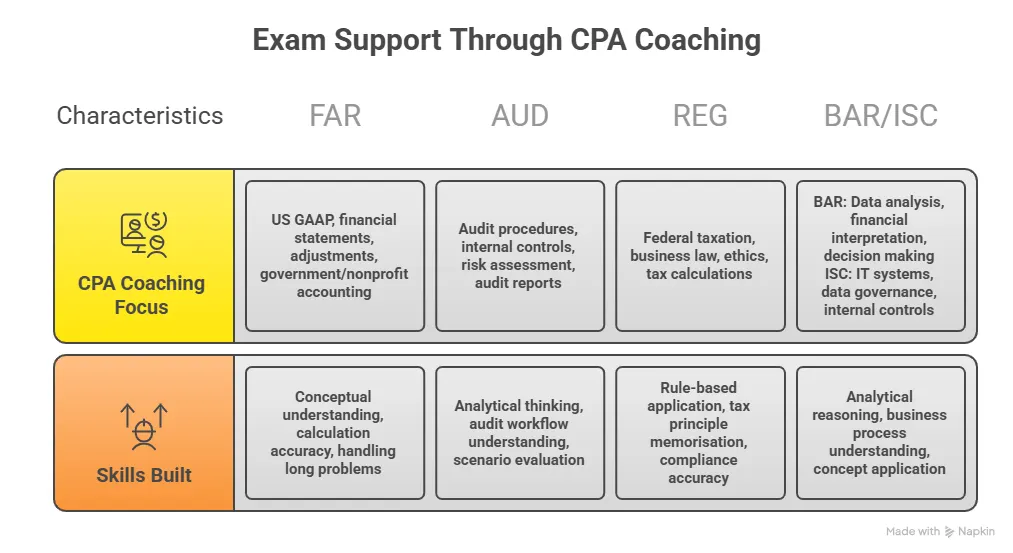

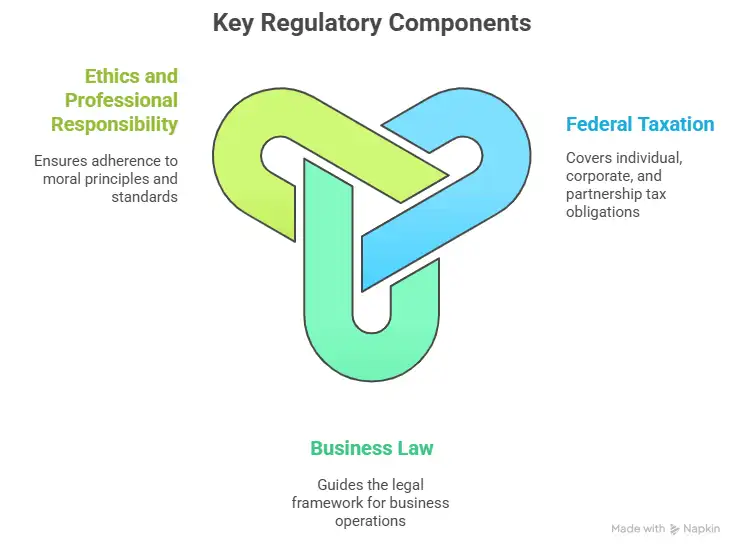

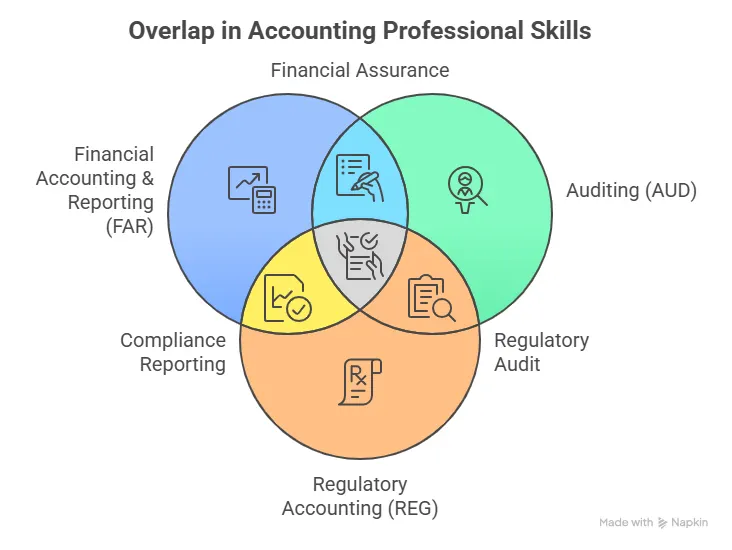

The CPA exam consists of four sections, each covering key CPA subjects:

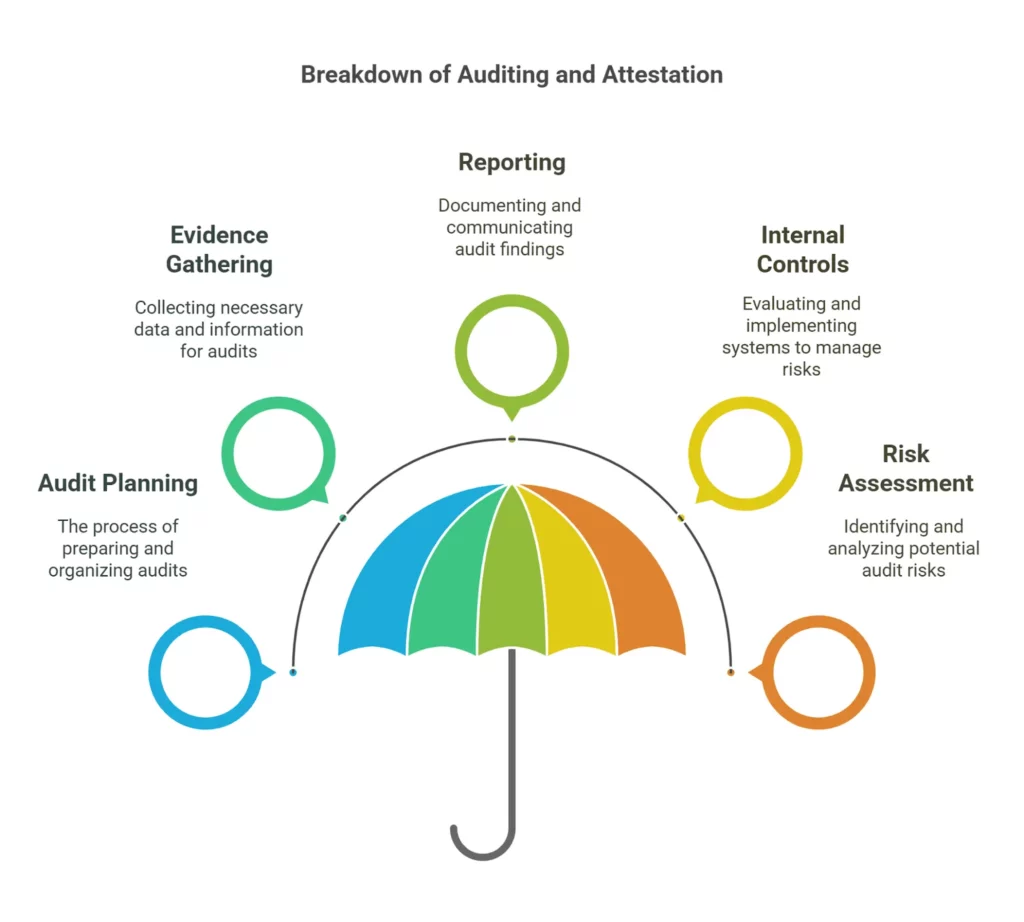

- AUD – Auditing and Attestation

- FAR – Financial Accounting and Reporting

- REG – Regulation

- BAR/ISC/TCP – Discipline section (based on the new CPA Evolution model)

Candidates must pass all four sections within an 18-month window.

Exam duration and pattern

It’s also useful to understand the CPA Course Duration and how long most students take to complete all sections. Each CPA exam section is:

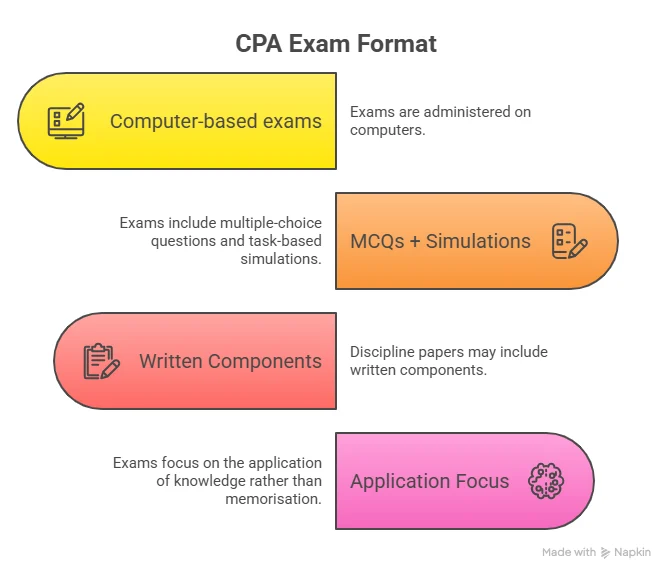

- Computer-based

- Around 4 hours long

- A combination of MCQs and task-based simulations

- There is no negative marking.

Each section is scored out of 100. To pass, you need 75 or above in each section. You don’t need to pass all sections at once. You can take them one by one.

Did you know?

The CPA exams test practical understanding through multiple-choice questions and task-based simulations, rather than just theoretical knowledge.

CPA Exam Requirements for Indian Students

Understanding CPA exam requirements is the first step before starting preparation. The CPA eligibility criteria can feel confusing initially, but once broken down, it becomes much easier.

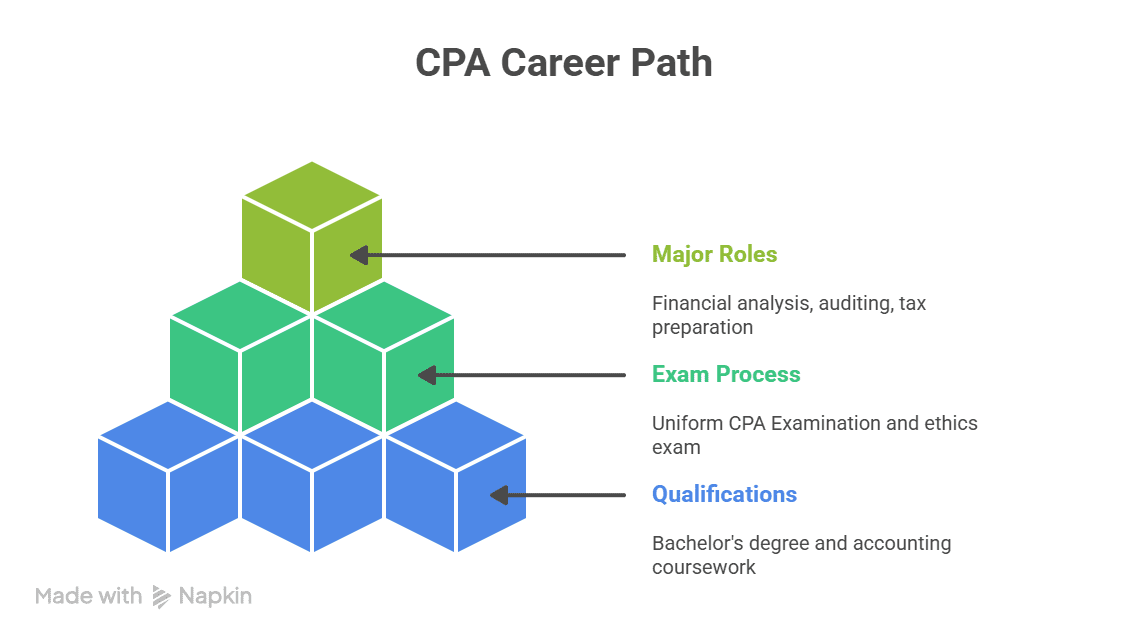

Educational requirements

Most US states require candidates to have a bachelor’s degree and a certain number of accounting and business credits. Indian students with degrees like:

- B.Com

- BBA

- M.Com

- MBA (Finance)

- CA/ACCA

are generally eligible to apply.

However, eligibility depends on the state board you apply through (such as Alaska, Montana, Guam, etc.), as each has slightly different criteria.

Credit requirements

To appear for the CPA exam, you typically need:

- 120-150 credit hours of education

- Accounting and business subjects included.

Many Indian students meet these requirements through their bachelor’s or master’s degrees. Some may need additional coursework.

Work experience requirement

To become a licensed CPA, most states require:

- 1-2 years of relevant work experience

- Supervision by a licensed CPA (varies by state)

However, you can still clear the CPA exam before completing work experience. Many students take the exam first and complete the experience later.

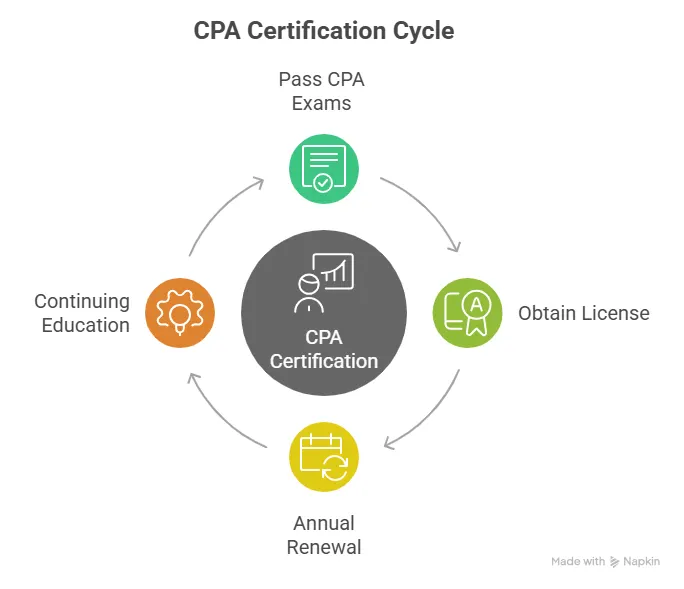

Licensing vs certification

Clearing the CPA exam and becoming a licensed CPA are slightly different.

- Clearing exam = CPA qualified

- Meeting experience + state requirements = Licensed CPA

Even without a US license, clearing the CPA significantly improves job prospects in India and abroad.

CPA Exam Dates and Testing Windows

One major advantage of the CPA exam is flexibility. The CPA follows a continuous testing model. This means:

- Exams are available throughout the year.

- You can choose dates based on readiness.

- No fixed annual attempt limits

This flexibility helps working professionals prepare without rushing.

CPA exam score release dates – After taking the exam, scores are released periodically by the AICPA.

Score release typically happens:

- Every few weeks

- Based on the exam submission timeline

CPA exam score release 2025 (reference timeline) – In 2025, score releases generally happened every 2 to 4 weeks. Similar timelines are expected in 2026. Staying updated with CPA exam score release dates helps you plan your next section strategically.

CPA Exam Centres in India

One of the biggest advantages today is that you can take the CPA without leaving India. CPA exam centres in India are available in major cities like:

- Mumbai

- Delhi

- Bangalore

- Hyderabad

- Chennai

- Ahmedabad

- Kolkata

These centres are operated by Prometric. Choose a centre based on proximity to your location, slot availability, and travel convenience.

Once your eligibility is approved and NTS (Notice to Schedule) is issued:

- Log into Prometric website.

- Select the city and centre.

- Choose preferred CPA exam dates.

- Confirm booking.

Pro Tip: It’s best to book early to get your preferred slot.

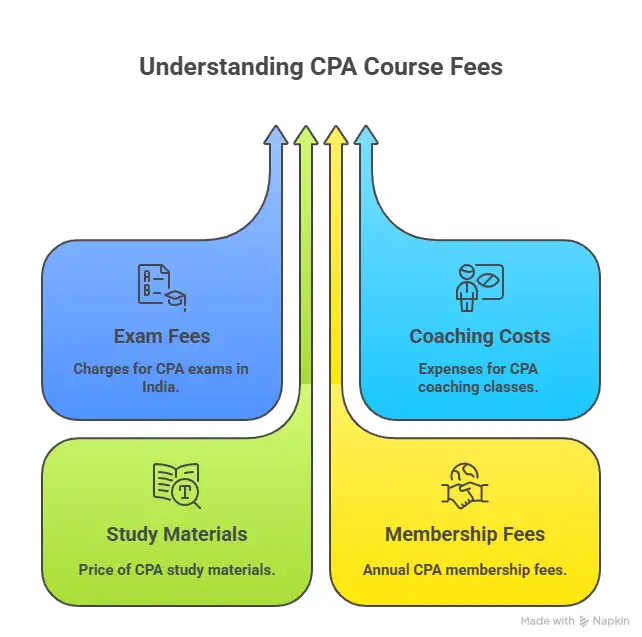

CPA Exam Cost in India

Understanding the CPA exam cost in India is crucial before starting. While the CPA course fees may seem high, many students recover this investment within 1 to 2 years of working in global roles.

CPA Exam Fees in India

The total CPA exam cost in India usually ranges between ₹2.5 lakhs and ₹4 lakhs.

| Component | Approx Cost |

| Application & evaluation | ~₹13,500-₹23,000 |

| Exam fees (4 sections) | ~₹81,000-₹1,10,000 |

| International testing fees | ~₹1,35,500+ |

| Ethics exam/licensing | ~₹13,500-₹27,000 |

Additional costs:

- Coaching or CPA exam prep courses

- Study materials

- Rescheduling fees (if any)

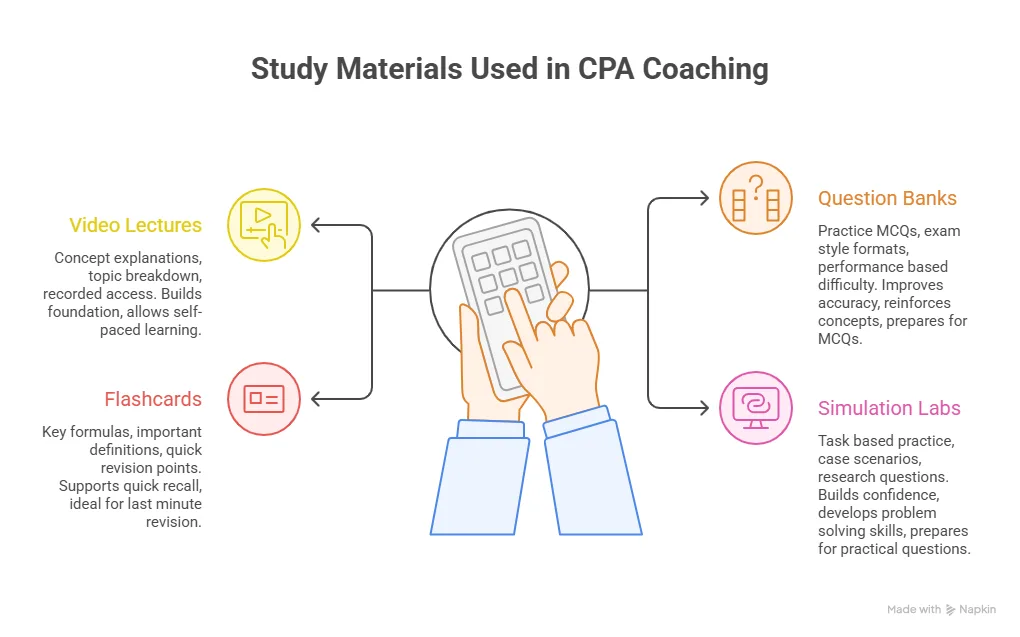

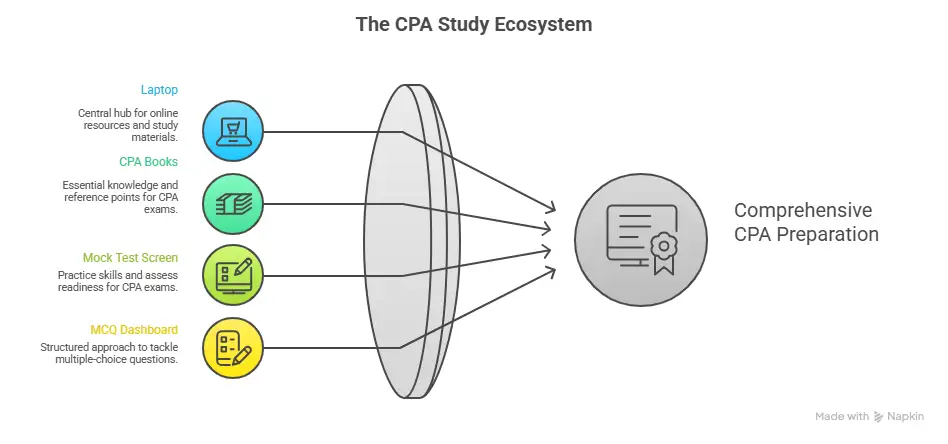

CPA Exam Prep Courses and Study Strategy

Clearing the CPA requires discipline and structured preparation. A typical preparation timeline is:

- 6-12 months for all four sections.

- 2-3 hours daily study.

- More on weekends.

Working professionals may take slightly longer.

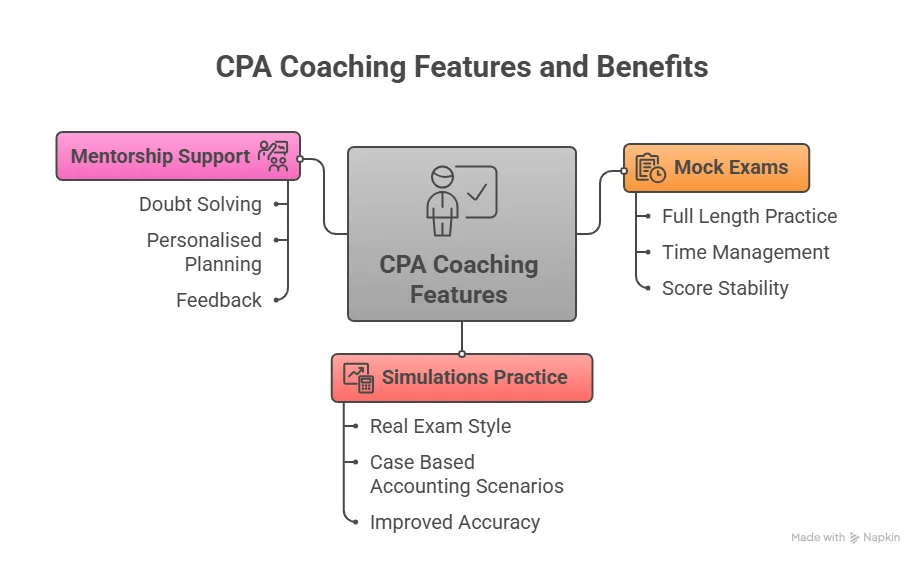

| Feature | How It Helps |

| Concept clarity | Builds a strong foundation in US GAAP, audit, and taxation. |

| Practice questions | Improves speed and accuracy for the exam with the CPA exam review class. |

| Mock exams | Simulates a real CPA exam environment |

| Exam strategy | Helps manage time and attempt questions smartly |

| Mentorship | Keeps you consistent and motivated |

CPA Study Timeline for Working Professionals & Students

A realistic CPA preparation plan looks like this:

| Month | Focus Area |

| Month 1-3 | FAR (largest and most technical section) |

| Month 4-5 | Move to AUD |

| Month 6 | Then REG |

| Month 7 | Finish with a Discipline paper (BAR/ISC/TCP) |

| Month 8 | Consistent Revision + mock testing |

Students who use official CPA books and course material and study consistently for 2 to 3 hours daily can complete all four sections within 8 to 12 months. The key is not speed – it’s consistency.

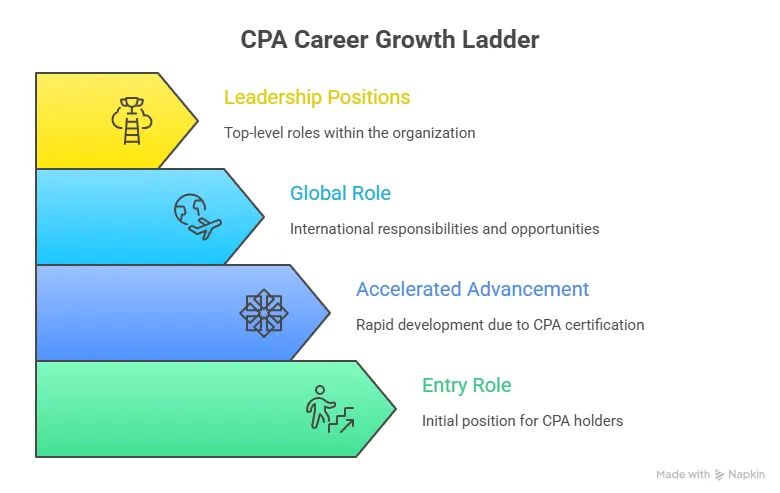

To understand how the CPA can shape your career all the way to the top, watch this insightful video that explains the journey from CPA to CFO. It highlights how deep accounting expertise, strong financial understanding, and consistent career growth can eventually lead to leadership roles like Chief Financial Officer.

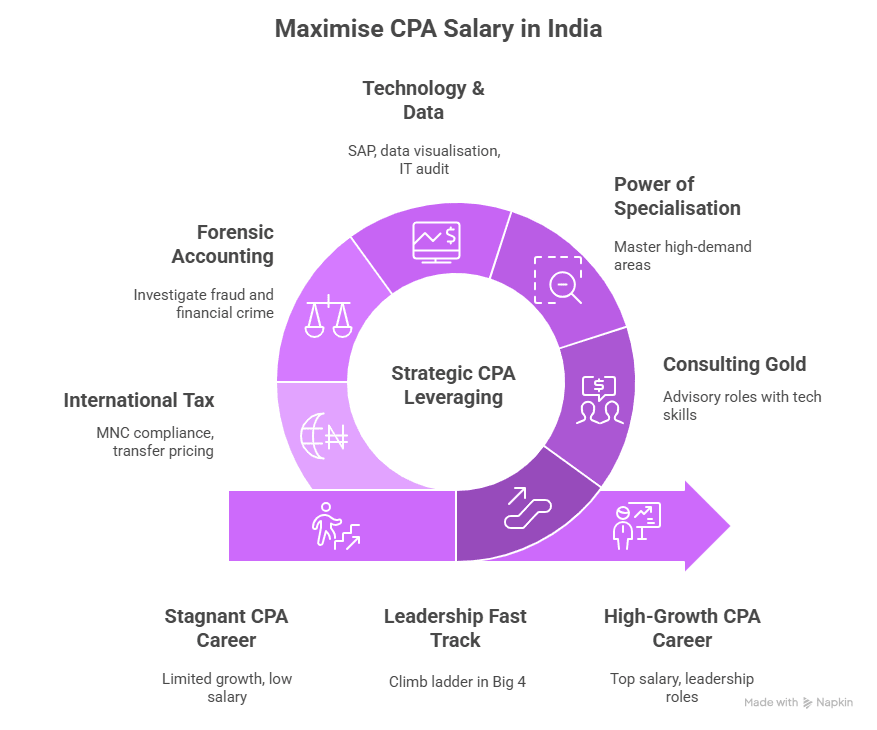

Is CPA Worth It for Indian Students

This is the most important question. Is CPA worth the time, effort, and money? For many students, the answer is yes – especially if they want global exposure.

| Experience Level | Average Salary | Industries Hiring | Common Job Roles |

| Freshers (0-1 year) | ₹6-10 LPA | Big 4 firms, US accounting & tax firms, Shared service centres (GCCs) | Auditor, Tax Associate, Junior Financial Analyst |

| 2-5 years of experience | ₹10-20 LPA | MNCs, Consulting firms, BFSI companies, Big 4 | Financial Analyst, Senior Auditor, Tax Consultant |

| Experienced professionals | ₹20 LPA+ | MNC leadership roles, Consulting, Global finance teams, BFSI | Accounting Manager, Finance Manager, Risk Consultant |

If you’re trying to understand the real career value, it’s worth taking a closer look at the CPA salary in India and how it typically grows as you gain experience and move into higher roles.

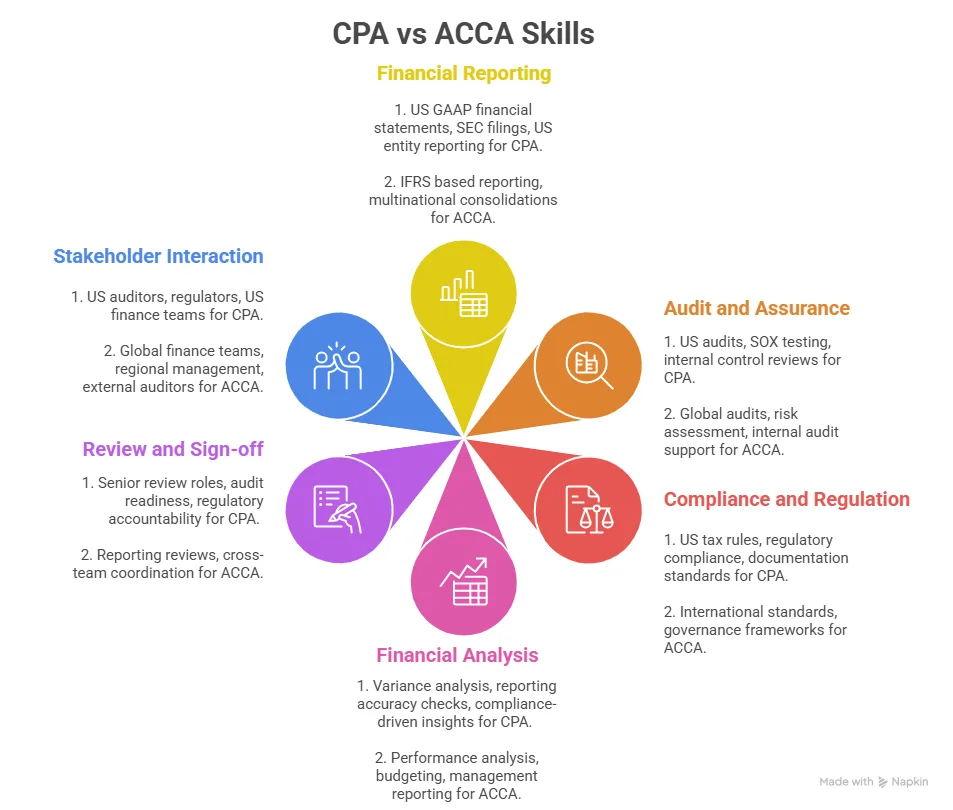

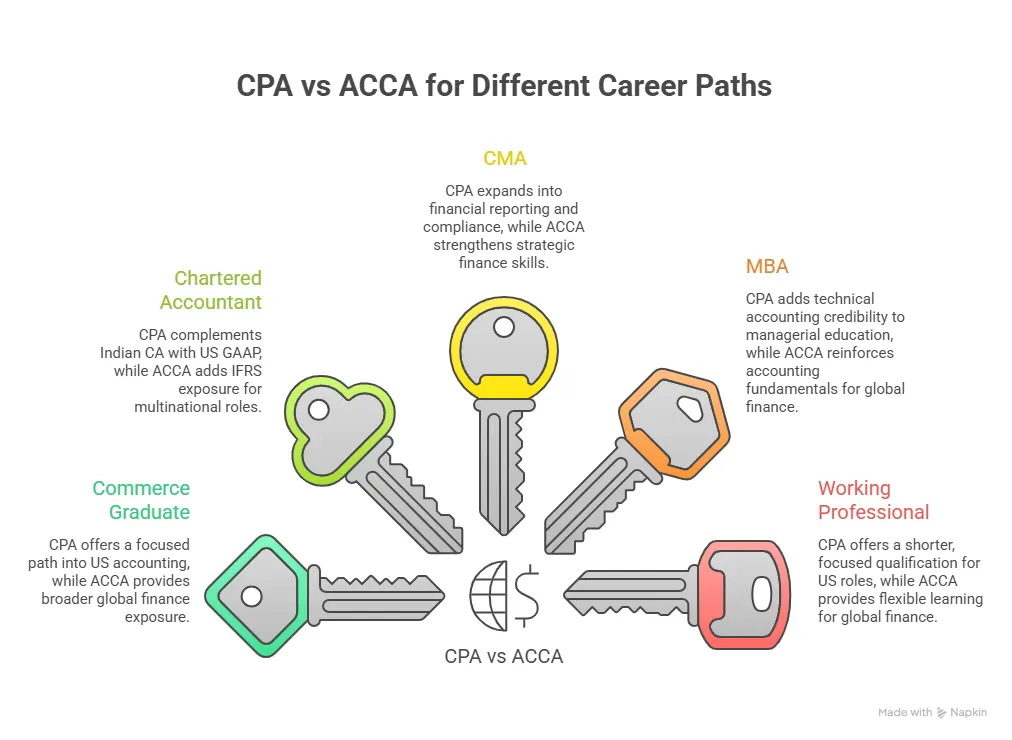

CPA vs CA vs ACCA

Students often get confused between CPA vs ACCA, and CA. Each qualification has a different career outcome.

| Factor | CPA | CA | ACCA |

| Duration | 6-12 months | 4-5 years | 2-3 years |

| Global recognition | Very high (US & MNCs) | High in India | Very high |

| Difficulty level | Moderate | Very high | Moderate |

| Best for | Cross-border accounting & US finance roles | India practice & compliance | Global business setups |

| Flexibility | Very flexible | Low | Flexible |

| Career focus | Audit, taxation, corporate finance | Indian taxation & audit | IFRS & corporate finance |

Many students also compare options like CPA vs CFA before making a decision, especially if they are evaluating different finance career paths. If your goal is mobility in global firms and faster completion, the CPA is often the most practical route.

Confused between CA and CPA? This video will help you understand which qualification makes more sense depending on whether your goal is to build a career in India or explore international finance opportunities.

Why Imarticus Learning is the Right Choice for CPA Exam Preparation

Preparing for the CPA exam can feel overwhelming with four exam sections, unfamiliar concepts like US GAAP, and the challenge of staying consistent while studying or working.

That’s where the right guidance, like CPA exam review courses, makes a big difference.

Imarticus Learning offers CPA preparation support that’s built specifically for Indian students and working professionals who want to move into large organisations for accounting roles. Instead of jumping between random study materials and YouTube videos, you get a structured path and mentors who keep you on track.

With Imarticus Learning, you get:

- A clear study plan from day one

- Guidance on how to study

- Concepts explained in a simple way

- Expert Industry Faculty

- Regular momentum and accountability

- Support when you get stuck

- Practice that builds real exam confidence

- Balanced preparation with work or college

- Preparation that connects to your career

- Consistency that leads to results

- Internship and Placement Opportunities

At the end of the day, the CPA program isn’t just about studying hard – it’s about studying consistently. And for many students, having structure, guidance, and the right support system is what makes that consistency possible.

FAQs About CPA Exam

If you’re considering the CPA exam, the answers below address some of the frequently asked questions Indian students and working professionals have. These will help you understand what to expect, how to prepare, and whether the CPA qualification aligns with your long-term career goals in accounting and finance.

Is the CPA exam tough for Indian students?

The CPA exam is challenging, but it’s not impossible, especially for Indian students who come from a commerce or accounting background. With the right guidance from reputed institutes like Imarticus Learning, regular practice, and a clear study plan, most dedicated students find the CPA course completely manageable.

Can I do the CPA exam after B.Com in India?

Yes, many Indian students start the CPA after completing B.Com. Most boards require 120-150 credit hours of education, including accounting and business subjects. If your credits are slightly lower, additional coursework or evaluation may be required. Once eligibility is confirmed, you can start preparing and appear for the CPA exams from India itself.

Can I do CPA without CA?

Yes. You do not need to complete CA before starting CPA. Many students pursue a CPA directly after B.Com, M.Com, or MBA Finance. CPA and CA are separate qualifications with different career paths. Students who want international exposure or faster completion often choose CPA as an alternative or complement to CA.

Is CPA valid in India and recognised by companies?

Yes, CPA is recognised and valued in India. Many multinational companies, Big 4 firms, and GCCs in India work with US and international clients. These organisations need professionals who understand US accounting standards, global reporting, and international taxation. That’s where CPA-qualified candidates stand out.

How long does it take to complete the CPA exam?

For most students, completing the CPA exam takes around 8 to 12 months. The exact timeline depends on how much time you can dedicate to studying each day and whether you’re balancing work or college alongside preparation. Students who enrol in training institutes like Imarticus Learning, follow a realistic study plan, practise regularly, and stay consistent usually complete the CPA journey within a year.

What is the CPA exam cost in India?

On average, the total exam cost for a CPA in India ranges between ₹2.5 lakhs and ₹4 lakhs. This includes application and evaluation fees, exam fees for all four sections, international testing charges, and licensing-related costs. If you choose to enrol in coaching or CPA exam prep courses, that would be an additional expense.

What is the salary after a CPA in India?

Fresh CPA-qualified professionals in India usually start with salaries between ₹6-10 LPA. As you gain experience and develop specialised skills in areas like US taxation, audit, or financial reporting, salaries can grow to ₹10-20 LPA within a few years. With strong experience and leadership roles, many CPAs earn ₹20 LPA or more. Over time, the CPA qualification not only improves earning potential but also opens doors to more strategic and senior roles in finance.

Are CPA exam centres available in India?

Yes, and this is one of the biggest advantages for Indian students today. You can complete the entire CPA course without travelling abroad. CPA exam centres are available in major cities such as Mumbai, Delhi, Bangalore, Hyderabad, Chennai, Ahmedabad, and Kolkata. These centres are operated by Prometric and offer a professional, computer-based testing environment similar to international centres.

Start Preparing for the CPA Exam Now

The CPA exam is more than just another professional qualification. It’s a gateway into international accounting, finance, and high-growth career opportunities.

For Indian students who want to work with multinational companies, Big 4 firms, or international clients, a CPA has become one of the most practical and rewarding credentials to pursue. But like any valuable qualification, it demands consistency, discipline, and the right preparation strategy.

If you’re ready to invest the next 6 to 12 months in building industry-relevant accounting skills, the CPA exam can open doors that few other finance certifications can. The CPA course can transform your career trajectory and position you as a globally recognised finance professional.

The opportunity is real. The demand is growing. The only question left is – are you ready to take the first step toward becoming a CPA?