Are you aspiring to be a cost accountant and exploring CMA in Mumbai? Mumbai, being the financial capital, has always been at the centre of India’s finance and corporate ecosystem. So it’s no surprise that students and professionals exploring the CMA course in Mumbai often find better access to coaching, internships, firms, and job opportunities than in most other cities.

Whether you’re searching for CMA classes in Mumbai, trying to understand CMA course fees in Mumbai, or exploring CMA jobs in Mumbai, this guide breaks everything down clearly, without the usual confusion.

That’s why students exploring the CMA course in Mumbai often find more than just exam preparation here. There’s better access to coaching, industry events, internships, and real-world corporate environments – things that matter just as much as clearing exams.

In this guide, I’ll cover the CMA certification, so you can decide which path fits your career goals better.

Whether you’re searching for CMA classes in Mumbai, trying to understand CMA course fees in Mumbai, or exploring CMA jobs in Mumbai, this guide brings everything together in one place. No jargon, no mixed signals – just a clear, practical look at what pursuing CMA in Mumbai actually involves and how it fits into your long-term career plans.

Did you know?

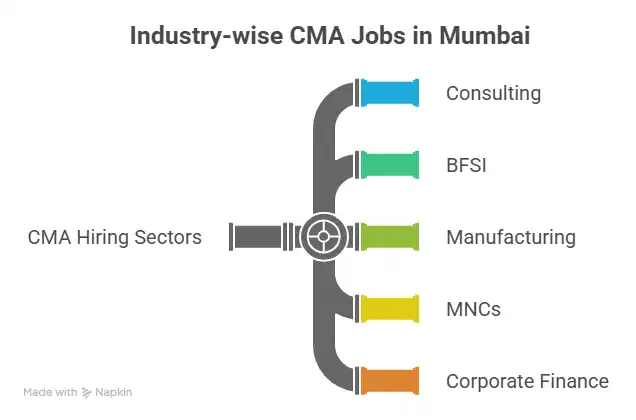

Mumbai consistently accounts for one of the highest concentrations of CMA-qualified professionals in India, largely due to its mix of manufacturing, consulting, BFSI, and global finance roles.

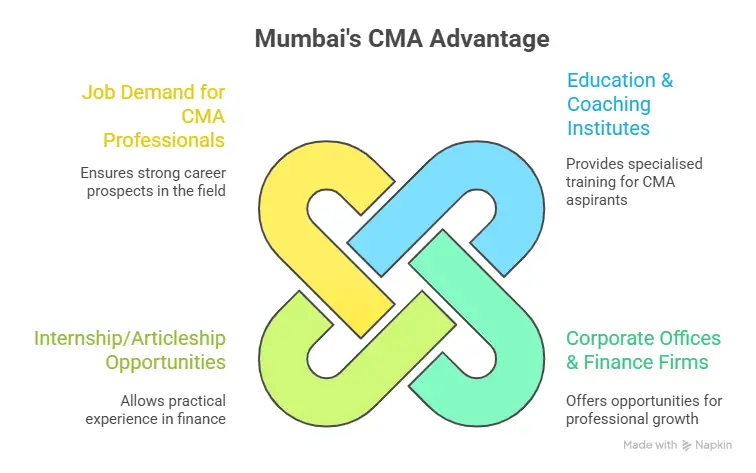

Why Mumbai Is a Strong City for CMA Aspirants

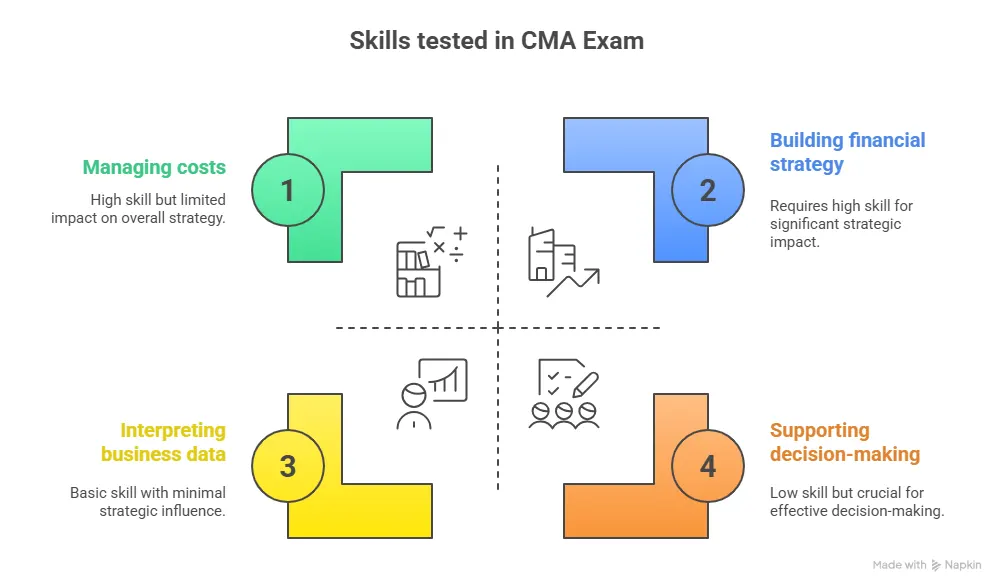

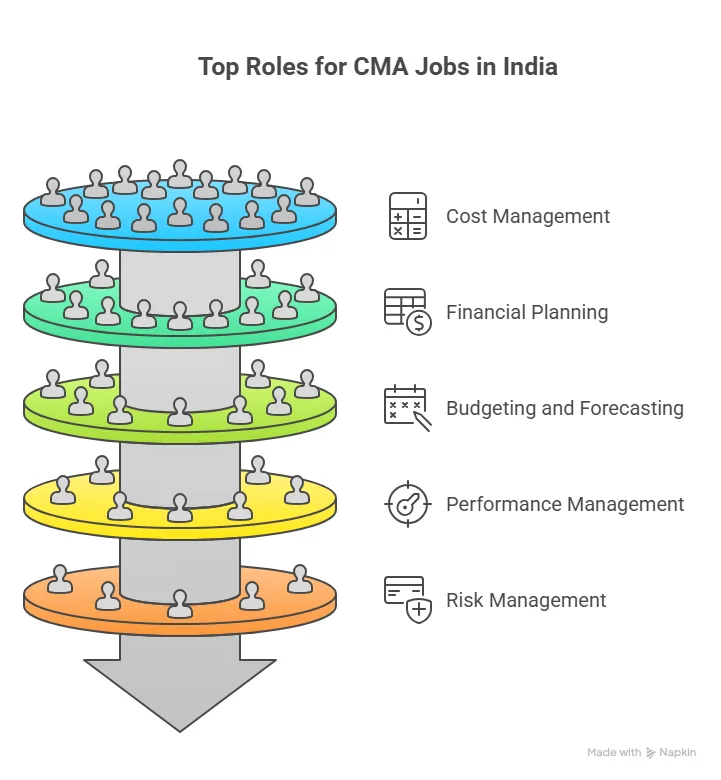

If you’re new to the field, it also helps to first understand what is CMA and how this professional qualification builds expertise in cost management, financial planning, and strategic decision-making. Mumbai offers something few cities can:

Education, industry exposure, and hiring opportunities – all in one place.

Here’s why CMA Mumbai continues to attract students from across India:

- Presence of top CMA firms in Mumbai across consulting, manufacturing, BFSI, and shared services.

- Multiple CMA institutes in Mumbai and private coaching centres.

- Access to CMA articleship vacancies in Mumbai and CMA trainee roles.

- Strong demand for CMA professionals.

CMA Course in Mumbai: Levels, Eligibility, and Entry Options

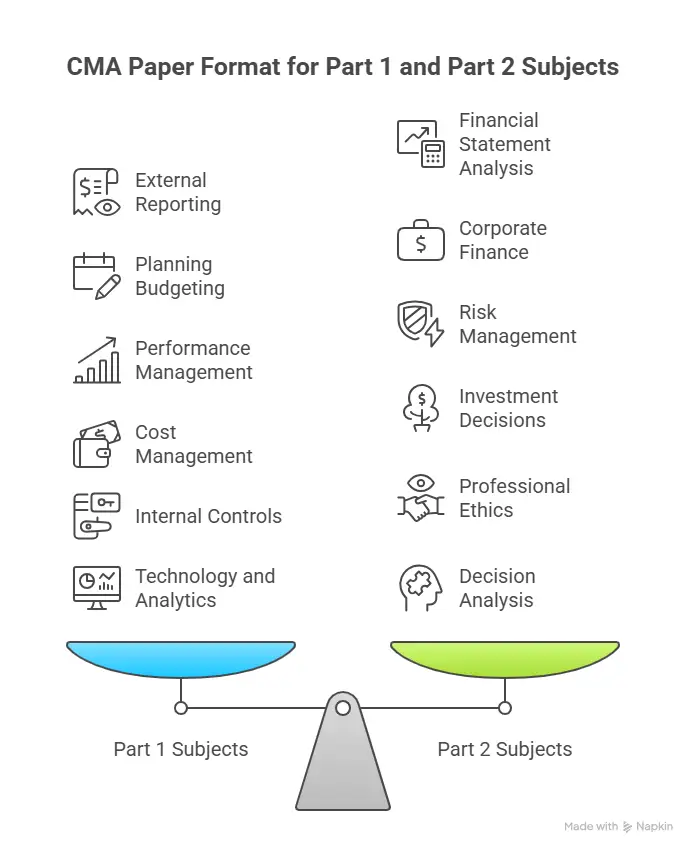

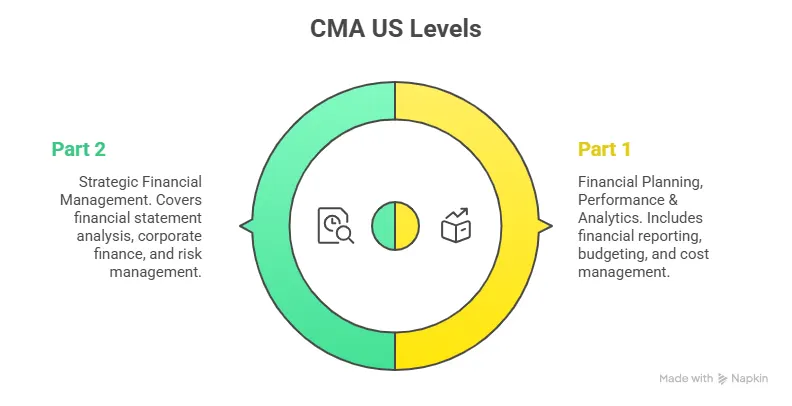

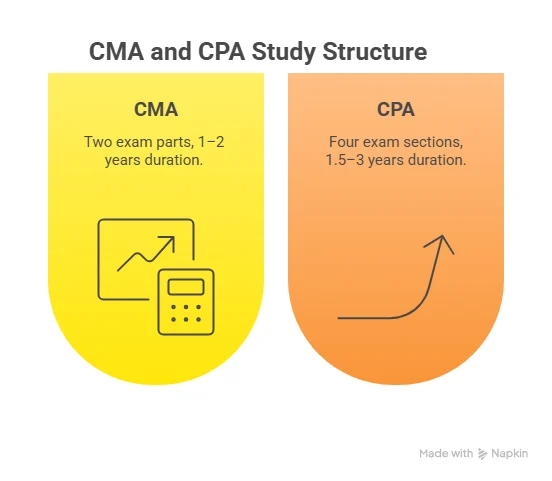

The US CMA course in Mumbai follows a globally recognised curriculum set by the Institute of Management Accountants (IMA), USA. What I personally like about the US CMA is how simple and focused the structure is. Instead of having multiple levels, it’s divided into just two parts, which makes it easier to plan and complete.

| US CMA Level | Key Focus Areas | What You Actually Learn |

| US CMA – Part 1 | Financial Planning, Performance & Analytics | Budgeting, costing, internal controls, performance analysis, and data-driven decision-making. |

| US CMA – Part 2 | Strategic Financial Management | Corporate finance, investments, risk management, financial analysis, and strategic thinking. |

There’s no Foundation or Intermediate level to clear. If you’re a graduate or in your final year, you can start the US CMA and complete the required work experience alongside or after clearing your exams. US CMA does not require articleship, which is why many Mumbai-based graduates complete it alongside internships or full-time roles.

For students in Mumbai, this streamlined format is a big plus. It lets you complete the US CMA faster while building practical, job-relevant skills that fit well with roles in FP&A, corporate finance, and global finance teams.

One usually tries to understand:

What is the US CMA eligibility, and who can apply for the course?

Which colleges in Mumbai are best to pursue the CMA course?

Which is the best CMA course institute in Mumbai?

Is the CMA course offered at the University of Mumbai?

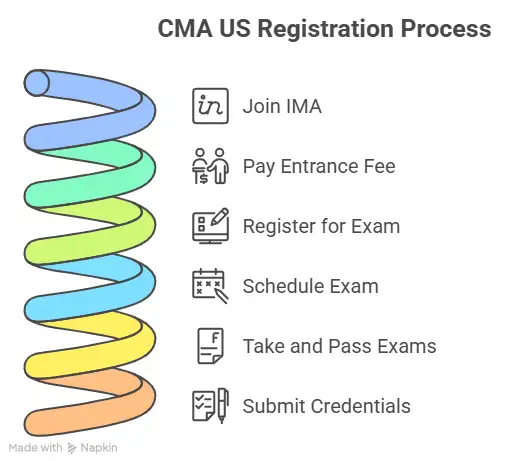

Well, CMA isn’t offered in colleges or universities. The US CMA is administered and offered by IMA US. While the degree is awarded centrally, coaching and training happen locally through institutes and classes.

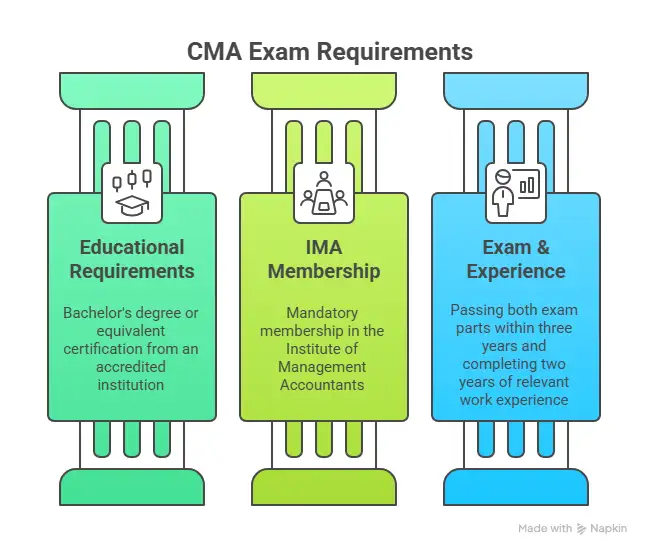

Before planning your preparation, it’s important to understand CMA eligibility and the basic requirements needed to register and complete the course successfully.

| Requirement | Details |

| Educational Qualification | Graduation in any stream or a final-year student |

| Exams to Clear | 2 parts (Part 1 and Part 2) |

| Work Experience | 2 years of relevant finance/accounting experience (can be completed before or after exams) |

| Mode of Study in Mumbai | Classroom coaching or online learning |

Each CMA paper builds on practical concepts in cost management, financial analysis, and decision-making.

Lesser-known fact:

Many CMA trainees in Mumbai get exposure to real budgeting, costing, and MIS work during their articleship – something that’s harder to access in smaller cities.

Indian CMA vs US CMA in Mumbai: Which One Should You Choose?

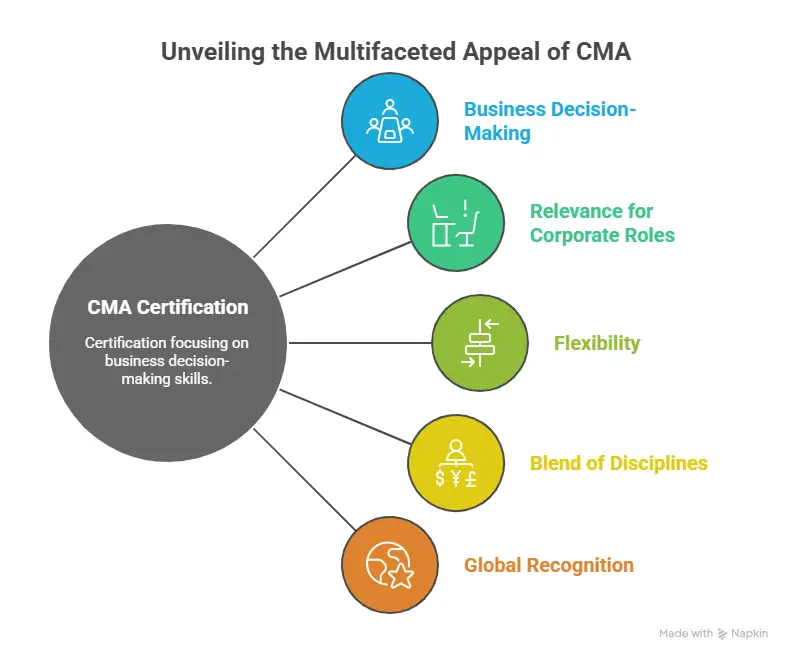

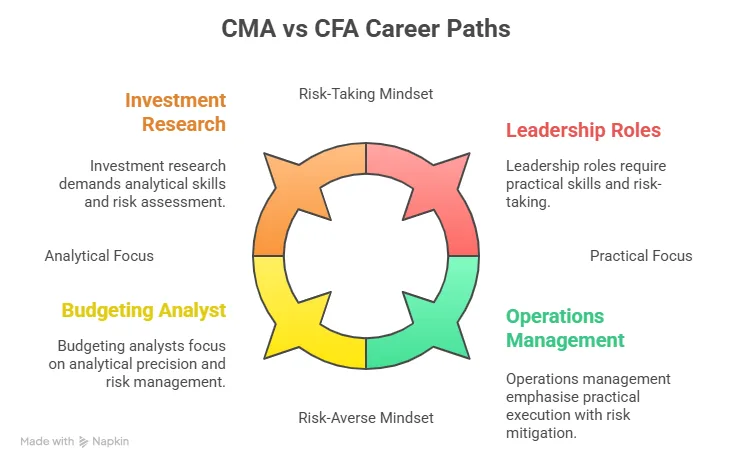

A common question I get asked by CMA aspirants in Mumbai is whether to pursue the Indian CMA or the US CMA. The right choice usually depends less on difficulty and more on the kind of career you want to build.

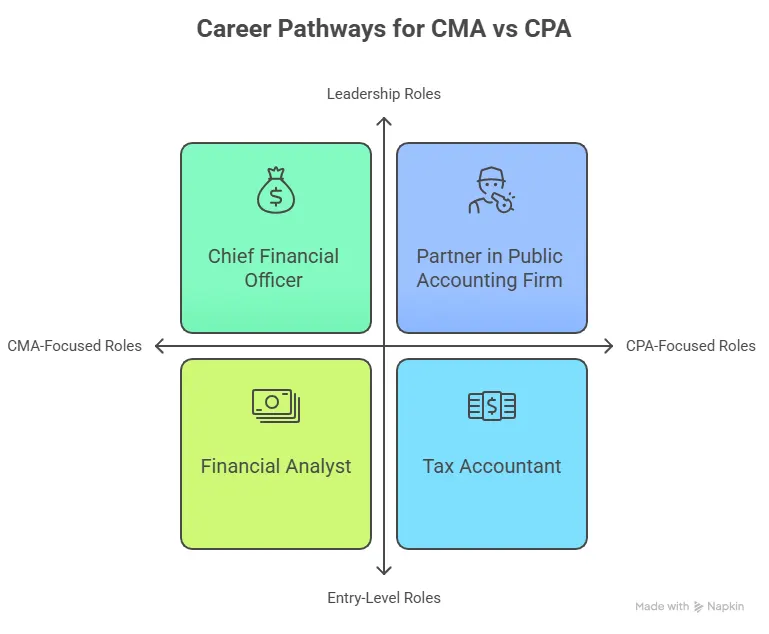

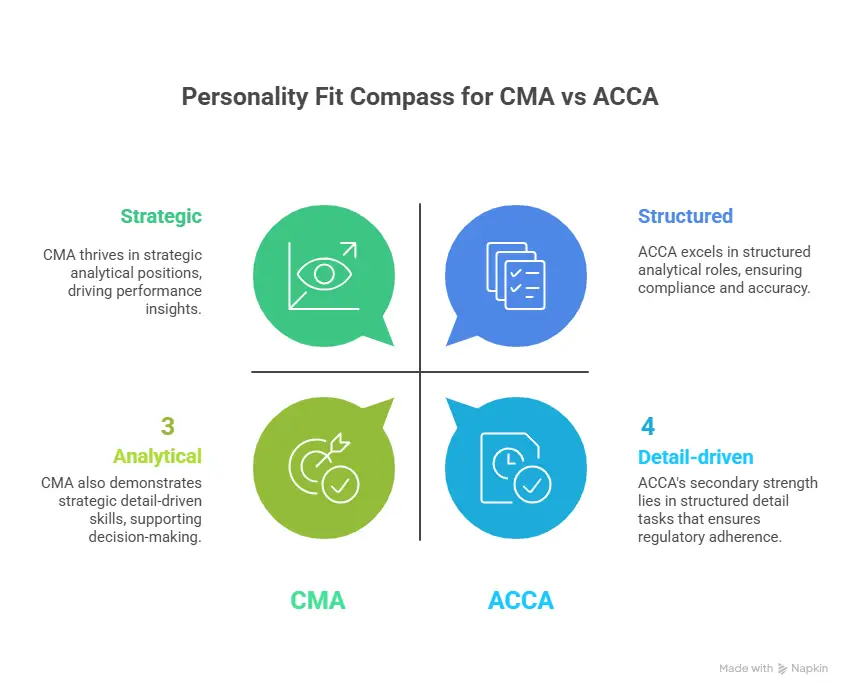

Indian CMA is well-suited for roles in cost accounting, manufacturing, compliance, and domestic corporate finance. It aligns closely with Indian regulations and traditional finance functions.

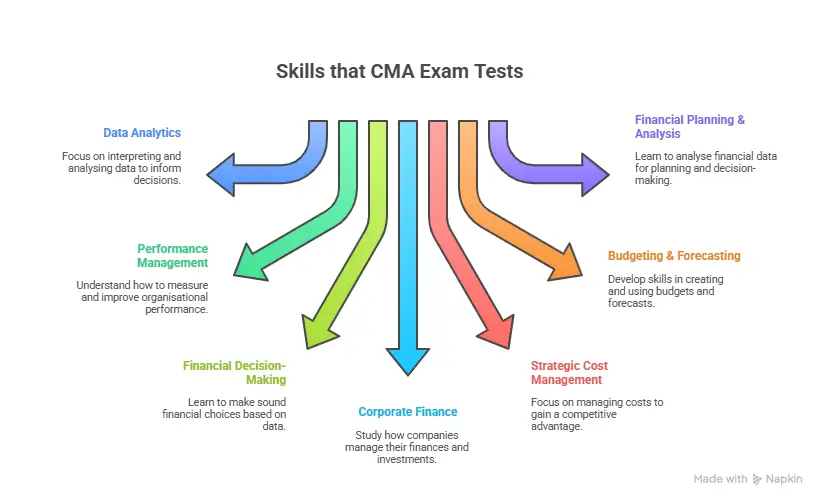

US CMA focuses more on management accounting, FP&A, analytics, and strategic finance roles – especially within MNCs and global teams.

| Factor | Indian CMA | US CMA |

| Administered By | ICMAI (India) | IMA (USA) |

| Course Structure | Foundation, Intermediate, Final | Part 1 and Part 2 |

| Focus Areas | Cost accounting, compliance, and Indian corporate finance | FP&A, analytics, strategic finance |

| Ideal For | Manufacturing, domestic firms, compliance roles | MNCs, GCCs, global finance teams |

| Popular Roles in Mumbai | Cost accountant, finance controller | FP&A analyst, finance business partner |

In a city like Mumbai, both qualifications have strong demand. The better option depends on whether you see your CMA career growing mainly in Indian corporate environments or in globally aligned finance roles.

CMA also builds decision-making skills through topics like project selection methods, which are commonly used in corporate finance and investment evaluation.

In terms of timelines, the CMA course duration typically ranges from 12 to 18 months for the US CMA and around 3 to 4 years for the Indian CMA, depending on entry level, exam pace, and individual preparation.

Lesser-known insight:

In Mumbai, it’s common to see professionals with Indian CMA backgrounds later add US CMA to move into FP&A or global finance roles.

CMA Course Fees in Mumbai

If you’re serious about pursuing the CMA certification, one of the first practical questions that comes up is the CMA course fees in Mumbai. And honestly, that’s a smart place to pause and assess before committing.

The good news? CMA is far more cost-efficient than a full-time MBA or any professional finance and accounting degree.

What Does the CMA Course Cost in Mumbai Include?

When you break it down, the total CMA course cost in Mumbai usually includes three main components:

- Registration & exam fees

- Coaching or CMA coaching in Mumbai

- Study material & mock tests

CMA Registration and exam fees are paid directly to IMA.

How Coaching Choice Impacts CMA Fees in Mumbai

- Your overall CMA fees in Mumbai also depend on the kind of learning support you choose.

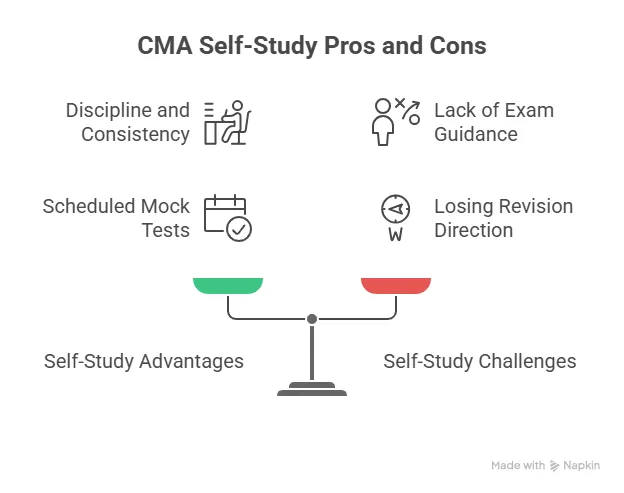

- Classroom-based CMA coaching in Mumbai does cost more than online options, but I’ve seen that many students find the structure, discipline, and face-to-face guidance worth it.

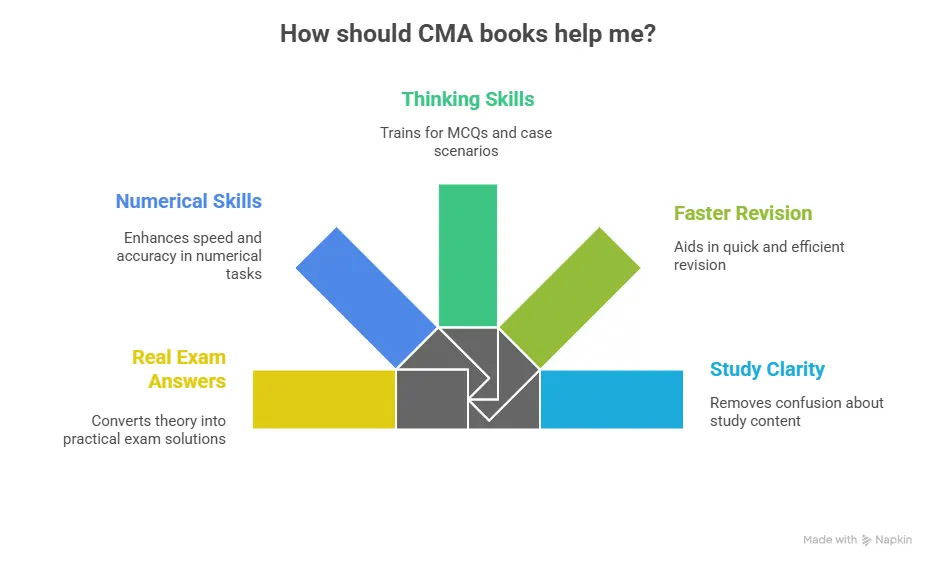

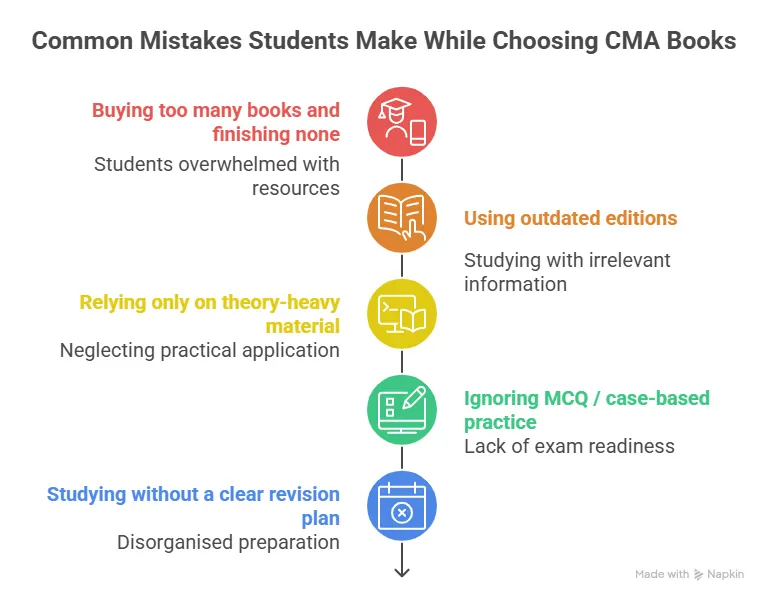

- Pair that with clear study material, CMA books, regular revisions, and mock tests that mirror the real exam, and preparation feels easier, and clearing the CMA exams feels far more achievable.

- Alongside coaching, choosing the best CMA review course can help candidates improve practice, time management, and exam confidence.

- Opting for a good CMA course institute in Mumbai often offers a high return on investment.

The Reality of CMA Course Fees in Mumbai

Now let’s talk numbers – without overcomplicating it.

On average, CMA fees in Mumbai can range from moderate to premium. The difference usually comes down to the quality of coaching – how experienced the faculty are, how accessible doubt-solving is, and how much real support students actually get. Well-established institutes do tend to charge higher fees, but they often save time in the long run by offering structured mentoring and exam-focused preparation that reduces repeat attempts and unnecessary delays.

Is CMA Worth the Cost?

Even then, CMA course fees in Mumbai are still significantly lower than many traditional finance degrees, especially when you consider the long-term return. You’re investing in a professional qualification that directly improves employability and salary potential.

In short, CMA is one of those rare courses where the cost-to-career payoff ratio actually makes sense.

Did you know?

Compared to most full-time finance degrees, CMA has one of the lowest opportunity costs – many students complete it without stepping away from work or college.

Where to Study CMA in Mumbai: Institutes, Classes & Coaching

Mumbai hosts some of the most important CMA infrastructure in the country. This is where a lot of official and professional activity happens, which is why students often feel more connected to the profession while studying here.

While preparing for the CMA in Mumbai, students often come across these important centres:

- CMA Bhavan Mumbai is the main physical hub for CMA-related activities, where students get support, attend seminars, appear for exams, and reach out for official communication.

- The CMA office in Mumbai is where most of their administrative matters are taken care of, including registrations, exam-related queries, grievances, and other official processes.

- CMA Mumbai Chapter is an event by IMA that regularly organises workshops, student-focused programs, and networking events, helping aspirants stay connected with both the CMA community and industry developments.

These offices and chapters play a bigger role than most students realise. They handle registrations, examinations, seminars, continuing education programs, and professional networking events. Attending events organised by the CMA chapter in Mumbai often gives students their first exposure to industry speakers and real corporate case discussions.

That’s also why searches like CMA institute in Mumbai address, CMA Mumbai contact details, and CMA office in Mumbai are so common. Students want clarity – not just on where to study, but on where the profession itself operates.

Did you know?

Students who combine CMA preparation with practical case-based learning tend to perform better in interviews than those who rely only on exam-oriented study.

CMA Classes & Coaching in Mumbai

Alongside official institutes, Mumbai has a wide range of coaching options, which is where many students spend most of their preparation time. A clear understanding of the CMA course subjects helps students see how accounting, finance, and decision-making come together in real business roles.

And for good reason. The right coaching can make a real difference – not just when it comes to clearing the CMA exam, but in how confident you feel stepping into internships and your first job.

Good CMA coaching in Mumbai doesn’t stop at completing the CMA syllabus. It focuses on helping you truly understand the concepts, plan your exam approach smartly, and learn through practical, real-world examples.

When subjects are taught this way, finance and cost management stop feeling abstract and start making sense in a business context.

For many students – especially those targeting roles in corporate finance, manufacturing, or consulting – this practical understanding becomes just as important as passing the exams themselves.

Put simply, Mumbai gives CMA students the best of both worlds – strong institutional support and deep coaching options – making it one of the most practical and well-rounded cities to pursue the CMA qualification.

CMA Colleges in Mumbai

When students look up CMA colleges in Mumbai, they’re usually trying to answer a very practical question: Can I do CMA along with my graduation, or is it something I should pursue separately?

In Mumbai, CMA isn’t offered as a standalone undergraduate degree, but some colleges do work closely with the institute to offer integrated programs. These options let students prepare for CMA alongside their regular commerce studies, instead of treating it as a completely separate path.

For many students, the most sensible and stress-free approach ends up being something like this:

- Complete graduation from a recognised college in Mumbai University.

- Pursue CMA in parallel or immediately after, with support from IMA or ICMAI, specialised coaching institutes, and structured CMA study materials designed around the exam syllabus.

This combination offers flexibility, academic credibility, and strong career alignment – especially in a city like Mumbai, where industry exposure and professional networks play a big role in long-term growth.

If you’re still unsure whether the US CMA is actually worth it, this short video explains how the certification translates into real roles, global exposure, and long-term career value.

US CMA in Mumbai: Growing Demand

Mumbai has quietly become one of the strongest hubs for US CMA aspirants in India. If you’ve been searching for US CMA classes in Mumbai or trying to understand whether the qualification actually translates into jobs, you’re not alone – the demand has been steadily rising over the last few years.

This is why searches like CMA USA classes in Mumbai, CMA USA course in Mumbai, and US CMA jobs in Mumbai have picked up so much momentum. Students are no longer looking at US CMA as just an international certification – they’re looking at it as a practical way to enter global finance roles while staying in India.

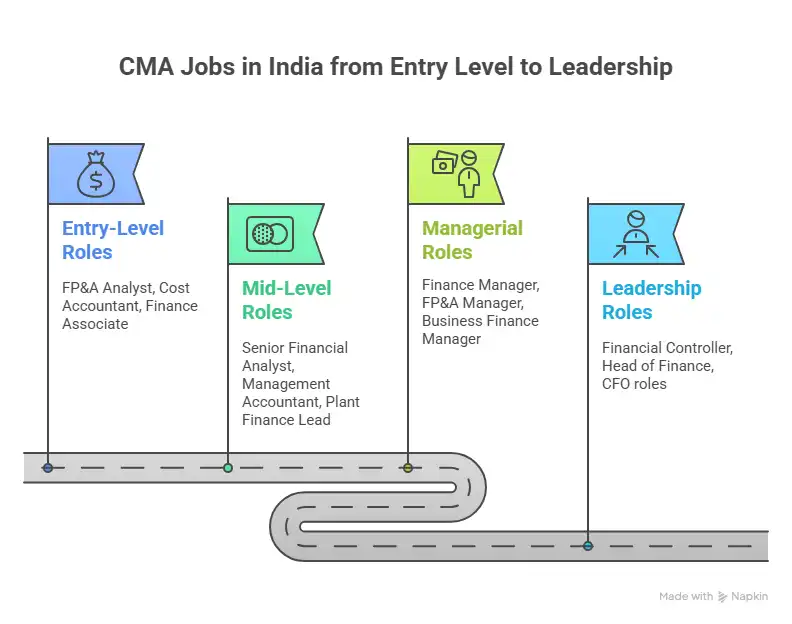

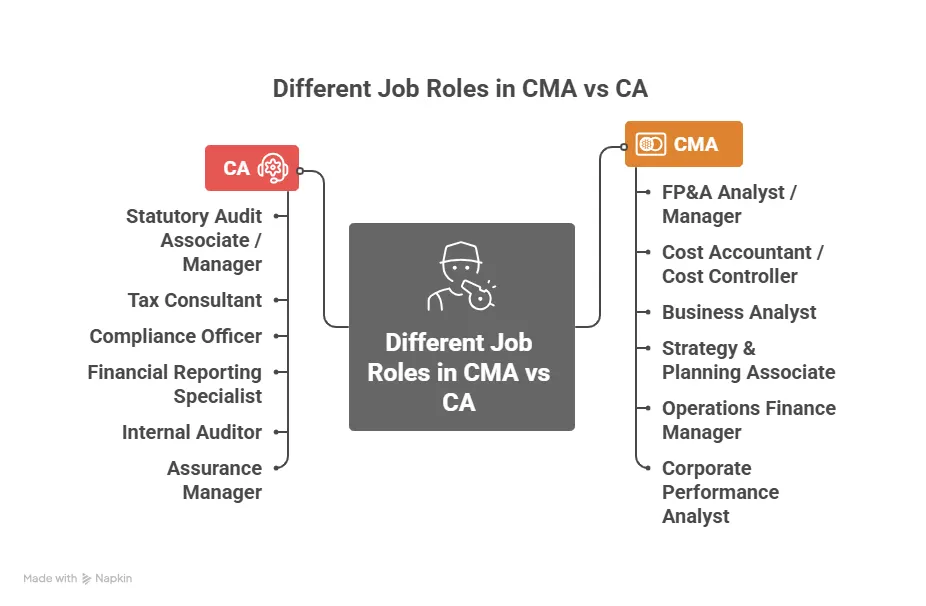

| Career Stage | Common Roles |

| Internship / Entry-Level | Finance intern, reporting analyst, junior FP&A analyst |

| 1-3 Years Experience | FP&A analyst, management accountant, cost analyst |

| 4+ Years Experience | Finance business partner, FP&A manager, finance transformation specialist |

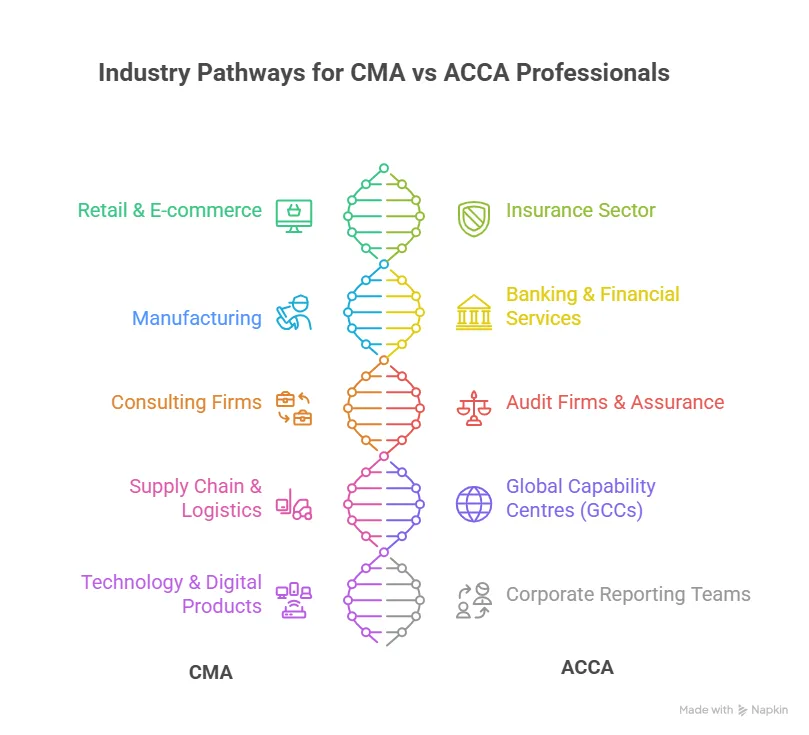

One big reason for this demand is hiring. US CMA professionals in Mumbai are increasingly recruited by MNCs, Big 4 consulting firms, global capability centres (GCCs), and FP&A or finance transformation teams. These roles value strong management accounting, planning, and decision-support skills – exactly what the US CMA focuses on.

This demand naturally reflects in the job market. There’s consistent interest in:

- CMA jobs in Mumbai across corporate finance, FP&A, and controllership roles.

- US CMA jobs in Mumbai within shared services, analytics-driven finance teams, and global reporting functions.

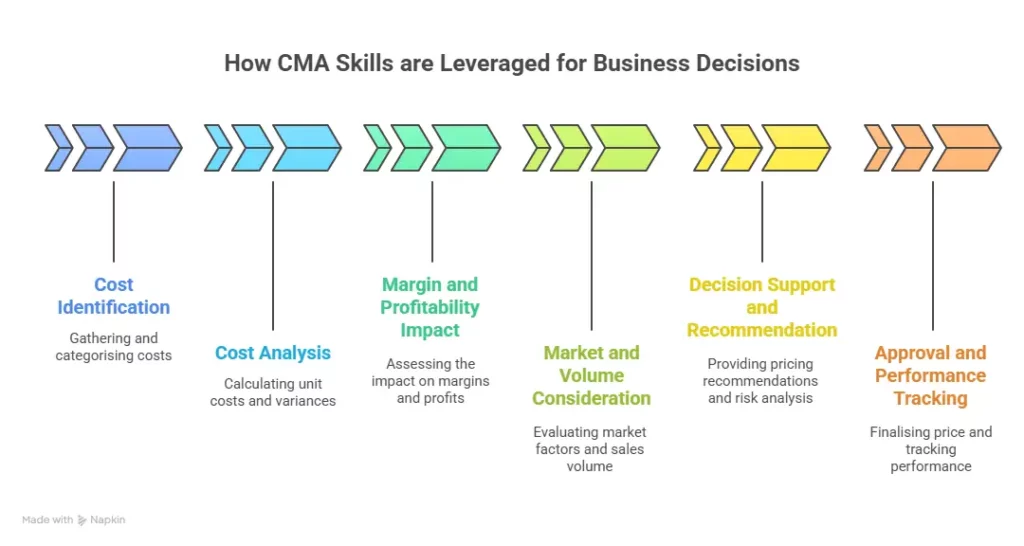

CMA also equips students with cost management strategies that help organisations control expenses and improve profitability. For those at the early stages, opportunities also exist at different levels:

- CMA fresher jobs in Mumbai in finance operations, costing, and reporting teams.

- CMA internship in Mumbai, CMA articleship vacancy in Mumbai, and CMA trainee vacancy in Mumbai, which often act as stepping stones into full-time roles.

Mumbai also continues to offer exposure through top CMA firms in Mumbai and the best firms for CMA articleship in Mumbai, where students gain hands-on experience alongside exam preparation. This early exposure often makes a noticeable difference when competing for full-time roles later.

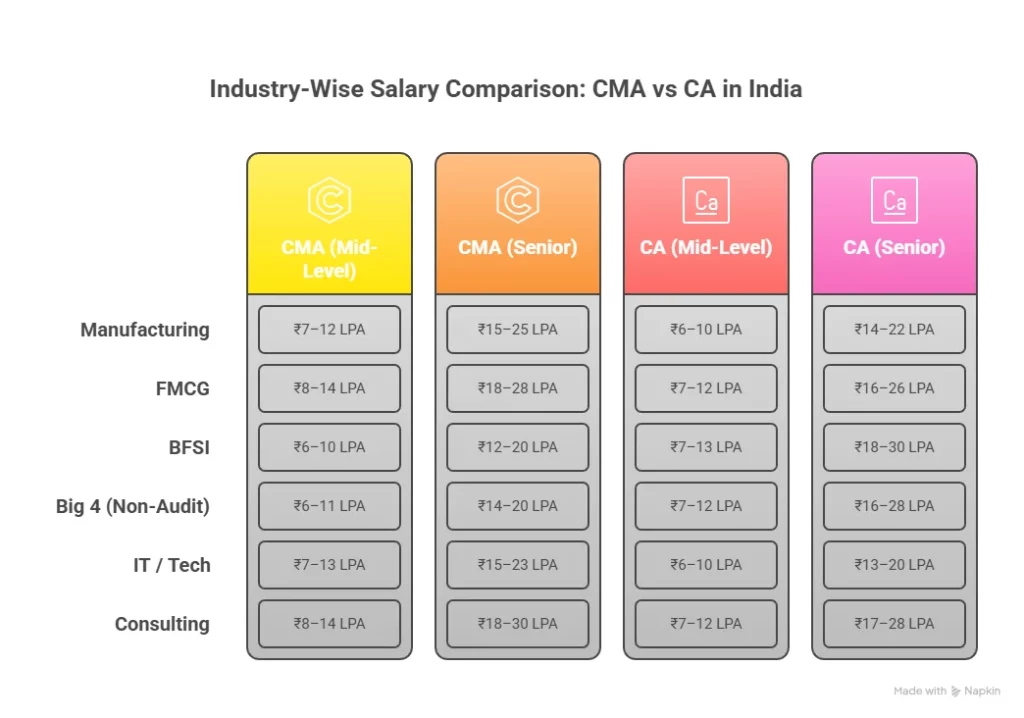

When it comes to pay, the CMA salary in Mumbai can vary quite a bit depending on your qualification level, the role you step into, and the industry you work in. That said, US CMA professionals in Mumbai often see better alignment with global pay benchmarks – especially in FP&A and finance transformation roles that work closely with international teams.

Here’s a brief overview of what CMAs earn at different levels:

| Experience Level | Typical Salary Range (Annual) |

| Fresher / Intern (0-2 yrs) | ₹4-8 LPA |

| Mid Level (2-5 yrs) | ₹7-12 LPA |

| Experienced (5-8 yrs) | ₹12-20 LPA |

| Senior / Leadership (8+ yrs) | ₹20-30 LPA |

| Average for CMA Professionals in Mumbai | ~₹17-46 LPA |

These figures feel clearer when you compare them with the broader CMA salary in India, beyond just Mumbai. Here are some of the top sectors that hire CMA professionals in Mumbai:

- Consulting & Big 4 – Audit, advisory, and consulting firms.

- MNCs – Global corporations with finance hubs in Mumbai.

- GCCs – Global capability centres supporting international finance teams.

- Corporate Finance Teams – FP&A and finance transformation units.

CMA also introduces governance and control concepts such as the COSO framework, which are widely used to strengthen internal controls and risk management in organisations.

This exposure opens up opportunities for CMAs in sectors like consulting, BFSI, and large corporates, particularly in roles related to internal audit, risk management, compliance, and business controls. With the right skills and experience, CMAs can access a wide range of CMA jobs in India across industries and functions.

In simple terms, whether you’re looking at internships, CMA fresher jobs in Mumbai, or long-term growth in global finance, a US CMA in Mumbai now sits at a sweet spot. It combines strong coaching options, genuine job demand, and career paths that offer both stability and upward growth.

If you’re preparing for interviews after completing or while studying for the US CMA, this mock interview video gives practical insights into the kinds of questions recruiters ask and how to structure your responses.

Why Many CMA Aspirants in Mumbai Choose Imarticus Learning

For most students, pursuing CMA in Mumbai isn’t just about clearing exams. It’s about knowing how to prepare in a way that actually works. What many students benefit from Imarticus Learning is the structure it brings to the CMA course. Instead of juggling scattered notes, videos, and study plans, preparation feels organised, focused, and easier to manage. Imarticus offers:

- Structured CMA preparation, so students don’t feel lost or overwhelmed by disconnected resources.

- Practical concept-focused learning, helping students understand how CMA topics apply in real business situations.

- Clear timelines and exam planning make it easier to balance CMA with college, internships, or work commitments.

- Regular revisions and mock exams, keeping preparation steady and reducing last-minute pressure.

- Career-focused guidance, connecting CMA preparation with internships, entry-level roles, and long-term growth.

For many aspirants looking to study CMA in Mumbai, this structured and practical approach removes a lot of uncertainty and helps the CMA journey feel more manageable, focused, and purposeful.

FAQs About CMA in Mumbai

If you’re considering CMA in Mumbai, it’s natural to have questions – about eligibility, fees, classes, jobs, and whether the course actually fits your career goals. These frequently asked questions cover the most common doubts students and working professionals have before starting their CMA journey in Mumbai to help you make an informed decision.

Which CMA colleges in Mumbai should I get into?

CMA in Mumbai isn’t offered as a traditional full-time college degree. Instead, students register with the professional body and prepare through CMA institutes in Mumbai or private coaching centres. What matters more than the college label is the quality of coaching, exam support, and career guidance you receive during preparation.

Are there good CMA coaching classes in Mumbai?

Yes, Mumbai has plenty of CMA coaching options, both classroom-based and online. Many students prefer classroom coaching for the structure, discipline, and regular interaction it offers, while online classes work well for those balancing studies with work or other commitments. A good CMA coaching like Imarticus Learning doesn’t just focus on getting you through exams – they also help you understand how the concepts apply in real business situations.

What career opportunities are available for CMAs in Mumbai?

Mumbai offers strong opportunities for CMAs across industries like consulting, manufacturing, BFSI, and corporate finance. You’ll find roles in cost accounting, FP&A, business finance, internal audit, and strategy. Both freshers and experienced CMAs can access a wider job market here compared to most other cities.

What should I look for when choosing a CMA institute in Mumbai?

Mumbai has official CMA offices and multiple private training institutes. These institutes support students with exam preparation, mentoring, and sometimes placement assistance. When choosing a CMA institute in Mumbai, you should focus on faculty experience, revision support, and how closely the training aligns with real exam requirements.

Which firms in Mumbai hire CMA trainees and qualified professionals?

Several CMA firms in Mumbai hire trainees and qualified professionals. These include cost audit firms, consulting practices, manufacturing companies, and corporate finance teams. Mumbai also has many of the best firms for CMA articleship, offering exposure to real business and compliance work.

Is the CMA salary in Mumbai higher than in other cities in India?

CMA salary in Mumbai is generally higher than in many other cities due to industry concentration. Freshers usually start at a solid baseline compared to generic commerce roles, while experienced CMAs see strong growth in consulting, corporate finance, and leadership roles. Salary ultimately depends on skills, domain exposure, and experience – not just qualifications.

How is the CMA course delivered in Mumbai?

The CMA course in Mumbai follows the globally recognised curriculum set by the professional body, but preparation happens locally through institutes and coaching partners. Many aspirants also explore job-oriented training providers like Imarticus Learning, which focus on practical finance skills, industry exposure, and employability alongside CMA preparation.

How much are CMA course fees in Mumbai?

CMA course fees in Mumbai, unlike any other city, include registration and exam fees, coaching costs, and study material. Fees can range from moderate to premium depending on the institute and level of support offered. Even then, CMA in Mumbai remains far more cost-effective than many long-term finance degrees, especially when viewed from a return-on-investment perspective.

Does Mumbai offer CMA job opportunities at different career stages?

Students and professionals regularly search for vacancies for CMA in Mumbai across roles like trainee, intern, analyst, and cost accountant. Vacancies are available at different stages – CMA Inter, traineeship, and post-qualification – especially in firms that value cost control, financial planning, and performance analysis.

CMA in Mumbai: What the Journey Looks Like Over Time

As you look at the many factors that shape your career as a CMA in Mumbai, one thing becomes clear. Each stage of the journey adds something meaningful. The early phase helps you build discipline and clarity. The middle stages deepen your technical understanding. And as you move forward, experience brings perspective – along with access to wider roles and responsibilities. The progress may show up in exams cleared and jobs secured, but the real shift happens in how you grow as a professional over time.

Mumbai’s finance ecosystem continues to reward people who think clearly, understand numbers in context, and can apply concepts to real business situations. That’s why CMA works well here. Studying CMA in Mumbai usually means stronger academic support, better access to real-world experience, and clearer career paths across industries. For many students, this makes the transition from studying to working in finance or accounting feel far more manageable and less overwhelming.

If you’re preparing for the CMA, having a structured approach matters. The right guidance, realistic timelines, and consistent preparation can make the process smoother and more focused. Over time, this steady approach doesn’t just help you clear exams – it helps you build a career path that feels well thought out and sustainable.