When I look at how students usually approach the CMA exam, most of them start with books and coaching schedules. I prefer starting with the CMA Paper itself. The moment you understand how the paper is built, many decisions become automatic. Your study hours, revision style, and mock test planning begin to align better.

The CMA qualification is structured to test applied understanding rather than memory. Each CMA Paper is designed to see how concepts are used in real business settings. This design explains why simply reading theory seldom works.

A CMA question paper reflects three things clearly:

- The weight of practical application

- The importance of time management

- The balance between the breadth and depth of topics

Understanding What Is CMA and the CMA Paper Format

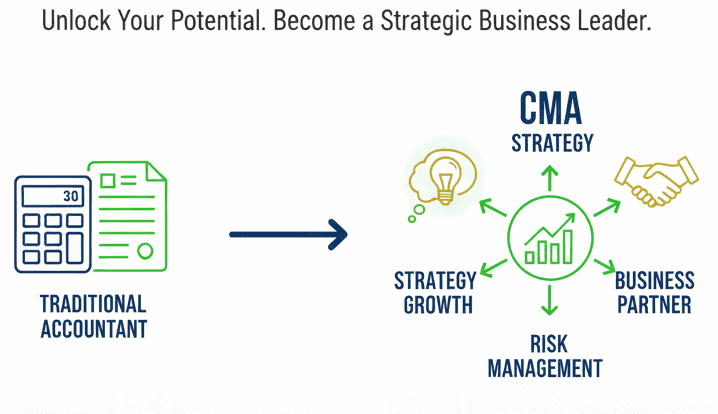

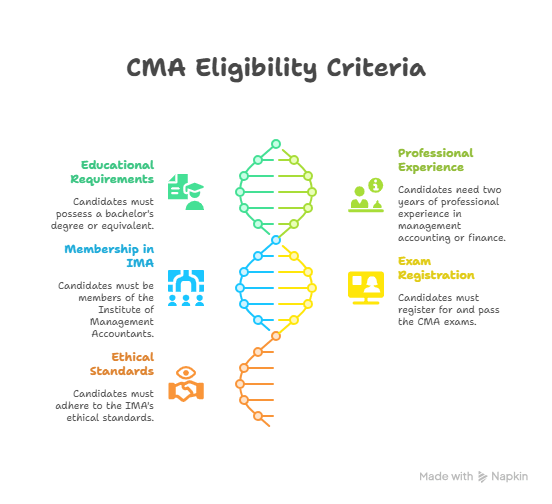

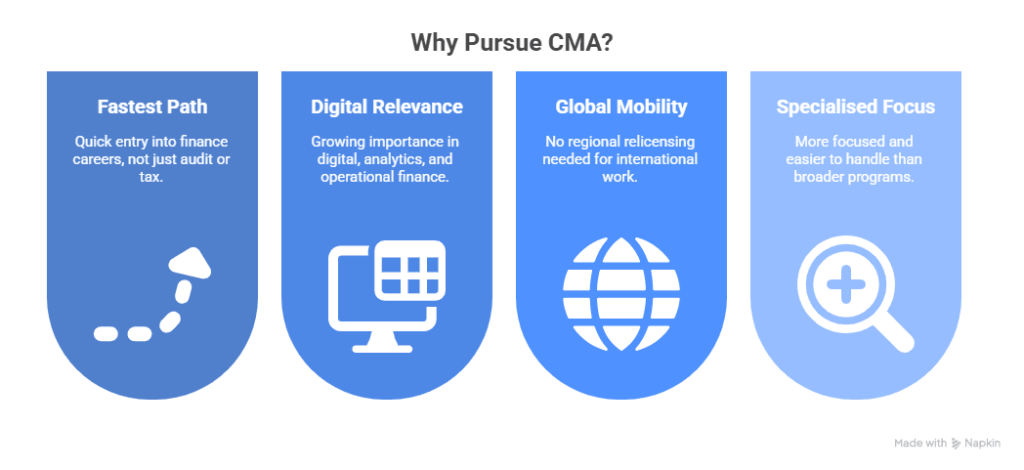

Before diving into exam patterns, pass rates, and results, it helps to pause and understand what is CMA and why the CMA Paper looks the way it does. The US Certified Management Accountant credential, offered by the IMA, is built for professionals involved in planning, analysis, and decision-making within organisations. This intent drives how the exam paper is designed and evaluated.

- What is CMA at Its Core

At its core, the US CMA course focuses on how financial information supports business decisions rather than compliance alone.

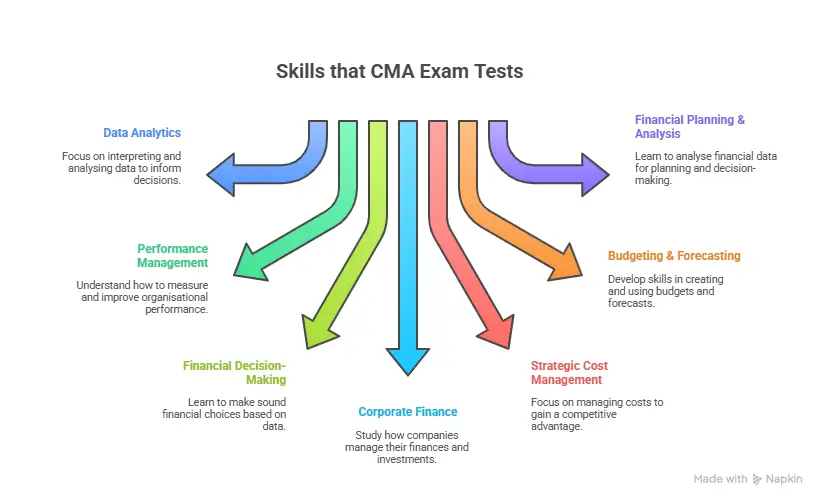

Key pillars of the CMA qualification:

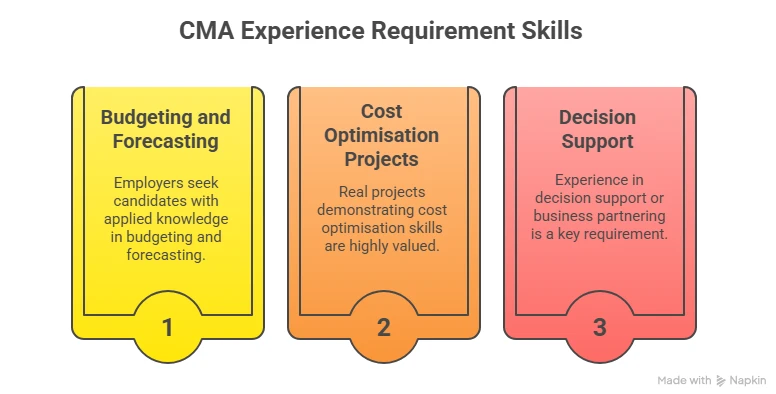

- Financial planning and budgeting

- Cost and performance management

- Financial analysis and interpretation

- Risk assessment and control systems

- Strategic and investment decision support

These areas explain why the CMA Paper tests judgment, clarity, and application instead of rote learning.

- How the US CMA Is Structured

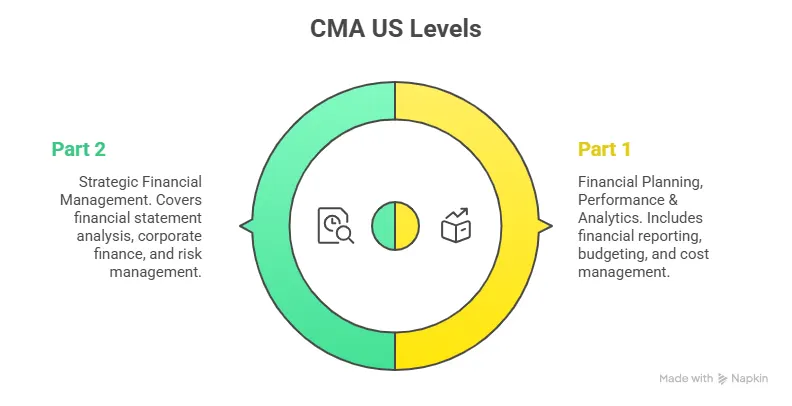

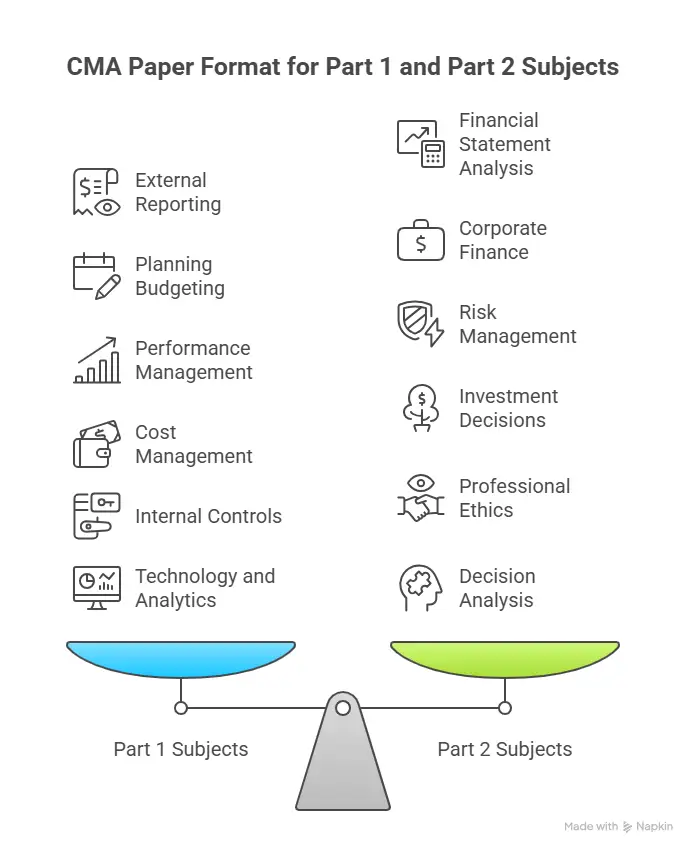

The CMA certification is divided into two exam parts, each testing a different competency set.

| CMA Exam Part | Primary Focus Areas |

| Part 1 | Financial planning, cost and performance management, and internal controls |

| Part 2 | Financial analysis, corporate finance, risk management, ethics |

Each part is assessed independently, but together they reflect how finance professionals operate across planning and strategy.

- How the CMA Paper Is Designed to Test These Skills

The CMA Paper translates these competencies into practical exam scenarios.

Common characteristics of the CMA Paper:

- Scenario-based MCQs that test reasoning

- Essay questions that require structured explanations

- Questions that combine more than one topic

- Marks awarded for logic, not just final answers

This design ensures that candidates demonstrate how concepts are used in real business situations. Here is a video that explains how this credential has set a global standard for top finance career opportunities and the value it can give to your professional endeavours:

How Many Papers in CMA and What Each Paper Covers

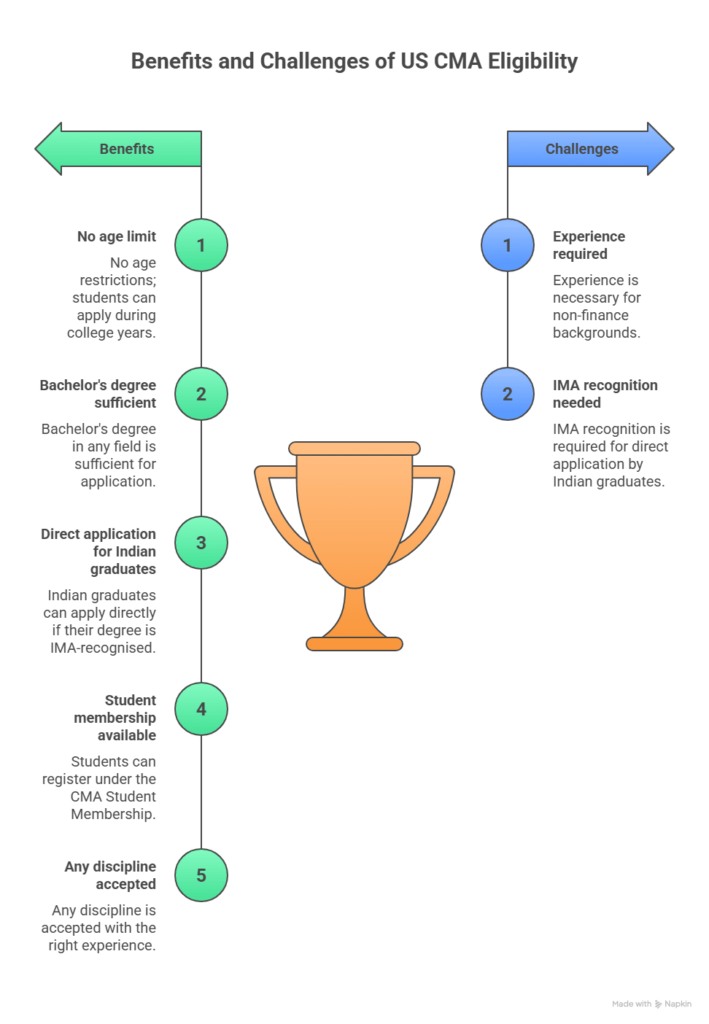

Many aspirants search for how many papers are in CMA because the number directly impacts the time and effort required. The US CMA program consists of two parts only.

CMA Paper Overview

| CMA Paper | Official Name | Core Focus Areas |

| Part 1 | Financial Planning, Performance, and Analytics | Costs, budgets, controls, data analysis |

| Part 2 | Strategic Financial Management | Corporate finance, risk, investments, ethics |

Each CMA Paper is independent. You can write either one first. There is no compulsory order. This flexibility allows professionals to plan preparation alongside work commitments.

I find this structure practical. Instead of spreading energy across many papers, candidates focus deeply on two well-defined examinations.

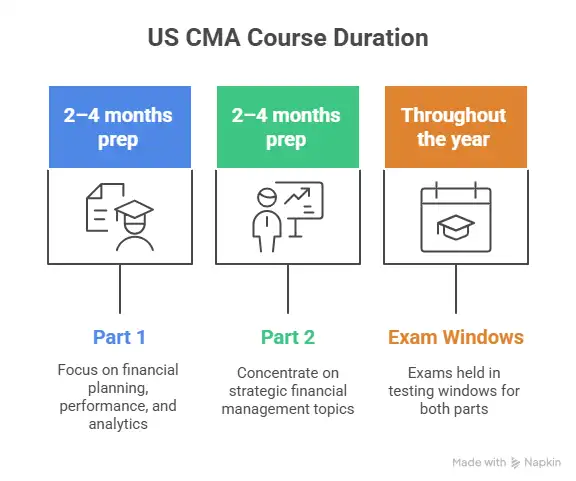

You can review the official syllabus on the IMA exam structure page. The visual below gives an overview of the subjects covered broadly in the CMA paper Part 1 and Part 2. Each of these will be discussed at length as we move forward in the blog:

CMA Paper Pattern Explained Clearly

The CMA Paper Pattern remains consistent across global testing windows. That predictability helps candidates plan precisely and reduces uncertainty.

Each CMA Paper follows the same structure:

- 100 Multiple-Choice Questions

- 2 Essay Questions with multiple scenarios

- 4 hours total exam duration

Time Distribution

| Section | Time Allocation |

| MCQs | First 3 hours |

| Essays | Final 1 hour |

An important detail is that essay questions unlock only if the minimum MCQ performance is achieved. The essays assess analysis, reasoning, and clarity of explanation, focusing on cost and management accounting. Calculations matter, but logic matters more.

Inside a CMA Question Paper

Once you know your CMA eligibility, the CMA exam pattern rarely feels theoretical. Questions often start with short business situations. A manufacturing company is facing cost overruns. A firm assessing a capital investment. A division evaluating performance metrics.

The multiple-choice questions test:

- Ability to select relevant data

- Speed and accuracy

- Conceptual clarity under time pressure

The essay section shifts the focus. Candidates must explain decisions, not just compute values. This is where communication skills quietly influence scores.

1. Part 1: Financial Planning, Performance, and Analytics

When I think of CMA Paper Part 1, I see it as the toolkit for running the numbers behind a business, day in and day out. It covers how money flows in, how it is planned, how it is controlled, and how it is analysed.

I. Costs: understanding what it really costs to run a business

In this part of the CMA paper, I work through how every cost behaves and how to use that information for decisions.

You usually see:

- Cost classification

- Direct vs indirect costs

- Fixed, variable, and mixed costs

- Product vs period costs

- Costing methods

- Absorption costing

- Variable costing

- Activity-based costing

- Standard costing and variance analysis

- Cost behaviour and CVP

- Break-even analysis

- Contribution margin

- Operating leverage

- Profit planning using sales volume and price changes

When I study this part, I focus on linking every formula to a business story. For example, I imagine a factory that wants to know how many units it must sell to recover a new machine. That makes break-even logic much easier to remember and apply.

II. Budgets: turning strategy into actionable numbers

The budgeting theme in Part 1 is about converting big goals into structured numbers for the year.

Key areas include:

- Master budget structure

- Sales budget

- Production and inventory budgets

- Direct material, labour, and overhead budgets

- Cash budget

- Budgeted income statement and balance sheet

- Types of budgets

- Static vs flexible budgets

- Zero-based budgeting

- Rolling budgets

- Forecasting for planning

- Trend analysis

- What is regression and correlation

- Using historical data to estimate future sales and costs

I like to treat a budget as a story in numbers. If sales go up, I ask myself how that will affect production, cash, staffing, and inventory, step by step. This approach helps a lot when I see a complex CMA question paper that integrates many schedules in one problem.

III. Controls: keeping the system safe and efficient

Controls in this CMA paper are about making sure things do not quietly go wrong in the background.

You typically work on:

- Internal control frameworks

- Control environment

- Risk assessment

- Control activities

- Information and communication

- Monitoring

- Internal controls for key processes

- Revenue and collections

- Purchasing and payables

- Inventory and fixed assets

- Payroll

- Fraud risk and prevention

- Types of occupational fraud

- Segregation of duties

- Approval and authorisation

- Reconciliations and audits

- Compliance and documentation

- Policy manuals

- Process flowcharts

- Control testing

When I read a question on internal control, I picture a real workflow. For example, I imagine who raises a purchase order, who approves it, who receives the goods, and who records the invoice. That mental picture makes it easier to identify where a control is missing or weak.

IV. Data analysis: turning raw data into usable insight

The analytics portion of Part 1 is where the CMA paper becomes very current. You learn how to use data to support management decisions.

Main elements:

- Analytical techniques

- Descriptive statistics like mean, median, and variance

- Trend and ratio analysis

- Sensitivity and scenario analysis

- Visualisation and dashboards

- Turning numbers into charts and dashboards

- Highlighting key variances and patterns

- Technology basics

- Spreadsheets and basic modelling

- Data governance concepts

- Understanding system-generated reports

- Using data in decision-making

- Identifying outliers

- Finding drivers behind performance

- Linking metrics to strategic objectives

I treat this part as my bridge between accounting and data. When I solve a CMA model question paper, I check if I can explain the result as a story using graphs or simple visuals in my own notes. That habit sticks and helps in real jobs where leaders expect clear, visual explanations rather than just tables.

2. Part 2: Strategic Financial Management

Part 2 of the CMA Paper moves from daily operations to higher-level decisions. It focuses on how a company raises funds, invests, manages risk, and behaves ethically. This is where you start thinking like a long-term business partner to management.

I. Corporate finance: raising and using capital wisely

In this section, I work on how a company structures its capital and evaluates long-term plans.

Key coverage:

- Time value of money

- Present value and future value

- Annuities and perpetuities

- Capital structure and cost of capital

- Dividend policy decisions

- Cash dividends, stock dividends, and repurchases

- Factors influencing payout decisions

- Working capital management

- Cash management and liquidity

- Receivables and credit policy

- Inventory policies and short-term financing

I usually link each topic to a simple business example, like a growing company deciding whether to fund expansion with a bank loan or new shares. That way, the formulas stay tied to real choices, not just abstract math.

II. Risk: identifying what can go wrong and planning for it

The risk management portion of this CMA paper builds awareness of different kinds of uncertainty and how to respond.

Main areas:

- Types of risk

- Business risk

- Financial risk

- Market, credit, and operational risk

- Risk measurement

- Standard deviation and volatility

- Value at risk basics

- Sensitivity and scenario tests

- Risk response strategies

- Avoid, reduce, transfer, or accept

- Hedging basics with forwards and options

- Insurance and diversification concepts

- Enterprise risk management ideas

- Identifying key risks across functions

- Mapping risk to controls and policies

When I work on a CMA previous year question paper, I remind myself that risk is always about uncertainty and impact. That simple idea helps me read long case-based questions more calmly, since I focus on what can go wrong and how the company plans to handle it.

III. Investments: making choices that grow value

Investment topics in Part 2 revolve around evaluating projects and financial instruments.

Core pieces:

- Capital budgeting

- Net present value

- Internal rate of return

- Payback and discounted payback

- Profitability index

- Project evaluation issues

- Inflation in cash flows

- Mutually exclusive projects

- Capital rationing

- Financial instruments basics

- Bonds, shares, and hybrid securities

- Return and risk trade-off

When I practice this part, I build a habit of structuring each problem as: initial outlay, yearly cash flows, terminal cash flow, discount rate, and decision. Once that structure is clear, most investment decision questions in any CMA question paper become much easier to tackle.

IV. Ethics: doing the right thing when no one is watching

Ethics is the backbone of the CMA credential. This portion of the CMA paper reminds me that technical skill without integrity is incomplete.

You study:

- IMA Statement of Ethical Professional Practice

- Competence

- Confidentiality

- Integrity

- Credibility

- Common ethical issues

- Pressure to manipulate earnings

- Insider information

- Conflicts of interest

- Misuse of company assets

- Ethical decision process

- Identifying the issue

- Evaluating alternative actions

- Consulting policies and guidance

- Escalating when needed

- Professional responsibilities

- Responsibility to employers and clients

- Responsibility to the profession and public

When faced with ethics questions, I read them slowly and ask one question: which option protects stakeholders and aligns with the IMA standards? That mindset usually points to the right choice even when options look similar at first glance.

Unlike many exams, the CMA Paper rewards structured thinking more than step-heavy calculations and allows you to crack the US CMA exam.

CMA Passing Marks and Scoring Logic

Understanding CMA passing marks removes unnecessary confusion about the US CMA course subjects.

Each CMA Paper is scored on a scale of 0 to 500.

The minimum passing score is 360.

This benchmark is officially stated by IMA and applies worldwide. Passing depends on scaled scoring, not raw percentages. That means difficulty adjustments are made between exam windows. A tougher exam does not disadvantage candidates unfairly.

Did You Know? IMA uses psychometric analysis to ensure score consistency across different exam versions. This process adjusts difficulty without changing passing standards.

What a CMA Model Question Paper Represents

A CMA model question paper is a simulated version of the actual CMA Paper. Its importance lies in structure, not prediction.

A good CMA model question paper helps candidates:

- Practice time allocation

- Experience question sequencing

- Identify weak cognitive areas

IMA publishes sample questions through its learning resources platform. These samples reflect question style, depth, and logic. Model papers are tools for calibration, not memorisation.

Using CMA Previous Year Question Paper Analysis the Right Way

There is a common misunderstanding about the CMA’s previous year’s question paper. Many assume repeating patterns or recycled questions. That assumption misunderstands how the US CMA exam works.

IMA does not reuse questions publicly. However, question themes and skills repeat consistently. These themes include variance analysis, risk evaluation, financial statement interpretation, and strategic trade-offs.

Studying previous year questions and solving mock papers helps in recognising:

- Common decision frameworks

- Logical traps in MCQs

- Depth of explanation expected in essays

Third-party coaching summaries often analyse recurring testing concepts rather than exact questions and give proper guidelines to prepare for the CMA exam. This analytical lens adds more value than raw reproduction.

How Difficulty Is Distributed in a CMA Paper

Every CMA Paper blends difficulty levels deliberately.

Typical distribution:

- 30% conceptual clarity questions

- 50% application-based questions

- 20% higher-order analytical scenarios

This distribution ensures candidates cannot pass by surface-level studying.

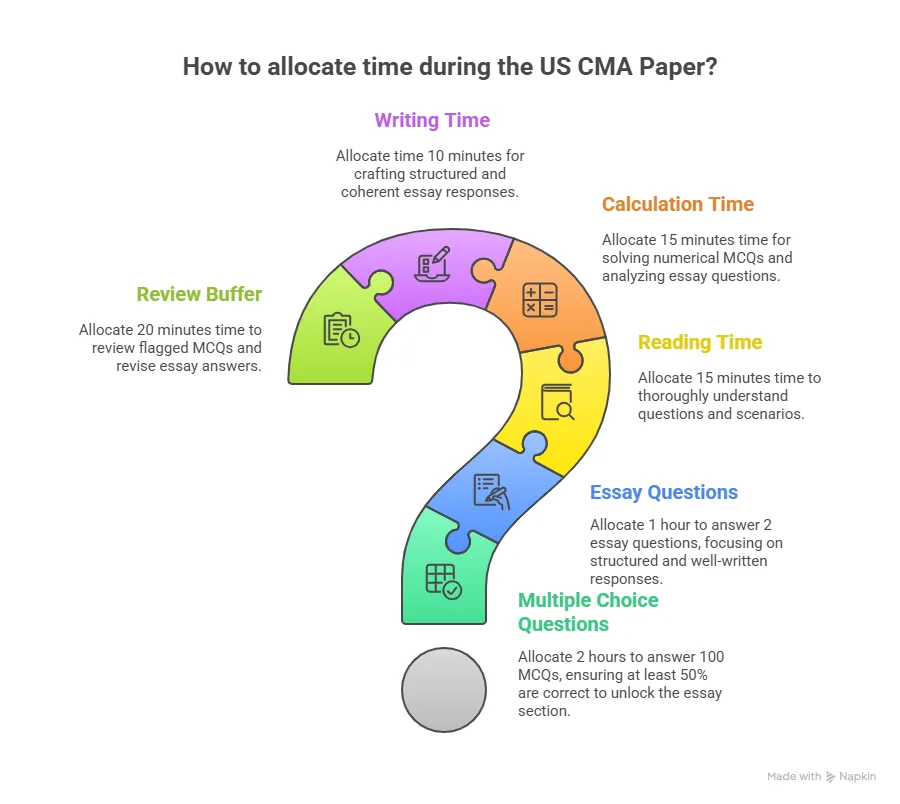

The Institute of Management Accountants confirms that essays are weighted heavily for analytical reasoning. If you want a bird’s-eye view of time allocation approaches for the CMA exam, the infographic below explains just that. You can consider this as a demo approach while preparing for the exam:

US CMA Pass Percentage Explained with Context

The US CMA pass percentage often causes anxiety when viewed without interpretation.

Global CMA pass rates usually range between 40 to 50% per paper, depending on the exam window.

This number reflects professional-level expectations, not poor candidate quality.

Why Pass Rates Stay Stable

- Questions evaluate applied understanding

- Candidates come from diverse educational backgrounds

- Time management plays a major role

The pass percentage also varies between Part 1 and Part 2. Historically, Part 2 edges slightly higher due to prior exposure to exam format. These are a few things you need to know before taking the exam.

Did You Know? Professionals with finance or accounting work experience tend to perform better in essay sections because they structure answers like real business memos.

Essay Answers and Real-World Thinking

Essay responses in a CMA Paper do not expect perfect grammar. They expect clarity.

Good answers usually demonstrate:

- Logical sequencing

- Correct use of quantitative support

- Clear recommendation aligned with data

Scoring rewards reasoning, even if calculations are partially incorrect. This evaluation style mirrors workplace decision-making.

And if you’re worried about the CMA paper being difficult, here is a quick watch for you that explains this in the simplest perspective for every candidate who is having nerves about facing the exams.

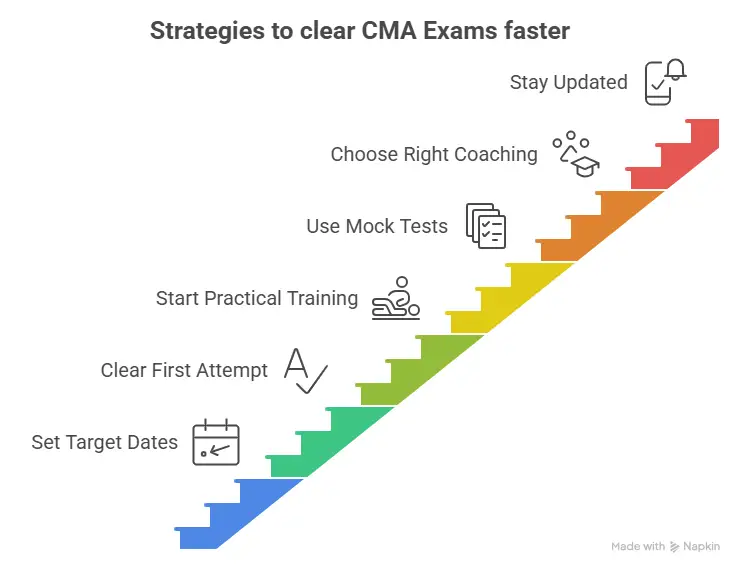

Preparation Strategy Aligned with CMA Paper Design

Because the CMA Paper evaluates applied thinking, preparation methods matter more than hours spent; you need to be aware of how to prepare yourself to be a successful CMA.

Effective preparation aligns study cycles with:

- Concept review

- Short MCQ drills

- Case-style explanation writing

Practising written justification even for MCQs builds mental patterns that transfer to essays.

Institutions like Imarticus Learning design structured preparation to mirror the real CMA Paper flow, which reduces exam-day cognitive overload.

What Happens If You Fail a CMA Paper

Failing a CMA Paper does not affect professional designation eligibility permanently.

Candidates can:

- Retake the same part

- Choose a different testing window

- Maintain progress on the other part

IMA allows unlimited retakes as long as registration validity remains active. This design reduces psychological pressure and encourages strategic retries.

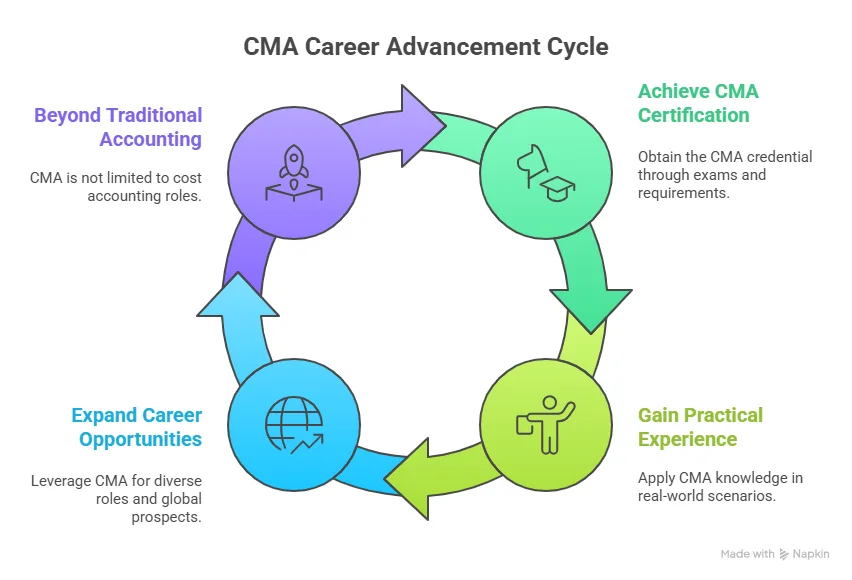

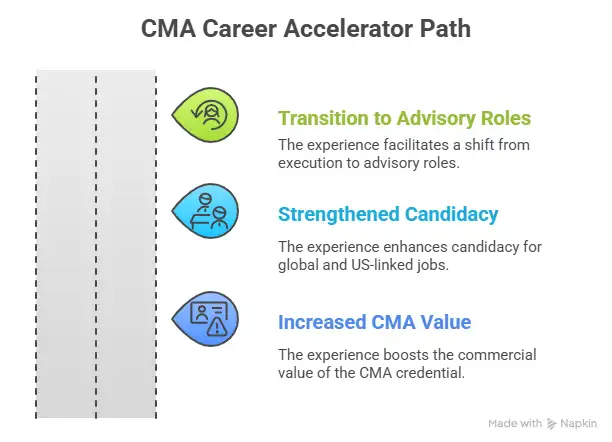

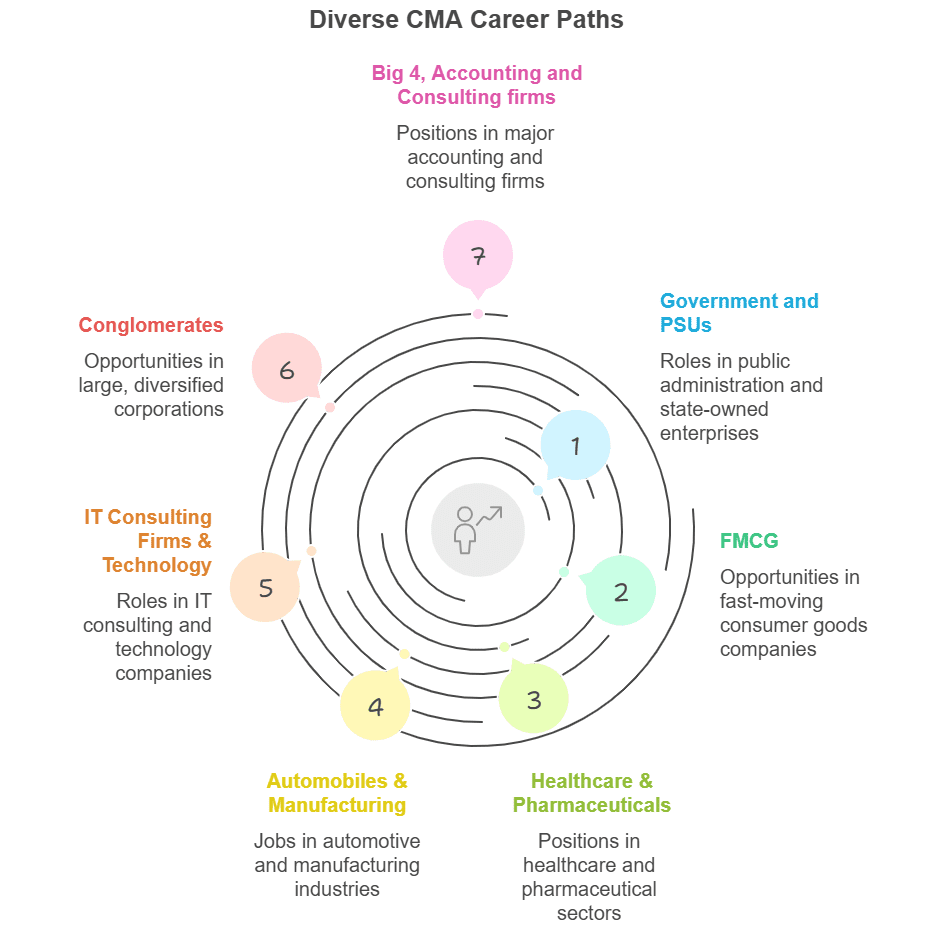

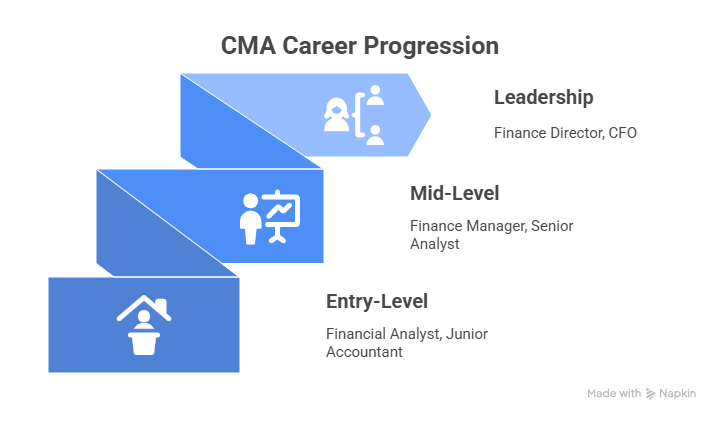

CMA Paper Performance and Career Outcomes

Employers do not review your score breakdown by section. They value the CMA credential because the CMA Paper tests decision-making skills relevant to leadership roles.

Recruiters associate CMA with:

- Cost strategy

- Performance optimisation

- Financial planning

- Risk-aware thinking

This perception explains why CMA certification aligns well with managerial finance tracks.

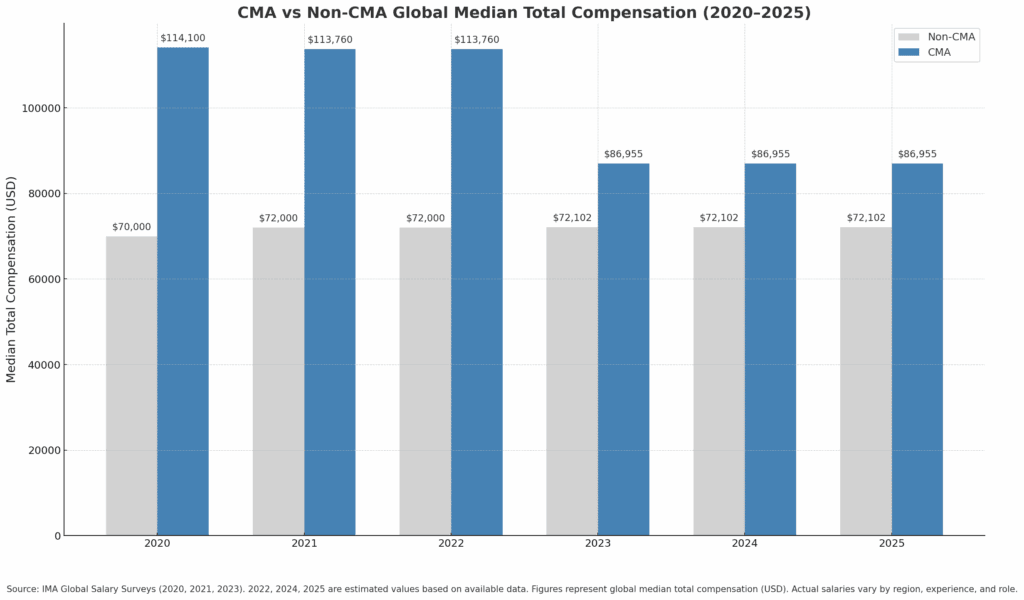

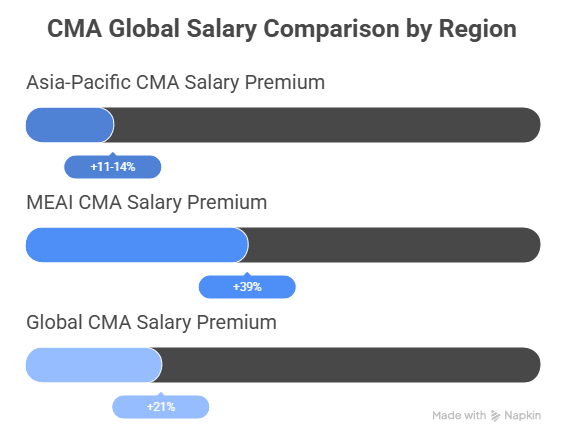

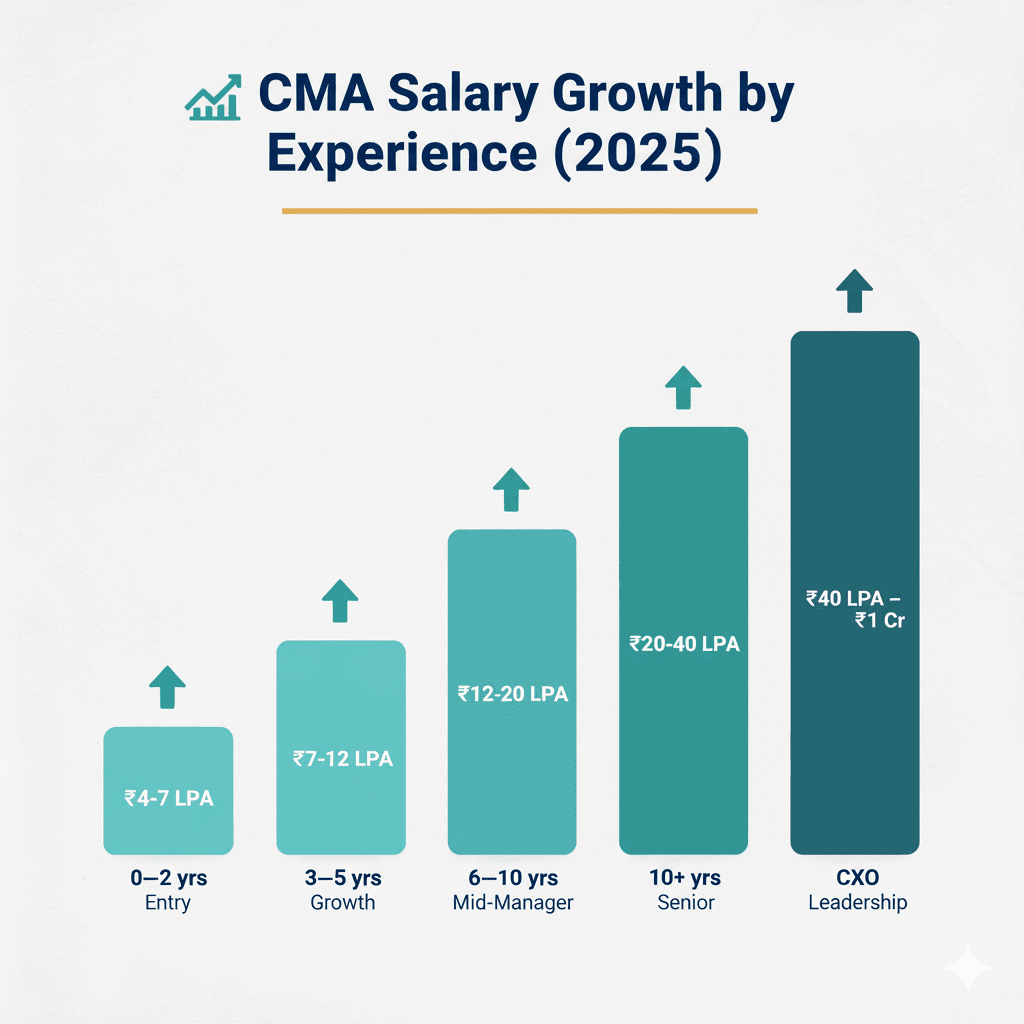

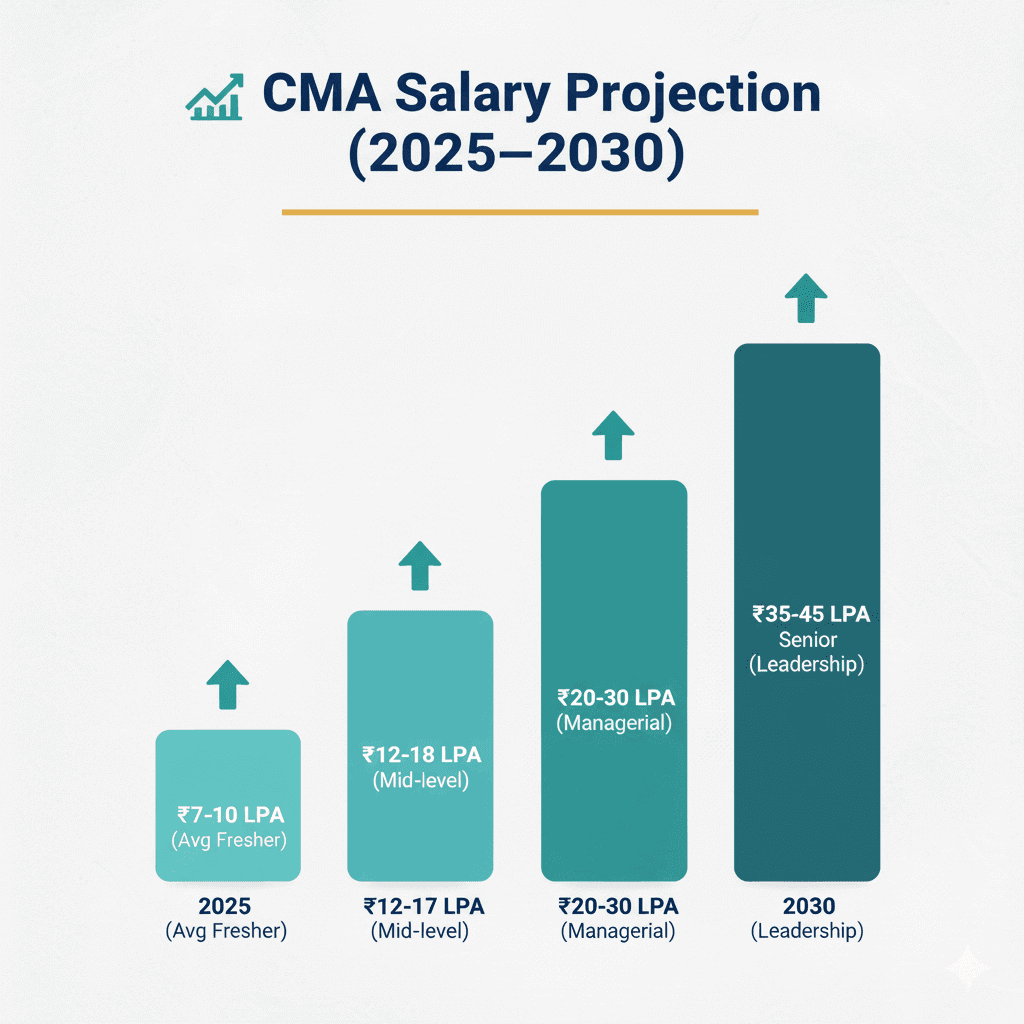

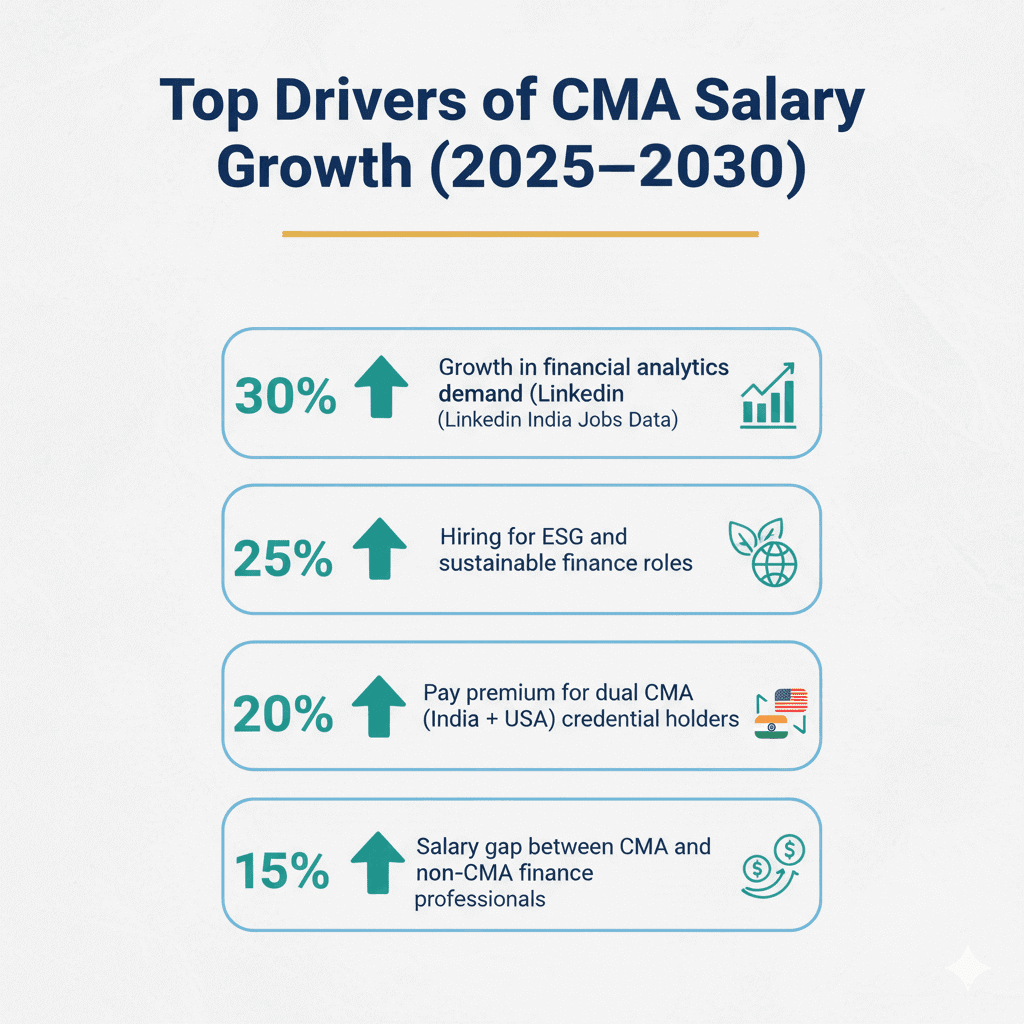

According to IMA salary surveys, CMAs earn higher median compensation than non-certified peers globally.

Timeline to Complete Both CMA Papers

Many candidates ask how many years to finish the CMA. The answer about the CMA course duration depends on the study bandwidth. Typical timelines can include:

| Study Pace | Timeframe |

| Intensive | 6–9 months |

| Balanced | 9–12 months |

| Part-time | 12–18 months |

IMA allows a three-year completion window from registration.

Costs Related to CMA Papers

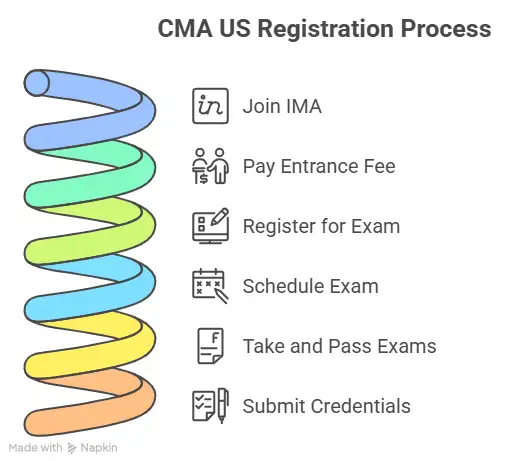

The CMA course fees involve three main components:

- Entrance fee: For Professionals- $300, and for Student/Academic Members- $225

- Exam fee per CMA Part: For Professionals- $545, and for Student/Academic Members- $407

- IMA Membership Fee: For Professionals- $295, and for Student/Academic Members- $49-160

- CMA Annual Maintenance Fee: $30

(Source- imanet)

Preparation program fees vary by provider. Structured programs reduce retake risk by aligning preparation with actual CMA Paper expectations.

Why choose Imarticus Learning for your US CMA

Preparing for the CMA Paper requires more than content access. It needs structured guidance, relevant practice, and alignment with global CMA standards. Imarticus Learning brings these elements together in a focused and outcome-oriented US CMA course.

Program credibility and recognition

- IMA Gold Learning Partner for US CMA

- Curriculum aligned with the official CMA Paper Pattern for Part 1 and Part 2

- Global relevance through direct alignment with IMA competency areas

Industry-aligned learning approach

- Program co-created with KPMG in India

- 23+ real-world business case studies, including CMA-relevant scenarios

- Emphasis on decision-making, analysis, and practical finance application

Structured preparation for CMA Papers

- Clearly defined learning path across both CMA papers

- Live instructor-led sessions with recording access

- Mock tests and practice aligned to the actual CMA question paper formats

Study resources designed for exam readiness

- Curated US CMA-specific study materials

- Practice questions reflecting the past CMA question paper depth and structure

- Focused preparation for MCQs and essay writing

Career and professional support

- Pre-placement bootcamp and soft-skills training

- Resume and profile development for finance roles

- Internship opportunities with KPMG India for eligible participants

Flexible learning formats

- Classroom and live online learning options

- On-demand access to classes, notes, and assessments

- Structure suitable for students and working professionals

Outcome-oriented program structure

- Clearly defined milestones and timelines

- Money-back guarantee model, based on program terms

- Focus on readiness before attempting each CMA Paper

Why this matters

The US CMA credential evaluates applied thinking through each CMA Paper. Imarticus Learning supports your preparation process of the CMA syllabus with global alignment, practical exposure, and structured preparation, helping you approach the exam and your career with confidence.

FAQs About CMA Paper

This section addresses the most frequently asked questions around the CMA Paper, helping candidates understand the exam structure, preparation expectations, scoring criteria, and career outcomes. It is designed to clarify practical concerns and provide concise, reliable insights for anyone planning or progressing through the US CMA journey.

What are the papers in CMA?

The CMA Paper structure consists of two separate exam papers known as Part 1 and Part 2. Each CMA Paper tests different professional competencies under the US CMA framework. Understanding both CMA Papers allows candidates to approach preparation systematically and align study plans with exam expectations.

Is the CMA exam easy?

The CMA Paper is designed to be practical rather than easy. Difficulty depends on familiarity with applied financial decision-making. Candidates who understand the CMA Paper logic and prepare strategically often describe it as manageable rather than overwhelming.

Can I self-study for CMA?

Self-study for the CMA Paper is possible using official resources and disciplined planning. However, many candidates prefer structured learning environments such as Imarticus Learning to maintain consistency with the CMA Paper Pattern and exam depth.

Can I pass the CMA on the first attempt?

Passing each CMA Paper on the first attempt is achievable with focused preparation. Understanding scoring logic, essay expectations, and realistic practice improves first-attempt success probability significantly.

What are the disadvantages of CMA?

The CMA Paper requires strong time management and conceptual clarity. Candidates unprepared for applied reasoning may find adaptation challenging. These demands reflect the professional standard of the certification.

How many CMAs pass every year?

Thousands of candidates worldwide pass at least one CMA Paper each year, with global numbers fluctuating based on exam windows and attempts. The Institute of Management Accountants reports consistent completion trends that broadly align with the published US CMA pass percentage across Part 1 and Part 2. Candidates who follow structured preparation pathways with Imarticus Learning often navigate the exam process more efficiently by aligning their study approach closely with the CMA Paper Pattern.

How many years to finish CMA?

The CMA Paper framework allows candidates to complete both papers within three years from the date of registration with IMA. Many candidates finish earlier based on their study pace, exam scheduling, and preparation strategy. Imarticus Learning helps streamline preparation across both CMA papers, enabling candidates to plan attempts efficiently and complete the certification well within the allowed timeframe.

What happens if you fail the CMA exam?

Failing a CMA Paper does not stop your progress or reset your eligibility. You can retake the failed CMA exam part in a future testing window while retaining credit for any paper you have already passed. Most candidates use this as an opportunity to refine their preparation and improve their exam strategy. Structured support from Imarticus Learning helps candidates reassess weak areas, strengthen alignment with the CMA Paper Pattern, and approach the retake with greater clarity and confidence.

What is the CMA entrance fee?

The CMA entrance fee is a one-time registration charge required to formally enrol in the US CMA program before scheduling any CMA exam. As per the Institute of Management Accountants (IMA), the entrance fee is $300 for professional members and $225 for student or academic members. This fee covers administrative setup and eligibility and must be paid in addition to exam fees before booking a CMA Paper.

Is it easy to get a job after CMA?

Employers value CMA Paper outcomes for roles involving planning, analysis, and strategic finance. Career outcomes improve further when certification is paired with relevant experience or structured learning from providers like Imarticus Learning.

Bringing the CMA Paper into Clear Focus

By the end of this guide, the CMA Paper usually gets far less abstract than it did at the start. The exam is no longer just a set of subjects or dates on a calendar. It becomes a structured assessment with clear patterns, predictable evaluation rules, and a strong link between preparation style and outcomes. When the exam pattern, passing rules, time expectations, and historical paper behaviour are understood together, preparation naturally becomes more organised and less reactive.

Regular exposure to question papers, attention to presentation, and an understanding of scoring logic quietly shape better performance over time. These habits reduce uncertainty and help candidates walk into the exam with a clear plan rather than last-minute guesses.

For those who prefer a more structured learning environment, guided preparation can make this alignment easier to maintain. Programs that integrate syllabus coverage with paper-based practice and continuous evaluation help convert effort into results more consistently. The CMA Course prep with Imarticus Learning follows this exam-centric approach, designed to keep preparation closely connected to how the CMA Paper actually works.