The Investment Banking Certification Program is the best way to learn the skills you need to become a successful investment banker. The program offers an online course with video lectures and interactive quizzes that provide real-world knowledge on mergers, acquisitions, financial modeling, debt securities, equity securities, structured products, and more.

CIBOP is an elite group of professionals who have shown a keen ability to work in the banking industry. They can perform many tasks related to finance, which is why they are so valuable to companies.

What is CIBOP?

Certified Investment Banking Operartions Professionals (CIBOP) is a certification designed by the Investment Banking Professional Certification Board (IBCPB) to test and certify professionals in IB operations, such as financial analysts.

Few skills necessary for success in IB operations:

- Scheduling and controlling activities

- Ensuring compliance with policies and procedures

- Keeping informed of market conditions

- Maintaining relationships with clients

- Identifying opportunities for profitable business

CIBOP certification requirements are flexible to meet the needs of already qualified professionals and those seeking to be certified. For example, if you have at least one year of experience in IB operations, you may obtain the professional designation of CIBOA. Companies look for these individuals because they can perform all necessary tasks related to banking operations.

To obtain CIBOP certification, applicants must pass a 100-question written test and provide references attest to their knowledge and abilities. Applicants are then required to pay a fee and complete a criminal background check if they have not already done so for an earlier certification process.

To obtain CIBOP certification, applicants must pass a 100-question written test and provide references attest to their knowledge and abilities. Applicants are then required to pay a fee and complete a criminal background check if they have not already done so for an earlier certification process.

Benefits of CIBOP Certification for Investment Banking Professionals

Professionals who receive CIBOP certification are more likely to be promoted within their current industry. Companies look for employees who can perform many investment-related tasks successfully, and this certification demonstrates your expertise in these areas. Additionally, professionals who work closely with clients will likely benefit from CIBOP certification due to its focus on client relationships.

Benefits of CIBOP Certification for Employers

As an employer, you may benefit from increased employee morale and productivity if your employees can obtain CIBOP certification. Professionals who hold this designation tend to stay with their company longer than average, decreasing training costs in the long run. Professionals will likely feel more confident in their abilities as employees and be more willing to take on additional tasks. It will ultimately lead to enhanced performance from these individuals, as they will feel they can do it all.

Because CIBOP is not specifically for investment banker courses alone, its benefits extend beyond those who work within the financial industry. If you believe that earning this certification would enhance your career or increase the success of your business, you can go with Imarticus Learning.

Explore Investment Banking with Imarticus Learning

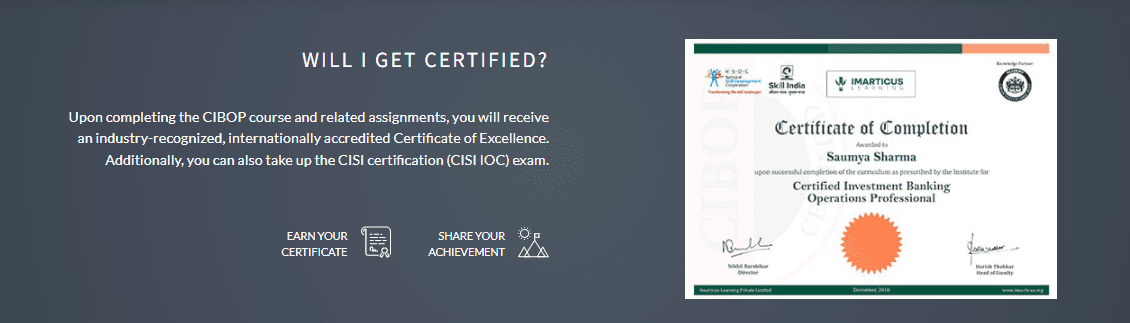

Students now have the opportunity to learn about complicated securities and derivatives, trade-lifecycles, and the services that make up IB operations. This 180-hour powerhouse CIBOP course will thoroughly prepare students for banking operations, treasury, and clearing services.

Some course USP:

- This Investment Banking course with placement assurance aids the students to learn job-relevant skills that prepare them for an exciting career.

- Impress employers & showcase skills with a certification endorsed by India’s most prestigious academic collaborations.

- World-Class Academic Professors to learn from through live online sessions and discussions. It will help students understand the 360-degree practical learning implementation with assignments.

Contact us through the live chat support system or schedule a visit to training centers in Mumbai, Thane, Pune, Chennai, Bengaluru, Hyderabad, Delhi, and Gurgaon.

Function Of Investment Banking Operations

Function Of Investment Banking Operations If a classroom environment seems uncomfortable in the post-Covid world then you can also consider this online

If a classroom environment seems uncomfortable in the post-Covid world then you can also consider this online

In this article, we discuss how to navigate the potential minefield of M&A and what investment bankers do in mergers and acquisitions.

In this article, we discuss how to navigate the potential minefield of M&A and what investment bankers do in mergers and acquisitions.

The journey begins with upskilling oneself to suit the requirements of an investment banking operations career.

The journey begins with upskilling oneself to suit the requirements of an investment banking operations career.

Hedge funding is used as leverage to make big investment decisions and protect those investment decisions related to those investments. Investment bankers are specialists who look after hedge funding.

Hedge funding is used as leverage to make big investment decisions and protect those investment decisions related to those investments. Investment bankers are specialists who look after hedge funding.