A fintech hub complete with accelerator, incubator, and platform for investors is set to open shortly in Mumbai to help young startups and fintech app innovations. The fintech revolution in India is young and already disrupting the space. The governments have been touting this revolution as the next big wave which will put India ahead economically and make it a strength to reckon with.

The Digital India movement, which began just three years ago in 2016, saw a majority switch to the ease of the Unified Payments platform or UPI-payments. QR scanning and app-based banking solutions are currently the norms. The financial, governmental curbs to end black-money, demonetization, the introduction of cheap 4G services by Jio, the mushrooming of Fintech courses, the simplified GST norms, and the government setting aside budgeted funds to develop this sector have been a boost to the commercial space.

Today there exist about 2700 startups and a 72% adoption rate of solutions for payments, with many fintech startups being incubated at Bangalore, the Vizag Valley for Fintech, Star Tank by Paypal and the T-hub of YES bank according to the Inc42’s 2018 report. India is today the startup leader with Mumbai and Delhi being the financial centers and Bangalore the technological mainstay.

When compared to the USA, China, and several other countries, India is not recognized for Fintech. This indicates that the marketing & innovation processes and incubation levels or quality of products need to be tweaked, a national level policy enacted, an excellent fintech training course and nation-wide support strategy needs to be put in place to collaborate on such ecosystems, measures and ideas for the fintech segment.

The measures put in place:

According to Inc42’s Suniti Nanda, who is also the Govt of Maharashtra’s CFO, the focus is pan-India and not restricted to the Mumbai hub alone. Some of the year-long boxed initiatives are –

- Setting up a base for the fintech segment, including a nation-wide live fintech registry. Able mentors, profiles, best practices used and a collaborative environment to promote the fintech initiative.

- Setting up of accelerators and incubators like corporate accelerators and in multi-partner collaborations like with NPCI, PayU, Fino Payments Bank, Zone Startups, Kotak, ICICI and Barclay Banks partnered accelerators.

- The proposed platform for investors will see buy-side investors and sell-side startups.

- On-boarding of global investors will be showcased at road-shows where small players can interact, tie-up and collaborate in a safe and moderated environment.

- A 3-year scheme of grants has been proposed for fund-creation for such startups and the fintech industry, where the fund will have industrial mentoring, banking support, private entities involvement, a better relational base, and such funds created will be jointly and agilely self-managed.

- As rents are high and a pain-point for startups, the government has proposed a policy of rental reimbursements to the tune of 4 lakh rupees for three years, and this has benefitted about 50 such firms already.

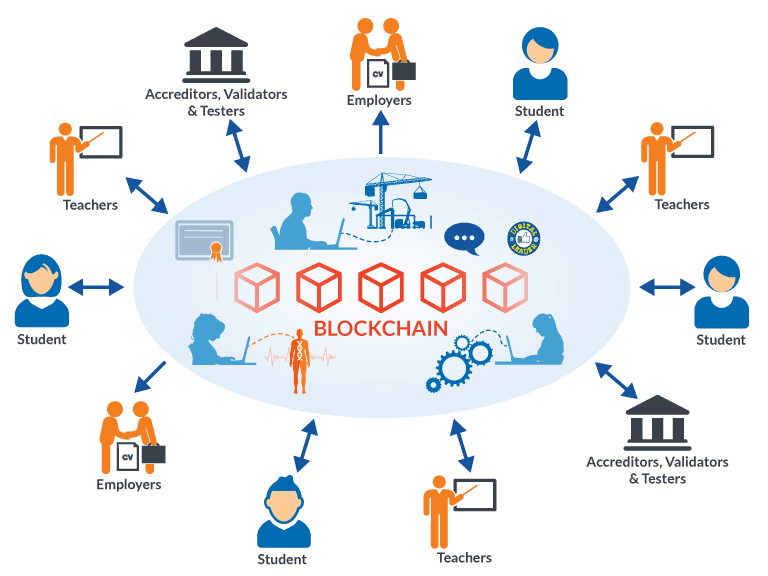

- Fintech education, polishing innovative ideas and talent, and developing excellent coding skills are being focused upon as the verticals of thrust and promotion in a bid to suit the demand for personnel.

- Innovative Fintech courses are the need of the hour and premier institutes, reputed colleges and the industry have come together to create a modern syllabus, intern opportunities, and validated fintech certifications. Amazon, ICICI, Kotak, NASSCOM and many such leading institutions are helping make this a reality.

Concluding notes:

Fintech without an enabling environment needs proactive support across all states in India as the drive to the top is impossible when in isolation. Mumbai has emerged the leader by enabling its governmental policy for fintech industries and also ensuring that the best startups stay involved in the development of the sector.

It is vital that all states and people concerned are communicative, collaborative and contributive if we want to see fintech be the big-bang of tomorrow. India has the talent, resources, workforce, and a host of other advantages. What does appear to be missing is the collective intent to succeed and help others?

If the fintech revolution is where you wish to make your career, then doing a fintech training course becomes essential. Imarticus Learning can help you succeed by providing you practical skill-oriented training with strong mentorship, a measurable and well-accepted certification, assured placements and even a persona developing module. Why wait?