Traditionally, an MBA degree is offered as an on-campus option, where a student has to pause their career and cede their salary for it. But, in recent years, technology has shaped course delivery methods considerably, and most of the leading business schools are now offering part-time and online MBA courses.

Due to the COVID-19 pandemic, a vast shift towards remote studies made aspirants opt for the online mode of education. Few of the world’s leading business schools have recently shifted to a complete online course curriculum. But, how do choose the right one? Here are the tips for settling on the right MBA course.

Tips to Choose a Right MBA Program

Tip 1: Know Your Purpose

While opting for an MBA program, it is vital to know the goals beforehand. Some aspirants wish to pursue the MBA to get a promotion, while others want to excel and get started in the business genre. For people who don’t want to leave their current job but want the degree to reach heights, an online MBA course will be perfect as physical meetings with new people, networking with industry experts, and reaching different companies might not be the primary priority.

But, for a student who wants to get started in the business sector, physically meeting people is the primary criteria; hence, a traditional on-campus course will be ideal for them.

Tip 2: Budget

While considering a business management course, budget is one of the primary deciding factors. While it is quite common to notice that on-campus courses are relatively costlier than digital MBA courses, it is essential to choose the suitable one.

Few business programs also provide scholarships for deserving students. Hence, students who have a tight budget or are meritorious can check out the institution providing financial aids.

Tip 3: Employability and Competition of Admission

Institutions providing the best online MBA courses have a high employability rate. This factor is beneficial for students looking for a course that will provide them significant opportunities but within a limited budget. These online courses will groom them with all the amenities with options of industrial connection and a virtual networking ecosystem. The employability rate of a particular university is provided on the website itself, or it can be found on the internet if researched well.

Additionally, an online business management course will give candidates options to study from their residence, with a minimum computer and fast internet connection requirement. Although most of the on-campus leading MBA courses have a high competition to get into due to their limited seat availability, these online programs have relatively more seats for students as institutions do not need to accommodate them on-campus. Hence, the competition to get into an online MBA degree course is somewhat easier for aspirants.

It is easy to get lost in the different university prospectus when choosing an MBA program. Apart from these primary pointers, you can check –

- Class Profiles –

Look at the profile of previously passed out candidates, where they are now, what positions are they serving, and others. This will provide you with the necessary idea of how the alumni have performed and your chances of success.

- Institution’s Reputation-

Lastly, know about the national and international reputation of the university. A highly reputed institution will let its students connect with a large alumni base, thus widening the scope of employability and further studies.

Hence, before choosing an MBA course, check out every above-mentioned factor to settle for an ideal one. Candidates should remember that both the digital and physical MBA’s have their pros and cons; hence it is crucial to choose accordingly. Imarticus offers some of the best management programs from some of the world’s renowned universities that one can choose from.

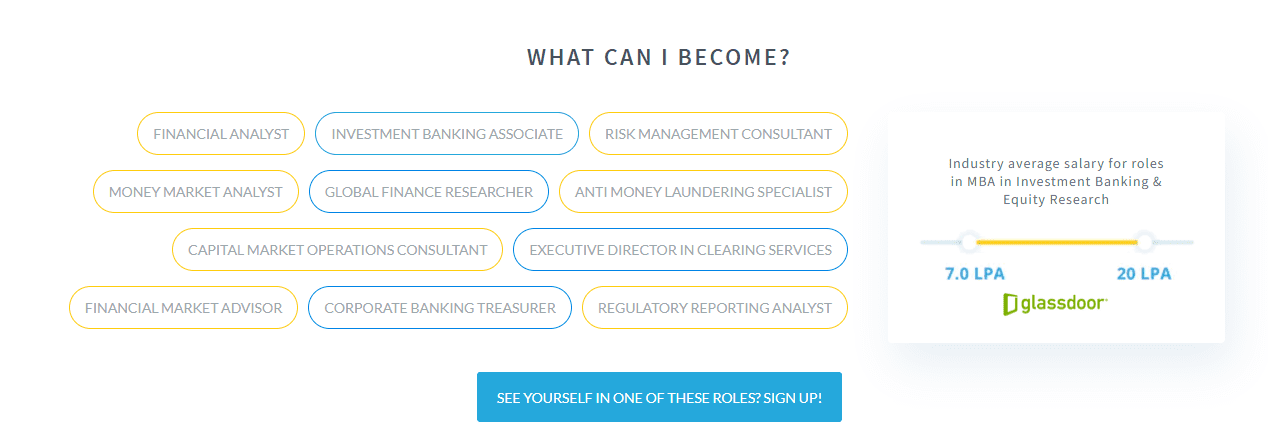

Each of these profiles is prospective high salaried jobs or the ones that open up better professional growth. Many of the

Each of these profiles is prospective high salaried jobs or the ones that open up better professional growth. Many of the