Cryptocurrency investments have increased over the past few years. Nowadays, people want to learn about cryptocurrency and invest even more. Cryptocurrency is based on machine learning and algorithms that software developers maintain and develop. There are multiple entrepreneurship and career opportunities revolving around this ever-growing industry.

What is the Best Career Path for Cryptocurrency Enthusiasts?

Cryptocurrency enthusiasts can opt for various careers and even change streams. After completing a cryptocurrency course, aspirants can find jobs in the following fields.

- Financial Analysis

Financial analysts analyze current and historical data based on cryptocurrencies. The insights generated from these analyses help people understand where they should invest. Financial analysts also provide investment strategies to clients. They also evaluate risks and assess the economical, social and political climate to find out the correct value of cryptocurrencies. To become a financial analyst, candidates need to have a professional certification in FinTech or an MBA with specialization in FinTech or new-age finance.

- Security Engineering

Cryptocurrency companies need to protect all assets from third-party attacks. Therefore, they spend significant resources on ensuring the use of the best security measures available. Security engineers can develop the necessary systems that will protect the company’s as well as the clients’ data and all digital assets. Candidates who have a degree in computer science are usually eligible and some companies might ask for certain specializations.

- Crypto Content Creation/Writing

Potential investors need to understand what cryptocurrency is and how beneficial it can be. Only then will they invest in it. Crypto content creators or writers provide detailed information related to cryptocurrency platforms, trends, use, Blockchain technology.

To become a crypto content creator or writer, candidates need to have a complete understanding of what cryptocurrency is. They should know their topics well and create unique content. The delivery of the content should be apt as well. The target audience needs to stay interested in the content. The content is responsible for investors finding the idea of investing in cryptocurrency more lucrative.

- Software Development

For cryptocurrency to stay relevant, software developers are essential. Software developers develop algorithms and use machine learning to create interactive interfaces. They also improve the security aspects of cryptocurrency platforms. In developing easily accessible platforms and interfaces, cryptocurrency companies are able to connect better with their potential clients and find more investors. To become a software developer and work with cryptocurrencies, aspirants need to have a master’s degree in a related field. They should also have adequate knowledge about natural language processing and data structures.

- Business Development

Even though cryptocurrency has seen growth in recent times, companies that deal with cryptocurrency and Blockchain still need to be developed. These companies require business developers who understand the condition and value of cryptocurrencies across industries. They should also be able to create channels for cryptocurrency use in sectors like healthcare, tourism, and retail, among others. Business developers working with cryptocurrency companies assess the market conditions and set up partnerships that are beneficial in the long run.

How Can a FinTech Course Help Cryptocurrency Enthusiasts?

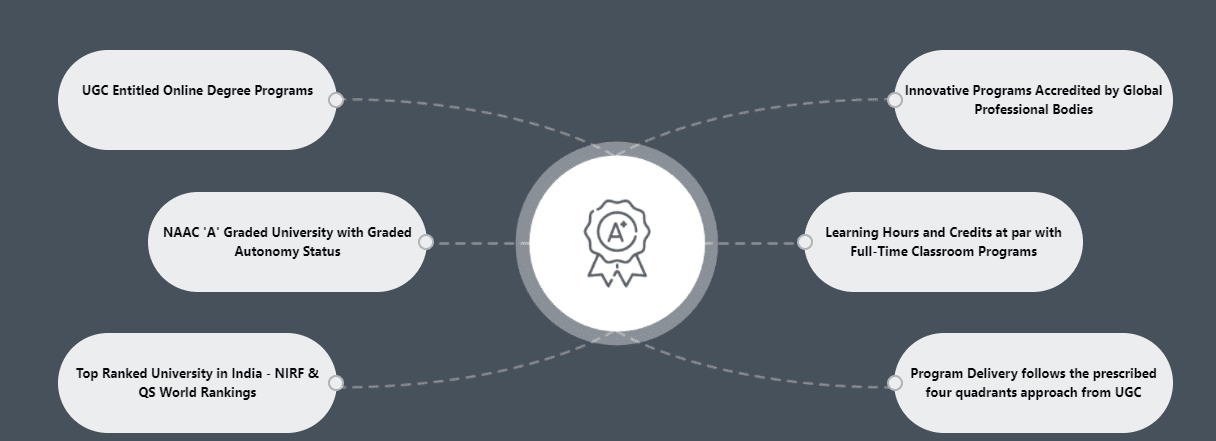

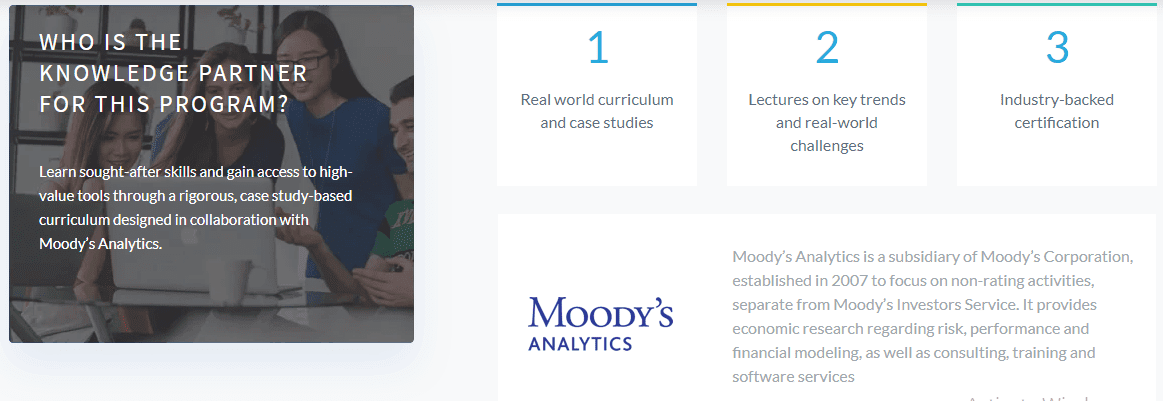

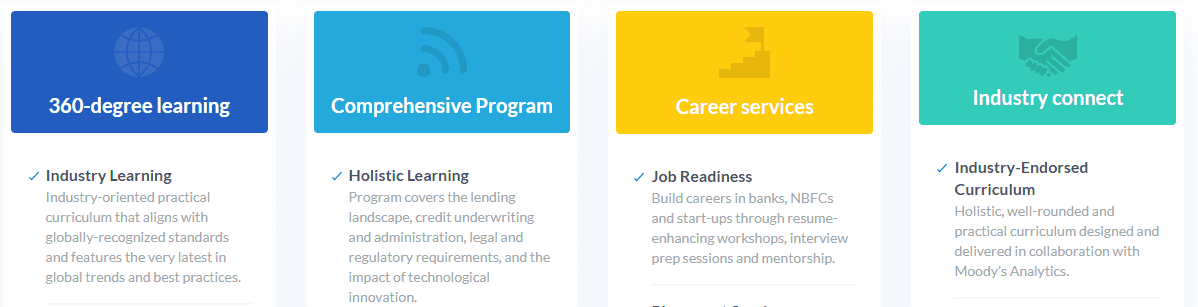

The advancement of cryptocurrency is centered around the financial sector and how it is perceived by investors. Therefore a FinTech course can definitely help. Imarticus Learning has FinTech courses where students can learn the use of current technologies like Cloud Computing and Blockchain.

Professional certification in FinTech from Imarticus Learning can help a student understand the industry and learn how cryptocurrency is relevant to the implementation of FinTech.

The program is in partnership with industry giants and this allows students to create essential contacts. Students will also get FinTech community access and work on 6 real-world projects. They can base these projects on cryptocurrency and develop a holistic approach towards the subject.

The program is in partnership with industry giants and this allows students to create essential contacts. Students will also get FinTech community access and work on 6 real-world projects. They can base these projects on cryptocurrency and develop a holistic approach towards the subject.

Nowadays, FinTech has a huge scope and since people are responding well to cryptocurrency, it is also a great career opportunity. Students who have an interest in finance and are enthusiastic about crypto can choose Imarticus Learning’s course to further their careers.

Enthusiasts can go for the Professional Certification in Supply Chain Management & Analytics provided by Imarticus Learning. The pros of the

Enthusiasts can go for the Professional Certification in Supply Chain Management & Analytics provided by Imarticus Learning. The pros of the

Business Analytics

Business Analytics

Typically, companies start their sustainability strategies by reducing their costs and their negative impact on the environment. However, this approach is not enough; sustainability must be considered a core value in any business strategy. To do this the

Typically, companies start their sustainability strategies by reducing their costs and their negative impact on the environment. However, this approach is not enough; sustainability must be considered a core value in any business strategy. To do this the

Enterprise Ethereum Alliance (EEA) is a support group formed by more than 200 market leaders such as Microsoft, Wipro, Intel, Accenture, JP Morgan, Thomson Reuters, Credit Suisse along with many start-ups and subject matter experts. They are all bound by a common factor; all of them believe in the potential of blockchain.

Enterprise Ethereum Alliance (EEA) is a support group formed by more than 200 market leaders such as Microsoft, Wipro, Intel, Accenture, JP Morgan, Thomson Reuters, Credit Suisse along with many start-ups and subject matter experts. They are all bound by a common factor; all of them believe in the potential of blockchain.

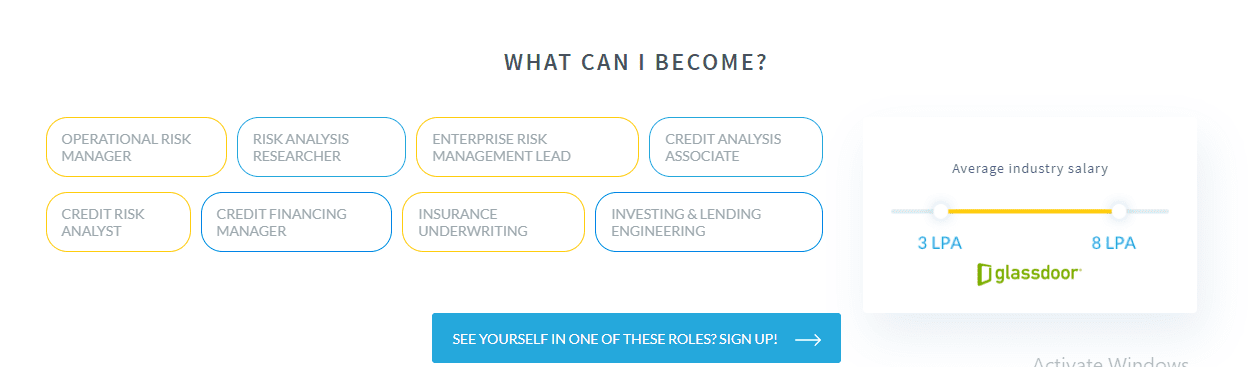

Let us understand why credit underwriting is such a fascinating career option.

Let us understand why credit underwriting is such a fascinating career option. You get to work with the latest technology:

You get to work with the latest technology:  Conclusion:

Conclusion: