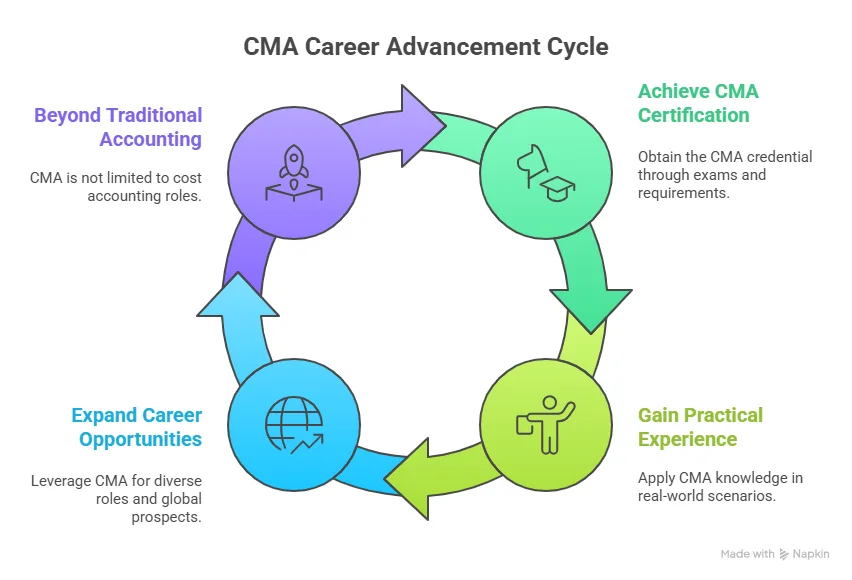

If you’re exploring the professional pathway after becoming a Certified Management Accountant, chances are you’ve already searched for CMA jobs and wondered what your real career potential looks like.

I’ve spoken to hundreds of CMA aspirants over the years, and almost everyone asks the same thing:

What kind of jobs can I realistically get after the US CMA?

The short answer? A lot more than traditional accounting.

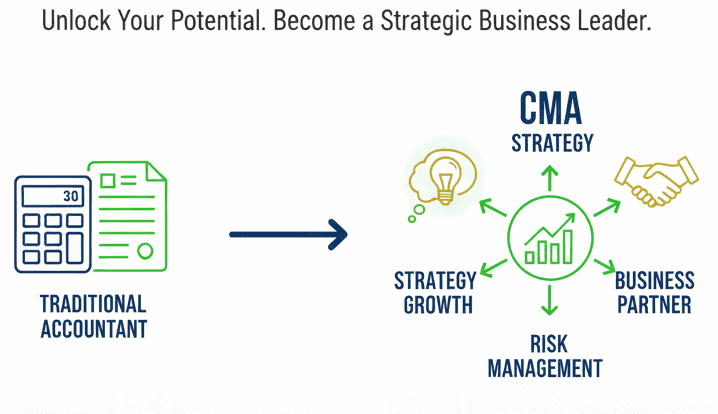

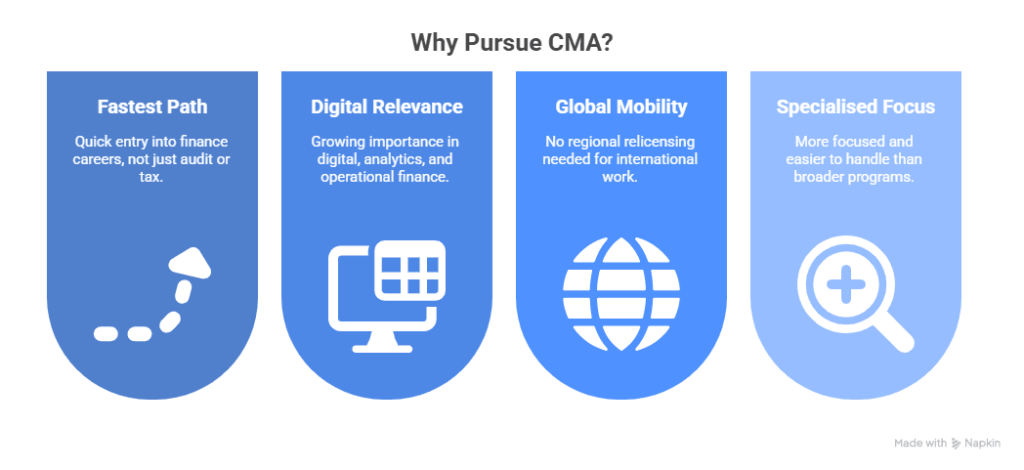

The US CMA qualification positions you not as a bookkeeper, but as a strategic finance professional – someone who helps businesses make smarter, data-driven decisions. That difference is exactly why organisations across the world increasingly hire CMA-qualified professionals.

In this guide, I’ll walk you through CMA jobs and responsibilities, global opportunities, especially US-focused roles and how you can strategically build your career in management accounting and business finance.

Understanding the CMA Job Market

I have been asked these questions by thousands of students: What is CMA, and what is the job of a CMA? So, to answer in simple terms, the CMA certification offered by IMA equips you to be more than just an accountant. It equips you to act as a business partner – analysing performance, making strategic decisions, managing risk and driving value. As such, the certified management accountant job opportunities span widely across industries, geographies and levels.

The qualification emphasises management accounting, financial planning & analysis (FP&A), cost management strategies, internal controls, decision support and strategic leadership. These are exactly the skills employers are seeking when they advertise CMA job opportunities.

In today’s environment, organisations increasingly expect finance professionals who can:

- Interpret performance metrics and link them to business strategy.

- Utilise analytics and data-driven insights with essential project selection methods.

- Collaborate with cross-functional teams and present clear business narratives.

- Ensure governance, risk and control aspects for the finance function.

This is exactly what the CMA course trains you for. Because the CMA certification covers these dimensions, CMA jobs are increasingly viewed as a strong hiring signal.

CMA Job Market – Global Context

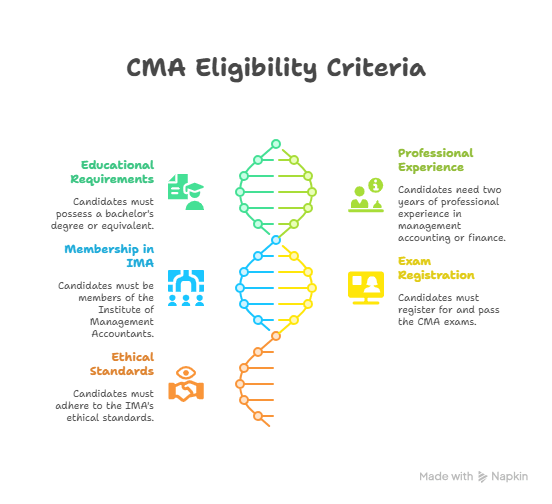

Most students become eligible to pursue this pathway after meeting the CMA eligibility criteria after graduation, which typically requires a recognised bachelor’s degree. I often explain this to students in simple words: A CMA is not hired to record history – a CMA is hired to shape business decisions.

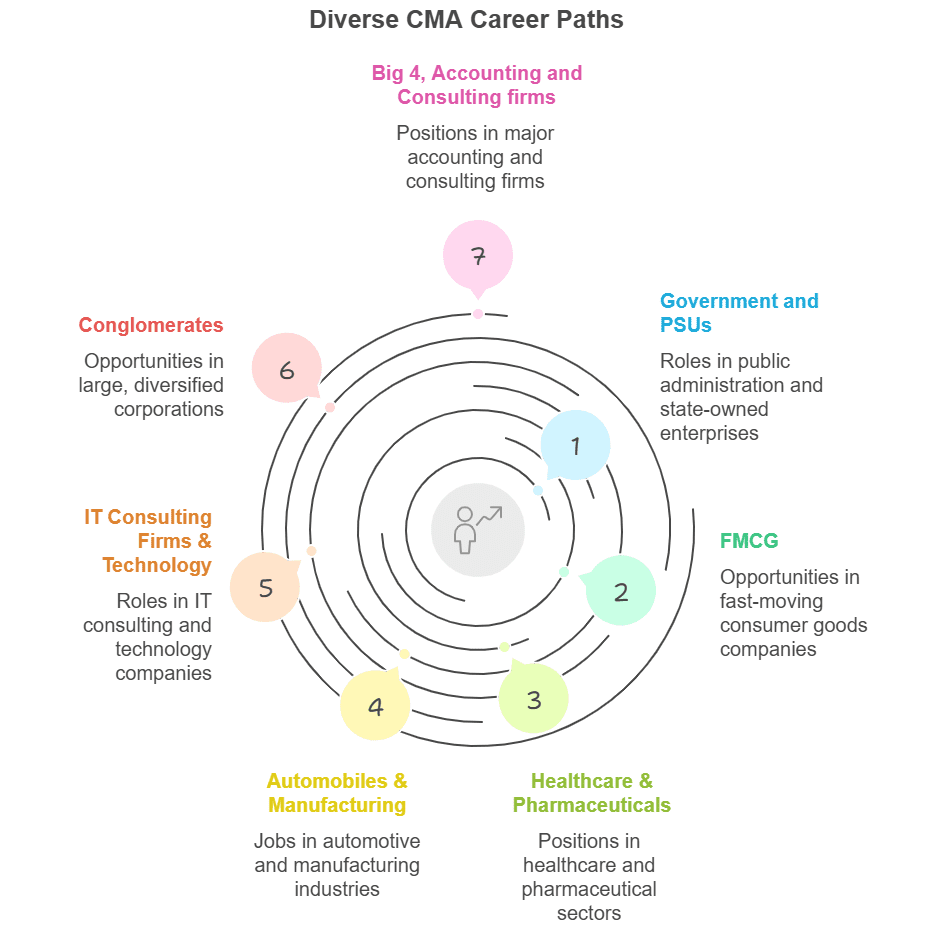

That’s why certified management accountant job opportunities span across:

- Manufacturing companies

- Technology and IT services

- Consulting firms

- Multinational corporations

- Global capability centres (GCCs)

- Startups and fast-growing businesses

Did You Know? The Institute of Management Accountants (IMA), which awards the US CMA, currently has around 140,000 members worldwide across about 150 countries.

Why Does the US CMA Matter for Your Career?

Before talking about CMA jobs, it’s important to understand what makes the US CMA different. The CMA is a globally recognised management accounting credential that focuses on:

- Financial planning & analysis

- Cost and performance management

- Strategic decision-making

- Risk management and internal controls

- Corporate finance and business leadership

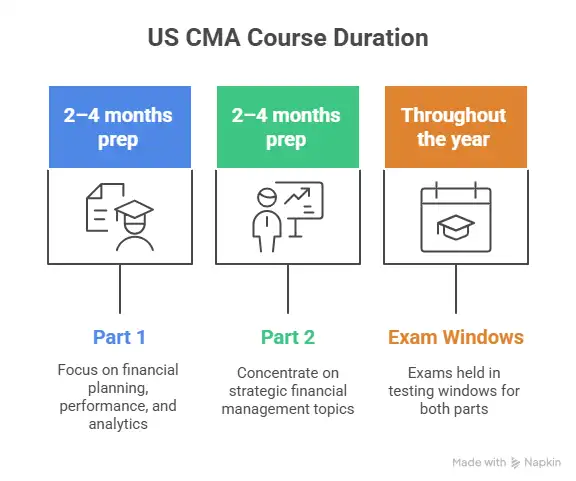

The certification is divided into two parts:

Part 1: Financial Planning, Performance & Analytics

Part 2: Strategic Financial Management

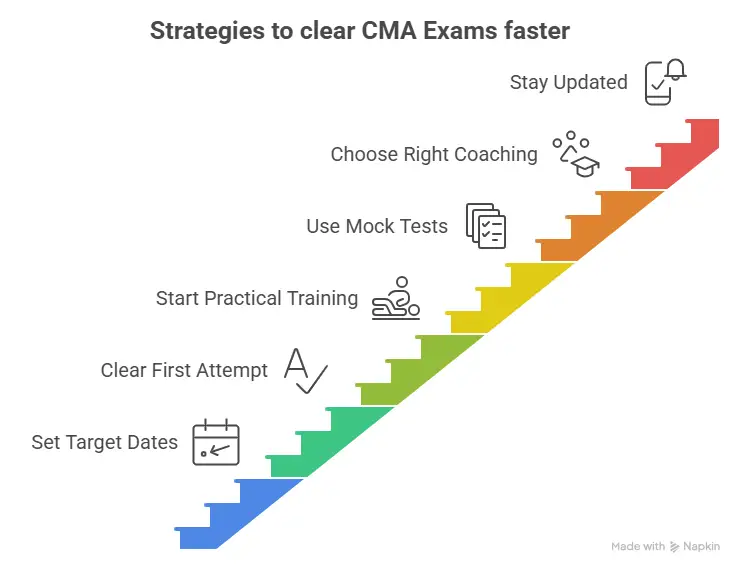

For many aspirants, understanding the CMA course duration is the first step in planning a realistic and achievable career timeline. What matters from a job-market perspective? Employers see the US CMA as proof that you can think like a business leader, not just prepare financial statements.

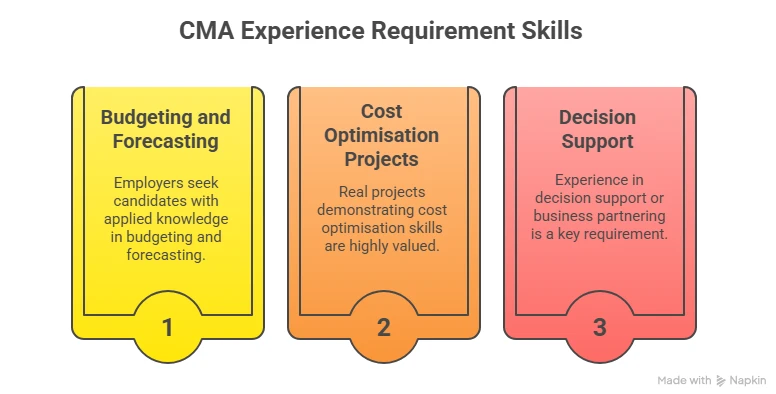

Another major factor is the work experience requirement. To become fully certified, you need relevant experience in management accounting or finance roles.

This is important because companies value:

- Real-world exposure to budgeting, reporting and decision support.

- Hands-on understanding of business environments.

- The ability to translate numbers into business insights.

That’s why US CMA jobs are usually not just fresh accounting roles -they are strategic finance careers.

This US CMA mock interview walks through exactly how to answer EY-focused technical, behavioural, and situational questions to improve your chances of cracking top finance roles.

What Are the CMA Job Responsibilities?

You might have seen CMA job descriptions and responsibilities in any job posting, but it might look quite challenging and overwhelming. Here are the core tasks CMAs are expected to handle:

| CMA Job Responsibility | Description |

| Budgeting & Forecasting | Preparing budgets, forecasts, and variance analysis to support strategic business decisions. |

| Cost & Profitability Monitoring | Monitoring cost structures, profitability, and margins across products, services, or business units. |

| Management Reporting | Developing management reports, dashboards, and KPIs for business units and senior leadership. |

| Business Partnering | Acting as finance business partners for operational teams by interpreting results, providing insights, and recommending improvements. |

| Internal Controls & Risk | Performing internal control reviews, risk assessments, and compliance checks. |

| Process Improvements | Driving improvements in finance systems for month-end closing, costing models, and automation. |

| Strategic Support | Supporting mergers, acquisitions, integration, and other strategic initiatives based on seniority level. |

| Global Finance Responsibilities | Managing multi-currency reporting, multi-entity consolidation, and global reporting. |

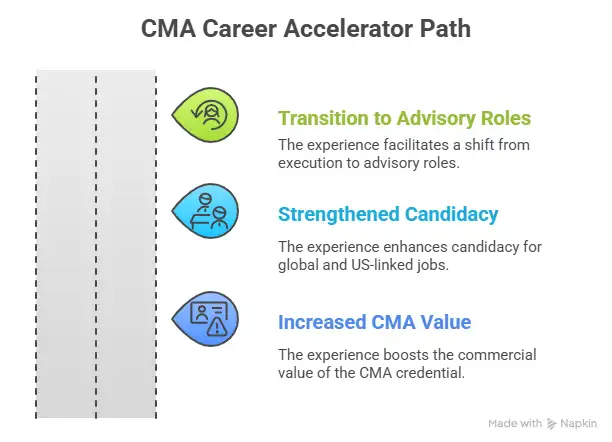

As you accumulate experience, the scope of responsibilities in CMA jobs broadens from tactical tasks such as costing, reporting to strategic activities like business advising and financial leadership.

Many students review the CMA course subjects in advance to understand how the syllabus builds skills in financial planning, strategy, analytics and risk management.

Top CMA Jobs: Which Fields Can You Work In?

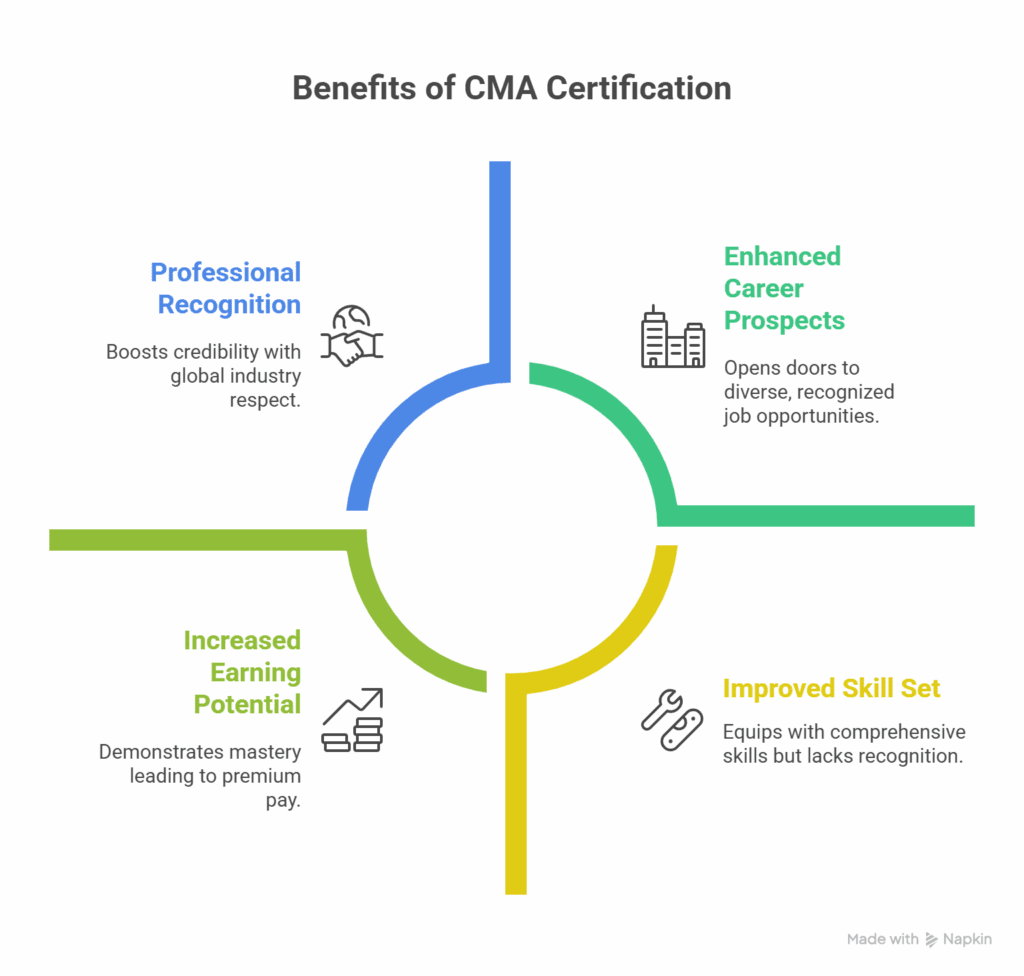

A common question among aspirants is – is CMA certification worth it, and for those aiming at strategic finance, leadership and global roles, the answer is often yes. The biggest advantage of a CMA qualification is the variety of career paths it opens up. Instead of being locked into one specific role, you can move across business-focused finance functions as your experience grows.

In each of these roles, a CMA credential helps you stand out by signalling that you are skilled not just in bookkeeping but in business decision-making. Employers offering CMA job opportunities value this strategic mindset.

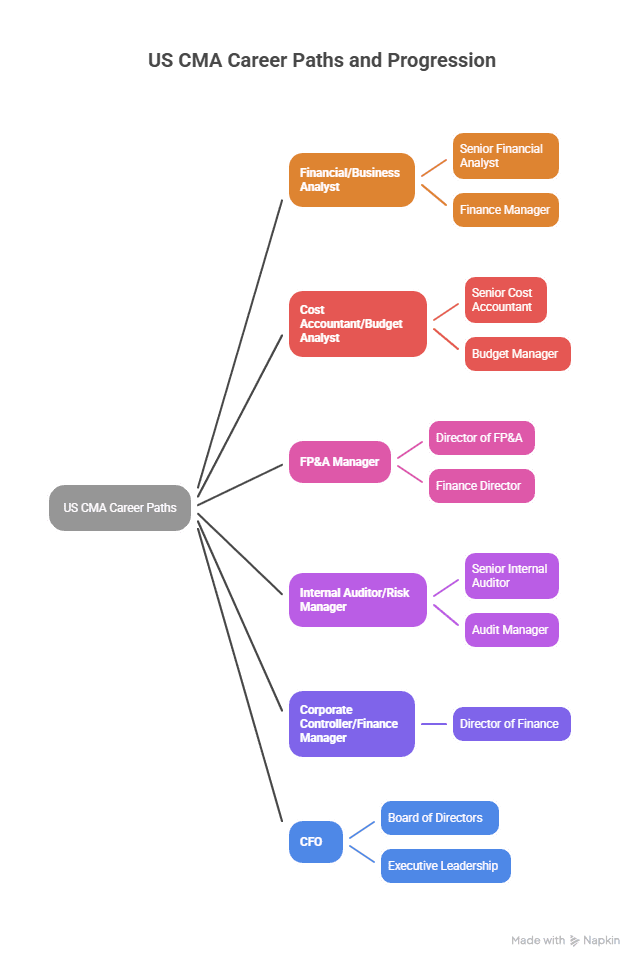

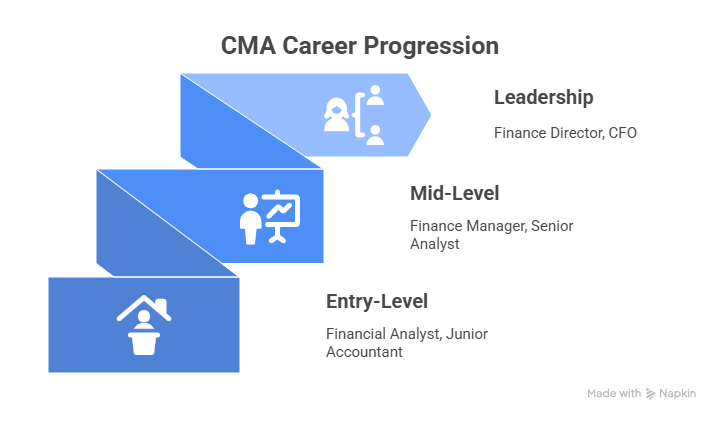

Entry-to-Mid Level

These CMA jobs help you build a strong foundation in management accounting, reporting, and business support. This is where most CMA professionals start their careers and develop practical, hands-on experience.

- Cost Accountant / Cost Analyst

- Management Accountant

- Financial Planning & Analysis Analyst

- Business Partnering Finance Analyst

- Internal Control Associate

Mid-Level

At this stage, your role becomes more strategic. You’re no longer just preparing reports – you’re influencing decisions, managing teams, and shaping business performance.

- Senior Management Accountant

- FP&A Manager

- Business Unit Finance Manager

- Finance Transformation Lead

- Risk & Compliance Manager

Senior Level

These are leadership-track roles where you drive financial strategy and influence key business decisions at an organisational level. This is where the CMA credential truly stands out as a marker of leadership readiness.

- Finance Director

- Head of FP&A

- Vice President – Finance

- Business Finance Leader

- CFO Track Roles

This is where the CMA credential becomes very powerful – it signals leadership readiness, not just technical skills, not just technical skills, and prepares you for high-impact CMA jobs as you grow in your career.

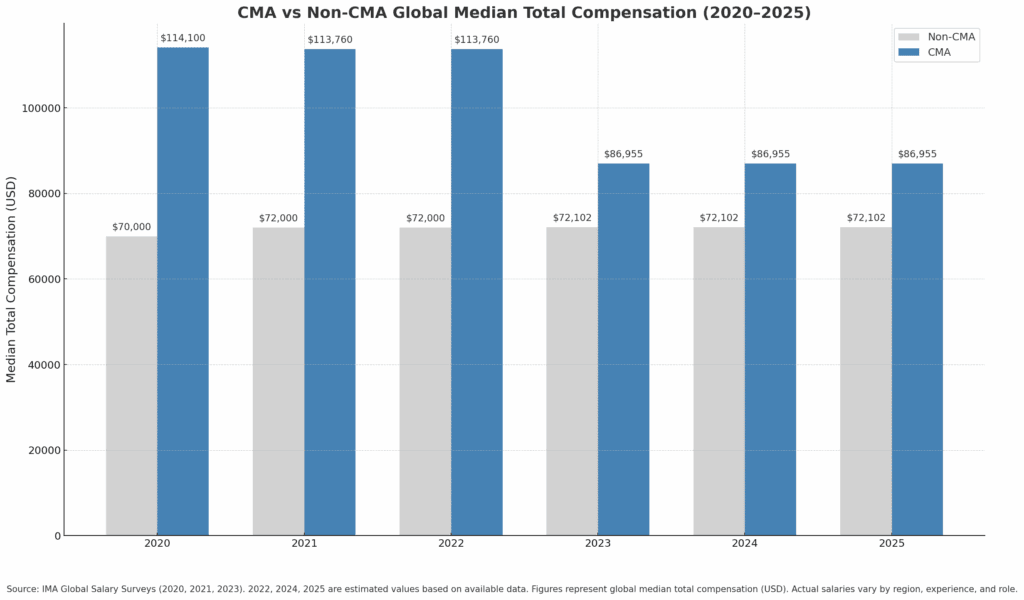

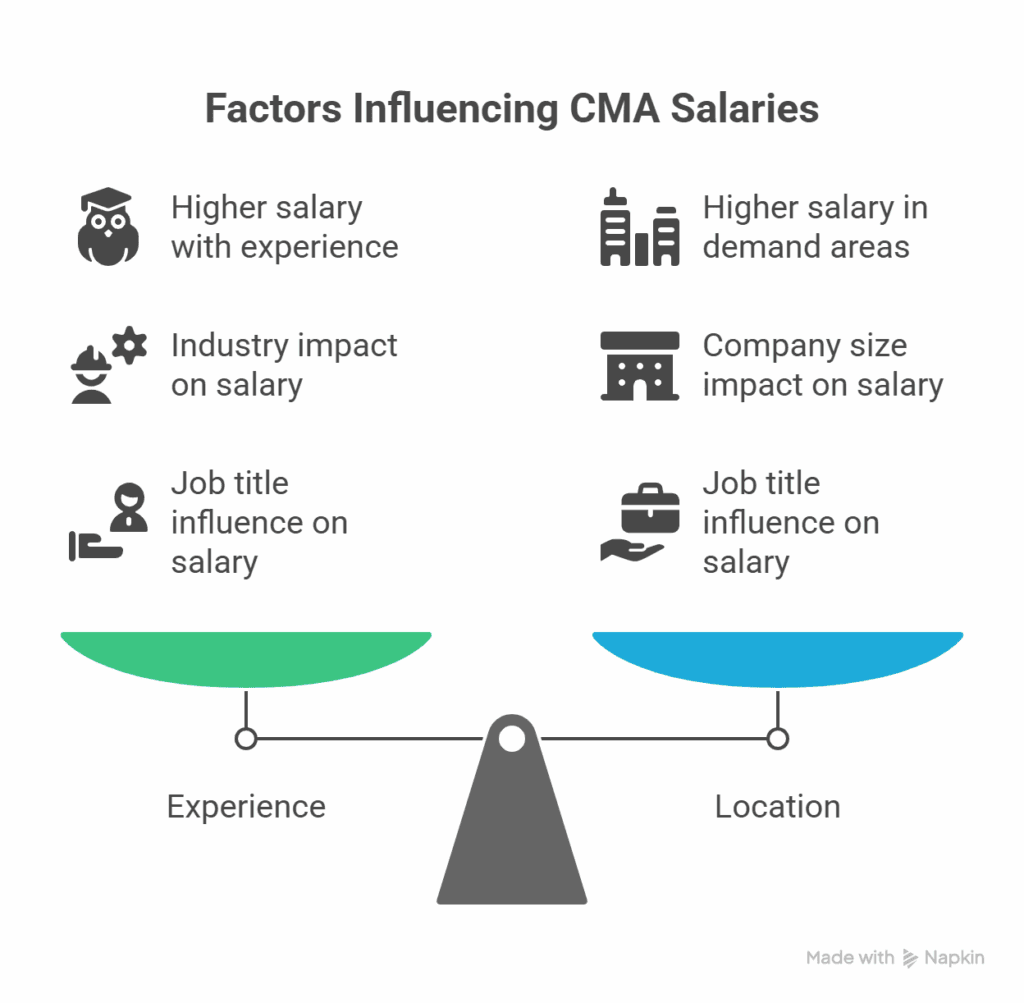

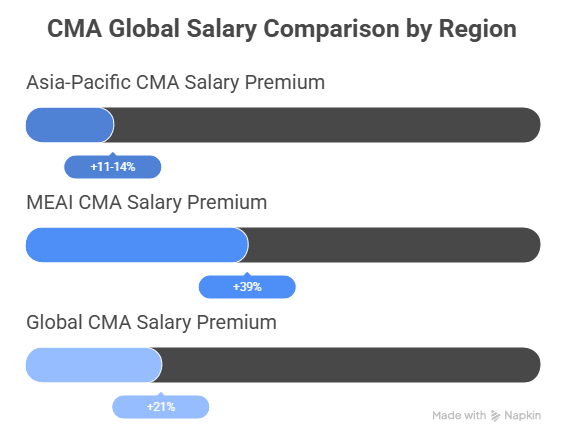

CMA Facts – According to the IMA’s 2023 Global Salary Survey, certified CMAs globally earn 21% more in total compensation than non-CMA peers.

US CMA Job Opportunities

One major attraction of obtaining the CMA certification is the global recognition, and especially the wide range of CMA jobs available for US-based roles or positions supporting US teams.

But here’s the honest reality: Not everyone directly moves to the US after CMA. Most successful professionals follow one of these realistic paths:

1. Working in Global Capability Centres (GCCs)

Many multinational companies have large finance hubs in:

- India

- Philippines

- Europe

- Latin America

These centres support US and global operations. This is where many US CMA holders build strong US-facing experience.

2. US-Facing Roles From Your Home Country

You may work on:

- US budgeting & forecasting.

- US financial reporting.

- US consolidation and analytics.

- Business partnering for US clients.

These roles give you global exposure without immediate relocation.

3. Direct US-Based Roles

These exist, but are more common at:

- Senior levels

- With strong experience

- Through company-sponsored mobility or internal transfers

Remote work has expanded US opportunities globally, but companies still evaluate:

- Time-zone alignment

- Data security

- Compliance and tax considerations

On a global level, CMA salary trends remain highly competitive due to the strategic value these professionals bring to organisations. The smarter strategy? Build strong US-facing experience locally first to unlock better global CMA jobs over time.

Watch this quick CMA US salary comparison for India vs the USA that breaks down entry-level to senior salaries and highlights why CMA US is a top career choice globally.

How Does the CMA Work Experience Requirement Impact Jobs?

The CMA work experience requirement is a critical aspect of converting your certification into real job eligibility and career advancement.

For example, many bodies require a certain period of work experience in relevant accounting/finance roles before full credentialing.

The value of this work experience for CMA jobs includes:

- Demonstrating that you’ve applied CMA-level skills like:

- Budgeting

- Planning

- Cost management

- Decision support in real-world business settings.

- Increasing your credibility for higher-level CMA job opportunities, since employers look for not just the credential but also experience.

- Enabling you to move from entry-level to mid or senior roles, because you’ve built the professional context in which the CMA certificate becomes applicable.

The CMA salary in India depends on your experience, industry and employer, with strong growth seen in multinational companies and global finance roles. So if you’re planning your career path after CMA certification, target roles where you can apply those strategic finance and business partnering tasks early – this sets you up for broader, high-growth CMA jobs.

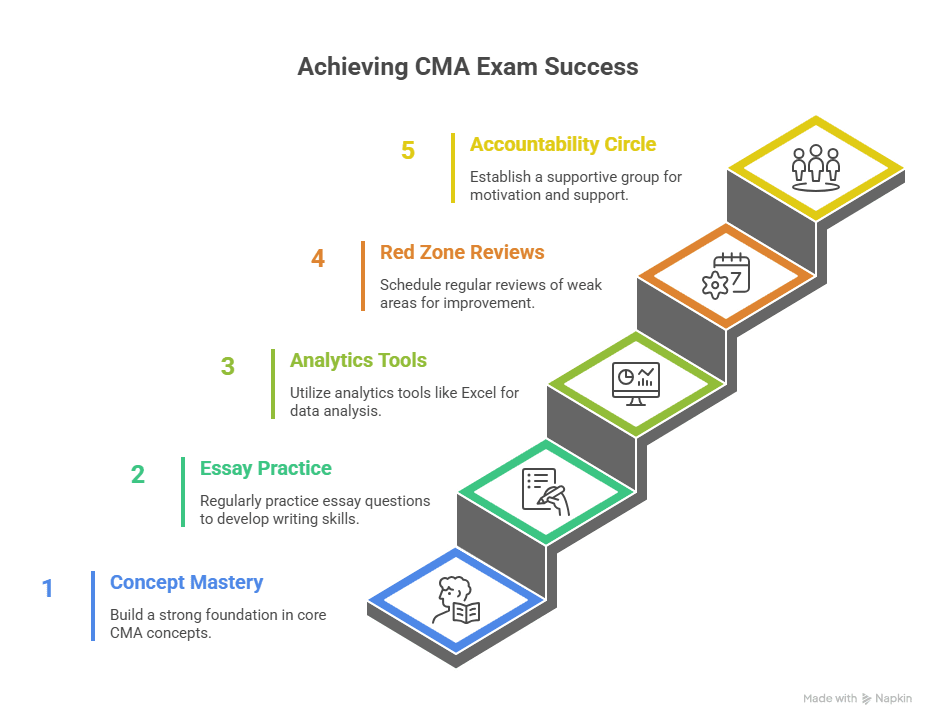

Skills You Should Build Alongside CMA

Here’s a truth I share with every aspirant: CMA alone is powerful, but CMA combined with practical skills is unstoppable. To stand out in global and US-linked jobs, focus on:

- ERP systems like SAP or Oracle.

- Advanced Excel and Financial Modelling.

- Business Intelligence tools – Power BI or Tableau.

- Understanding US GAAP and IFRS basics.

- Presentation and communication skills.

- Stakeholder management across geographies.

These skills make you employable, not just certified, and significantly improve your chances of securing high-growth CMA jobs.

CMA Facts – The demand for CMA-qualified professionals appears to be rising globally: IMA hit a milestone by certifying its 100,000th CMA in 2021 – underscoring the growing recognition and value of the credential.

Why Choose a CMA Qualification Before Planning Your Career?

Here are several reasons why the CMA credential is a powerful driver of job opportunities:

- It signals you’re equipped for management accounting, strategic business finance, not just traditional bookkeeping or auditing.

- It opens doors to global roles, including US CMA jobs and jobs in organisations with cross-border finance operations.

- It enhances your attractiveness for higher-value roles rather than purely operational ones.

- It provides a foundation for remote/virtual finance roles, which are increasingly common.

While the CMA course fees vary based on exam registration and coaching support, many professionals see it as a long-term investment in global career growth.

How Does the US CMA Compare With Other Global Finance Credentials?

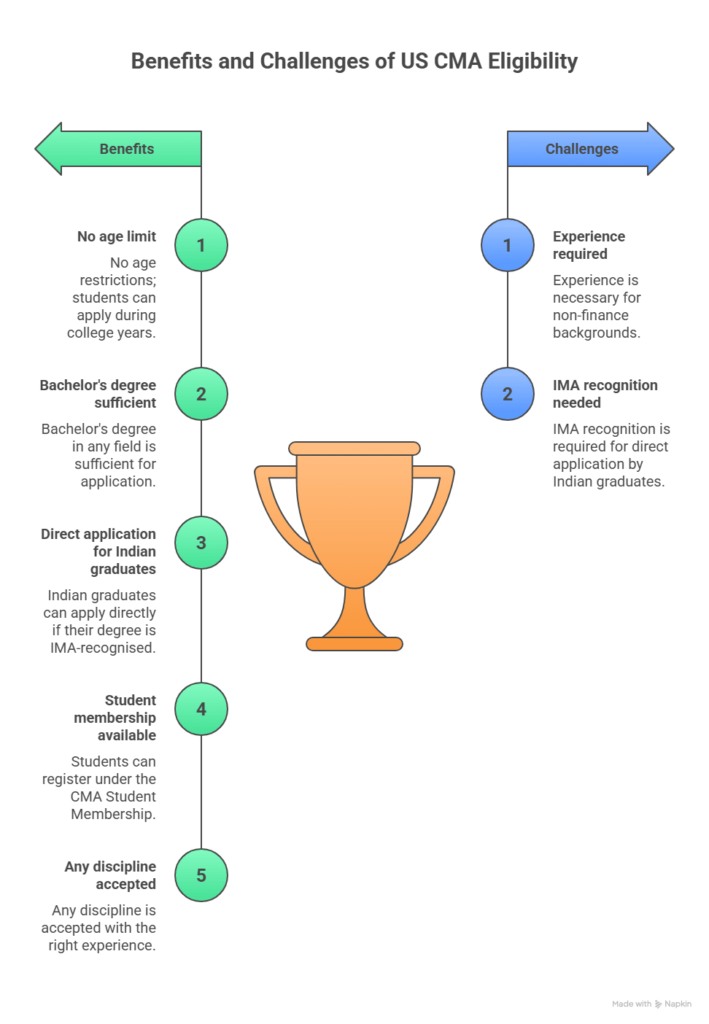

One of the advantages of the program is its flexible CMA eligibility, which allows graduates from commerce, business, finance and even non-commerce backgrounds to apply. US CMA is particularly strong in management accounting, business finance, FP&A, and strategic leadership.

Many aspirants often compare the US CMA with other popular global finance certifications, such as ACCA, CPA, and CFA, before deciding their career path. Each of these qualifications serves a slightly different career objective. Here’s a brief overview of the focus areas of each course:

| Focus Area | US CMA | ACCA | CPA (US ) | CFA |

| Management Accounting | ✅ | ✅ | ❌ | ❌ |

| Financial Planning & Analysis (FP&A) | ✅ | ✅ | ❌ | ❌ |

| Business Finance | ✅ | ✅ | ✅ | ❌ |

| Strategic Leadership | ✅ | ❌ | ❌ | ❌ |

| Corporate Finance | ✅ | ✅ | ✅ | ✅ |

| Global Industry Recognition | ✅ | ✅ | ✅ | ✅ |

Many professionals combine CMA with tech-finance skills, data analytics, and other global certifications, depending on their career goals. The key is choosing based on career direction, not just popularity, especially if your long-term goal is to build high-impact CMA jobs in strategic and global finance roles.

For a quick comparison of how the fast-track CMA US stacks up against the traditional MBA, especially when it comes to time to certification and career momentum.

Practical Job Search Strategy for CMA Professionals

If you want better CMA job opportunities, focus on:

- Targeting roles in MNCs and global/shared service organisations.

- Highlighting US-facing, global reporting and cross-border experience in your CV.

- Using LinkedIn strategically to connect with hiring managers.

- Framing your profile as a business finance partner, not just an accountant.

- Preparing for interviews with real-life case scenarios.

This is exactly what helps CMA professionals stand out.

Build a Global Career with CMA Jobs

CMA jobs are not just about employment – they’re about impact. When you combine:

- Strong CMA fundamentals

- Real business experience

- Global exposure

- Communication and leadership skills

You don’t just qualify for jobs – you become valuable in a global finance ecosystem.

Whether you aim to work in global corporations, US-facing roles, or leadership positions, the right strategy can take you there. Your CMA credential is your launchpad. Your skills, mindset and experience will decide how far you go.

Why Choose Imarticus Learning for Your CMA Journey?

When you decide to pursue a global qualification like CMA, the support and learning partner you choose along the way can make a huge difference to your career journey. It’s not just about clearing the exams. It’s about becoming the kind of finance professional companies actually want to hire.

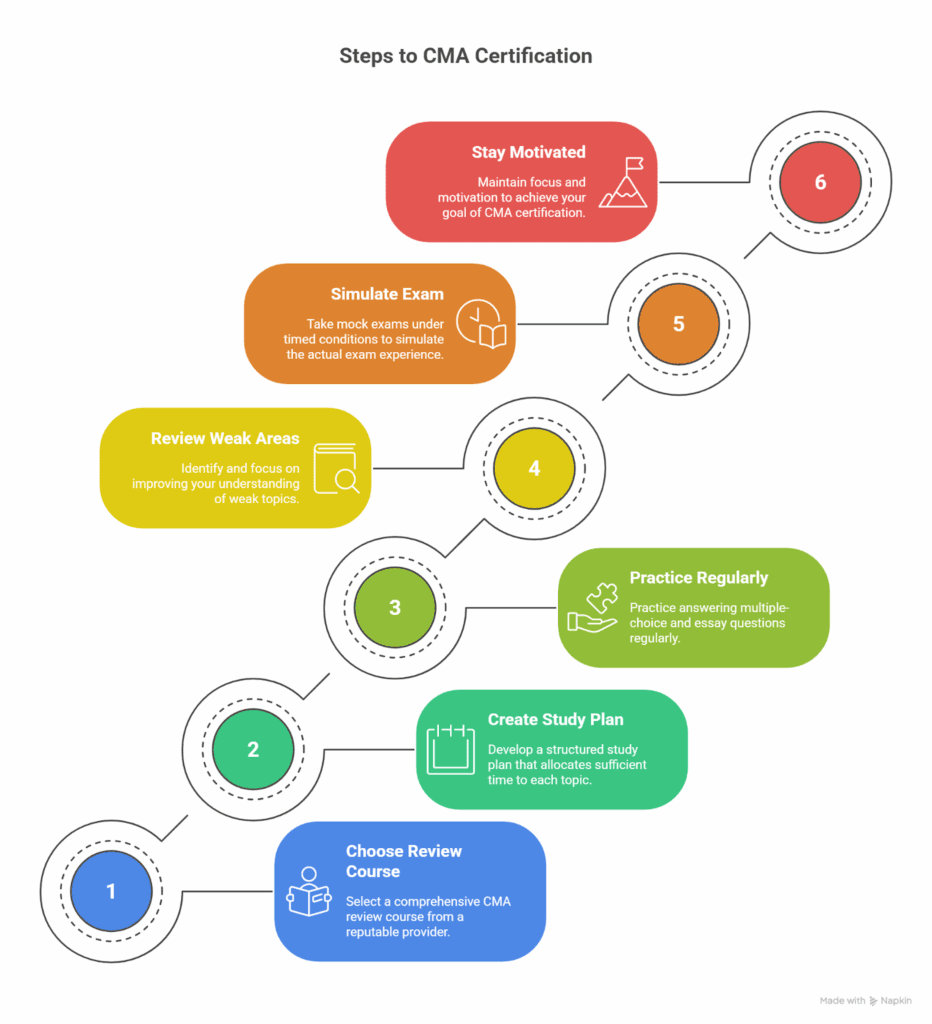

Many students also look for the best CMA review course to strengthen their preparation, improve exam confidence and build job-ready skills. At Imarticus Learning, the approach goes far beyond classroom learning. The focus is on helping you move confidently from studying CMA to working in real strategic finance roles.

Here’s what makes the learning experience different:

- Learn what companies really use – The curriculum is designed with industry professionals, with study material from the top providers like Surgent, so you’re not just learning theory – you’re building skills that are directly used in real finance and business roles.

- Practical, hands-on exposure – You don’t just read about case studies. You work on real-world business scenarios, financial models, internship opportunities with KPMG in India and live projects that mirror what you’ll actually do in CMA jobs.

- Global career mindset – Special focus is given to the kind of skills required for US and global finance roles, such as FP&A, business partnering, management reporting, and strategic thinking.

- Career support that actually helps – From resume-building and LinkedIn optimisation to mock interviews and placement guidance, you’re supported at every step of your job search – not left to figure it out alone.

- Strong hiring connections – With access to multinational companies, Big 4 consulting firms, and global capability centres, you get exposure to real hiring opportunities, not just promises.

Whether you’re just starting out or already working, Imarticus Learning helps bridge the gap between qualification and career, so you don’t just become CMA-certified – you become genuinely job-ready.

If you’re serious about building a global career through the CMA course, having the right guidance, structure, and mentorship can fast-track your success.

FAQs About CMA Jobs

If you’re considering CMA as a career path, these are some of the frequently asked questions students and working professionals have about CMA jobs before stepping into the job market.

What kinds of roles can a CMA graduate apply for?

You’ll find certified management accountant jobs in areas such as cost management, budgeting & forecasting, business partnering, FP&A, internal controls, performance management, and strategic finance. Many of the jobs after CMA follow this pattern.

What are typical CMA job responsibilities?

Some of the common CMA job responsibilities include preparing management reports, analysing financial performance, conducting variance analysis, improving cost efficiency, supporting leadership with insights, and ensuring strong internal financial controls.

What are the top CMA jobs in the market today?

Some of the top CMA jobs include Financial Planning & Analysis (FP&A) roles, Business Finance Manager, Cost Accountant, Finance Controller, Risk & Compliance roles, and leadership-track finance positions.

What are CMA career opportunities like in the long term?

CMA career opportunities are strong for professionals who want to move into strategic finance, leadership, and business-partnering roles. With experience, many professionals move into senior roles such as Finance Manager, Head of FP&A, and CFO-track positions.

Are there US CMA jobs if I am based in India?

Yes, roles supporting US-based businesses, global finance operations, and remote/project roles are available. With the right experience and skills, you can aim for jobs in the USA or with US organisations.

How good are US CMA job opportunities?

US CMA job opportunities are strong in companies that have global finance teams, shared service centres, and US-facing business operations. With the right experience and communication skills, these roles can offer excellent global exposure.

What is the salary potential for top CMA jobs?

It depends on geography, industry, role, and experience. Entry-level may be moderate, but mid-level and senior roles, especially global or US-facing, can command significantly higher compensation. The key differentiator is the value you bring to business decisions, not merely your title.

Do I need any special work experience to qualify for CMA-level jobs?

Yes. The CMA work experience requirement mandates that you’ve worked in relevant finance or management-accounting roles. For jobs, this means employers will look for evidence of planning, analysis, cost management or business partnering, not just general accounting.

What is the salary potential for top CMA jobs?

It depends on geography, industry, role, and experience. Entry-level roles may offer moderate packages, while mid-level and senior global roles can command significantly higher compensation. The key differentiator is the value you bring to strategic business decisions.

Can CMA get a job easily?

Yes, CMA professionals generally find strong employment opportunities. Combining the certification with practical experience and job-ready skills through Imarticus Learning helps improve job readiness through hands-on training, interview preparation, and career support.

Are there certified management accountant job opportunities in India?

Yes, certified management accountant job opportunities are available in India across multinational companies, Big 4 consulting firms, global finance centres, and growing startup ecosystems.

How can I prepare for US CMA jobs effectively?

Imarticus Learning provides guided preparation, real-world projects, and career mentoring that build strong technical fundamentals, help to gain practical exposure, and improve communication skills to effectively prepare for US CMA jobs.

What are CMA job opportunities like for freshers?

CMA job opportunities for freshers usually start with entry-level roles in the field of cost analysis, FP&A, management accounting, or business analysis. Career-focused training providers like Imarticus Learning help bridge the gap between certification and employment.

Build a Global Career With CMA Jobs

The path to securing meaningful CMA jobs becomes much clearer when you understand how job responsibilities, global opportunities, including US job opportunities, remote work trends, and practical experience come together.

When you build the right mix of technical expertise, business partnering mindset, and global readiness, you don’t just qualify for roles – you become genuinely valuable in a finance-driven world that’s evolving at an incredible pace.

Whether you aim for top CMA jobs, remote work-from-home opportunities, or US-based finance roles, remember this: your CMA credential is your badge, but your experience, insights, and communication are what truly make you stand out.

Focus on roles where you can apply your certified management accountant skills meaningfully, and your career path will naturally accelerate. Start your CMA course with the right strategy today.