The banking world is changing at lightening pace, and Fintech skills are no longer a nicety—they are a necessity. Whether you’re a bright student in India or a career professional considering a career change, knowing what employers want can help you secure your ideal Fintech career.

Fintech unites finance and technology to create an entirely new world of employment, gadgets, and prospects. But the thing is, it’s no longer about being able to code or understand finance in a vacuum. Clients demand an exclusive cocktail of Fintech capabilities that infuses technological proficiency with domain insights and soft competencies to shine in this battleground.

Table of Contents

- Introduction to Fintech Skills

- In-demand Fintech Skills for 2025

- Skills Needed to Get Fintech Jobs: Technical & Soft Skills

- Discovering Fintech Career Prospects in India

- The Most Important Technical Skills in Fintech That You Should Have

- Developing Your Fintech Resume Skills to Excite the Employers

- The Best Fintech Courses to Learn

- Frequently Asked Questions

- Important Takeaways

- Conclusion

Introduction to Fintech Skills

India’s Fintech ecosystem is flourishing. As per a NASSCOM report, India has more than 9,000 Fintech startups, which makes it one of the world’s fastest-growing markets. But with growth comes competition.

To thrive in this sector, you require an empowering combination of Fintech capabilities—ranging from digital payments literacy to data analytics and blockchain mastery. The silver lining? These talents are not exclusive to coders. Graduates of finance, engineers, and even non-technical professionals can achieve a successful career in Fintech if they take the time to upskill.

The question is, what specifically are recruiters on the lookout for? Let’s explore.

In-demand Fintech Skills for 2025

The Fintech sector is changing fast, and the talent sets sought by employers shift swiftly as well. But a few in-demand skills in Fintech do remain stable based on market demand.

Technical skills are a necessity, but it is flexibility. Employers welcome applicants who can not only prove technical skills, but can also solve the problem and prove creative thinking. The ability to quickly learn, explain well and cooperate in multiplexing teams is equally necessary.

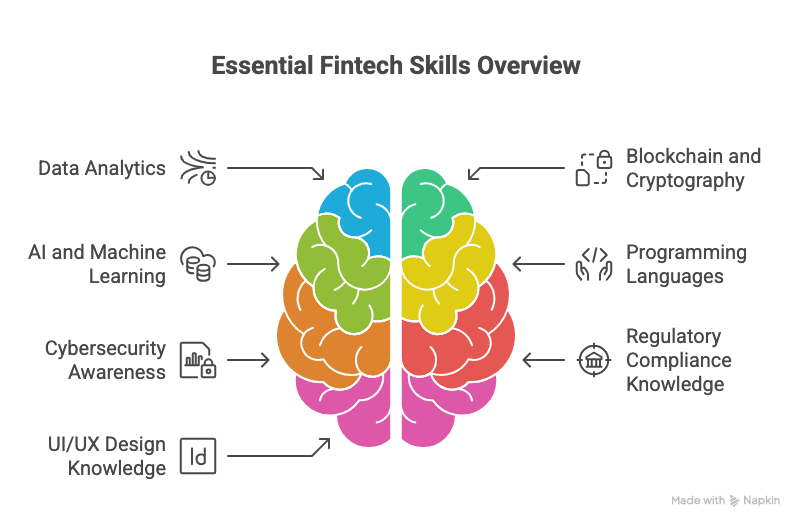

Here you need to develop the observation of skills in high demand for Fintech:

- Data Analytics: This requires working with large data and extracting worthy intelligence.

- Blockchain and Cryptography: blockchain basics, smart contracts and crypto-system.

- AI and Machine Learning: Familiarity with AI uses fraud detection, risk management and individual finance.

- Programming languages: The most demand is made after Python, Java, SQL and R.

- Cyber security awareness: Data security for digital transactions and systems.

- Regulatory Compliance Knowledge: Knowledge of financial regulations and digital compliance.

- UI/UX Design Knowledge: Creating user-friendly finance platforms.

It is reported by PwC that 82% of financial institutions intend to develop Fintech collaborations—showing high demand for these skills.

Skills Necessary for Fintech Roles: Technical & Soft Skills

Becoming a foot in the door of a Fintech firm is not solely about technical magic. Hiring managers look for an integrated set of skills. A combination of hard and soft skills that are needed for Fintech roles makes the applicant truly exceptional.

Technical skills lie the groundwork—but your communications, critical thinking, and business savvy might be the icebreaker during job interviews. Employers appreciate applicants who are able to express complicated tech in terms of workable business solutions.

Crucial skills needed for Fintech roles are:

Technical Skills:

- Data visualization and data analysis tools

- Cloud computing basics

- API integration and management

- Understanding financial products and markets

- Blockchain architecture knowledge

Soft Skills:

- Ability to solve problems

- Good communication

- Collaboration with teams

- Agility and flexibility

- Entrepreneurial thinking

Developing this synergy makes you job-ready for Fintech companies, startups, or traditional banks foraying into technology.

Fintech Career Opportunities in India

India’s Fintech revolution has unlocked a treasure trove of Fintech career prospects for budding professionals. From payment gateways to digital lending and Insurtech, the horizon is endless.

But what’s more thrilling is the fact that Fintech careers are not the sole prerogative of techies. There is ample scope for finance professionals, data analytics enthusiasts, and even marketing and design specialists.

Some popular Fintech career opportunities in India are:

| Role | Description |

| Data Analyst | Analysing consumer data to guide financial decisions |

| Blockchain Developer | Building secure and transparent financial solutions |

| Product Manager | Overseeing the design and rollout of Fintech products |

| Compliance Officer | Ensuring regulatory adherence in digital finance |

| Cybersecurity Analyst | Protecting financial systems from cyber threats |

| Financial Analyst | Evaluating financial data and market trends |

The emergence of digital banking, investment apps, and AI-based platforms guarantees that Fintech careers will only increase from here.

Key Technical Skills in Fintech You Need

The foundation of every effective Fintech professional is a strong technical skill base in Fintech. Soft skills are important, but your technical ability demonstrates to employers that you walk the talk.

Surprisingly, you don’t have to be a hard-core software developer. However, you do need to be at ease with key technologies that power today’s financial platforms.

Here’s a long list of technical skills in Fintech to prioritize:

- Python programming for data analysis and automation

- SQL for database management

- Machine Learning basics

- Cybersecurity best practices

- Knowledge of digital payment architecture

- Blockchain development and smart contract fundamentals

- API integration methods

- Data visualization with Tableau or Power BI

- Mobile app development principles

- Knowing cloud platforms such as AWS or Azure

Mastering even a few of these domains can highly increase your employability in Fintech.

Developing Your Fintech Resume Skills to Wow Employers

Your first impression is your first impression-and in a competitive market, it is non-parasitic to highlight the correct fintech starting skills. Employers thrive through hundreds of CVs, so your skill section should reflect relevance, clarity and confidence.

Beyond listing your skills, demonstrate projects, certificates and quantitative achievements that display your abilities.

Tips to polish your Fintech resume skills section:

- List both technical and soft skills (e.g., Python, data analysis, problem-solving)

- Mention relevant certifications (such as Blockchain, Data Analytics, AI)

- Highlight live projects or internships in Fintech

- Employ action verbs: “Developed,” “Implemented,” “Optimized”

- Quantify results: “Decreased processing time by 30%”

- Customize your resume for every job position

Need help to begin? Join the PGDM in Fintech by Imarticus Learning and develop job-ready skills as well as earn industry-approved credentials.

Suggested Fintech Courses

A formal course can accelerate your career in Fintech by training you in job-specific skills. Some of the world-renowned courses to look at are:

| Course | Provider | Highlights |

| PGDM in Fintech | Imarticus Learning | Industry-focused, job-ready skills, placement support |

| Certified Fintech Practitioner | CFTE | Practical modules on AI, blockchain, open banking |

| Fintech: Foundations & Applications | Wharton, Coursera | Strong academic foundation with case studies |

Spending time and money on the right course boosts your resume and interview confidence.

FAQs

1. Are Fintech jobs only for IT professionals?

No.. Fintech is open to opportunities for finance, data, design & marketing professionals if they learn specific Fintech skills.

2. Do I require coding knowledge for a Fintech job?

Coding is useful -but there are plenty of Fintech careers (e.g., product management, compliance) that are not coding-intensive, relying on domain knowledge and business acumen instead.

3. Which are the best-paying Fintech jobs?

Jobs such as blockchain developers, AI experts, and cybersecurity analysts are likely to be well-paid.

4. How much time does it take to develop Fintech skills?

Depends on your background. With dedicated learning, you can gain basic Fintech skills in 6–12 months.

5. Is India a good place for Fintech employment?

Yes. India’s Fintech industry is one of the fastest-growing in the world, providing plenty of career opportunities.

6. Are Fintech certifications worthwhile?

Yes, certifications from established platforms show your determination and hands-on experience to employers.

7. Are soft skills crucial in Fintech?

Extremely. Communication skills, critical thinking, and teamwork are critical in addition to technical skills.

8. Are there opportunities to switch from conventional finance to Fintech?

Absolutely. A majority of Fintech workers are from conventional bank or finance backgrounds, re-skilling as needed.

9. Are experience or certifications preferred by employers?

Ideally, both are required. Certifications are useful for entry-level personnel or career changers who have no hands-on experience.

10. What’s the future of Fintech in India?

The future is good- with growing digital adoption, government policies & international investments driving the industry’s growth.

Key Takeaways

- Fintech skills are essential for anyone hoping to see the future in finance and technology.

- Employers seek both in-demand Fintech skills such as blockchain and AI, and soft skills.

- A mix of skills needed to work in Fintech enhances your prospects.

- Fintech career prospects in India are varied and expanding fast.

- Developing your technical skills in Fintech makes you job-ready.

- Don’t forget to hone your Fintech resume skills to remain competitive.

Conclusion

The Fintech revolution is here to stay, and by possessing the right Fintech skills, you can be at the forefront of the transformation. As either a student or established professional, ongoing learning is essential. The need for qualified Fintech talent will only increase, and those who are prepared will be the ones who reap the benefits.

If a career in Fintech is on your mind, be serious about it, and opt for programs with structure such as the PGDM in Fintech by Imarticus Learning to acquire industry-relevant skills and remain at par.

The future of finance is for the tech-heads—prepare accordingly.

Here’s help in the form of a starter guide about the 5 most in-demand skills in the industry.

Here’s help in the form of a starter guide about the 5 most in-demand skills in the industry. Some of the most common languages used in fintech are JavaScript, Python, and SQL. You can learn more about them through easily available

Some of the most common languages used in fintech are JavaScript, Python, and SQL. You can learn more about them through easily available