If you’re searching for the CFA Institute, chances are you’re serious about building a career in global finance – not just landing a job, but growing in roles that truly matter. Maybe you’re fresh out of college, or perhaps juggling a job and dreaming bigger. You’ve heard that the CFA charter opens doors in equity research, investment banking, asset management – and gives you a global passport to opportunity.

But here’s the truth: the CFA journey is not a walk in the park.

The syllabus is vast, demanding and heavy on concepts. The average candidate studies hundreds of hours per level, and success demands more than memory – it requires clarity, commitment, and the right mentorship.

That’s why choosing the right CFA Institute matters so much. What really shapes your success is the institute you pick: how they break down complex topics, how they guide you through ethics and valuation, and how they help you build consistency across multiple levels rather than just cramming at the last minute.

In this blog, I’m going to walk you through how to spot the best institute for CFA, what distinguishes a reliable certified financial analyst institute, and why aligning with the standards can make a difference – not just for clearing exams, but for building an international-ready finance career. Think of this as your roadmap: this is where your decision-making should begin.

What the CFA Institute Does and What It Doesn’t

Students often keep asking me what is CFA and why it carries so much weight.

The CFA Course, issued by the CFA Institute USA, is considered one of the most respected qualifications in investment management. It focuses on practical skills – analysing companies, valuing assets, managing portfolios, and making ethical financial decisions.

The CFA journey is spread across three levels, each getting progressively tougher. It starts with core financial concepts, moves into valuation, and ends with portfolio and wealth management. It’s demanding, but that rigour is exactly why the CFA charter is recognised and trusted worldwide.

And that’s also why choosing the right CFA preparation institute makes a real difference.

While the CFA Institute provides the curriculum and conducts the exams, it does not offer coaching. Without structured guidance, many candidates struggle to interpret the vast, concept-heavy syllabus – especially in subjects like Financial Reporting, Ethics, Derivatives, and Portfolio Management.

Did you know? About 60% of CFA holders work in Equity Research. Since the role centres on analysing companies and markets, the CFA is widely seen as the gold standard and is often expected for senior positions.

Why Structured Guidance Matters for CFA Success

Passing the CFA exams requires far more than intelligence. It demands long-term discipline, a clear study strategy, and consistent execution across all three levels. On average, candidates spend over 300 hours per level, yet pass rates remain historically below 45%. This is exactly why choosing the best institute for CFA is not a luxury – it’s a necessity.

A quality certified financial analyst institute bridges the gap between CFA Institute textbooks and real exam success by:

- Breaking the CFA curriculum into manageable study plans.

- Offering structured CFA lectures aligned with exam weightage.

- Explaining concepts using real-world financial examples.

- Reinforcing ethics as per the Institute standards.

- Supporting candidates with mock exams, revisions, and doubt-clearing sessions.

In short, structured guidance transforms effort into outcomes, helping candidates stay consistent and confident throughout the CFA journey. A clear understanding of CFA course details is essential before deciding on an institute.

Understanding the CFA Program by CFA Institute

Before deciding on the best institute for CFA, it’s important to understand how the CFA Program itself is structured by the CFA Institute.

| CFA Level | Focus Area | CFA Institute Objective |

| Level 1 | Foundations | Financial concepts & ethics |

| Level 2 | Valuation | Asset analysis & application |

| Level 3 | Portfolio Management | Decision-making & wealth planning |

Each level builds progressively, and the CFA certification ensures that ethical reasoning is integrated across all three levels and not treated as a standalone subject.

Another important factor to understand early is the CFA course fees. The CFA Institute charges a one-time enrolment fee along with exam registration fees, which usually depend on how early you sign up. As the journey spans three levels, the total cost can add up over time. Having clarity on the fee structure helps you plan better and choose an institute that fits your budget realistically.

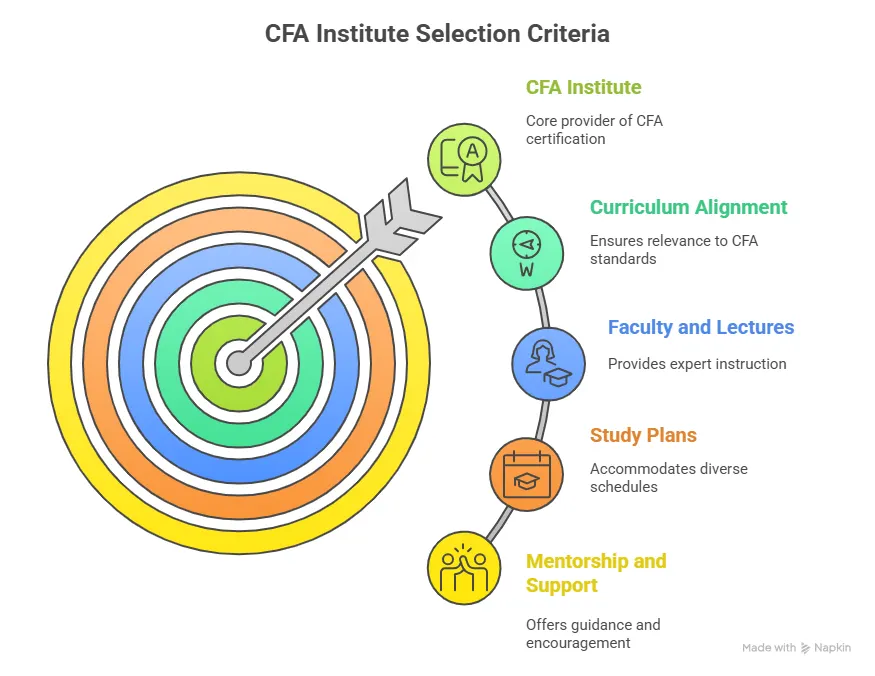

Key Criteria to Identify the Best Institute for CFA

Let’s break down the most important factors to consider when evaluating a CFA best institute for your preparation. Having a clear view of how the CFA levels build on one another can help you judge whether an institute’s teaching approach truly prepares you for long-term success.

1. Alignment With CFA Institute Curriculum

The best institute for CFA strictly follows the learning outcomes and modules published by the official Institute. Beware of coaching providers who promise shortcuts or exam hacks without building conceptual depth.

The best institute for CFA offers a study program that ensures:

- Curriculum coverage exactly as prescribed by the CFA Course.

- Regular updates when syllabus changes occur.

- Ethical standards are integrated across all subjects.

2. Quality of CFA Lectures and Faculty

One of the most critical aspects of CFA preparation is CFA lectures. High-quality lectures should do more than read slides – they should explain, contextualise, and challenge students.

When evaluating a certified financial analyst institute, check for:

- Faculty with CFA charterholder status.

- Industry experience in asset management or finance.

- Concept-driven teaching rather than rote learning.

- Recorded and live lecture options.

The CFA Institute expects candidates to apply knowledge, not memorise formulas. Your CFA lectures should reflect this expectation.

3. Structured CFA Institute Study Plan

Given the vast syllabus outlined by the CFA Institute, self-study without structure can be overwhelming. The best institute for CFA Certification provides:

- Weekly study schedules aligned with exam dates.

- Topic-wise milestones and revision cycles.

- Integrated practice questions and mock exams.

- Time-management strategies are recommended by the institute guidelines.

Such a structure helps candidates balance work, studies, and personal commitments effectively.

4. Accessibility: CFA Institute Near Me vs Online Learning

Many candidates assume that physical classrooms lead to better learning. While in-person classes can be beneficial, modern CFA preparation is increasingly digital.

When choosing between offline and online formats, consider:

- Flexibility of accessing CFA lectures anytime.

- Ability to revisit complex CFA syllabus concepts.

- Peer learning communities and discussion forums.

- Recorded content availability for working professionals.

For many candidates, a blended or fully online CFA Institute study approach offers greater consistency and depth. Today, quality, structure, and mentorship matter more than proximity.

Certified Financial Analyst Institute vs Self-Study: Which Is Better?

While the CFA Institute permits self-study, most successful candidates rely on support from a certified financial analyst institute – especially in their first attempt.

Self-study often fails due to poor interpretation of the curriculum, lack of accountability, and absence of exam feedback. Institute-led preparation adds expert CFA lectures, CFA books, structured timelines, and regular assessments that significantly improve outcomes.

If you’re evaluating CFA salaries in India or globally, alongside prep quality, institute choice, and career planning, this video gives a realistic breakdown of how compensation evolves at different stages of the CFA journey.

CFA Institute USA Recognition and Global Career Impact

The CFA Institute USA plays a pivotal role in shaping global finance careers. Since the CFA designation originates in the US, it holds exceptional credibility among multinational banks, investment firms, and consulting companies headquartered there.

Because of this global recognition, CFA charterholders are commonly considered for a wide range of CFA jobs both in India and international markets. Graduates affiliated with CFA standards are commonly hired in:

- Investment banking and equity research

- Asset and wealth management firms

- Hedge funds and private equity

- Risk management and financial consulting

- Even outside the US, employers recognise the CFA Institute as a benchmark of analytical excellence and professional ethics.

- Choosing the best institute for CFA ensures you are trained to meet global expectations – not just exam requirements.

Long-Term Value of Studying Under CFA Institute Standards

A CFA Program education goes far beyond exams. The CFA Institute emphasises lifelong learning, ethical behaviour, and professional excellence.

Graduates benefit from a wide range of CFA benefits, including:

- Global mobility

- Higher credibility with employers

- Leadership roles in finance

- Strong professional network via CFA societies.

The right certified financial analyst institute helps candidates internalise these values – not just clear exams.

If you’re balancing a job alongside CFA preparation, this video offers practical insights into managing time, staying consistent, and avoiding burnout during the CFA journey.

Best CFA Study Models for Working Professionals: Why CFA Lectures and Structure Matter

For working professionals, the biggest challenge in the CFA journey isn’t motivation – it’s time, consistency, and mental bandwidth after long workdays.

Although the CFA Institute allows self-study, most working professionals who succeed in the CFA Level 1 exams rely on structured preparation from a certified financial analyst institute. Balancing a full-time job with a demanding syllabus is challenging, and without the right framework, even committed candidates can lose momentum.

How Institute-Based CFA Preparation Makes a Difference

A structured CFA program helps working professionals convert effort into results by offering:

- Expert-led CFA lectures that simplify complex and technical concepts.

- Exam-focused explanations aligned with CFA Institute expectations.

- Regular assessments, mock exams, and revision cycles.

- Peer learning, case discussions, and guided motivation.

- This structure ensures progress remains steady – even during demanding work periods.

The Role of CFA Lectures in Exam Performance

For working professionals, CFA lectures are the backbone of effective preparation. High-quality lectures bridge the gap between CFA Institute textbooks and real-world application by:

- Breaking down financial models step by step.

- Connecting theory to live market scenarios.

- Highlighting high-weight exam topics.

- Reinforcing ethical decision-making across subjects.

This approach helps candidates understand how to apply concepts – exactly what the CFA exams test.

What the Best CFA Institutes Offer Working Professionals

The best institute for CFA recognises the realities of a working schedule and provides:

- Recorded CFA lectures for flexible revision.

- Modular CFA Institute study plans.

- Weekend support and doubt-clearing sessions.

- Personalised mentorship and exam strategy guidance.

With the right structure and support, working professionals can prepare consistently without compromising performance at work or burning out before exam day.

One of the common questions aspirants have while considering the CFA path is about the CFA salary in India. While compensation depends on experience, role, and organisation, the CFA charter generally leads to strong earning potential over time.

Common Mistakes CFA Aspirants Make

Many candidates, despite their respect for the CFA Institute brand, make mistakes that hurt their chances of success. The best institute for CFA trains candidates to avoid these pitfalls and maintain consistency throughout their preparation.

Many of these mistakes become even more costly at CFA Level 2, where candidates are expected to apply concepts across subjects rather than study them in isolation.

Common mistakes CFA aspirants should avoid:

- Relying only on self-study

- Choosing low-quality CFA lectures

- Ignoring ethics – heavily emphasised for CFA exams.

- Delaying mock exams.

- Underestimating CFA Level 1 or over-complicating CFA Level 3.

How To Evaluate the CFA Institute Near Me

When searching for a CFA Institute near me, candidates should prioritise quality over location. Today, online institutes offer study programs with:

- Recorded CFA lectures for revision

- Flexible schedules

- Global faculty access and faculty with CFA charterholder credentials

- Alignment with CFA course syllabus updates

- Post-class mentorship and doubt support

If you prefer physical coaching, evaluate the institute carefully:

Are lecturers CFA charterholders?

Are CFA lectures recorded for revision?

Does the institute provide post-class mentorship?

Physical proximity matters less than teaching quality and curriculum integrity set by the Institute.

When choosing between offline and online coaching, consider:

- Flexibility to access CFA lectures anytime.

- Ability to revisit complex topics multiple times.

- Peer learning communities and discussion forums.

- Availability of recorded content for working professionals.

Choosing the Best Institute for CFA Success

Not all CFA coaching providers are created equal. A good institute doesn’t promise shortcuts – it promises clarity, structure, and consistency. The CFA charter is not just another certification – it is a professional identity shaped by the CFA Institute. Success in this journey depends heavily on the preparation ecosystem you choose.

A reliable certified financial analyst institute goes beyond syllabus coverage. It focuses on building long-term financial thinking rather than short-term exam tactics. The best institute for CFA is one that:

- Respects CFA Institute standards

- Offers concept-first CFA lectures

- Provides structured CFA study plans

- Supports students beyond the exam

A successful CFA Institute study approach balances discipline, flexibility, and revision. Choose wisely, study consistently, and let the CFA pathway transform your professional future.

A structured study approach includes:

- Weekly topic-wise planning

- Integrated practice questions

- Regular ethics revision

- Full-length CFA-style mock exams

The best institute for CFA makes sure candidates are never overwhelmed, even with the demanding CFA curriculum.

This video compares the CA vs CFA pathway – a comparison many Indian aspirants face when choosing their finance career route. It’s particularly useful if you’re deciding whether to pursue CA, CFA, or even both.

Why Imarticus Learning Makes Sense for CFA Candidates

One of the key advantages of enrolling with Imarticus is its industry-aligned programme, developed in collaboration with KPMG in India. This means what you study connects closely with how finance actually works in corporate and investment settings, not just what appears in textbooks set by the CFA Institute.

- Candidates also benefit from Kaplan Schweser study material, a resource trusted by aspirants across the world for its clarity and exam relevance. It helps simplify complex topics and keeps preparation focused.

- Another strength is the dual-teacher model. You learn through live sessions with experienced faculty while also getting ongoing support for doubts and concept clarification – an important advantage if you’re balancing studies with work or other commitments.

- To reduce the pressure that comes with such a demanding course, Imarticus also offers a 50% fee refund if you follow the study plan and don’t clear the exam.

- With access to structured learning, real-world case discussions, and even internship opportunities for select candidates, the focus goes well beyond just clearing exams.

- Added to this are career services such as resume guidance, interview preparation, and placement support, which can be particularly helpful for candidates looking to transition into or grow within finance roles after clearing CFA levels.

The preparation approach is designed not only to help you pass, but to gradually build the skills and confidence needed for real finance roles – something that truly matters when you’re committing to a demanding CFA course.

FAQs About CFA Institute

If you’re exploring the CFA path or comparing preparation options, a few questions tend to come up again and again. I’ve answered the most frequently asked questions about the CFA Institute so you can make informed decisions with confidence.

What is the CFA Institute?

The CFA Institute is a global, non-profit professional organisation that administers the Chartered Financial Analyst (CFA) Program and sets ethical and professional standards for investment professionals worldwide. Headquartered in the USA, it governs curriculum design, exams, and charter awarding.

What is the full form of CFA Institute?

The Chartered Financial Analyst Institute is the full form of CFA Institute. It governs the CFA certification globally.

Where is the CFA Institute headquartered?

The CFA Institute headquarters is located in Charlottesville, Virginia, USA, with regional offices and local CFA societies across multiple countries, including India.

Which institute is best for CFA preparation?

The best institute for pursuing CFA depends on your preferences. A good certified financial analyst institute like Imarticus Learning offers:

- Global-standard study material

- Strong CFA lectures

- Structured study plans

- Mock exams, mentorship and doubt support

- Combine structured prep

Are CFA lectures really important?

Yes. CFA lectures are critical because they translate complex CFA Institute curriculum concepts into simplified, exam-oriented, and practical explanations – especially for subjects like Financial Reporting, Derivatives, and Portfolio Management.

How do I find a CFA Institute near me?

Many candidates search for institutes near them, but physical proximity matters less today. Online and hybrid models often work better, as they offer recorded CFA lectures, flexible schedules, and mentorship. Focus on teaching quality and CFA Institute study alignment rather than location alone.

Should I choose self-study or the CFA Institute?

While self-study is allowed, many candidates benefit from guided preparation. A structured CFA Institute study model helps with planning, accountability, and exam strategy. Imarticus Learning is often considered by candidates looking for additional mentorship and structure.

Choosing the Right CFA Institute for Long-Term Success

Choosing the best institute for CFA is less about promises and more about preparation quality. The CFA charter represents global credibility, ethical responsibility, and long-term professional identity.

The right certified financial analyst institute doesn’t chase shortcuts. It builds clarity, discipline, and exam readiness – while preparing you for global finance roles beyond the classroom.

Success in the CFA course depends not just on effort, but on guidance. A preparation partner aligned with CFA Institute standards, strong CFA lectures, and structured learning can significantly improve exam outcomes and long-term career prospects.