The derivatives market is the money market for derivatives, which are financial instruments generated from other types of assets, such as futures contracts or options. The derivatives market is separated into two parts: exchange-traded derivatives and over-the-counter derivatives.

A derivative is a sophisticated sort of financial security that is agreed upon by more than two parties.

A derivative is a sophisticated sort of financial security that is agreed upon by more than two parties.

Traders utilize derivatives to get access to certain marketplaces and trade various assets.

The most widely known underlying assets for derivatives include currencies, stocks, bonds, commodities, interest rates, etc.

Contract values are determined by changes in the underlying asset’s price.

7 Emerging Trends in the Derivatives Market:

Artificial Intelligence in Trading

The derivative market is an essential component of financial services; it is a vast worldwide hut with ample capacity to accommodate cutting-edge technologies. Blockchain, artificial intelligence, and robots are already aiming towards it.

We all know that practically any asset may be traded in the derivatives market as futures and options. However, the intricacy of these instruments presents difficulties for investors. Reliable pricing solutions are essential due to continually changing market dynamics and regulatory restrictions.

A competent pricing tool is required by everyone from buy-side and sell-side trading desks to adherence, pricing, and accounting departments, among others. The most popular solutions in the market have some limits that must be overlooked.

For example, the answers are so complex that they must first be taught in order to be used. These technologies are so expensive that not everyone can manage to benefit from them; also, because of their vast size, they are confined to endpoints and can only be used with a few devices. Consider the following instances for better elaboration.

Based on the current SEBI rules, foreign investors or EFIs are participating in commodity derivatives. (For example — cotton exchange/trading, trading in metals such as nickel and zinc). Trading in fossil fuels such as natural gas and crude oil has seen a rise. The demand for these is booming like never before.

Emphasizing futures derivatives and forwards derivatives when deciding upon contracts. A major focus is on individual securities in Indian and even foreign markets or exchanges, new sets of compliances in foreign markets as well as Indian markets (especially when it comes to bonds and percentages in the agricultural sector)

Crypto derivatives are again gaining the spotlight and Indian investors are shifting towards modern trends or derivatives.

Physical settling of stock derivatives — It’s been determined that the physical setting of all stock derivatives will be made mandatory. Cash-settled stocks will be listed in decreasing order, based on daily market capitalization aggregated for the month of December 2018. SEBI has stated that in 2019, the worst 50 derivatives equities would be moved to delivery resolution every quarter.

Conclusion

Financial derivatives have taken a prominent place among all financial instruments (products) as a result of innovation and revolutionizing the landscape. Derivatives are financial instruments that help dealers manage risk and profit. It aids in the transfer of risk from one to the next.

Learn investment banking online to gain better insights into the derivatives markets and become an expert. Pursuing investment banking courses online will help you juggle between your work as well academics, seamlessly, and that will give you the right push you need for a successful career.

Related Articles:

Pros & cons of Derivatives Markets

Why choose a career in Derivatives Markets?

How are Derivatives Changing Markets?

Here’s why learning about derivatives is essential to begin a career in the capital markets

Understanding the Difference Between Asset Management and Wealth Management

Understanding the Difference Between Asset Management and Wealth Management

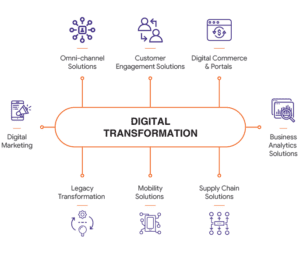

The effect of digital transformation on banks can also be seen in the recruitment process. Applicants with an

The effect of digital transformation on banks can also be seen in the recruitment process. Applicants with an