Financial analytics is required for healthcare companies to perform core functions of claims processing and maintaining payment integrity and fraud, waste, and abuse (FWA), and risk assessment. The advances in big data are driving the accelerated growth of the financial analytics segment, especially in the healthcare domain. Big data analytics gives a better way to tackle healthcare expenditure and quality issues.

The healthcare financial analytics market is growing. The largest market for healthcare financial analysis is North America and the top players include Cerner, Oracle, IBM, etc. The market size was $11.59 billion in 2018 and is projected to grow to $80.21 bn by 2026 with a CAGR of 27.5%.

While the coronavirus pandemic jeopardized many markets, it showed the importance of healthcare financial analytics. The costs of vaccine development, monitoring the health of the population, health insurance innovations, etc. resulted in new directions of financial work for many healthcare providers. Most hospitals faced massive losses and are unlikely to be profitable even in 2021.

Another trend across the world is the rise of the geriatric population across developed countries. Even countries like India will have a large aging population in 2-3 decades at the most. The nature of healthcare costs will change as more people will require preventive care. Currently, the healthcare market operates on a service-based model but is moving towards a value-based model.

There are also many healthcare disruptors coming on the scene, building diagnostics that put people’s healthcare in their hands. There is also a call for strategic planning to cope with the revenue loss and deal with the emerging costs of people deferring healthcare and opting for teleconsultations. World over, attention is also upon the systemic inequities of healthcare.

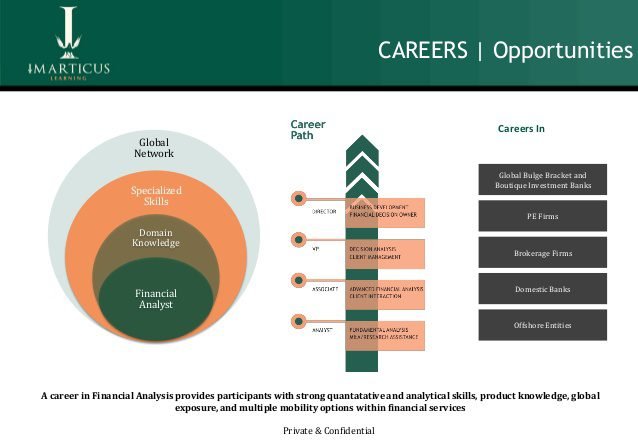

Considering the need for healthcare financial analysts, this is a good niche for students and those who want a career change. Skilled analysts can get paid quite well. Students have to acquire domain knowledge of accounting, financial modeling, debt, and the healthcare industry. This can be obtained by opting for a financial analyst course online.

What do Healthcare Financial Analysts do?

The responsibilities of a healthcare financial analyst may include:

- Creating reports of financial data, forecasting trends, presenting, etc.

- Budgetary management

- Claims processing and compensation

- Ensuring that taxation and legal compliances are in place

- Reviewing operational and purchase costs

- Finding ways to maximize revenue generation, business plans creation, and execution

- Handling teams of other finance professionals

Pathway to Becoming a Financial Analyst in Healthcare

Traditional education offers a basic pathway to enter the field with comparative ease:

- A Bachelor’s in math, engineering, finance, commerce, economics, etc. helps but you can also do the following steps if you lack a relevant Bachelor’s.

- A Master’s in Business Administration (MBA) with a specialization in hospital management or finance, is the easiest way to get your resume accepted by prospective employers.

- A Master’s in Public Health or Commerce or even Chartered Accountancy can be sufficient. However, you have to acquire additional skills by taking courses for financial analysts.

- Chartered Financial Analyst course online is often desired by employers.

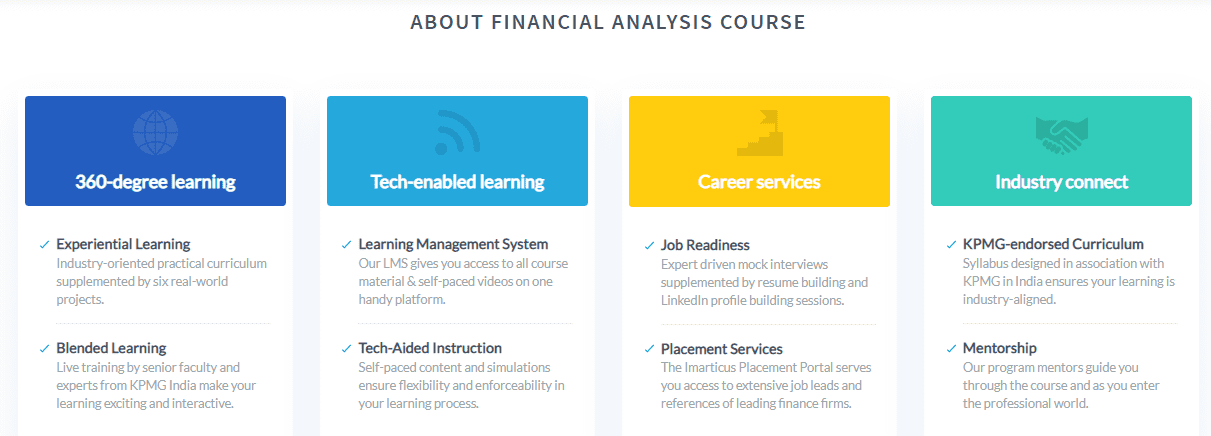

- A professional certificate or Financial Analysis Prodegree can teach you the skills needed. It can also give you the exposure needed to connect with real professionals in the field.

There are a few reputed courses for financial analysts online which can help those who have basic degrees but want to change careers into this field. One should ensure that they are taught by industry-recognized organizations.

Getting Experience:

As many companies prefer experienced candidates, one can opt for a Financial Analysis prodegree where live projects give a chance to develop a working knowledge of healthcare financial analysis. It’s also good to look for jobs in hospitals and healthcare companies, especially if you already work in a similar domain. Hospitals can have overwhelming balance sheets, so gaining experience makes your candidature stronger.

This

This

Investment banking courses are specially curated for financial analyst professionals. It takes a comprehensive approach to impart knowledge related to the financial markets. It also helps you understand the complexities involved in a

Investment banking courses are specially curated for financial analyst professionals. It takes a comprehensive approach to impart knowledge related to the financial markets. It also helps you understand the complexities involved in a

Why do you want to be a financial analyst?

Why do you want to be a financial analyst?

At Imarticus, we empower students with

At Imarticus, we empower students with