What is Fintech?

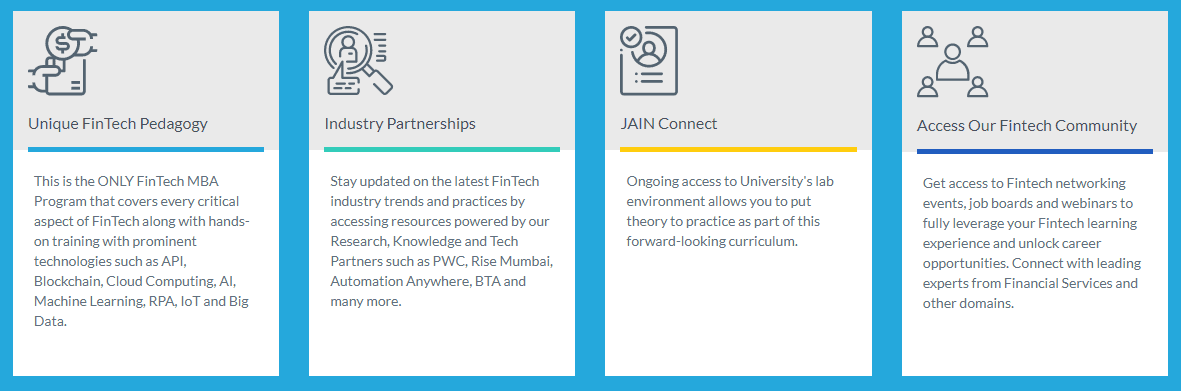

In today’s world of modern advancements, technology has paved its way to reach out to the most fundamental aspect of any industry that is finance. The clubbing of technology with finance aims to modify the traditional ways of providing financial services. This idea has recently come to the forefront which has challenged the classic methods of financial services across the globe.

Fintech has brought about some notable changes in fields like investment, banking, trading, and insurance as of now. It has transformed the very essence of traditional ways of doing these things.

Impact of fintech on finance

So far, fintech has been able to grip some of the major areas of financial services which have turned out to be in the favor of the users. Some of the impacts of fintech on finance are discussed in the following points.

- Banking

Unlike the traditional banking methods, where people used to visit the banks even to check their account balance, fintech has facilitated the users by providing almost all the banking facilities online.

Apart from the existing banks, fintech training has made available ample other banking solutions for the users which work more efficiently and provide better services as compared to the classic banking structure.

Apart from the existing banks, fintech training has made available ample other banking solutions for the users which work more efficiently and provide better services as compared to the classic banking structure.

- Investment

It is only just a few years ago, that investment was considered a choice fit for the rich class only. With everything at your fingertips, from small to huge investment options available through fintech, anyone can invest online according to their budget. Nowadays, investment in e-commerce has turned out to be a popular option for many investors.

- Small Entrepreneurs

Fintech has proven to be the most beneficial sector for the betterment of small entrepreneurs who were struggling hard to make their place in the market. From securing loans to managing the payments, everything has been eased through fintech. The development of various secured payment portals like PayPal has brought down the transaction costs for both the buyer and seller.

- Currency

With the advent of technology, the usage of digital currency has surpassed the usage of currency notes. Considering the current trends, it can be anticipated that soon the concept of physical currency may become outdated and digital currency will be the only mode of payment.

In present times of global pandemic, many companies and organizations have stopped transacting in physical currency. This twin motive of containing the virus spread along with the emphasis on the digital currency has been working out pretty well.

Overview

Considering the current status of fintech, it can be apprehended that this amalgamation is truly functioning in the best interest of the users. With financial services being provided online, the world has become a global hub. This collaboration of both finance and technology can be marked as a milestone in the process of formulating a world that knows no boundaries.

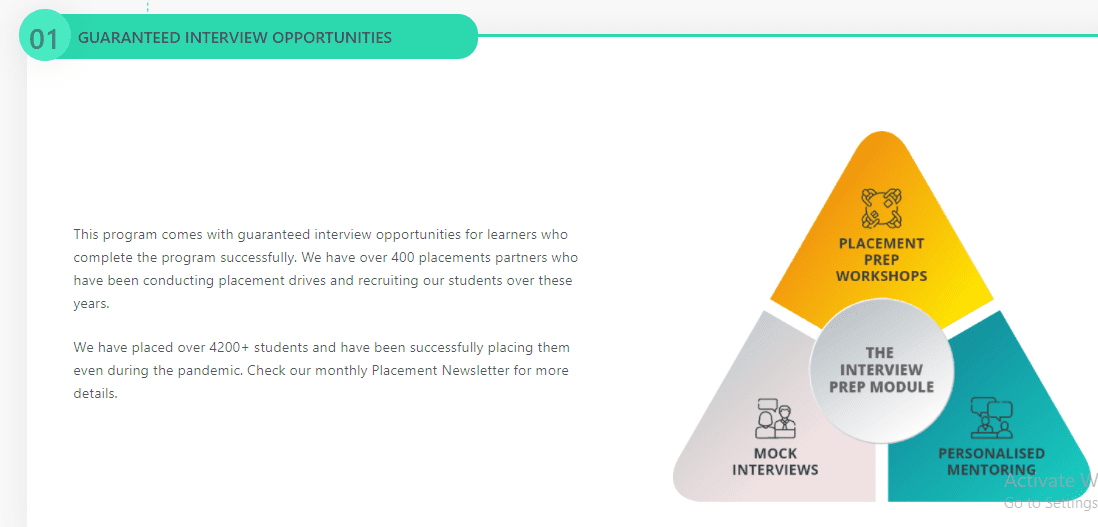

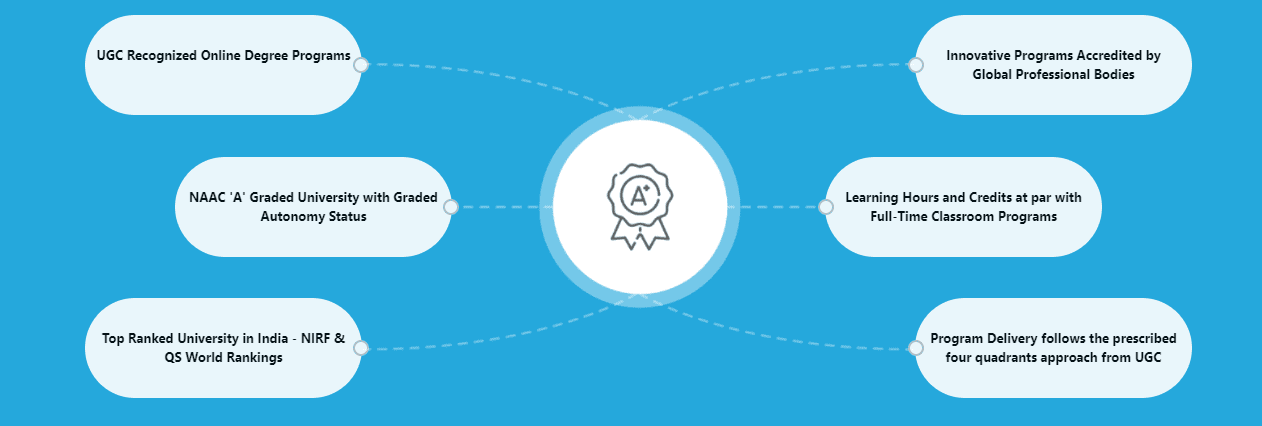

For a stable fintech career, there are a variety of options if you want to take up the best fintech course in India available at Imarticus. Students of this course will also be assisted for the placement in renowned companies from all over the globe.

Along with that, graduates aspiring to work as product managers in renowned companies can take up a

Along with that, graduates aspiring to work as product managers in renowned companies can take up a

If you want to know more about cryptocurrency and finance, enroll in one of our

If you want to know more about cryptocurrency and finance, enroll in one of our

By and large, affiliate marketing is one of the most robust marketing methods. If you want to become an expert in this field, we recommend joining a digital marketing institute. And, you can join a digital marketing institute here.

By and large, affiliate marketing is one of the most robust marketing methods. If you want to become an expert in this field, we recommend joining a digital marketing institute. And, you can join a digital marketing institute here. A

A  If you are confused about what to learn in finance, get guidance at Imarticus Learning. We offer a range of Financial Analysis courses, including MBA and

If you are confused about what to learn in finance, get guidance at Imarticus Learning. We offer a range of Financial Analysis courses, including MBA and

Learning how to efficiently analyze large sets of data can help make you stand out from other applicants who might have an impressive resume but lack experience with big data tools like Excel and R programming language.

Learning how to efficiently analyze large sets of data can help make you stand out from other applicants who might have an impressive resume but lack experience with big data tools like Excel and R programming language. Furthermore, it can help you by providing reports on the time spent on each campaign or task that will enable you to measure how much effort is put into work. Thus, learning how to utilize

Furthermore, it can help you by providing reports on the time spent on each campaign or task that will enable you to measure how much effort is put into work. Thus, learning how to utilize  The curriculum includes a range of topics, from basic statistics and probability theory to advanced machine learning techniques. You can learn data analytics online at your own pace, so there’s no need to put off enrolling until you have more time or money!

The curriculum includes a range of topics, from basic statistics and probability theory to advanced machine learning techniques. You can learn data analytics online at your own pace, so there’s no need to put off enrolling until you have more time or money!

This article will help you find the answer to this question and more. The following points will cover advanced analytics, its relationship with financial analysis, and how to

This article will help you find the answer to this question and more. The following points will cover advanced analytics, its relationship with financial analysis, and how to

A key highlight of this MBA program is it allows you to get an

A key highlight of this MBA program is it allows you to get an

However, in the current time, when there is a contagious virus spreading globally, it would be best to join a data science online course. That is because an

However, in the current time, when there is a contagious virus spreading globally, it would be best to join a data science online course. That is because an