You are not just searching for CMA Coaching near me. You are trying to find a place where your effort will turn into a result. You want classes that respect your time, explain tough topics in a simple way, and keep you on track till the exam day and beyond.

The right institute for a CMA Certification feels organised from the start. The schedule is clear. The faculty explains concepts without rushing. The study material does not feel heavy or confusing. You know what to study this week and how to test yourself at the end of it. When this structure is in place, your preparation stops feeling scattered. Before you decide, attend a demo class. Listen to how the faculty explains a topic. Check if the pace suits you. Ask how doubts are solved and how often tests are conducted. These simple checks give you a clear picture of what your next few months will look like.

A good learning environment does not feel complicated. It feels steady. You know what to do each day. You see your progress each week. And you move closer to your goal without confusion. That is the kind of CMA coaching centres near me you should look for as you begin your journey.

In this guide, you will learn how to choose the right CMA Coaching near me based on your study style, budget, and career goals. It will walk you through the different types of coaching options, fees, learning formats, placement support, and daily study experience so you can compare institutes with clarity. By the end, you will know what to look for, what to avoid, and how to pick a CMA coaching centre near you that supports your exam preparation and long-term career in finance.

How To Choose the Right CMA Coaching Near You

Before you finalise your CMA Coaching near me, it helps to know what the CMA course actually covers and where it can take you. When you understand the structure and career value of CMA, it becomes easier to choose the right institute and study format. If you are new to the course, you can start with this quick guide on: what is CMA? and then match your learning needs with the right coaching option near you.

What CMA Stands For

CMA stands for Certified Management Accountant. It is a professional certification in management accounting and financial management. It focuses on how businesses plan budgets, control costs, analyse data, and make financial decisions. This is why CMA professionals are often part of decision-making teams inside companies.

What You Study in CMA

The syllabus is designed for real business situations. Key subjects include:

- Financial planning and analysis

- Cost management

- Performance management

- Risk management

- Corporate finance

These subjects help you understand how companies manage money and make strategic decisions.

Skills You Build During CMA

While preparing with the right CMA coaching institute near me, you build skills that are useful in many roles. You learn to:

- Analyse financial data

- Create budgets

- Control costs

- Interpret business performance

- Support management decisions

These skills are valuable across industries.

Why CMA Is in Demand

Companies today rely on data and cost control to stay competitive. CMA professionals help with:

- Improving profitability

- Reducing wasteful spending

- Planning future investments

- Managing financial risks

This is why many learners look for the best CMA coaching near me to enter this field.

Evaluating whether CMA is worth pursuing becomes easier when you look at the long-term value it brings in terms of career growth, global opportunities, and earning potential. It helps you understand how the certification aligns with your professional goals and what kind of roles and progression you can expect after completing the program.

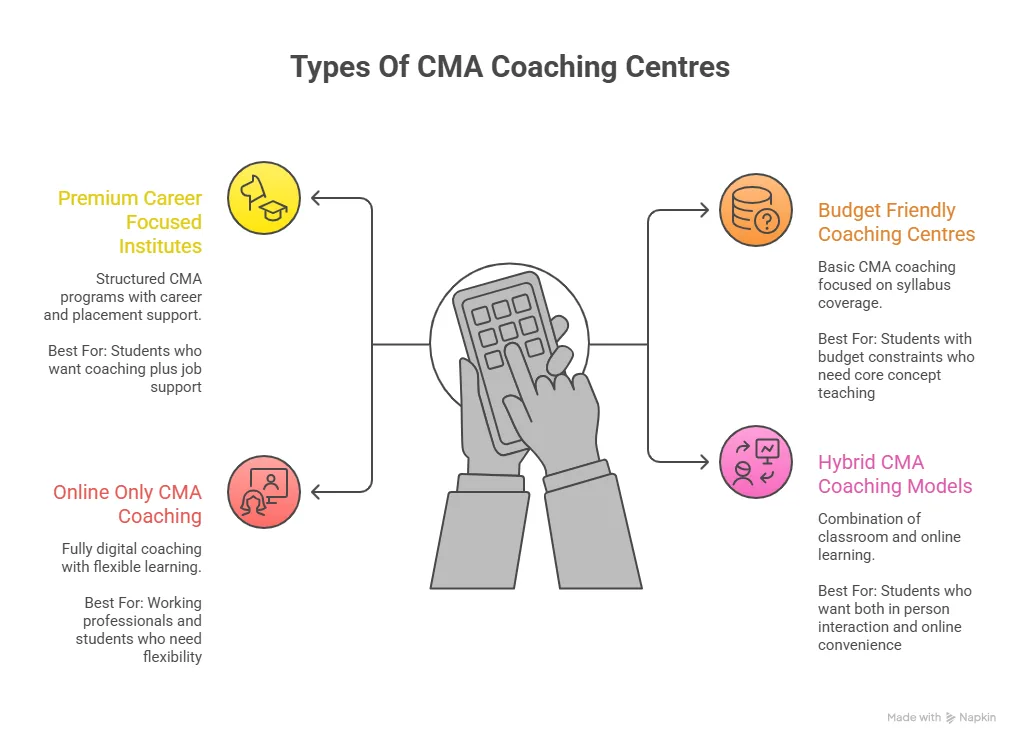

Types of CMA Coaching Classes Near Me

Every learner studies in a different way. That is why I see three main formats when I explore CMA coaching classes near me.

1. CMA Classroom Coaching

This is the traditional method.

- Fixed class timings

- Face-to-face teaching

- Peer learning with classmates

This works well when I need discipline and a fixed routine.

2. CMA Live Online Coaching

This feels like a virtual classroom.

- Live sessions with faculty

- Chat-based doubt solving

- Recorded backups of each session

This is useful when I want flexibility but still need live interaction.

3. Recorded Self-Paced CMA Coaching

This is fully flexible.

- I can watch lectures anytime

- I can revise topics multiple times

- I can study at my own speed

This works best when you are working or managing college with your studies.

Also Read: How to Choose the Best CMA Review Course for Your Preparation

CMA Coaching Fees Near Me

Fees vary based on institute, format, and support. When you compare CMA coaching institute near me, you’ll usually see these ranges:

| Type of Program | Approx Fees Range |

| Classroom CMA India | ₹80,000 to ₹2,50,000 |

| Online CMA India | ₹60,000 to ₹1,80,000 |

| US CMA Coaching | ₹1,50,000 to ₹3,50,000 |

These numbers change based on faculty quality, study material, and placement support. According to the official IMA body, the global CMA certification sees salary growth of up to 21% compared to non-certified peers. Source: IMA Global Salary Survey. So, the investment in the right coaching has long-term value.

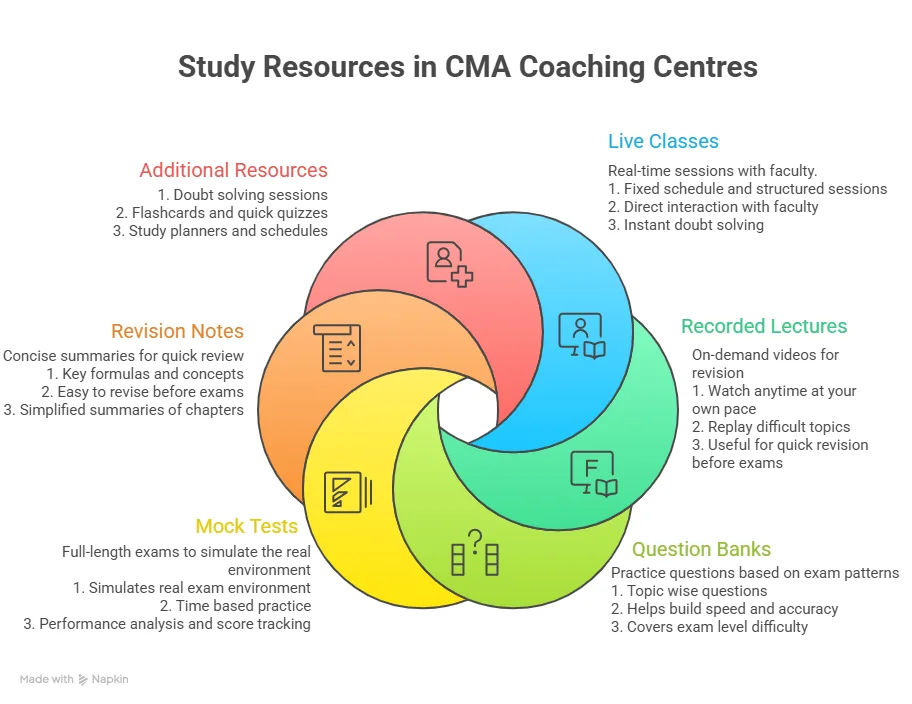

What I Look For in the Best CMA Coaching Near Me

When I compare options, I focus on simple but powerful factors.

- Faculty Quality: I check if the faculty has industry exposure and teaching clarity.

- Study Material: I prefer concise notes with practice questions.

- Mock Tests: Regular tests help me measure progress.

- Doubt Solving: I need quick responses to my questions.

- Placement Support: This is important if I want job support after the course.

How Location Plays a Role in Choosing the Right CMA Coaching

Even though online learning is growing, location still matters. If I attend offline classes, I check:

- Travel time

- Safety of the area

- Class timings

- Batch size

A nearby centre helps me save time and stay consistent. That is why the search for CMA coaching centres near me still has strong value today.

Did You Know?

Finance and analytics roles are among the fastest-growing job segments globally. And CMA professionals are in demand in sectors like consulting, manufacturing, and fintech. (Source: Statista)

Top CMA Coaching Centres Near Me in Mumbai With Detailed Comparison

When I search for CMA coaching centres near me, I usually find many options. Each institute claims strong results. So I compare them on clear factors that matter in daily study life. Before going forward with the comparison, I make sure to look at:

- Faculty background

- Teaching format

- Student reviews

- Placement support

- Fees

This helps me compare fairly.

CMA Coaching Institutes Near Me – Mumbai Comparison Table

| Institute Type | Mode | Fees Range | Placement Support | Ideal For |

| Premium Career Institute | Hybrid | ₹2L to ₹3.5L | Yes | Fresh graduates |

| Mid Tier Coaching Academy | Classroom | ₹1L to ₹2L | Limited | Students in college |

| Online Only Platform | Online | ₹80K to ₹1.5L | No | Working professionals |

| Skill Focused Finance School | Hybrid | ₹2L to ₹4L | Strong | Career switchers |

When I compare CMA coaching institutes near me, I do not focus on brand names only. I focus on how well they support my daily learning and final placement.

Getting a feel for how CMA interview rounds are structured can help you prepare with more confidence and clarity. It gives you a sense of the kind of questions asked, how to present your knowledge, and the way employers assess finance and management accounting skills during hiring conversations.

Area-wise CMA Coaching Near Me in Mumbai

Mumbai is a large city. Travel time can reduce study hours. So I prefer looking at coaching options area-wise.

CMA Coaching Near Me in Andheri

Andheri is a popular education hub.

- Easy metro access

- Many coaching centres in one area

- Evening and weekend batches available

This area works well for students and working learners.

CMA Coaching Classes Near Me in Thane

Thane is growing fast as an education centre.

- Lower fees compared to central Mumbai

- Good classroom infrastructure

- Easy train connectivity

This works well for students living in central suburbs.

CMA Coaching Centres Near Me in Navi Mumbai

Navi Mumbai offers modern campuses.

- Planned locations

- Less crowd

- Better classroom environment

This is helpful if I prefer a calm learning space.

CMA Coaching Institute Near Me in Dadar

Dadar connects the western and central lines.

- Easy to travel from multiple locations

- Many reputed institutes

- Weekend batches available

This is ideal if I travel from different parts of the city.

Also Read: Check Your CMA Eligibility Criteria and How You Can Apply?

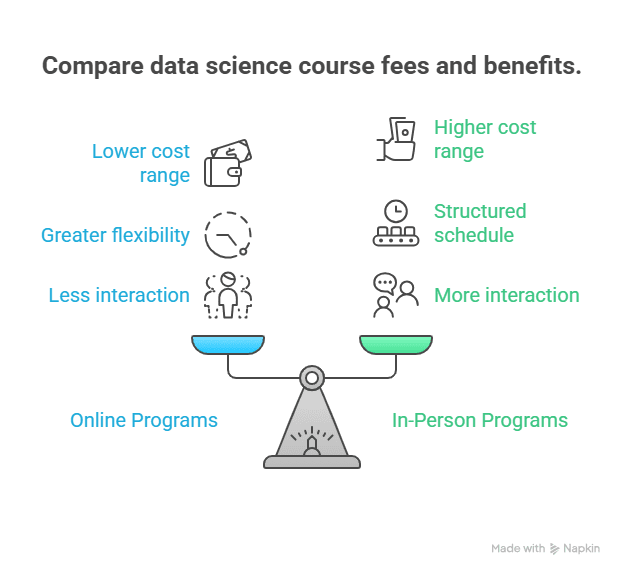

Online CMA Coaching vs Offline CMA Coaching Near Me

Both formats have benefits. I decide based on my schedule and learning style.

Offline CMA Coaching Benefits

- Face-to-face interaction

- Fixed routine

- Classroom discipline

This suits me if I need structure.

Online CMA Coaching Benefits

- Learn from home

- Access to recorded lectures

- Flexible revision

This suits me if I work or manage college.

Placement Outcomes After CMA Coaching Near Me

One of the biggest reasons for choosing the right coaching is job support. Many institutes now provide placement assistance after course completion.

CMA Career Opportunities After Coaching

After completing my course, I can explore many job roles.

Core Roles

- Cost Accountant

- Financial Analyst

- Internal Auditor

- Budget Analyst

Growth Roles

- Finance Manager

- Business Analyst

- Strategy Consultant

A report by PayScale shows that finance professionals with management accounting skills often move faster into leadership roles. According to the US Bureau of Labour Statistics, finance and accounting roles are expected to grow steadily through this decade.

Salary Range After CMA

| Experience Level | Average Salary Range |

| Fresher | ₹5-8 LPA |

| 2 to 5 years | ₹8-15 LPA |

| 5+ years | ₹15-30 LPA |

For global CMA roles, salaries can be higher based on the country and company.

Understanding how CMA salaries compare in India and the USA gives useful context when you are planning your career path after certification. It highlights how factors like job role, experience level, and location influence earning potential and long-term growth for CMA professionals.

CMA Coaching Near Me With Placement

Some CMA institutes focus on job outcomes along with teaching.

These programs include:

- Resume building sessions

- Interview training

- Industry projects

- Placement drives

Institutes like Imarticus Learning and similar finance academies often integrate career services into the program structure. When I look for the best CMA coaching near me, placement support becomes a major factor.

CMA USA Coaching Near Me – What I Check Before Joining

If I choose the US CMA path, I check a few extra things.

- IMA Alignment: The institute should follow the official IMA syllabus.

- Exam Support: Guidance on exam registration and testing centres.

- Global Placement Help: Support for roles in MNCs or global companies.

- Industry Faculty: Faculty with corporate finance experience.

These factors help me get full value from CMA USA coaching near me.

Did You Know?

The global CMA certification is recognised in over 150 countries. This gives strong career mobility across regions. (Source: IMA Certification Page)

How I Shortlist the Best CMA Coaching Near Me in 3 Steps

When you have many options, it helps to follow a clear method instead of choosing in a hurry. Start by creating a shortlist of a few reliable institutes you find through search and reviews. This gives you a focused list instead of too many choices. From there, attend demo classes to see how each faculty explains concepts and whether the pace suits your learning style.

Once you have seen a few demos, compare the institutes using a simple scorecard. Look at teaching quality, fees, student support, and placement assistance. When you rate each option on these factors, the right CMA Coaching near me becomes easier to identify and you can make your final decision with clarity and confidence.

| Step | What to Do | How to Do It | Outcome |

| Step 1 | Create a shortlist of 5 institutes | Use search results, reviews, and ratings to list top CMA coaching options near you | You get a focused list of reliable institutes to compare |

| Step 2 | Attend demo classes | Attend at least 2 demo sessions to check teaching style, clarity, and interaction | You understand which faculty and format suit you best |

| Step 3 | Compare using a scorecard | Rate each institute on teaching quality, fees, support, and placement | You can make a clear and confident final decision |

Final Checklist Before You Join a CMA Coaching Institute Near Me

Before I make the final payment, I pause and review a simple checklist. This step helps me avoid confusion later. I look at each factor one by one.

| Checklist Area | What to Check | Why It Matters |

| Academic Readiness | Do you understand the syllabus clearly | Helps you plan your study approach from day one |

| Do you know the exam pattern? | Improves your exam strategy and time management | |

| Do you have enough time each week to study | Ensures you can stay consistent and complete the syllabus | |

| Institute Quality | Is the faculty qualified and clear in teaching | Good teaching improves concept clarity and confidence |

| Do they provide updated study materia?l | Keeps your preparation aligned with the latest syllabus | |

| Are mock tests part of the program | Helps you practise under exam conditions and track progress | |

| Career Support | Do they provide resume help | Prepares you for job applications after the course |

| Do they conduct interview training? | Improves your chances of clearing finance interviews | |

| Do they have placement tie-ups | Gives access to job opportunities after certification |

When I tick these boxes, I feel confident about my choice of CMA coaching near me.

Common Mistakes I Avoid During CMA Preparation

Many students lose time because of avoidable mistakes. I try to stay aware of them.

- Skipping mock tests

- Delaying revision

- Studying without a fixed schedule

- Ignoring weak subjects

By avoiding these habits, I get better results from my CMA coaching institute near me.

Did You Know?

According to a global survey by IMA, CMA-certified professionals report higher job satisfaction due to career growth opportunities in corporate roles.

Why Imarticus Learning Stands Out for CMA Preparation

When you compare options for CMA Coaching near me, you will notice that not all programs are built the same way. Some focus only on completing the syllabus. Some combine learning with career readiness and global standards. The CMA program prep at Imarticus Learning is designed as a structured pathway that supports both exam preparation and career transition into finance roles.

Here are the key features that define the Imarticus Learning CMA experience:

- Gold Learning Partner with the Institute of Management Accountants (IMA), USA, reflecting globally benchmarked teaching standards and recognised program quality

- Industry-aligned program developed in collaboration with KPMG in India, bringing real business scenarios into classroom learning and strengthening practical exposure

- Study material powered by Gleim, a globally trusted CMA content provider, reviewed by professionals for over 40 years, ensuring depth and exam relevance

- Proven training outcomes with high student success rates reported to be significantly above global averages in CMA exam performance

- Career-focused approach that includes resume-building support, interview preparation, and a structured pre-placement bootcamp to help learners move into finance roles

- Flexible learning formats with online, classroom, and hybrid delivery options that fit different schedules and learning preferences

These features make Imarticus Learning a strong choice for learners who want their CMA coaching institute near me to offer both academic clarity and career direction in one place.

FAQs on CMA Coaching Near Me

Choosing the right CMA Coaching near me often raises practical questions about classes, fees, difficulty level, and study options. Clear answers to these frequently asked questions help you make a confident decision and move forward with your CMA preparation.

Which coaching classes are best for CMA students?

The best choice depends on the student’s learning style, budget, and career goals. Some learners prefer classroom interaction, while others choose online flexibility. When I evaluate CMA Coaching near me, I check faculty quality, mock test support, and placement services. Institutes such as Imarticus Learning offer structured programs with career support, which help many students prepare and transition into finance roles with confidence.

Is it necessary to go to coaching classes for the CMA?

Coaching is not compulsory, but it helps create a strong structure. Many students can study on their own, but guidance improves consistency and clarity. When I look for CMA Coaching near me, I find that coaching adds discipline, doubt solving, and exam strategy support. Institutes like Imarticus Learning provide guided learning paths that help many learners stay on track and complete the syllabus on time.

Which coaching institute is best for CMA in Delhi?

Delhi has many reputed institutes with strong faculty and classroom infrastructure. The best institute depends on the student’s schedule and budget. When searching for CMA Coaching near me, I compare demo classes, reviews, and placement support. Imarticus Learning also offer online access, so students in Delhi can attend quality programs without location limits.

What are the CMA course fees?

CMA course fees vary based on the institute and program type. Classroom programs often cost more than online courses due to infrastructure and faculty access. When I compare CMA Coaching near me, I usually see total program costs ranging from ₹80,000 to ₹3,50,000, depending on whether it isan Indian CMA or US CMA. Institutes like Imarticus Learning often bundle study material and placement support within the course fees.

Can I study CMA at home?

Yes, many students prepare at home using online learning platforms and recorded lectures. Self-paced study works well when I have strong discipline and time management. Even then, I often look for CMA Coaching near me that offers online doubt solving and mock tests. Providers like Imarticus Learning support home-based learners with structured content and live sessions.

Is CMA a 1-year course?

The duration depends on the level and the pace of study. A US CMA can often be completed within 6 to 12 months, while an Indian CMA takes longer. When you enrol in CMA Coaching near me, the institute usually provides a study plan based on your timeline. Structured programs from providers like Imarticus Learning can help learners complete the course faster with guided preparation.

Is CMA hard to pass?

CMA exams require consistent practice and concept clarity. The difficulty level becomes manageable with proper guidance and revision. When you choose CMA Coaching near me, you receive mock tests and faculty support that improve your exam readiness. Institutes like Imarticus Learning focus on exam-oriented teaching, which helps many learners clear the exams confidently.

What is the age limit for CMA?

There is no strict age limit for CMA. Students, graduates, and working professionals can pursue the course. When I search for CMA Coaching near me, you’ll find batches designed for different age groups and schedules. Institutes like Imarticus Learning offer flexible learning options so learners at different life stages can join and prepare comfortably.

Choose the Right CMA Coaching Today

At this point, the path is clear. The right CMA Coaching near me is the one that fits your daily routine, explains concepts in a simple way, and supports you until you step into a job role. When you compare options, focus on the basics that matter every day. Look at the quality of faculty, the clarity of study material, the regularity of mock tests, and the strength of placement support. Also, check the class schedule, travel time, and access to revision lectures.

A good institute gives you structure. It gives you a plan for each week, regular tests to track progress, and quick doubt-solving support. These small details shape your consistency. When your routine is clear, your preparation becomes steady and stress-free.

Take a few practical steps before you enrol. Shortlist a few CMA coaching centres near me. Attend demo classes. Ask for the study plan and mock test schedule. Check how they support placements. When you review these points, your decision becomes simple and confident.

If you want a guided path with career support, you can explore structured programs that combine teaching, practice, and placement assistance. The CMA Course prep with Imarticus Learning is designed for learners who want a clear route from preparation to a finance role. A quick discussion with their counsellors can help you understand the format, timelines, and outcomes before you decide.

Your CMA journey begins with one clear step. Choose the right support, follow a steady plan, and move ahead with confidence.