Cloud computing and analysis are the buzzwords these days. Businesses have seen its appeal and are moving to this side pretty fast. Another sector that has readily adapted to the changes made by cloud computing is fintech. It helps to store and process data quickly and more easily. Not just this, using and analyzing data has also become easier due to its in-memory computing.

Notably, fintech is a sector that has amazing job opportunities for people who are looking to stabilize their careers properly. The jobs can be demanding and there is little leeway to err. But, they are high-paying and as long as you have good training, you will ace your career in no time. This is why it is an excellent time to do a fintech training course for students all around.

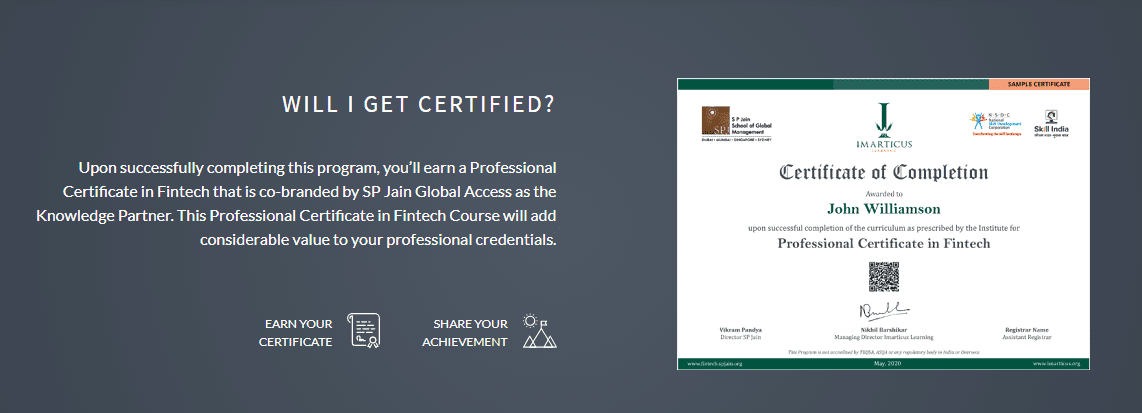

Lots of institutions provide a good course with fintech certification in India. And, Imarticus Learnings is one among them that you should definitely check out. The Imarticus cloud computing course along with fintech training courses will give you the required boost needed for career growth. Here, we are going to talk about how cloud computing is reinventing the fintech sector and how it affects everyone wanting to land a job in the domain later on. Please go through the whole article to learn more.

Impact of Cloud Computing in Fintech

Cloud computing uses remote servers on the internet to store, manage and process data instead of using a local one. Lots of cloud services (storage, networking, database, and servers) are used during this process. There are numerous benefits of cloud computing, and finance companies, as well as banks, are taking full advantage of it. It helps with the interoperability, 24×7 upkeep, and secure storage all without any extra investment. It also helps finance companies to lessen their compliance and operational costs. As the process is pretty fast, it makes it easier to process and cater to the customers’ demands.

Benefits of Cloud Computing

As we have already stated, there are numerous benefits of cloud computing in the fintech sector. Here is a detailed list of the major factors behind its increasing popularity:

- Faster data processing: As fintech is a sector that has to deal with a vast amount of data regularly, the impact of cloud computing here is the most effective. The process gets securer and also helps businesses to approach lending, frauds, and even payments in a better way.

- Lower operational cost: On-site data storage is an expensive process. Thanks to cloud computing, businesses now can store data more safely without any extra cost.

- Automated analysis: With advanced ML, data science, and AI, nowadays analyzing, fraud detection, credit scoring, and other banking processes get done smoothly and without the risk of human error.

- It also helps businesses maintain continuity for longer terms without the threats of hacking. And, along with business continuity comes higher levels of business efficiency, resulting in better client satisfaction.

Fintech training courses can help you land your dream job in a short time. Imarticus Learnings is one of the leading institutions offering a solid cloud computing course and fintech training course. So, do check them out and gear up for an excellent journey ahead.

FinTech provides its users with an ability to perform all their important financial operations through their smart-phones or computers and these are processed in a matter of seconds.

FinTech provides its users with an ability to perform all their important financial operations through their smart-phones or computers and these are processed in a matter of seconds.

Enterprise Ethereum Alliance (EEA) is a support group formed by more than 200 market leaders such as Microsoft, Wipro, Intel, Accenture, JP Morgan, Thomson Reuters, Credit Suisse along with many start-ups and subject matter experts. They are all bound by a common factor; all of them believe in the potential of blockchain.

Enterprise Ethereum Alliance (EEA) is a support group formed by more than 200 market leaders such as Microsoft, Wipro, Intel, Accenture, JP Morgan, Thomson Reuters, Credit Suisse along with many start-ups and subject matter experts. They are all bound by a common factor; all of them believe in the potential of blockchain.