Last updated on November 7th, 2025 at 11:36 am

The world of finance has never stood still. Markets evolve, investor behaviour shifts, and technologies redefine how value moves. Yet one professional qualification remains the benchmark for analytical excellence, the CFA Level 1 certification. For students and professionals in India hoping to build a meaningful career in investment management, equity research, or financial analysis, earning the Chartered Financial Analyst (CFA) Level 1 credential is often the first concrete step.

The CFA Program, offered by the CFA Institute, is globally recognised as the gold standard for ethics, analytical rigour, and financial knowledge. The first level, CFA Level 1, acts as both a filter and a foundation. It tests candidates across 10 critical finance domains, from quantitative methods to portfolio management. It isn’t an exam of memorisation; it’s a test of conceptual clarity and consistent application.

But here’s where most aspirants falter: they treat CFA Level 1 like another university test. It’s not. It demands a structured strategy, sustained discipline, and an understanding of how concepts interconnect, which is why this detailed guide breaks down every element: from syllabus to strategy, from fees to study plan, and from exam trends to career outcomes.

What is the CFA Certification?

If finance were a language, the CFA Certification would make you fluent in it.

The Chartered Financial Analyst (CFA) program is one of the most respected credentials in the world of investment and financial management. It’s not just about passing an exam; it’s about learning to see the financial world through an analyst’s lens, where every number tells a story, every graph reveals a pattern, and every decision is backed by data.

So, what is CFA really about? It’s about transforming how you think about money.

Here’s a simple way to picture it.

Imagine you’re planning to buy a house. Most people look at the design, the price, and maybe the location. But a CFA-trained mind looks deeper, analysing the property’s long-term appreciation potential, comparing mortgage options, assessing interest rate risks, and evaluating whether it fits into the broader portfolio of assets.

You gain the expertise to look beyond the obvious, measure risk against return, and make decisions that create value over time.

At its foundation, the CFA course is divided into three progressive levels: CFA Level 1, Level 2, and Level 3.

- CFA Level 1 builds your base. Introducing you to financial statements, quantitative analysis, and ethics.

- Level 2 sharpens your valuation and analytical skills. Applying theory to real-world investment cases.

- Level 3 brings it all together. Testing how you manage portfolios, balance risk, and deliver sustainable performance.

Each level is like a stage in mastering financial thinking:

- Level 1 teaches you to understand the markets.

- Level 2 teaches you to evaluate opportunities.

- Level 3 teaches you to act strategically as an investment leader.

Understanding CFA Level 1

The CFA charter isn’t merely a certificate; it’s a global badge of trust. As per the CFA Institute, more than 190,000 charterholders currently work in over 160 countries. In India, the number of CFA candidates has grown by nearly 25% year-on-year since 2019, signalling the program’s rising relevance in emerging markets.

At a Glance:

- Administered by: CFA Institute

- Exam levels: 3 (Level 1, Level 2, Level 3)

- Exam frequency (Level 1): 4 times a year (Feb | May | Aug | Nov)

- Global pass rate (2024 avg): ~45% (source)

- Average study hours: 300 – 350

- Duration to complete all levels: ~2.5 to 3 years

In India, the CFA Level 1 certificate has become a yardstick for employers when assessing financial analysts and investment associates. Major firms such as JP Morgan, Goldman Sachs, Citi, ICICI Securities, and Deloitte actively recruit Level 1 cleared candidates for research and support functions.

CFA Level 1 Exam Snapshot

| Parameter | Detail |

| Exam Frequency | 4 times a year (Feb, May, Aug, Nov) |

| Format | 180 MCQs (2 sessions of 90 each) |

| Passing Score | Around 70% (not officially disclosed) |

| Global Pass Rate (2024) | 39% |

| Recommended Study Time | 300 hours |

| Average Prep Duration | 5–6 months |

| Fees (approx.) | $940–$1,250 depending on registration period |

| Credential Awarded | CFA Level 1 Certificate |

Eligibility and Registration Process for CFA Level 1

One of the most common questions aspirants ask is whether they’re even eligible to sit for the exam. Thankfully, the CFA Institute keeps the entry barriers fair but defined.

| Eligibility Criteria | Details |

| Education | Final-year undergraduate students or graduates (any discipline). |

| Work Experience | At least 4,000 hours of professional experience or combined education + experience over 3 years. |

| Passport | A valid international passport is mandatory for registration. |

| English Proficiency | The exam is conducted only in English. |

Registration Timeline (2025):

- Early Registration: September 2024 – USD 940

- Standard Registration: November 2024 – USD 1,250

- One-Time Enrollment Fee: USD 350 (CFA Institute Fees)

(In INR, total cost ≈ ₹2.3 – ₹2.7 lakhs depending on exchange rate)

Most Indian candidates begin preparing during the final year of college or while working. Professionals from non-finance backgrounds, such as IT or engineering, also increasingly attempt CFA Level 1 to pivot into finance.

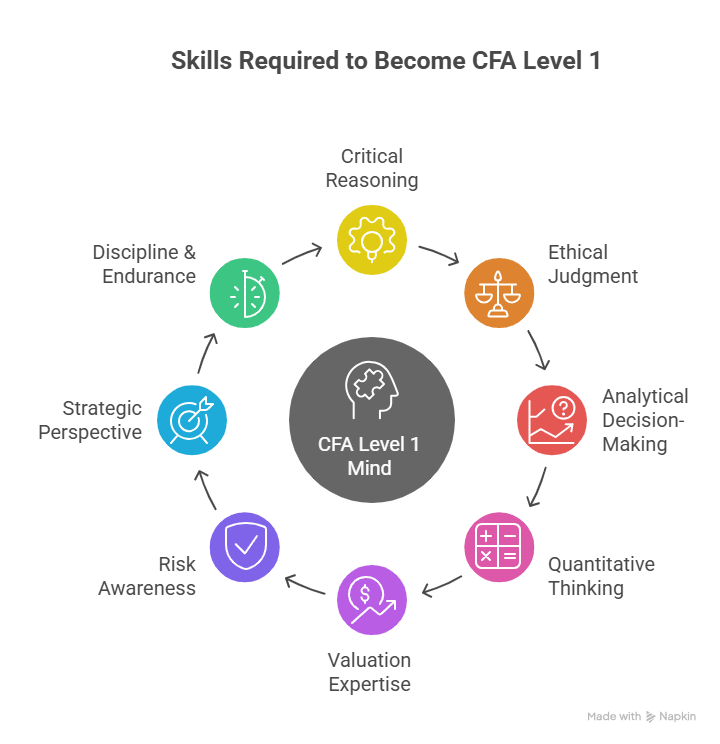

Behind the formulas and ethics codes, CFA Level 1 is a training ground for sharper decision-making. This skill wheel shows the mental toolkit you’ll develop throughout your prep.

CFA Level 1 Exam Pattern and Structure

Before you learn how to crack CFA Level 1, it’s essential to understand what you’re preparing for.

Exam Format Overview

| Component | Details |

| Format | Computer-Based Testing (CBT) |

| Duration | 4.5 hours (total) – 2 sessions of 2 hours 15 minutes each |

| Questions | 180 multiple-choice (MCQs) – 90 per session |

| Scoring | No negative marking; each question = 1 mark |

| Language | English |

| Exam Centres (India) | Mumbai, Delhi NCR, Bengaluru, Hyderabad, Chennai, Pune, Kolkata and others |

Did you know? 68% believe certifications are more valuable than postgraduate degrees for career growth (Business Wire).

Topic-Wise Weightage in the CFA Level 1

CFA Level 1 tests 10 key subject areas, each designed to build a foundation for advanced levels. Knowing the weightage helps you plan study hours strategically.

| Topic | Weightage (%) | Recommended Study Hours (out of 350) |

| Ethical & Professional Standards | 15 – 20 | 55 – 65 |

| Quantitative Methods | 8 – 12 | 30 – 40 |

| Economics | 8 – 12 | 30 – 40 |

| Financial Reporting & Analysis | 13 – 17 | 45 – 55 |

| Corporate Finance | 8 – 12 | 30 – 40 |

| Equity Investments | 10 – 12 | 35 – 45 |

| Fixed Income | 10 – 12 | 35 – 45 |

| Derivatives | 5 – 8 | 20 – 25 |

| Alternative Investments | 5 – 8 | 20 – 25 |

| Portfolio Management | 5 – 8 | 20 – 25 |

Study Hours and Time Commitment

Every CFA Level 1 certificate aspirant dreams of clearing it on the first attempt. The difference between success and burnout lies in the strategy of preparation, not just effort.

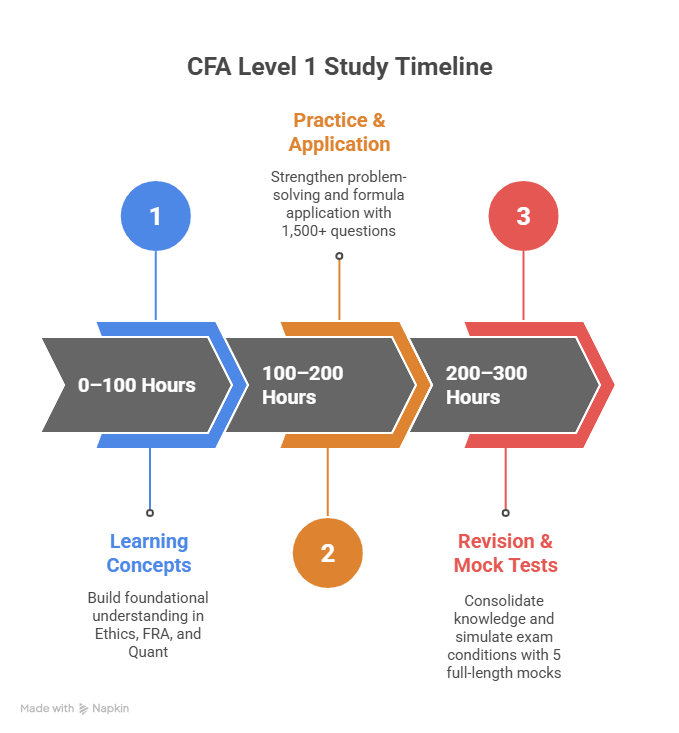

A common misconception is that “more hours equal higher success.” However, what truly matters is how you use those hours. The CFA Institute recommends approximately 300 hours of study per level, but successful candidates often structure those hours in phases.

Ideal Timeline (6-Month Plan)

| Month | Focus Area | Tasks |

| Month 1 | Ethics & Quantitative Methods | Lay the foundation, practice concept questions. |

| Month 2 | Economics & Financial Reporting | Build conceptual clarity through examples from Indian markets. |

| Month 3 | Corporate Finance & Equity Investments | Relate to real company valuations like Infosys and Reliance. |

| Month 4 | Fixed Income & Derivatives | Use visual tools to grasp yield curves and options pricing. |

| Month 5 | Alternative Investments & Portfolio Management | Focus on case studies from mutual funds and VC funds. |

| Month 6 | Revision + Mock Tests | Take 3 – 5 full-length mocks, analyse errors, and refine timing. |

Tips from Charterholders

- Divide your study hours: Aim for 12–15 hours a week, not cramming before the last month.

- Morning > Night: Studying quantitative or analytical subjects early in the morning improves retention.

- Daily Revision Ritual: Spend 15 minutes revising formulas before sleep. This spaced repetition solidifies learning.

- Mock Tests are Gold: Attempt at least 5 full-length mocks to understand your performance under pressure.

Every CFA Level 1 aspirant needs clarity on where to start and what to study each week. The visual guide is designed to help you cover every concept with confidence and strategy.

Study Strategies That Actually Work for CFA Level 1

Cracking the exam isn’t about cramming; it’s about systematic preparation. Here’s how to make your hours count.

a. Follow the Learning Outcome Statements (LOS)

Every CFA book begins with LOS, the exact skills you’ll be tested on. Write them down and tick each as you master it. Think of this as your personal checklist.

b. Use Active Recall and Spaced Repetition

Use flashcards for formulae, for instance, TVM (Time Value of Money) and DCF (Discounted Cash Flow). Revise them weekly to move knowledge from short-term to long-term memory.

c. Mock Tests Are Non-Negotiable

Take at least five mocks under real exam conditions. Analyse your performance to identify weak areas. Students who attempt 5+ mocks typically score 12-15% higher than those who don’t.

d. Focus on Ethics

Ethics is often a deciding factor, especially when you’re on the borderline score. The CFA Institute applies the ‘Ethics Adjustment,’ which can push you from failing to passing if your ethics score is strong.

e. Build a Study Community

Join peer groups on Reddit, LinkedIn or Telegram. Sharing notes and solving questions collectively keeps you accountable. Imarticus CFA students often form cohorts guided by industry mentors, a model that consistently delivers superior pass rates.

f. Stay Current with Financial News

Relate concepts to real-world events. For example, when studying Fixed Income, follow RBI’s repo-rate announcements. It cements your understanding and prepares you for practical application questions.

This insightful mock interview offers a realistic glimpse into how candidates with the CFA Level 1 credential are evaluated in top-tier investment banking roles

Cracking the CFA Level 1 With Smart Study Resources

CFA Level 1 covers a wide conceptual ground, from ethics to derivatives. Choosing the right study resources can drastically shorten your learning curve.

Top Recommended Resources

- CFA Institute’s Learning Ecosystem (LES) – the most reliable and updated source.

- Kaplan Schweser Notes – concise, easy-to-digest summaries for revision.

- Imarticus CFA Prep Program – personalised mentorship-led training designed for Indian learners.

The Imarticus CFA Level 1 prep course stands out because it pairs you with industry professionals and CFA Charterholders who mentor you throughout your journey. This guidance ensures your study plan isn’t generic but tailored to your individual strengths.

Moreover, their guaranteed refund policy (if you don’t clear the exam after following the prescribed schedule) reflects their confidence in their mentorship-driven approach. Explore the program here.

This video dives into three proven strategies to help you effectively manage your time, stay focused, and pass the CFA Level 1 exam on your first attempt.

Breaking Down Key Sections of CFA Level 1

Now that we’ve seen the exam’s scope, let’s dive deeper into what each major topic demands and how you can approach it smartly.

1. Ethics and Professional Standards (15–20%)

Ethics is the bedrock of the CFA program. It defines how analysts maintain integrity and transparency.

Many students ignore it till the end, which is a grave mistake. Ethics is heavily tested, and the Institute often uses Ethics as a tiebreaker in borderline cases.

Approach:

- Study from the CFA Handbook’s Ethics section directly.

- Revisit Ethics every week; it’s more about context than memory.

- Solve case-based questions to understand ethical dilemmas in practical settings.

2. Financial Reporting and Analysis (FRA)

Arguably the most technical section, FRA accounts for 13–17% of the exam.

Understanding income statements, cash flows, and ratio analysis is vital for analysts.

Example:

If a company’s Return on Equity (ROE) is rising, is it due to operational efficiency or increased leverage?

CFA Level 1 ensures you can read beyond the numbers.

Preparation Strategy:

- Focus on IFRS vs GAAP differences.

- Practice calculating ratios like ROA, ROE, and EPS manually.

- Use past question banks to test conceptual clarity.

3. Quantitative Methods

This section tests your statistical intuition, from probability to hypothesis testing.

You use examples from daily life, like estimating average returns from past stock data.

Study tip:

Practice time value of money (TVM) using a financial calculator (e.g., Texas Instruments BA II Plus). Mastering this one tool saves you minutes in every exam.

4. Portfolio Management and Investments

While less weighted, this section introduces fundamental portfolio theories (CAPM, diversification).

Here’s where you start connecting dots, understanding how Ethics, Quant, and FRA translate into actual portfolio decisions.

Career Scope After Earning the CFA Level 1 Certificate

Clearing CFA Level 1 is more than just an academic feat; it’s a gateway to global finance. Even at this stage, before completing all three levels, professionals start to unlock significant opportunities in the finance and investment sectors.

The CFA Level 1 certificate demonstrates your grasp of core finance concepts, from ethics and valuation to portfolio management, making you an attractive hire for employers seeking analytical talent.

Top Career Paths After CFA Level 1

- Investment Banking Analyst – Supporting M&A transactions, pitchbooks, and valuation models.

- Equity Research Associate – Analysing listed companies and preparing reports for institutional investors.

- Portfolio Management Assistant – Helping senior managers with asset allocation and performance tracking.

- Risk Analyst – Measuring credit, operational, or market risks using statistical models.

- Corporate Finance Associate – Managing internal financial strategies and capital structures.

These roles allow you to apply CFA concepts directly in real-world business decisions.

CFA Level 1 Salary in India and Abroad

While the CFA Level 1 salary varies based on geography and experience, data consistently shows that CFA-certified professionals earn significantly higher than their non-certified peers.

Let’s look at the salary insights based on 2025 industry surveys from Glassdoor, Payscale, and CFA Institute Career Centre.

| Region | Average Annual Salary (Post Level 1) | Typical Job Roles |

| India | ₹6–10 LPA | Research Analyst, Risk Associate, Portfolio Support |

| UAE | AED 95,000–130,000 | Investment Analyst, Finance Consultant |

| UK | £35,000–50,000 | Junior Analyst, Investment Banking Intern |

| USA | $65,000–85,000 | Financial Analyst, Equity Research Associate |

| Singapore | SGD 70,000–90,000 | Corporate Finance Associate |

(Sources: Glassdoor, Payscale, CFA Institute Career Centre)

Key Insight:

Employers in investment banks, asset management firms, and consulting companies value CFA candidates because of their proven commitment and analytical discipline.

Top recruiters for CFA Level 1 candidates include:

- JPMorgan Chase & Co.

- Deloitte

- EY

- Goldman Sachs

- KPMG

- Morgan Stanley

How to Crack CFA Level 1: Proven Techniques

Passing CFA Level 1 isn’t about memorising; it’s about consistency and method. Here’s a curated list of effective strategies compiled from experienced Imarticus CFA mentors and successful charterholders.

1. Active Recall Over Passive Reading

Instead of rereading textbooks, summarise formulas and concepts in your own words. Use flashcards or spaced repetition apps like Anki for better memory retention.

2. Focus on High-Yield Topics

Prioritise Ethics, FRA, and Quantitative Methods – they make up 45–50% of the exam weight.

Consistent scoring in these ensures a safety margin, even if smaller topics feel shaky.

3. Simulate Exam Conditions

Take at least 5–6 full-length mocks in a realistic setting. This reduces cognitive fatigue and improves time management.

4. Join a Mentor-Led Prep Course

A mentor who’s already a CFA Charterholder can guide you with study pacing, conceptual clarity, and mock test insights. This is where the Imarticus CFA Level 1 program excels.

5. Revisit Ethics in the Final Week

Many toppers recommend dedicating the last week exclusively to Ethics and formula sheets: the Ethics section often acts as the pass/fail differentiator.

Why Choose Imarticus Learning For Your CFA Preparation

When it comes to preparing for the CFA Course, what truly makes a difference isn’t just access to study material; it’s having the right guidance, structure, and support system throughout the journey. That’s exactly what this program delivers. It’s not another generic prep course; it’s a complete mentorship ecosystem built around how real candidates study, struggle, and succeed.

1. Mentor-Led Learning from CFA Charterholders

One of the biggest strengths of the program is its mentor-led classes, conducted by seasoned CFA Charterholders who’ve not only cleared all three levels but also worked in the finance industry. Their real-world insights help bridge the gap between theory and application, making complex topics like equity valuation or derivatives far easier to grasp. This guidance gives learners clarity on what matters most for the exam and how to think like a finance professional.

2. AI-Driven Mock Test Analytics for Smarter Prep

Simply practising questions isn’t enough; knowing where you go wrong and why is what accelerates improvement. Imarticus provides full-length mock tests backed by AI-powered analytics, which break down your performance by topic, difficulty level, and time management. This lets you adjust your strategy early, focus on weak areas, and walk into the exam with confidence and data-backed preparation.

3. End-to-End Career Support and Placement Opportunities

Unlike most CFA prep providers that end their role after the exam, Imarticus extends support beyond certification. Learners gain access to career services, resume building, and placement opportunities with top finance firms, including banks, consulting companies, and investment firms. This is particularly valuable for candidates looking to transition into finance roles or seeking global exposure post-certification.

4. Flexible Schedules for Working Professionals and Students

Balancing CFA prep with a job or college can be challenging. That’s why the Imarticus program offers flexible learning schedules, including weekend and online batches, so learners can maintain consistency without compromising their existing commitments. This balance ensures that candidates stay disciplined without feeling burnt out.

5. Guaranteed Refund Policy for Performance Assurance

Perhaps the most confidence-inspiring feature of the program is its Guaranteed Refund Policy. If you follow the complete study plan and still don’t clear the exam, Imarticus offers a money-back guarantee.

6. Structured Curriculum Aligned with Global CFA Standards

The program structure mirrors the official CFA Institute’s curriculum but with added localised context for Indian learners—helping you connect theoretical frameworks to practical, market-relevant scenarios. Each module builds on the last, reinforcing learning through case studies, revision bootcamps, and topic-wise tests

7. Personalised Mentorship and Peer Learning Network

Learning doesn’t happen in isolation. Imarticus fosters a strong peer-learning community where aspirants can discuss doubts, share strategies, and learn collaboratively. On top of that, the one-on-one mentorship sessions help you build a study plan tailored to your strengths, pace, and exam timeline.

FAQs on CFA Level 1

Before you begin your CFA Level 1 journey, it’s natural to have a few questions. This section brings together the most frequently asked questions about the Chartered Financial Analyst Level 1 certification, explained in simple, practical terms.

Is CFA Level 1 very tough?

The CFA Level 1 exam is challenging but not insurmountable. Its difficulty comes from its breadth, covering 10 subject areas, rather than extreme complexity. With structured preparation of around 300 hours, you can comfortably pass. The key lies in consistency, not last-minute cramming.

What is CFA Level 1 for?

The CFA Level 1 certificate serves as the foundational step toward becoming a Chartered Financial Analyst. It validates your understanding of ethics, financial analysis, and portfolio management, all essential for roles in investment banking, asset management, and equity research.

Is CFA harder than CA?

Both exams demand rigour but test different skill sets. A CA (Chartered Accountant) focuses on accounting, auditing, and taxation, while CFA Level 1 emphasises valuation, investments, and ethics. For those aiming for global roles, CFA is more internationally aligned. With expert mentorship and structured guidance from Imarticus Learning, students can navigate CFA Level 1 preparation with greater clarity and confidence.

What is the CFA Level 1 salary?

In India, a CFA Level 1 professional typically earns between ₹6-10 LPA, depending on the firm and role. Internationally, the starting average ranges between $60,000-$85,000 per year. Salaries rise sharply with experience and higher-level completion.

Is 27 too late for CFA?

Absolutely not. The average CFA candidate age is around 27–30 years, and many start even later while working full-time. Employers value maturity and applied learning, so starting at 27 is perfectly strategic.

Is CFA equivalent to an MBA?

Not exactly. MBA focuses on broad management training, while CFA is a specialised credential for investment and finance professionals. Many professionals pursue CFA to gain a technical edge, and with Imarticus Learning’s structured mentoring and placement-driven approach, candidates can translate this specialised knowledge into strong career outcomes similar to top finance-focused MBA graduates.

Can CFA earn 1 crore?

Yes, with experience. Senior CFA Charterholders working in portfolio management, private equity, or investment banking can earn ₹1 crore+ annually. However, it typically takes 5–8 years of post-charter experience to reach that level.

Who is eligible for the CFA exam?

To appear for CFA Level 1, you must have either completed your bachelor’s degree or be in your final year. Candidates also need a valid international travel passport. Professionals with relevant work experience can apply too.

Does JP Morgan hire CFA?

Yes. Global firms like JP Morgan, Goldman Sachs, and Morgan Stanley actively recruit CFA candidates for analytical and investment roles. CFA’s emphasis on ethics and quantitative skills aligns perfectly with such employers’ requirements.

Do Indian banks hire CFA?

Yes. Many Indian financial institutions, including ICICI Bank, HDFC Bank, and Axis Bank, hire CFA candidates for roles in risk analysis, wealth management, and corporate finance. The credential enhances credibility in regulated financial services, and with Imarticus Learning’s placement support and industry connections, candidates gain a strong pathway to such opportunities in top-tier financial institutions.

What is the CFA pass rate?

According to the CFA Institute, the global pass rate for CFA Level 1 in 2024 was 39%. This shows the exam’s competitiveness, but also that nearly 4 out of 10 candidates clear it with proper preparation.

Endnote for Every CFA Level 1 Aspirant

Preparing for CFA Level 1 is a test of consistency more than anything else. The syllabus is vast, the concepts are detailed, and balancing it with work or college can feel overwhelming at times. But once you understand how to break it down, setting weekly targets, revising regularly, and practising mock tests, the entire process becomes manageable.

The biggest takeaway most candidates share after clearing Level 1 is this: success doesn’t come from studying the most, but from studying smart. Focus on understanding concepts, not just memorising them. Simulate exam conditions early, and track your weak areas before they snowball.

That’s also where structured guidance, like the CFA Program in collaboration with KPMG in India, offered by Imarticus Learning, makes a difference. It gives you a clear roadmap, personalised mentorship, and placement support to translate your hard work into real career outcomes.