Graduating is a milestone… but figuring out what comes next can feel overwhelming—especially if you’re eyeing the competitive world of banking. From finance to fintech… public sector to private investment firms, the banking space is vast.

So, how do you choose the right banking courses after graduation that match your career goals, learning style… & future aspirations?

This guide will help you cut through the clutter & make a smart, future-proof decision.

Why Banking Is Still One of the Most Promising Career Paths

Despite rapid tech disruption, banking continues to be a stable, respected & financially rewarding career—especially for commerce & finance grads.

Some key advantages:

- Multiple specialisations: retail, corporate, investment, compliance, etc.

- Excellent growth opportunities with clear ladders

- Roles in both Indian & global organisations

- Recession-resistant with job security

Whether you want to work with global banks or fintech startups, the right banking courses after graduation can open that door.

Step 1: Know Your Career Goals

Before jumping into a course, ask yourself:

| Question | Why It Matters |

| Do you want a public or private banking job? | Helps decide between exam-based or industry-led courses |

| Are you more analytical or customer-facing? | Investment roles vs. retail banking |

| What’s your ideal salary or growth target? | Certification & placement support will vary |

| Do you prefer fast-track or in-depth learning? | Short-term vs. post graduate banking programs |

Understanding this will help you avoid enrolling in a course that doesn’t align with your future vision.

Step 2: Explore Course Types That Fit Your Goals

Here’s a breakdown of popular options when exploring banking courses after graduation:

| Course Type | Ideal For |

| Diploma in Banking and Finance | Freshers wanting job-readiness in 3–6 months |

| Post Graduate Banking Programs | Grads wanting in-depth training + placement |

| Best Banking Certification Courses | Professionals wanting role-specific upgrades |

| Online Banking Courses with Placement | Those who prefer remote, flexible learning |

| Professional Banking Courses in India | Those preparing for government or private bank roles |

Understanding the Diploma in Banking and Finance

A diploma in banking and finance is a great starting point for those who want a quick, practical & job-oriented program right after graduation.

Key Features:

- Duration: 3 to 6 months

- Modules: Retail banking, risk management, digital banking, customer service

- Skills: Relationship management, KYC/AML, basic Excel

- Outcome: Placement support in entry-level roles in private banks & NBFCs

These diplomas are ideal for those who want to get started fast… without investing years.

Why Post Graduate Banking Programs Are Worth It

If you’re aiming higher—say, corporate roles or investment banking—then post graduate banking programs offer depth, rigour & placement support.

These programs go beyond theory… focusing on:

- Financial analysis

- Risk & compliance

- Wealth management

- Financial modelling

- Trade finance

One strong example is the Postgraduate Financial Analysis Program from Imarticus. It offers industry-aligned training, hands-on projects… & guaranteed interview opportunities. You can even watch this program video for a better understanding.

The Rise of Online Banking Courses with Placement

If you can’t relocate or prefer weekend learning, online banking courses with placement are a smart, flexible option.

These courses are ideal because:

- You learn from anywhere

- Sessions are recorded for revision

- You get access to mentors & career coaching

- Most include capstone projects or case studies

The key is to choose an institute that offers placement assistance, resume support, interview training… & access to hiring partners.

Here’s a comparison table:

| Learning Mode | Benefits |

| Classroom Banking Courses | Better peer learning, structured routine |

| Online Banking Courses with Placement | Flexible schedule, same certification, cost-effective |

| Hybrid/Blended Models | Best of both worlds |

Which Are the Best Banking Certification Courses?

When we say best banking certification courses, we’re talking about programs recognised by employers, updated regularly & taught by experts.

Look for certifications that offer:

- Case-based learning

- Placement tie-ups

- Projects aligned with industry needs

- Skill-building in Excel, financial modelling & risk analysis

Here are a few skill areas such programs cover:

| Skill Set | Why It’s Important |

| Financial Statement Analysis | Helps in credit & risk assessment |

| Customer Relationship Skills | Crucial for retail & SME banking |

| Digital Banking Tools | Increasingly used by banks & NBFCs |

| Compliance & AML | Must-have for regulatory & audit roles |

Want to explore finance roles outside banking too? This blog on finance career scope offers a great overview.

What to Expect from Professional Banking Courses in India

Professional banking courses in India often bridge the gap between academic learning & what the industry actually expects.

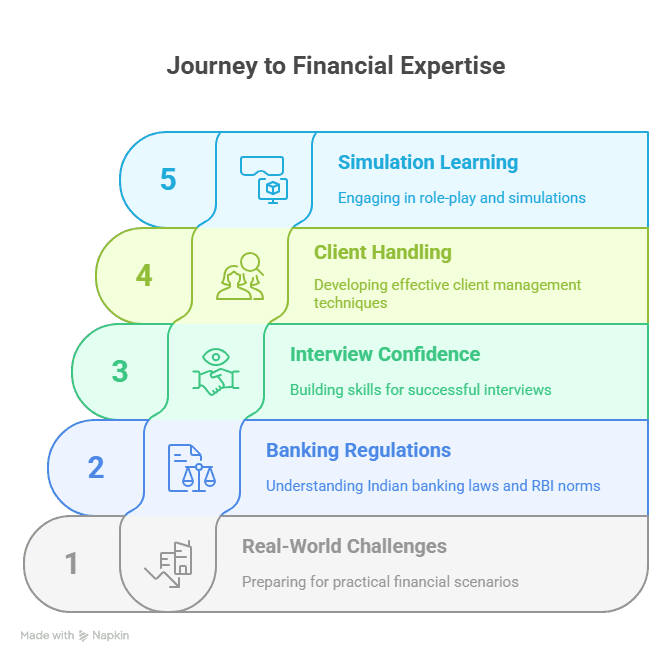

Here’s what they focus on:

- Preparing for real-world finance challenges

- Covering Indian banking regulations & RBI norms

- Building confidence for interviews & client handling

- Providing simulation-based or role-play learning

These are typically ideal for working professionals… or for those preparing for government or private bank exams.

Career Paths You Can Explore After Completing a Course

Once you finish one of the top banking courses after graduation, these are the roles you can consider:

| Job Role | Where You’ll Work |

| Retail Banking Officer | Private sector banks, NBFCs |

| Credit Analyst | Lending companies, fintech firms |

| Relationship Manager | Wealth management & HNI segments |

| Financial Analyst | Investment firms, MNCs, treasury teams |

| Risk & Compliance Analyst | Banks, insurance companies, fintech startups |

Want a deeper look at roles like M&A or investment banking? Read this M&A career guide for CA grads.

Final Tips to Choose the Right Banking Course

Before enrolling, here’s a final checklist:

✅ Is the course recognised by top employers?

✅ Does it offer practical training or just theory?

✅ Will you get access to placement support?

✅ Can it be completed alongside a job?

✅ Does it align with your long-term career goal?

If all these check out, you’re on the right track.

And if you’re still exploring, the Postgraduate Financial Analysis Program is a strong all-rounder—perfect for those looking to enter finance or banking with confidence.

Still Confused? Here’s a Quick Summary

| Course Type | Best For |

| Diploma in Banking and Finance | Quick job entry after graduation |

| Post Graduate Banking Programs | Deep knowledge + strategic finance roles |

| Best Banking Certification Courses | Targeted skills for career growth |

| Professional Banking Courses in India | Aligned to Indian job market & regulatory trends |

| Online Banking Courses with Placement | Flexibility + job assistance |

FAQs

1. What are the best banking certification courses for freshers?

Short-term, skill-based ones with job support work best.

2. Are professional banking courses in India recognised by banks?

Yes… especially those aligned with industry standards.

3. Is a diploma in banking and finance useful after BCom?

Definitely—it builds job-ready skills fast.

4. Do post graduate banking programs help in placements?

Yes, most come with strong hiring support.

5. Can I take online banking courses with placement from home?

Absolutely… they’re built for flexible learning.

6. Are post graduate banking programs better than MBAs?

If you want role-specific training… then yes.

7. Will a diploma in banking and finance boost my resume?

For sure—it adds practical banking knowledge.

8. Do professional banking courses in India include internships?

Some do… especially the ones with placement tracks.

Conclusion

The right course doesn’t just teach—it transforms.

Choosing from top-rated banking courses after graduation isn’t just about getting a certificate… it’s about unlocking the next chapter of your career.

Take your time, ask questions… & pick a course that offers credibility, flexibility, & career support. Because in the world of banking, how you start… often defines how far you go.

Things to Consider While Applying for an Investment Banker Course

Things to Consider While Applying for an Investment Banker Course