Businesses are made to expand and grow, for which data analysis and success measurement are vital. Efficiently analyzing the data and putting forth a plan of action is where business analytics plays a key role.

Introduction to BA and Growth Scope

Business analytics is essential data for every organization. The data is used to measure success metrics and plan for the future and define goals.

According to IDC, 55% of IT budgets go into business growth initiatives, which inevitably pushes for the growing demand of business analysts. But the actual number of employable certified business analysts is much lesser than the demand. So this is a great career opportunity for those interested in analytics.

Why Become A Business Analyst?

Here are some reasons for motivations to become a successful business analyst:

Low Barriers to Entry: Business Analysis being in the growth stage, the role of a BA has low entry barriers compared to other professions. But the rise in importance of IIBA, CBAP accreditation and, ISEB qualification is changing scenarios rapidly.

Challenging And Demanding Job: A business analyst utilizes multiple skills like problem-solving, relationship management, time management, etc. This makes the job role a challenging ride. However, anyone enjoying challenges is welcomed on board.

Spring to Other Careers: The skills acquired by business analysts are helpful in many roles and open doors to opportunities to move up in better profiles.

Use Existing Industry Knowledge: General business or industry-specific knowledge makes you a valuable asset and differentiates you from other business analysts.

The Importance of Business Analytics Certification

The concept of business analytics might sound simple, but it demands excellent technical proficiency to excel as a business analyst. Skilled professionals must understand technology and business and make an organizational commitment to data-driven decision-making.

Thus, adequate training and suitable business analyst certification courses are of great help. Here are some advantages of enrolling in business analyst certification courses:

Career Growth Opportunities

Career Growth Opportunities

Too obvious, but in a competitive job market, job security is everything. Being certified for something that’s in demand certainly gives you an edge. Besides lucrative job opportunities, you get better salary advantages after enrolling in a business analyst course online.

Structured Learning

The business analyst course in India is strategically structured. The course framework includes fundamentals of strategy analysis and data analytics, and other advanced components. Therefore, only a business analyst course online can provide a complete learning package. Also, some business analyst course fees may surprise you over affordability!

Vast Employment Opportunities

Since every business depends on data analytics these days, you establish eligibility for employment in different industries with a certification course. Unfortunately, not every career path offers the flexibility and diversity of fitting into multiple job roles and qualify for high-paying jobs.

Learn More About Popular Business Analytics tools

The business Analyst Certification program trains you to perform different tasks using some most popular tools in business analytics. To name a few, Microsoft Excel, NumPy, SciPy, Tableau, Python, R, SAS are some tools you’ll be trained to use.

Commitment & dedication For Interests

Obtaining certification for business analyst courses in India proves your dedication and establishes your acumen. Employers appreciate the candidate’s efforts and hire those who have worked hard to obtain a particular certification.

Learn with Peers & Experts at Imarticus:

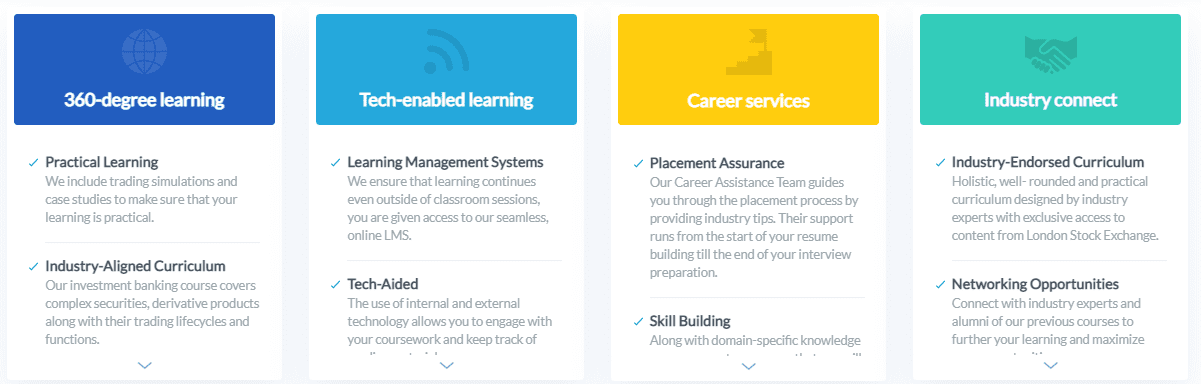

Anything must be started from building a base. A building without a foundation can be a risky affair. Imarticus understands this and offers PG programs in Data Analytics and ProDegree in Data Science and Machine Learning.

The Agile Business Analyst programs empower candidates to gain business insights, communication skills, domain expertise, and management skills. Since industry experts supervise the learning program, students can interact with professional business analysts and learn from their experience.

If you’re looking for a business analyst course in India, Imarticus has a couple of great options available; to learn more about courses in analytics, check out their course catalog and business analyst course fees today!

Related Article:

https://imarticus.org/why-agile-is-important/

If you’re a FinTech enthusiast, you don’t want to be caught napping while competitors gain an edge through up-skilling. To be a professional, well-versed in fintech, you need to look for

If you’re a FinTech enthusiast, you don’t want to be caught napping while competitors gain an edge through up-skilling. To be a professional, well-versed in fintech, you need to look for

What is the difference between a primary market and a secondary market?

What is the difference between a primary market and a secondary market?

Become a freelance digital marketer

Become a freelance digital marketer You can start your search with looking by ‘

You can start your search with looking by ‘

As far as soft skills are concerned, as a financial analyst, you need to have incredible correspondence and relational abilities and the capacity to explain and turn complicated data into concise and compact presentations.

As far as soft skills are concerned, as a financial analyst, you need to have incredible correspondence and relational abilities and the capacity to explain and turn complicated data into concise and compact presentations.