When you begin looking into CMA vs CFA, it can suddenly feel like you’re staring at a menu of powerful certifications and wondering which one is right for you. This is a common dilemma for students and young professionals who want to move beyond a basic commerce or accounting degree.

The CFA and CMA aren’t just two badges – they’re two completely different problem-solving philosophies. Choosing between them really starts with deciding what kind of problems you want to become great at.

And honestly, you’re not alone.

On one hand, you have CFA, which is the gold standard for careers in investment banking, equity research and global finance. On the other hand, there’s CMA – a powerful certification focused on corporate finance, management accounting and strategic decision-making inside organisations.

The confusion is real:

Should I choose CMA or CFA?

Shall I pursue CMA and CFA together?

The truth is, both paths are excellent, but they lead to very different careers.

In this blog, I’ll break down everything you need to know about CMA vs CFA in simple, real-world terms. I’ll talk about syllabus, difficulty level, career scope, and finally answer the big question students keep asking: CMA or CFA, which is better for you, and which one might suit you better depending on your ambitions.

Understanding CMA and CFA

When I talk to students who are trying to figure out their finance careers, one question comes up again and again: Should I choose CMA or CFA? And honestly, I get the confusion – because at first glance, both CMA vs CFA sound equally powerful and equally confusing.

To understand what CMA and CFA actually stand for and why they are so popular among finance professionals. Let me simplify it for you.

What is CMA?

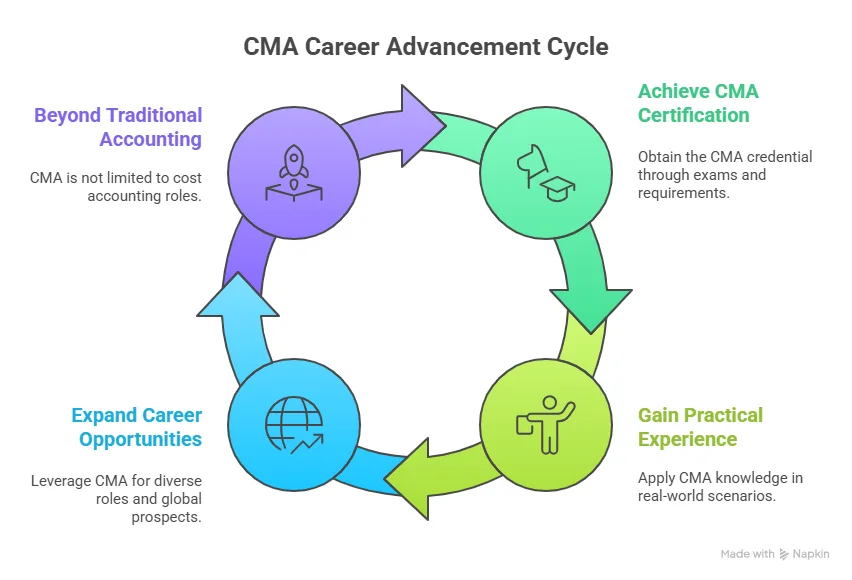

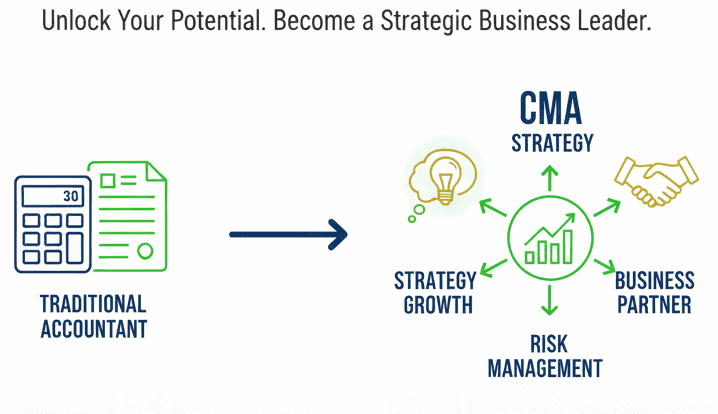

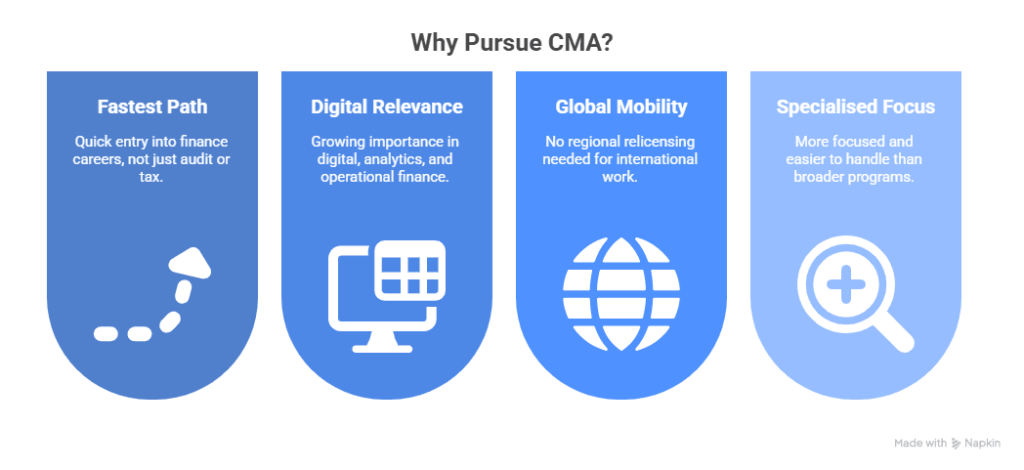

Firstly, let’s understand what is CMA – Certified Management Accountant is for those of you who enjoy understanding how a business actually runs from the inside. It’s more about real-world business decisions – things like budgeting, cost control, financial planning, and helping companies become more efficient and profitable. If you like the idea of being the person who helps management make smarter decisions, a CMA course is built for that.

What is CFA?

Now, coming to what is CFA (Chartered Financial Analyst), on the other hand, is for people who are drawn to the world of investments and financial markets. This is where you get into equity research, portfolio management, company valuations and global market analysis. If you find yourself excited by stock prices, market trends and investment strategies, CFA might feel more natural to you.

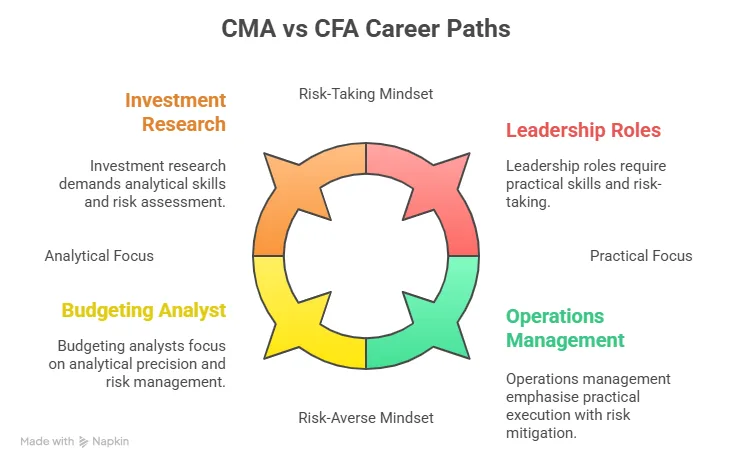

Not sure whether you’re more suited for CMA or CFA? CMA and CFA career paths often align with different interests and personality traits, which can make the choice much clearer when you understand how you naturally think and work.

Both CMA and CFA are highly respected certifications. But they don’t lead you to the same kind of daily work. One prepares you to run businesses better, the other prepares you to analyse and grow money in the markets. And once you understand that difference, choosing between them becomes a lot less overwhelming.

Looking for clarity on which finance qualification to pursue after your bachelor’s? This video breaks it down in a simple way and shows how CMA compares with CFA and other popular certifications, so you can easily understand the differences and choose what fits you best

CMA vs CFA: Eligibility and Entry Requirements

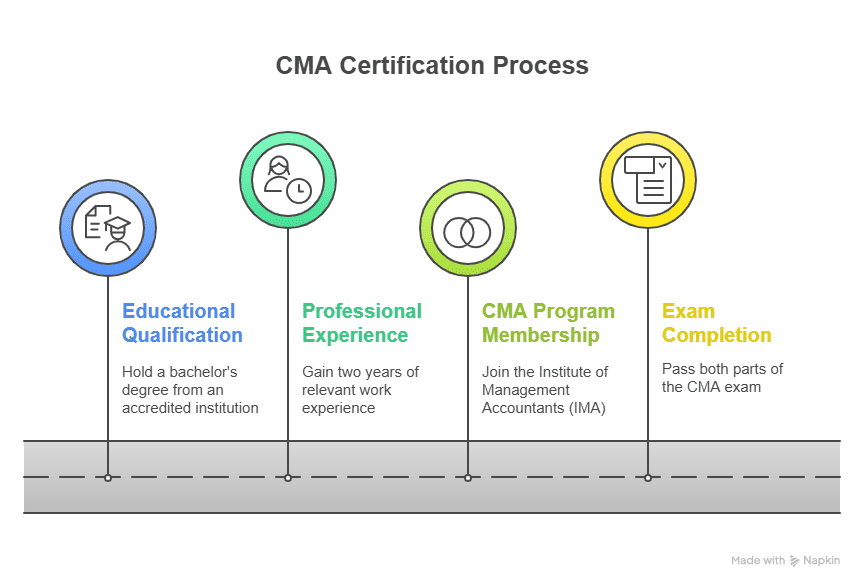

When you’re comparing CMA vs CFA, one of the first things to look at is who can apply, because both certifications have different education and experience requirements.

CMA Eligibility

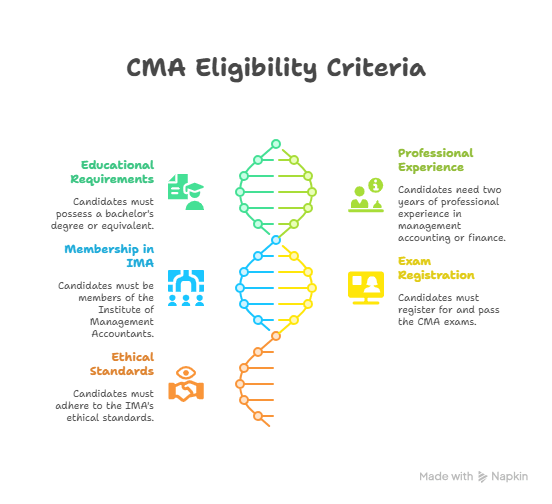

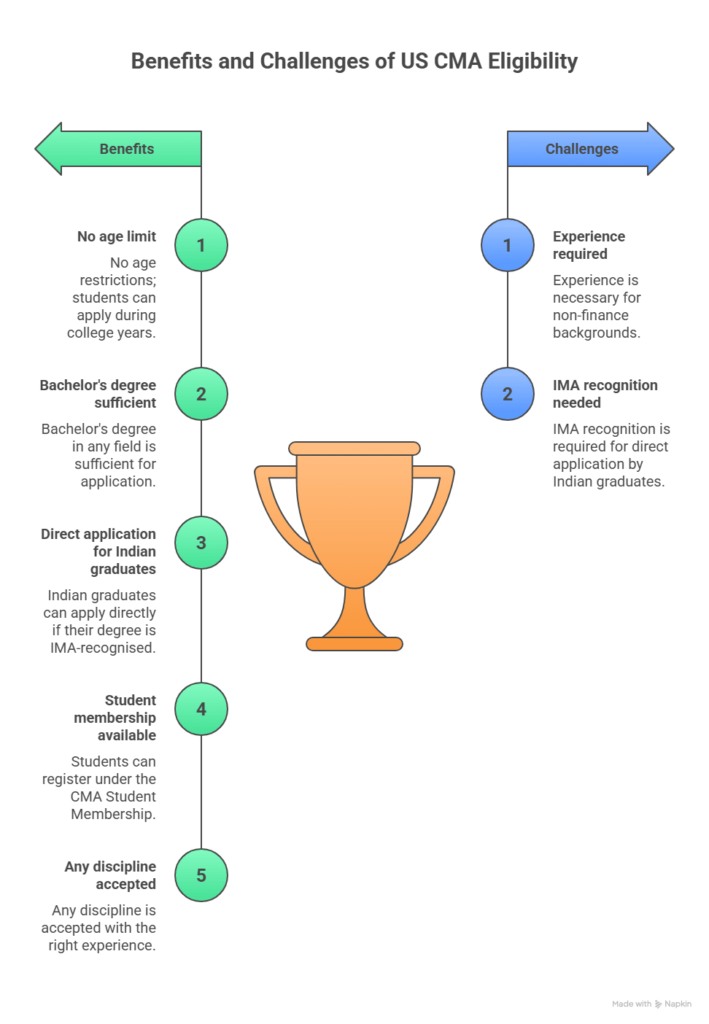

For CMA eligibility, you generally need to:

- Have a bachelor’s degree.

- Or you are in the final year of graduation.

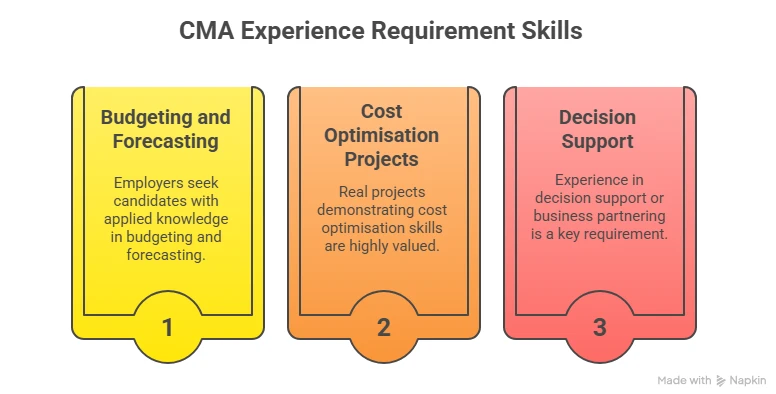

- Complete relevant work experience before or after exams.

- Even non-commerce students can pursue CMA with the right preparation.

CFA Eligibility

You can register for CFA if:

- You have a bachelor’s degree.

- Or you are in your final year of graduation.

- Or have relevant professional work experience.

- Graduates from commerce, economics, finance, engineering and even non-commerce backgrounds can pursue CFA.

💡Did You Know? To earn the CFA charter, you must not only pass all three levels but also meet the work-experience requirement set by the issuing body.

CMA vs CFA: How Do They Differ?

Choosing between CMA vs CFA can feel overwhelming at first – and that’s completely normal. Both are highly respected certifications in the finance world, and from the outside, they can look quite similar. But in reality, they prepare you for very different career journeys.

This comparison table of CFA and CMA makes things simple for you, so you can clearly see how they differ:

| Factor | Chartered Financial Analyst | Certified Management Accountant |

| Primary Focus | Investment management, Equity Research, and Portfolio Analysis. | Management Accounting, Corporate Finance, and Budgeting. |

| Exam Structure | 3 Levels | 2 Parts |

| Exam Format | Multiple-choice and item set questions | Multiple-choice and essay-style questions |

| Work Experience | Required for Charter. | Required for Certification. |

| Average Time to Complete | 2 to 4 years | 1 to 2 years |

| Difficulty Level | Academically intensive. | Practical and business-focused. |

| Global Recognition | Extremely strong global recognition. | Strong global recognition, especially in corporate finance roles. |

| Skills Gained | Valuation, investment analysis, portfolio strategy, ethics, and global market understanding. | Budgeting, forecasting, cost management, strategic planning, and internal financial controls. |

This video gives clarity about what the US CMA offers in terms of career growth, salary prospects, and how it positions you for leadership and finance roles.

CMA vs CFA: Syllabus Structure and Completion Time

When looking at CMA vs CFA, a major difference between CMA and CFA comes down to how the syllabus is designed and how long it typically takes to finish each course – something that really matters when you’re mapping out your career.

CMA Syllabus Structure

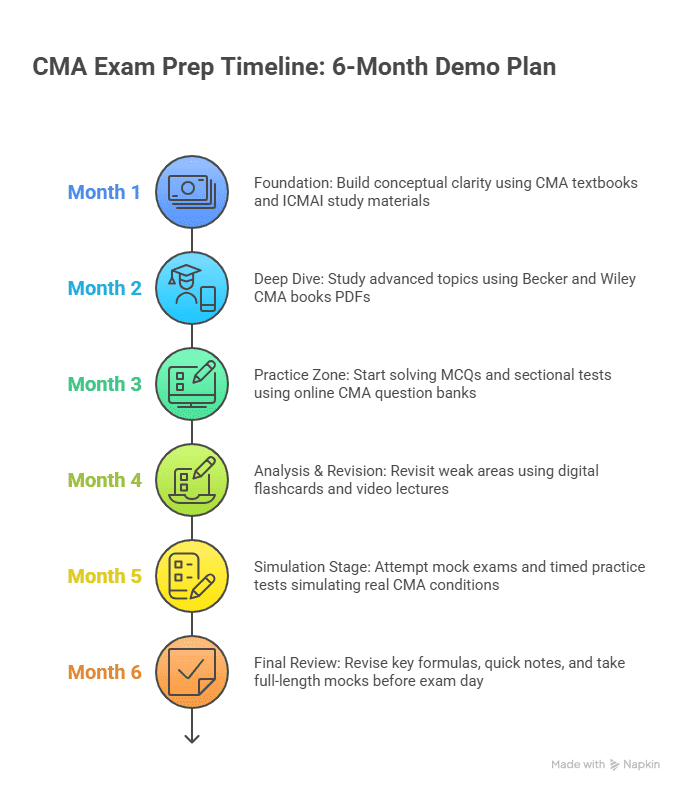

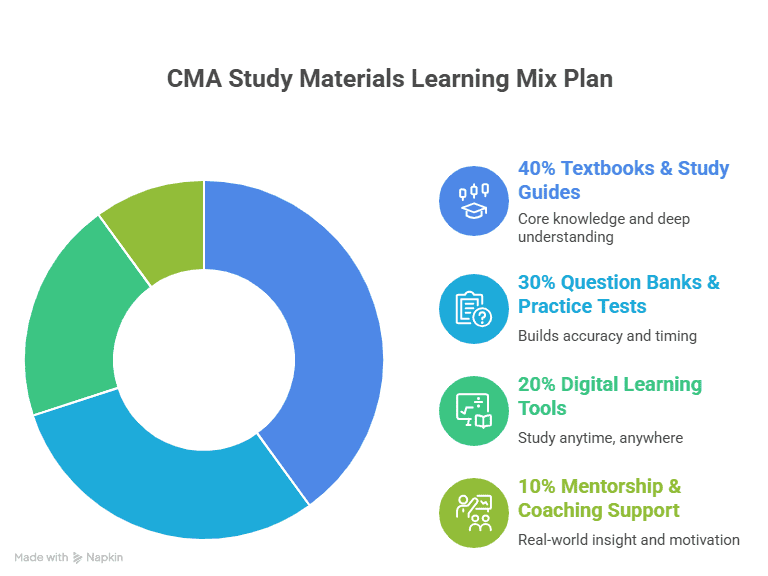

The CMA syllabus is more streamlined and practical. It’s divided into two focused parts, which many students find easier to manage alongside college or work. The CMA course subjects are designed to build practical expertise across cost accounting, financial planning, performance management, internal controls, and strategic financial management.

| CMA Part | What It Covers | What It Focuses On |

| Part 1: Financial Planning, Performance & Analytics | Budgeting, forecasting, cost management, internal controls, and performance evaluation. | Practical, day-to-day business finance and operational decision-making. |

| Part 2: Strategic Financial Management | Financial statement analysis, corporate finance, risk management, investment decisions, and professional ethics. | Strategic financial thinking and leadership-oriented decision-making. |

The CMA curriculum is built to be highly practical, business-driven and job-oriented. You’re not just memorising theory, you’re learning how to apply project selection methods and real-world finance skills in real business environments.

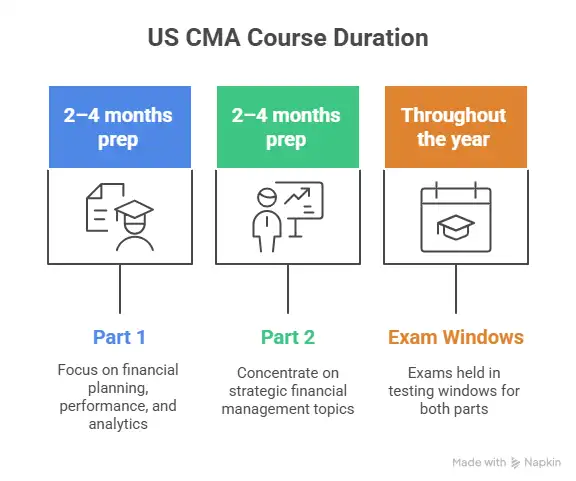

So, how long does CMA take? The CMA course duration is approximately 1 to 2 years. Most students manage to complete it within this timeframe, making it a faster and more direct route compared to CFA.

CFA Syllabus Structure

Let me simplify how the CFA course syllabus actually works, because on paper, it often sounds scarier than it really is. The course is divided into three levels, and the idea is very simple – you start with the basics and slowly move towards advanced, real-world decision-making.

| CFA Level | What It Covers | What It Focuses On |

| Level I | Financial reporting, economics, quantitative methods, corporate finance, and ethics. | Building a strong foundation and learning the language of finance |

| Level II | Asset valuation, deep financial analysis, and case-based problem solving. | Applying concepts to real-world business and investment scenarios |

| Level III | Portfolio management, wealth planning, and investment decision-making. | Strategic thinking and advanced, real-world financial decision-making |

The CFA program is known to be academically demanding because its structure is slow and layered. It’s not about rushing – it’s about consistency over time.

So, how long does CFA take? Most students usually take around 2 to 4 years to finish all three levels, depending on how quickly they’re able to clear each exam.

Time Commitment and Study Hours

- CFA: 300+ study hours per level, spread over several years.

- CMA: 150-200 study hours per part.

CFA requires long-term discipline. CMA requires focused, short-term consistency. If flexibility matters to you, CMA is easier to manage alongside work.

💡Did You Know? CMA candidates must finish both parts of the exam within three years of registration.

Exam Difficulty, Pass Rates and Attempt Flexibility

Students often ask which is easier to clear in the CMA vs CFA comparison. Rather than thinking of one as “easy” or “hard,” it’s more helpful to understand how each exam is designed and what kind of effort they demand.

CFA exams are known for:

- A structured, academically rigorous format.

- A deep and comprehensive syllabus covering global finance concepts.

- A strong focus on long-term discipline and consistency.

- A three-level structure that builds expertise step by step.

This makes CFA ideal for those who enjoy academic depth and gradual skill-building.

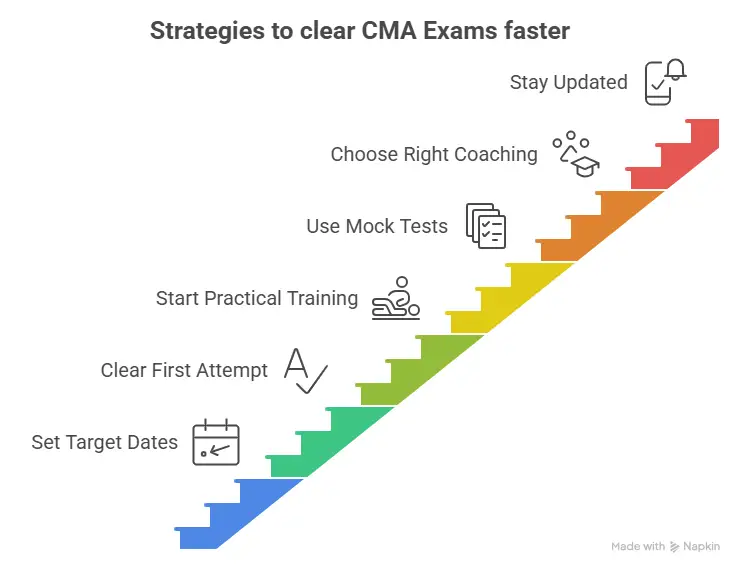

CMA exams are known for:

- A practical, business-focused approach.

- A streamlined structure with two parts.

- Flexible testing windows that suit working professionals.

- A strong emphasis on application-based learning.

This makes CMA well-suited for those who prefer practical learning and faster application of concepts.

CMA vs CFA: Course Fees and ROI

Cost and long-term career returns play a huge role when choosing between CMA vs CFA. After all, this isn’t just about passing exams – it’s about investing your time, money, and effort into your future. So, here’s what you should realistically know before you decide.

CFA Course Fees & ROI

For Indian students, the total cost of the CFA program usually falls between:

| Component | Estimated Cost (India) |

| Registration + Exam Fees | ₹2.5 – 4.5 lakhs |

| Study Materials | Extra |

| Coaching | Optional |

CFA tends to offer strong long-term returns, especially if you’re aiming for careers in:

- Investment Banking

- Asset Management

- Equity Research

- Global Finance Roles

The CFA charter carries a strong brand value worldwide, leading to high-paying roles over time. However, it usually requires more time, effort, and patience to fully realise the returns.

CMA Course Fees & ROI

For Indian students, the CMA course fees generally range between:

| Component | Estimated Cost (India) |

| Registration + Exam Fees | ₹1.5 – 3 lakhs |

| Study Materials | Included/extra (varies by provider) |

| Coaching | Optional |

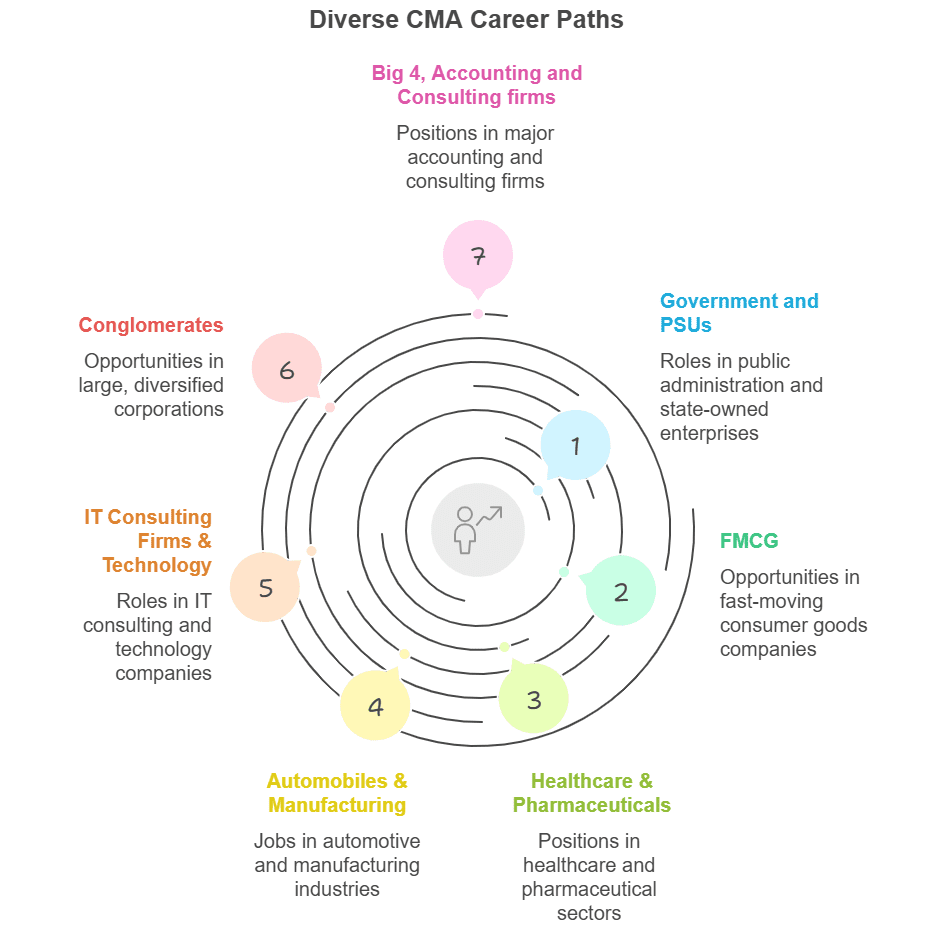

CMA is known for delivering quicker, more practical career outcomes, especially in:

- Corporate Finance Roles

- FP&A

- Business Finance Teams

- Leadership-focused and strategic roles

Many students also invest in the best CMA review course and use practice question banks, mock exams, and concept guides to strengthen their preparation. Because the course is shorter, many students experience faster career movement and quicker financial returns after completing the CMA.

Where Can CMA and CFA Take You in 5 to 10 Years?

It’s important to think beyond your first CFA and CMA jobs and visualise long-term growth.

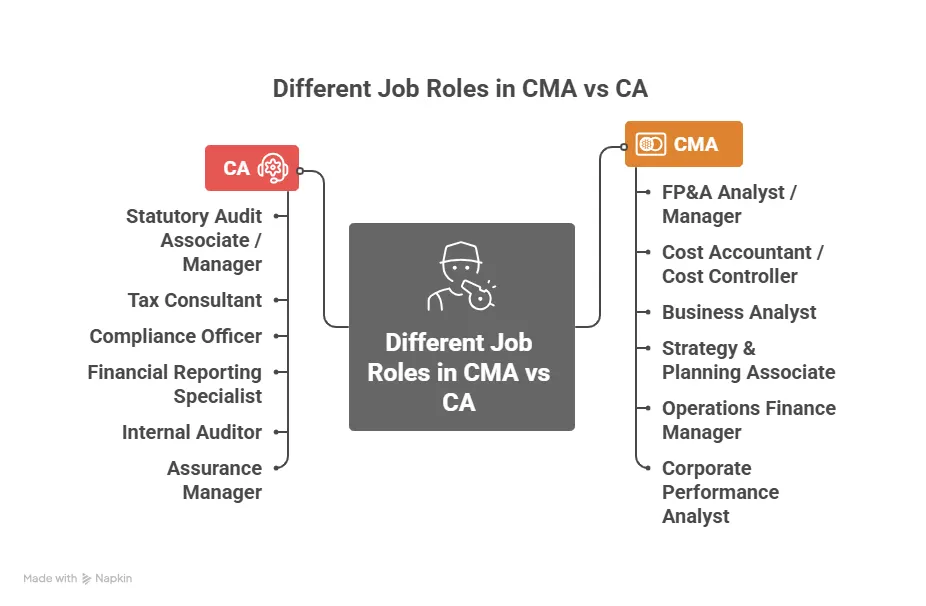

CFA career growth path in 5 to 10 years will move into roles like:

- Senior equity research analyst

- Portfolio manager

- Investment strategist

- Fund manager roles in global firms

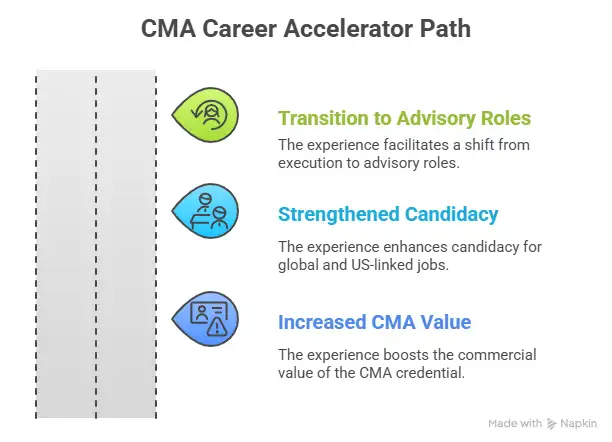

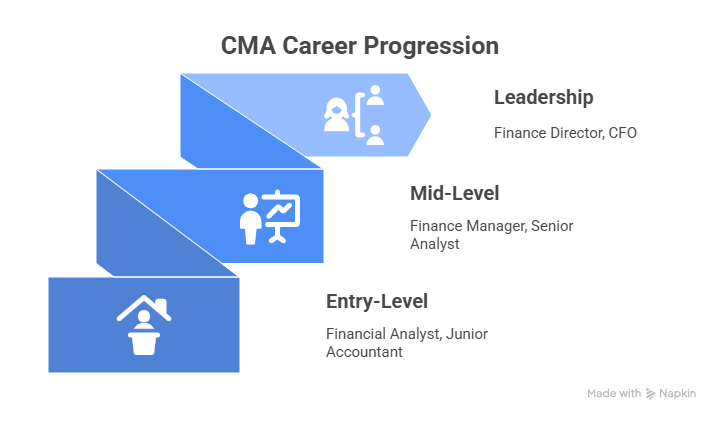

CMA career growth path in 5 to 10 years often grows into roles such as:

- FP&A Head

- Finance Manager or Controller

- Business Finance Lead

- CFO-track leadership roles

Your long-term success depends not just on the certification, but on how you build your experience alongside it.

CMA vs CFA: Pros and Cons

Before you make a final decision between CMA vs CFA, it’s worth looking at both the good and the difficult sides. Every professional course has its strengths and challenges, and understanding both will help you choose what truly fits your goals.

| Feature | CFA | CMA |

| Global recognition | ✅ | ✅ |

| High long-term salary potential | ✅ | ✅ |

| Corporate Leadership Career Path | ❌ | ✅ |

| Corporate Finance & FP&A roles | ❌ | ✅ |

| Investment Banking & Asset Management roles | ✅ | ❌ |

| Strong focus on portfolio, valuation & markets | ✅ | ❌ |

| Preferred for front-end finance exposure | ✅ | ❌ |

| Faster completion | ❌ | ✅ |

| Practical focus | ❌ | ✅ |

| Deep focus on financial markets | ✅ | ❌ |

If you’re curious about what makes the CFA so valuable in finance, this video gives a quick, clear breakdown of its global credibility and career impact.

Global Recognition, Career Mobility and Pay: What Can You Really Expect?

Let’s be honest for a moment. One of the biggest reasons students look at CMA vs CFA isn’t just the syllabus or the exams – it’s the kind of global exposure and lifestyle these certifications can potentially unlock. And that’s completely fair.

But what does global recognition in these certifications actually mean in real life? And how much can you realistically expect to earn? Let me break it down in a simple, no-fluff way.

Global Recognition

Both CFA and CMA are respected across the world, but for very different reasons. It is essential to consider important factors that shape long-term career direction and industry exposure. This is one of the key factors people consider when comparing CMA vs CFA.

For many professionals, CFA acts as a gateway to global finance, opening doors to international roles in investment banking, asset management, and global financial institutions. CFA is often seen as the gold standard if you want to work in investment-focused roles. It carries strong brand value in countries like the USA, UK, Canada, Singapore, Hong Kong and the Middle East. If your dream is to work in financial hubs, global banks, or investment firms, CFA gives you strong international credibility.

On the other hand, CMA is globally recognised and highly valued in the corporate world. It is respected in multinational companies, especially for roles in FP&A, corporate strategy, internal finance, and cost management strategies. Countries like the US, Canada, the Middle East, Australia and parts of Europe actively hire CMA-qualified professionals, which is a key difference when evaluating CMA vs CFA.

In simple terms:

- CFA gives you stronger recognition in investments and financial markets.

- CMA gives you stronger recognition in corporate finance and business strategy.

Career Mobility – How Easy Is It to Work Abroad?

This is where both qualifications really shine, especially when comparing CMA vs CFA. With CFA, moving abroad becomes more realistic if you’re targeting careers like:

- Investment banking

- Portfolio management

- Asset management

- Equity research

- Hedge funds and private wealth firms

With CMA, international opportunities open up more naturally in roles such as:

- Corporate finance roles in MNCs

- FP&A and business finance teams

- Strategic finance and internal consulting

- Finance leadership pipelines

Many professionals use CMA or CFA as stepping stones to move from India to markets like the Middle East, the USA, Canada and Southeast Asia.

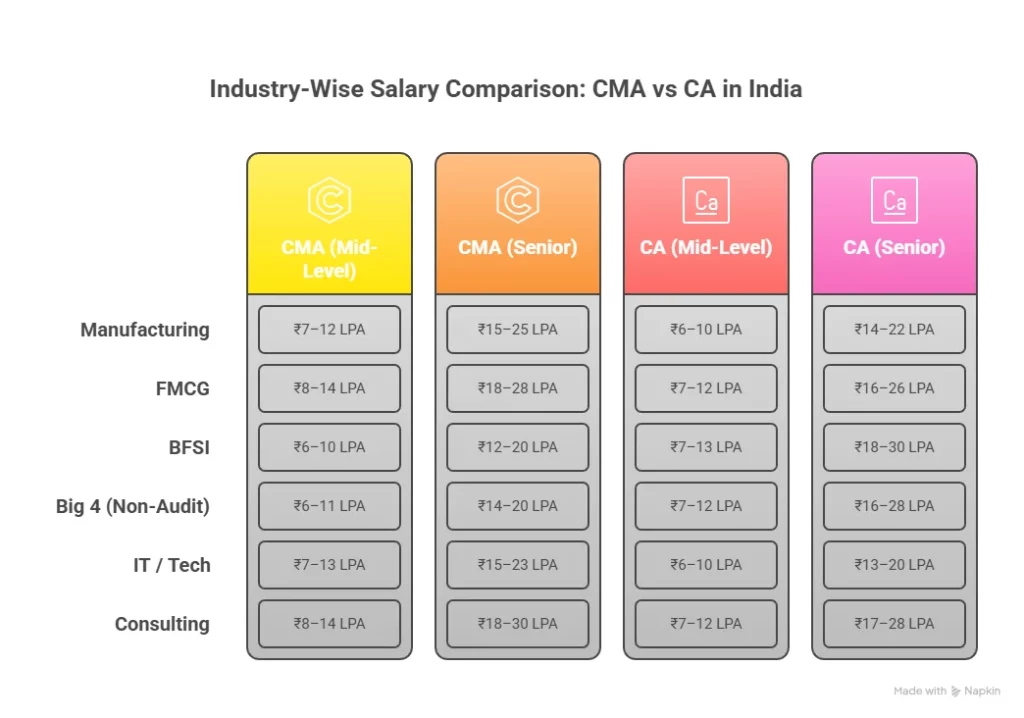

Pay Ranges – What Does the Salary Look Like?

Let’s talk about money – because it matters, and there’s no shame in that when comparing CMA vs CFA.

Here’s a simple, realistic picture of typical salary ranges. These are approximate and can vary based on your experience, company, location and performance.

CFA Salary Range

CFA-based roles tend to pay more in areas like investment banking and asset management, especially as you move up the ladder.

| Career Level | India Salary (LPA) | Global Salary (Converted to LPA) |

| Entry-level | ₹6-10 LPA | ₹40-60 LPA ( $50k-$75k) |

| Mid-level (3-6 years) | ₹12-25 LPA | ₹50 LPA – ₹1 Crore Per Annum ($60k-$120k) |

| Senior roles | ₹30 LPA+ | ₹1.25 Crore Per Annum+ ( $150k+) |

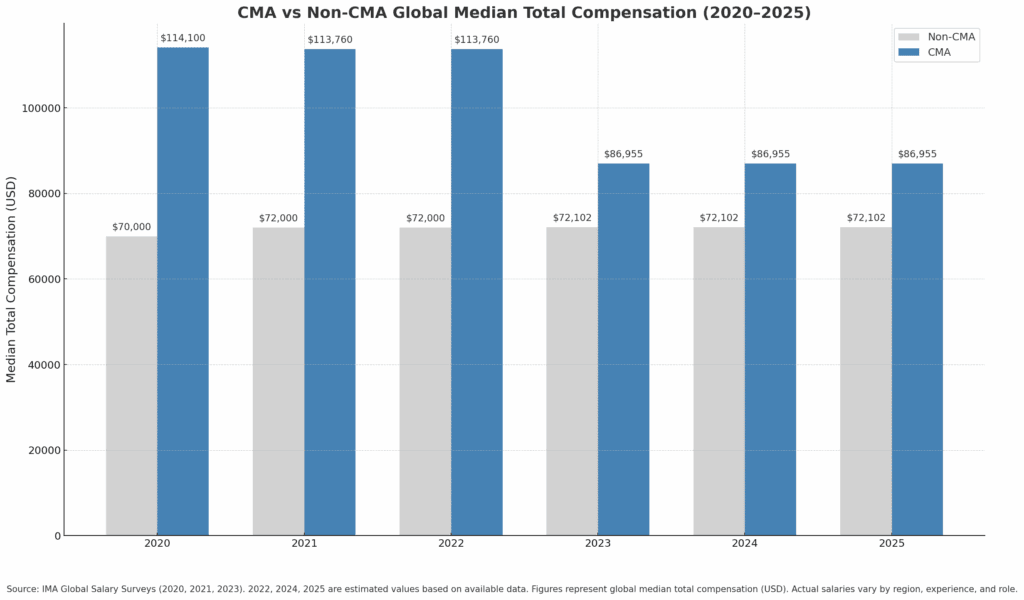

CMA Salary Range

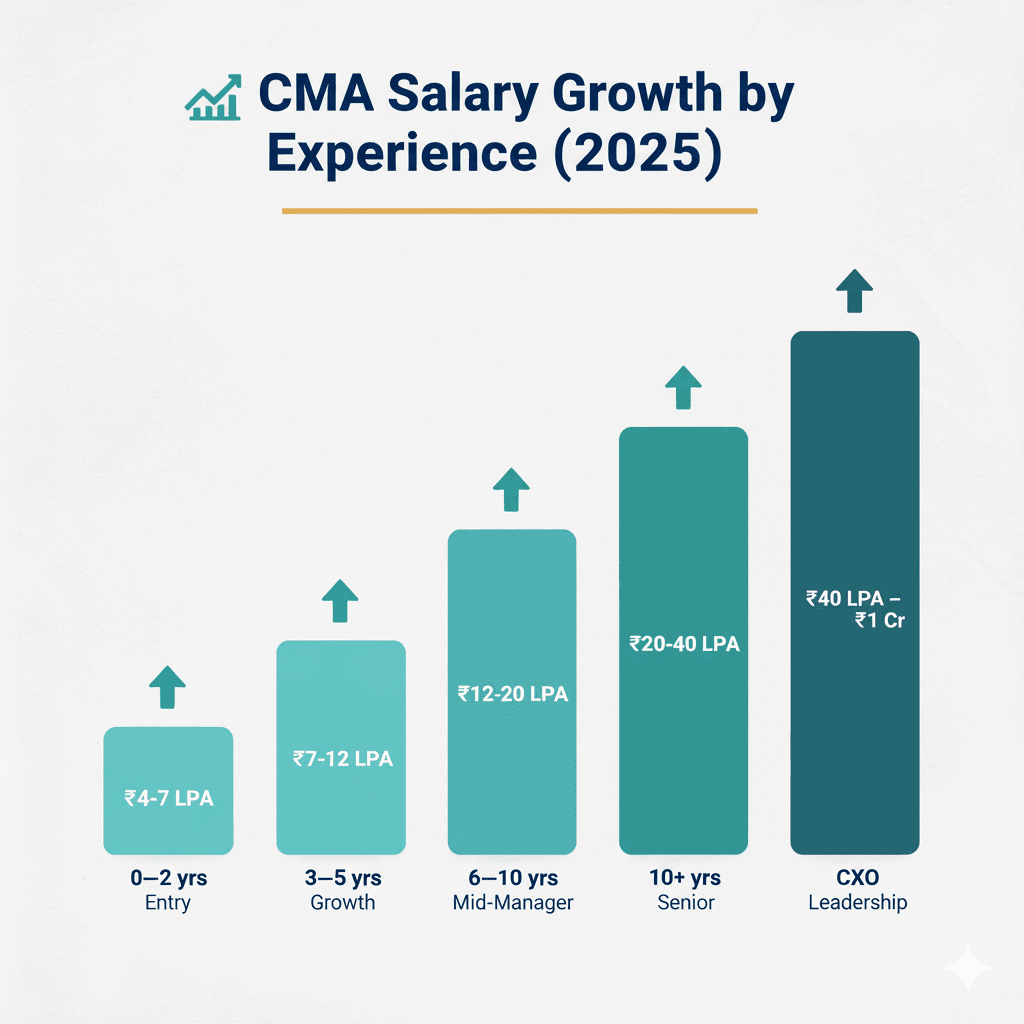

CMA professionals tend to see strong salary growth when they move into cost accounting and management accounting, FP&A, leadership, and strategic finance roles.

| Career Level | India Salary (LPA) | Abroad Salary (Converted to LPA) |

| Entry-level | ₹5-9 LPA | ₹35-50 LPA ( $45k-$60k) |

| Mid-level (3-6 years) | ₹10-20 LPA | ₹41-83 LPA ( $50k-$100k) |

| Senior roles | ₹25 LPA+ | ₹1 Crore Per Annum+ (from $120k+) |

The Real Truth About CMA vs CFA Pay

When students ask me, Which one pays more – CMA or CFA? my answer is always honest: Both pay well. Both open doors to global careers. Neither guarantees success overnight.

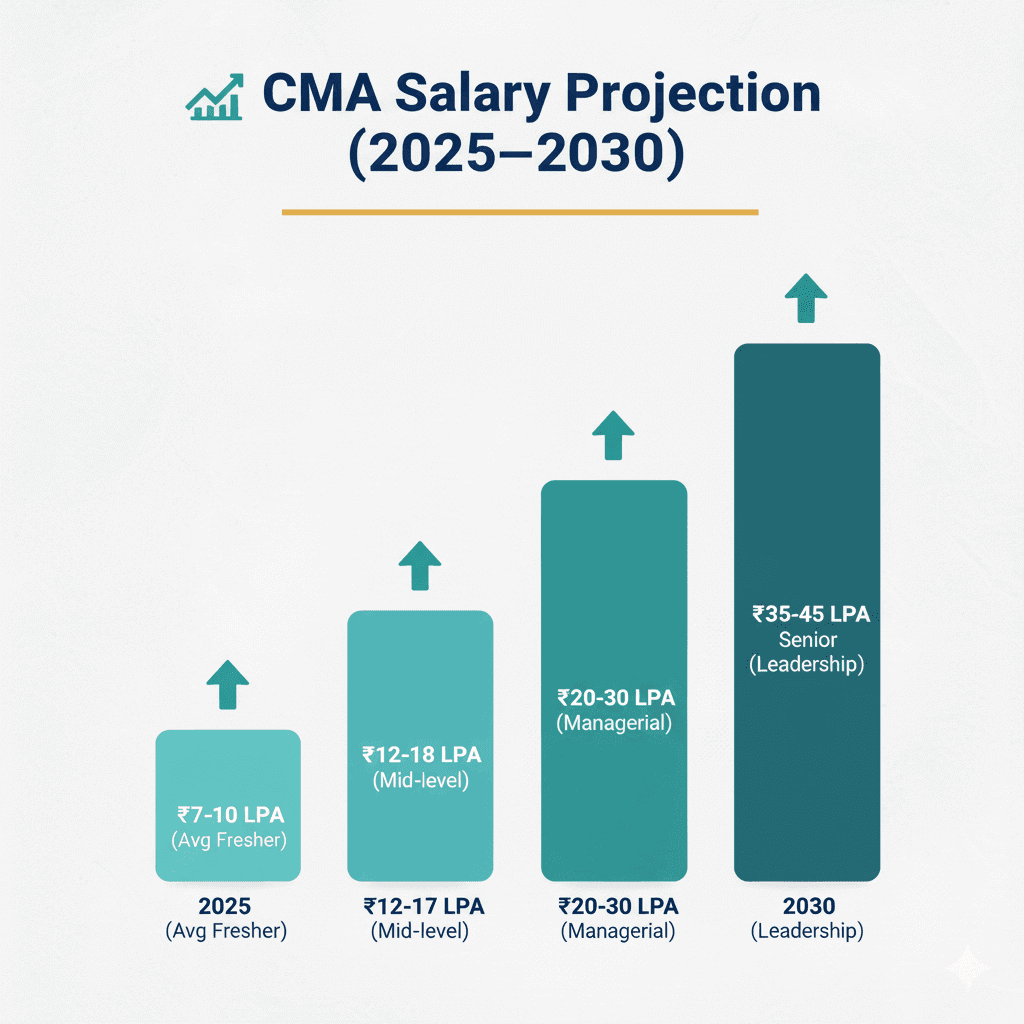

When students research CMA salary, they often want to understand how pay grows with experience, industry, and role. CMA salary in India typically starts strong at the entry level and increases significantly as professionals move into FP&A, business finance, and leadership roles.

CFA usually offers a higher upside in front-end finance and investment roles, while CMA offers stable, powerful growth inside corporate leadership and business finance roles.

At the end of the day, your growth depends more on your skills, mindset and experience than just the title on your resume.

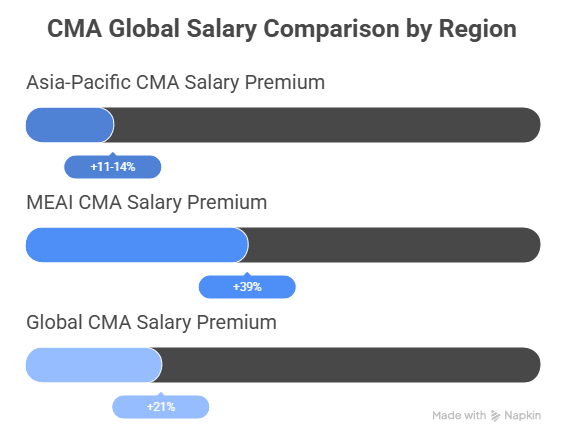

CMA Facts: Global data from IMA shows that holding the CMA designation yields higher total compensation than non-holders in equivalent positions.

CMA vs CFA: Which Is Harder?

If you ask most experts, they’ll say CFA is generally considered tougher than CMA.

Why? Because CFA has a more extensive syllabus covering investments, economics, derivatives, portfolio theory, financial reporting, ethics, and global markets, quite vast and intense.

CFA demands three levels of exams, plus relevant work experience, before you earn the designation. Lower pass rates and more study hours per level make CFA quite challenging.

That said, CMA is no cakewalk. It’s more specialised and shorter-term focused, but still demands a solid understanding of accounting, cost analysis, budgeting, and corporate finance fundamentals.

This structural difference is also why many students ask: CMA vs CFA – which is harder? – Overall, CFA is considered harder due to its wider syllabus and multiple exam levels.

Who Should Choose What?

Still confused between choosing CMA or CFA? When it comes to CMA vs CFA, here’s a simple way to know which one naturally fits your personality and career goals.

If you prefer a longer, deeper academic journey into investments and global finance, CFA may suit you better. Choose the CFA Certification if you:

- Are fascinated by stock markets, investments and company valuations.

- Want to work in investment banking, asset management or global finance roles.

- Are ready for a longer, more academically intensive journey.

- Enjoy deep financial analysis and research.

If you want a quicker, more practical path into corporate finance and management accounting, CMA can be the right fit. Choose the CMA Certification if you:

- Enjoy understanding how businesses actually work from the inside.

- Like budgeting, cost control, financial planning and strategy.

- Want to grow in corporate finance, FP&A or business leadership roles.

- Prefer a faster, more practical career path.

Here’s a quick decision guide to help you choose the best career path:

| Your Goal | Best Choice |

| Investment banking | CFA |

| Global markets | CFA |

| Private Equity | CFA |

| Corporate finance | CMA |

| Faster career entry | CMA |

| CFO track roles | CMA |

Should You Do Both CMA and CFA?

Doing both makes sense only if you:

- Want senior leadership roles.

- Want exposure to both corporate and market finance.

- Can handle long-term academic commitment.

It doesn’t make sense if your only goal is a quick salary increase.

CFA Facts: According to the 2024 global compensation survey by CFA Institute, based on data from ~17,000 members across 132 markets, the reported compensation benchmarks give a broad global perspective.

CMA vs CFA: Which Is Better for You?

There’s no universal winner. When it comes to CMA vs CFA, it all depends on what you want your career to look like. Think about the time and commitment you can realistically give.

CFA takes longer and covers more depth, but it offers strong global recognition and mobility. CMA is faster to complete and gives you practical, job-ready skills for corporate finance roles.

Also consider your long-term career vision. If you see yourself working in MNCs or large corporates, handling COSO Frameworks and regulations, especially from India, CMA can be a strong fit. If you’re drawn to global finance, investments, and international roles, CFA gives you more flexibility.

Some professionals even choose to combine CMA and CFA to gain both corporate finance and investment exposure. It’s a powerful combination – but it demands more time, effort, and clarity about what you really want from your career.

In short, CMA or CFA, which is better, depends on you – your interests, time, willingness to commit, and career vision and not what the trends say.

Why Imarticus Learning Is the Right Choice for CMA and CFA Aspirants?

Choosing the right certification is only half the journey. Whether you’re deciding between CMA vs CFA, the other half is choosing the right learning partner – and that’s where Imarticus Learning stands out.

Imarticus focuses on building real-world finance skills, not just helping you clear exams. With industry-experienced faculty and structured learning, students get practical exposure that aligns with today’s corporate expectations.

Here’s what makes Imarticus different:

- Job-oriented, practical learning approach.

- Mentors with real finance industry experience.

- Dedicated career support, including resume building and interview preparation.

- Flexible learning formats for students and working professionals.

Whether you’re planning for a CMA course, CFA, or both, Imarticus provides the structure, guidance, and career support needed to stay consistent, confident, and career-ready.

FAQs About CMA vs CFA

Deciding to choose the right professional course isn’t a piece of cake. It takes a lot of calculation and planning to analyse and reach a conclusion, especially when comparing CMA vs CFA. Here are some of the frequently asked questions people have when deciding between CFA and CMA, helping you clear doubts and make a more confident choice.

Can I do CMA and CFA together?

Yes, you can pursue CMA and CFA together, and many professionals actually do this to build a strong, versatile profile. Doing both makes sense if you’re aiming for senior roles where you want exposure to both business strategy and market-level finance. With structured guidance from institutes like Imarticus Learning, managing both becomes easier. However, strong time management is essential – so plan your exam timelines and study preparation carefully to balance both effectively.

Can CMA earn 1 lakh per month?

Well, a CMA can definitely earn ₹1 lakh per month or more, especially with the right combination of experience, industry, and role. However, for CMA professionals working in FP&A, business finance, senior corporate finance roles, or leadership positions in large companies and MNCs, there are far more career prospects than just salary.

Is CFA harder than CMA?

This is one of the most common doubts in the CMA vs CFA debate. In general, CFA is considered harder than CMA because it has three levels compared to CMA’s two parts. The syllabus is much broader and deeper. Also, the global pass rates for CFA are lower. It requires more study hours over a longer period. That said, CMA is not easy. It is more practical and application-driven, which comes with its own challenges. What feels harder depends on your strengths and learning style. Imarticus Learning can help make preparation more structured.

Is CMA useful only in India?

Absolutely not. CMA is a globally recognised credential, and it’s valued by employers in many international markets, including the USA, Canada, the Middle East, Australia, and parts of Europe. For professionals looking to work in multinational companies or in global finance/FP&A/strategy roles, CMA gives a strong, internationally relevant profile – a pathway to careers beyond just India.

Is CFA only for people who like stock markets?

No, CFA is not limited to professionals interested in the stock market. While CFA is strongly linked to investment and market-based careers, it also develops powerful skills in financial analysis, valuation, ethics, and risk management that are useful in many finance roles beyond just stock markets.

Should I choose CMA or CFA?

The right choice depends on your career goals, interests and learning style, not what everyone else is doing. Choose CFA if you’re excited by financial markets, investments, equity research, and portfolio management. Choose CMA if you’re more interested in corporate finance, business strategy, budgeting and cost control, and internal decision-making roles.

Is it worth doing both CMA and CFA?

For some candidates, yes. Only if you’re aiming for senior leadership roles, global finance careers, or high-impact strategic positions, a combination of CMA and CFA can significantly strengthen your profile. However, it also means more time, effort, and financial investment. But if you plan to pursue both certifications just for salary, it is better to consider your interests with the ROI and specialise in any one field.

CMA or CFA? The Right Choice Is Personal

By now, you’ve probably realised that choosing between CMA vs CFA isn’t really about which course is better, but which one is right for you.

CFA stands out if you’re drawn to markets, investments, and global finance. And the CMA shines if you want to shape financial strategies within companies, manage costs, make budget decisions, and be the backbone of corporate finance.

So before you choose, reflect on where you want to be in 5-10 years. Think about what excites you more: analysing markets or managing a company’s finances. Once that’s clear, you’ll know whether CMA and CFA – or perhaps even both – fit into your dream path.

Whichever route you choose, CMA or CFA, you need to commit to it fully, get a strong understanding of the syllabus, be ready for hard work, and most importantly, know why you want to do it. Because in the world of finance, clarity of purpose matters as much as knowledge.

If you’re serious about building your career in finance, the right support system can make all the difference. Confused between the CMA course and CFA? Let Imarticus Learning’s experts help you make the right choice and start your finance career with confidence.