A financial market, unlike the other markets, is more of an intangible concept and basically refers to a marketplace where buyers and sellers usually participate in an exchange of assets such as equities, bonds, derivatives and currencies. The basic characteristic of any financial market comprises of transparent pricing, basic regulations regarding costs and fees and a number of market forces, that determine the prices of securities that trade. These financial markets can be found almost in every single country across the world, some of these may be small, with a very few numbers of participants, while some are huge in terms of the amount of money they trade, for example, the New York Stock Exchange.

It is basically investors, who have an access to a great number of financial markets and exchanges, that deal with a vast array of financial products. Some of these markets have always been open to private investors, while some have always remained, pretty much exclusive in terms of catering to major international banks and financial professionals. There are a variety of financial markets, which make up the field of finance.

Capital Markets

Capital Markets

These markets are where individuals and various organizations, deal with the trading of financial securities. There are a number of organizations and companies, that sell securities on these markets, in order to raise funds for themselves. This is why the capital markets consist of both primary as well as secondary markets. Any organization or corporation requires capital in order to finance its various operations, as well as to engage in long-term investments. In order to accomplish this, the corporation raises money through the sale of securities, basically bonds and stocks; all of which is in the name of the company.

Stock Markets

These are markets, which allow all of the investors to buy and sell the shares in publicly traded companies. They are popularly known to be the most vital area of a market economy, this is because they provide companies, with the access to capital and all the investors, with a chance to have a percentage of ownership in the company. This market is divided into primary markets as well as secondary markets.

Bond Markets

Bond Markets

A bond refers to any debt investment in which, an investor loans money to an entity, this can be either corporate or governmental. This entity basically borrows the funds for a specific period of time Bonds are usually used by a number of companies, municipalities, states as well as governments, in order to finance a variety of projects and activities. This markets basically deals with buying and selling of bonds on the various credit markets, all over the world. This market is also referred to as the debt market or credit market or fixed-income market. The many types of bonds are corporate bonds, municipal bonds, notes and bills which are also known as treasuries and so on.

All of these markets require a financial professional, wither a corporate banker, investment bankers or portfolio manager and so on, to deal with their various aspects. The various attractive benefits that these markets offer are a result of a lot of finance aspirants seeking positions in the field of financial markets. Imarticus Learning is one of the best institute for finance and investment banking training and very much preferred by these professionals, in order to get a hang of how the markets work, through various certification courses in corporate finance, investment banking and so on.

Tag: stock market

How Do Traders Working On The Cloud And Data To Cope With The New Normal?

COVID-19 or coronavirus is spreading like wildfire throughout the world. And, this even forced the World Health Organization (WHO) to declare it a pandemic. Ever since this disease was spotted, countermeasures have been set to curb its spread effectively. One such way is social distancing.

Because of social distancing and worldwide lockdown, the world’s foundations shook from within. And, it wasn’t late until this shockwave reached the stock market. In fact, both the trade life cycle and banking courses after graduation have taken a huge hit as well.

To do their bit, financial institutions like the New York Stock Exchange (NYSE) have closed their doors to traders for the first time in history. Things are only slowly returning to normal, and a few traders are allowed on NYSE. However, most of the traders are forced to trade from home and find online alternatives for conventional processes.

Cloud offers a lucrative opportunity for anyone looking to trade online. Traditional problems like lack of storage space, security concerns, and connectivity issues have all but disappeared in the cloud era. Statistics state the same. With an online chatting interface, apps providing a secure interface for traders have seen a substantial rise during the pandemic. Let us see how traders are using cloud services in great detail.

How are traders using the cloud?

Stock trading should never come to a halt because it has the power of crumbling economies. The COVID-19 outbreak can thus be considered a major test. Thankfully, traders are armed with the power of the cloud in today’s world.

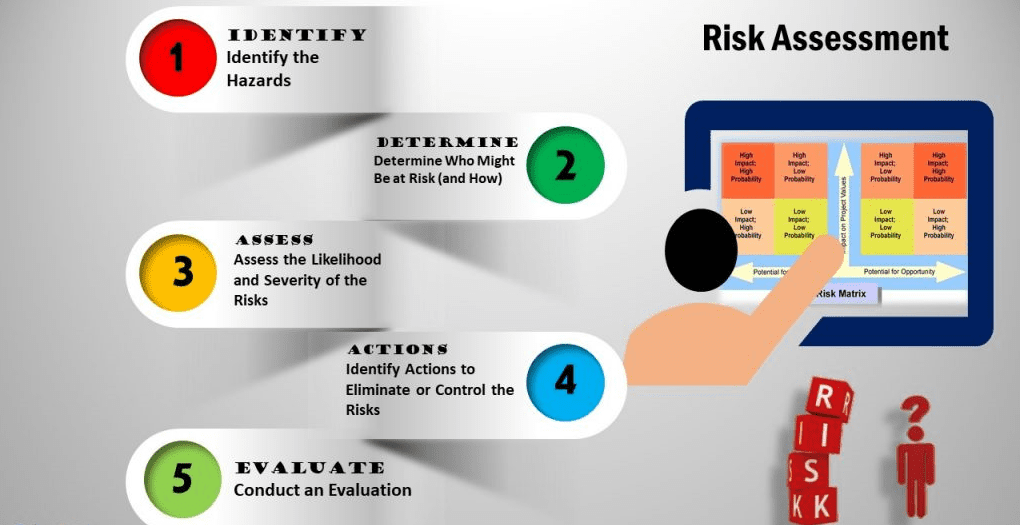

Data is the central part of any trader’s life. It is even more important to store and analyze the information correctly. Traders are increasingly using cloud solutions to store their data and run their models. The processing power of cloud computing allows them to quickly run multiple analyses like risk assessment within a matter of minutes as opposed to hours or even days from conventional means.

Data is the central part of any trader’s life. It is even more important to store and analyze the information correctly. Traders are increasingly using cloud solutions to store their data and run their models. The processing power of cloud computing allows them to quickly run multiple analyses like risk assessment within a matter of minutes as opposed to hours or even days from conventional means.

Cloud also allows for better traffic management. Traders can be seen leveraging the cloud to tackle any amount of traffic effectively. Mainly because the cloud is a scalable entity, it can quickly go up and down depending on the actual amount of people using it. Moreover, cloud computing offers a cheaper solution to many problems associated with stock trading.

Cloud also allows for better traffic management. Traders can be seen leveraging the cloud to tackle any amount of traffic effectively. Mainly because the cloud is a scalable entity, it can quickly go up and down depending on the actual amount of people using it. Moreover, cloud computing offers a cheaper solution to many problems associated with stock trading.

Not to mention, it provides the ability to analyze customer demographics, which allows for targeted solutions for a particular section. So, not only does the cloud act as a cheaper alternative but on top of that, it also improves profit margins.

In the search for normalcy, traders are looking towards the cloud to provide them with solutions. We are fortunate enough to live in a time where we have enough computing prowess to shift the base of operations online. Not only does it allow us to fight the virus but it also provides some benefits overall. In the future, we can expect cloud computing to take up a major role in the trading market.