Let us assume that we are opening a bakery. The entire town (let us say 10,000 people) represents the Total Addressable Market (TAM) for our delicious pastries. That is the total number of people who could potentially buy our croissants.

However, not everyone will be our customers. Some might prefer doughnuts, others might have dietary restrictions and some might just live too far away. This is where the Serviceable Available Market (SAM) comes in. It is the portion of the TAM that you can realistically reach with your offerings.

Finally, within our SAM, there is the Serviceable Obtainable Market (SOM). This is the slice of the pie we can realistically capture. It considers factors like competition, marketing budget, and our ability to convert potential customers into loyal patrons.

Market Sizing with Total Addressable Market

It is extremely crucial to understand the market size as that is the foundation of a business. Knowing the TAM helps a business in these ways:

- Project revenue potential: A larger Total Addressable Market suggests a bigger potential customer base and higher revenue possibilities.

- Allocate resources effectively: For example, if the TAM for gluten-free pastries is smaller, you might not invest as heavily in marketing them compared to your classic pastries.

- Make informed investment decisions: Investors often look at TAM to assess the potential growth of a business.

Limitations of Total Addressable Market

While TAM is valuable, it has limitations. Here is why relying solely on TAM can be misleading:

- Disruptive Innovations: Let us assume that you have invented a teleportation device. The TAM for traditional transportation (cars, aeroplanes) would not reflect the entirely new market you are creating.

- Future Focus: TAM is a snapshot of the current market. It might miss out on emerging trends and the potential for future market growth.

Validating the Total Addressable Market

Do not just take the Total Addressable Market number at face value. Here is how to strengthen your TAM analysis:

- Customer Discovery: Talk to potential customers, understand their needs, and see if your product truly solves a problem for them.

- Market Research: Analyse existing market trends, competitor strategies, and the overall market landscape to refine your Total Addressable Market estimate.

By combining Total Addressable Market with customer insights and market research, we can paint a more accurate picture of a product’s market potential and set any business up for success.

A Step-by-Step Breakdown of TAM

Here is a breakdown of the Total Addressable Market formula and how to use it effectively:

The core total addressable market calculation is,

TAM = ARPU * Total Potential Customers

In the above total addressable market calculation:

- ARPU (Average Revenue Per User): This represents the average amount of revenue generated from a single customer within a specific period (usually monthly or annually).

- Total Potential Customers: This signifies the total number of individuals or businesses that could potentially use your product or service.

Example: Let us say you run a fitness app with a monthly subscription fee of $10. If your research suggests there are 1 million people interested in mobile fitness solutions, your TAM would be:

TAM = $10/month * 1,000,000 people = $10,000,000 per month

For niche markets with limited ARPU data, alternative methods exist:

- Market Penetration Rate: Multiply the total addressable market of a broader category by the estimated percentage your product can capture within that category.

- Bottom-Up Approach: Identify customer segments within your TAM and estimate ARPU for each segment.

We should always remember that reliable data sources are crucial. Use industry reports, market research, and competitor analysis to support your assumptions when calculating TAM. A well-informed Total Addressable Market estimate is a valuable tool, but not a crystal ball.

TAM: A Multifaceted Tool for Strategic Advantage

TAM’s power extends far beyond simply gauging market size. Here is how it fuels strategic decision-making:

- Investment Decisions: Venture capitalists use TAM to identify markets with high growth potential. A large TAM with a proven track record of customer spending signals a potentially lucrative space for investment.

- Product Development: TAM guides product prioritisation. If one feature caters to a larger segment within the TAM compared to another, it might take precedence in development based on its potential revenue stream.

- Marketing and Sales Strategies: TAM helps define target markets within the overall pool. By segmenting the TAM based on demographics or needs, companies can tailor their marketing messages and allocate resources efficiently to maximise market penetration.

Beyond market sizing, TAM fuels strategies for market dominance within a specific segment. Here is how:

- TAM Share: This metric represents the percentage of the TAM a company captures. Companies can develop strategies to increase their TAM share, like expanding their product offerings or targeting new customer segments within the existing TAM.

- Market Opportunity Analysis (MOA): This analysis builds upon TAM by factoring in competition and market dynamics. By understanding competitor strategies and market growth rates, businesses can refine their TAM estimates and identify opportunities for differentiation within the market.

By wielding TAM alongside MOA, companies gain a holistic view of the market landscape and can craft targeted strategies to carve out a dominant position within their chosen TAM segment.

Real-World Examples of Total Addressable Market in Action

Total Addressable Market is not just a theoretical concept. Here is how companies leverage it in the real world:

Success Story, Uber’s TAM Takeover: Initially, Uber focused on the taxi market (limited TAM). Recognising the broader TAM for on-demand transportation, they expanded to ride-sharing, capturing a much larger market share.

Missed Opportunity? Kodak and the Digital Shift: Kodak dominated the film photography market (large TAM). However, they underestimated the TAM for digital photography, leading to their decline.

Disruption and TAM, Airbnb’s Hospitality Revolution: Airbnb disrupted the hotel industry by creating a new market for shared accommodations. Traditional Total Addressable Market calculations would not have captured this entirely new market segment Airbnb unlocked.

TAM and Emerging Tech, The Self-Driving Revolution: The TAM for self-driving cars is difficult to estimate due to the nascent technology. However, understanding the potential impact on transportation, logistics, and urban planning is crucial for companies positioning themselves in this disruptive market.

The above examples showcase the power and limitations of TAM. While it provides valuable insights, staying attuned to disruptive innovations and conducting thorough market research alongside TAM analysis is key to making informed strategic decisions and navigating the ever-evolving market landscape. If you wish to learn financial analysis and other essential concepts such as TAM, you should enrol in a solid financial analyst course.

Beyond TAM

TAM paints a broad picture, but businesses need a sharper focus. Here is how we delve deeper:

Customer Segmentation: A large TAM does not guarantee success. Segmenting the TAM based on demographics (age, income), needs (business vs. personal use), and buying behaviours allows for targeted marketing and product development.

TAM Fragmentation: A large TAM can be deceiving. It might be composed of numerous smaller segments with vastly different needs. For example, the fitness app TAM might include segments interested in weight loss, muscle building, or general health, each requiring tailored features.

Market dynamics are ever-changing. Here is why considering market growth is crucial:

- Market Growth Rates: A TAM with a high growth rate suggests a more promising market compared to a stagnant one. Understanding growth rates helps businesses prioritise resources and plan for future market expansion.

- TAM Evolution: The TAM itself can evolve over time. New technologies, regulations, and consumer behaviour can affect the market size. Regularly revisiting TAM estimates ensures businesses adapt their strategies to a changing landscape.

TAM alone does not tell the whole story. Here is why understanding your competitors is key:

- Competitive Analysis: Knowing your competitors’ market share within the TAM helps assess your own potential for growth. Analysing their strengths and weaknesses can inform your differentiation strategies.

- Disruption Potential: Emerging technologies or innovative business models can disrupt existing markets, rapidly shrinking or expanding the TAM. Staying informed about potential disruptions helps businesses prepare and adapt.

By considering customer segmentation, market growth, and competitive dynamics alongside TAM, businesses can gain a comprehensive understanding of their market and make informed decisions that lead to long-term success.

Wrapping Up

TAM equips businesses with a powerful tool to assess product/service potential. It provides valuable insights into market size and potential revenue streams. However, the Total Addressable Market is just one piece of the puzzle. Remember, successful market evaluation requires considering customer segmentation, market growth, and the competitive landscape. By wielding TAM alongside these factors, businesses can make strategic decisions that unlock the true potential of their offerings and navigate the ever-evolving market landscape with confidence.

If you want a career in financial analysis, you can enrol in Imarticus Learning’s Financial Analysis Prodegree in Collaboration with KPMG. This is a comprehensive financial analyst course that will teach you everything you need to know about financial analysis.

Frequently Asked Questions

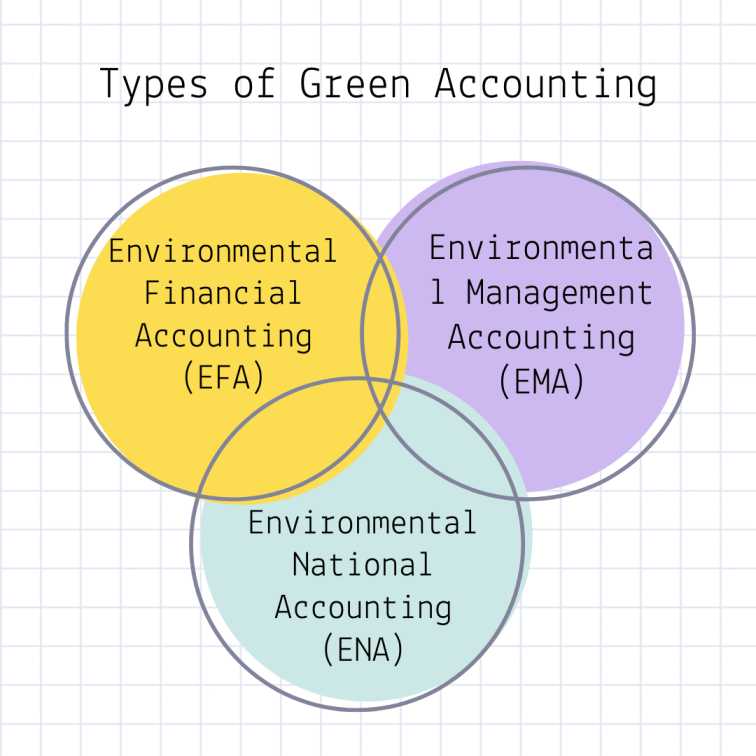

What is total addressable market? What is the difference between TAM, SAM, and SOM?

TAM (Total Addressable Market) is the entire pool of potential customers. SAM (Serviceable Available Market) is the portion of TAM you can realistically reach. SOM (Serviceable Obtainable Market) is the part of SAM you can capture with your resources and strategies.

Is not TAM just a basic market size metric?

Total Addressable Market goes beyond just size. It helps with investment decisions, product development, and marketing strategies by showing the potential revenue a market holds.

Can TAM be misleading?

Yes, for disruptive innovations that create entirely new markets, the Total Addressable Market might underestimate the true potential. It is also a snapshot in time and does not account for future market changes.

How can I improve my TAM analysis?

Segment your TAM based on customer needs. Consider market growth rates and how the TAM itself might evolve. Do not forget to factor in competitor analysis to understand the competitive landscape within your TAM.