On a random weekday in Bangalore, a founder is pitching to investors in Indiranagar, a finance team is preparing numbers for a board meeting in Whitefield, and a global firm is reviewing an acquisition target from its office on Outer Ring Road. These are not isolated events. They are small pieces of a larger financial system that runs through the city. Investment banking in Bangalore sits right inside this system.

It helps to think about it in simple terms. When a company wants to grow, it needs money, advice, and a plan. The banker becomes the bridge between the company and the investor. They look at the numbers, they assess the risk, they shape the deal. Bangalore adds its own layer to this story. The city has a habit of creating new businesses at a fast pace.

→ Many of them need capital within the first few years.

→ Many of them reach a stage where they want to expand or bring in global partners.

This constant cycle creates space for investment banking firms in Bangalore to step in and guide these transitions.

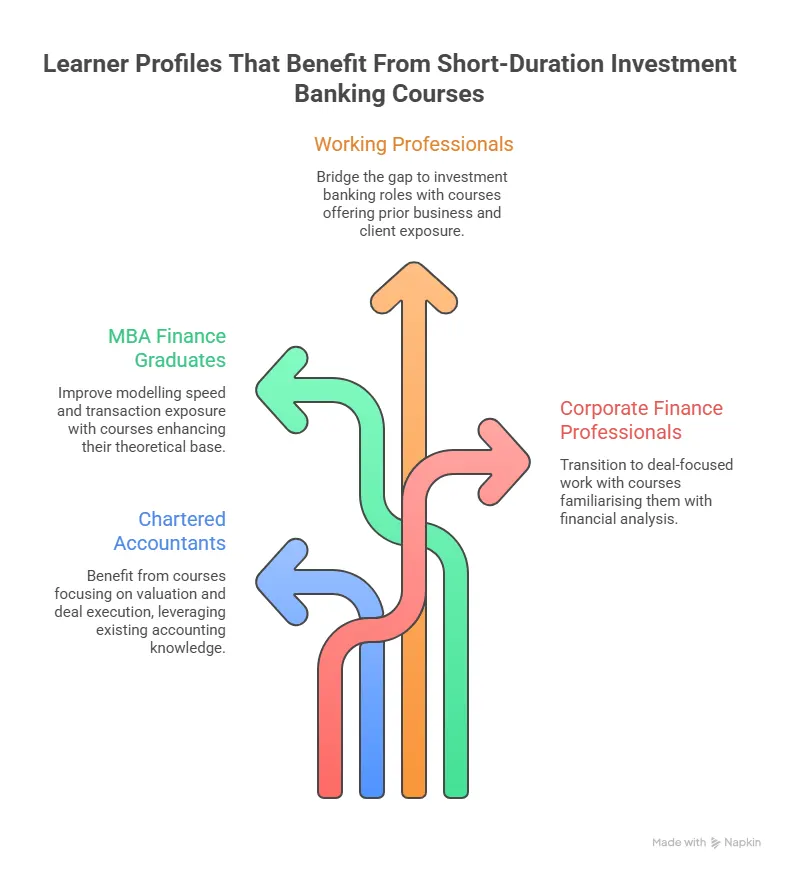

People often ask if this career is only for a small group of high scorers. The reality for the Investment Banking Course in Bangalore is more open. The city values skill and output. If you can analyse numbers, build models, and communicate clearly, there is a place for you in this ecosystem. That is why many fresh graduates start with an investment banking internship in Bangalore and then move into full-time roles once they gain exposure.

All of this makes the field both demanding and rewarding. It requires attention to detail, long hours during active deals, and the ability to stay calm when numbers and deadlines change together. If you are looking at careers that connect finance, strategy, and real-world impact, this is one of the clearest paths available today. The sections that follow take this further. They explain the roles, the skills you need, the firms you can work with, and the steps that can help you build a career in investment banking in Bangalore with clarity and purpose.

Did You Know?

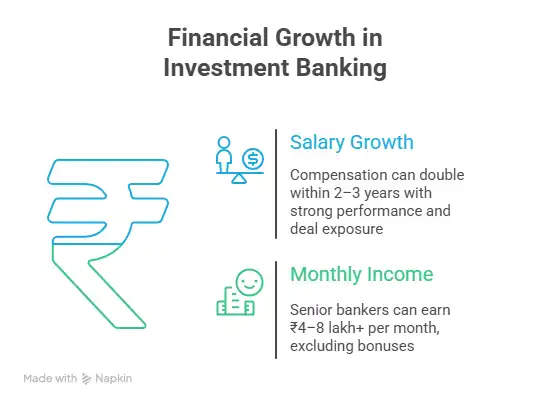

Financial analysts and investment banking professionals in metro cities often see faster salary growth compared to other finance roles due to deal-based incentives.

(Source: Glassdoor)

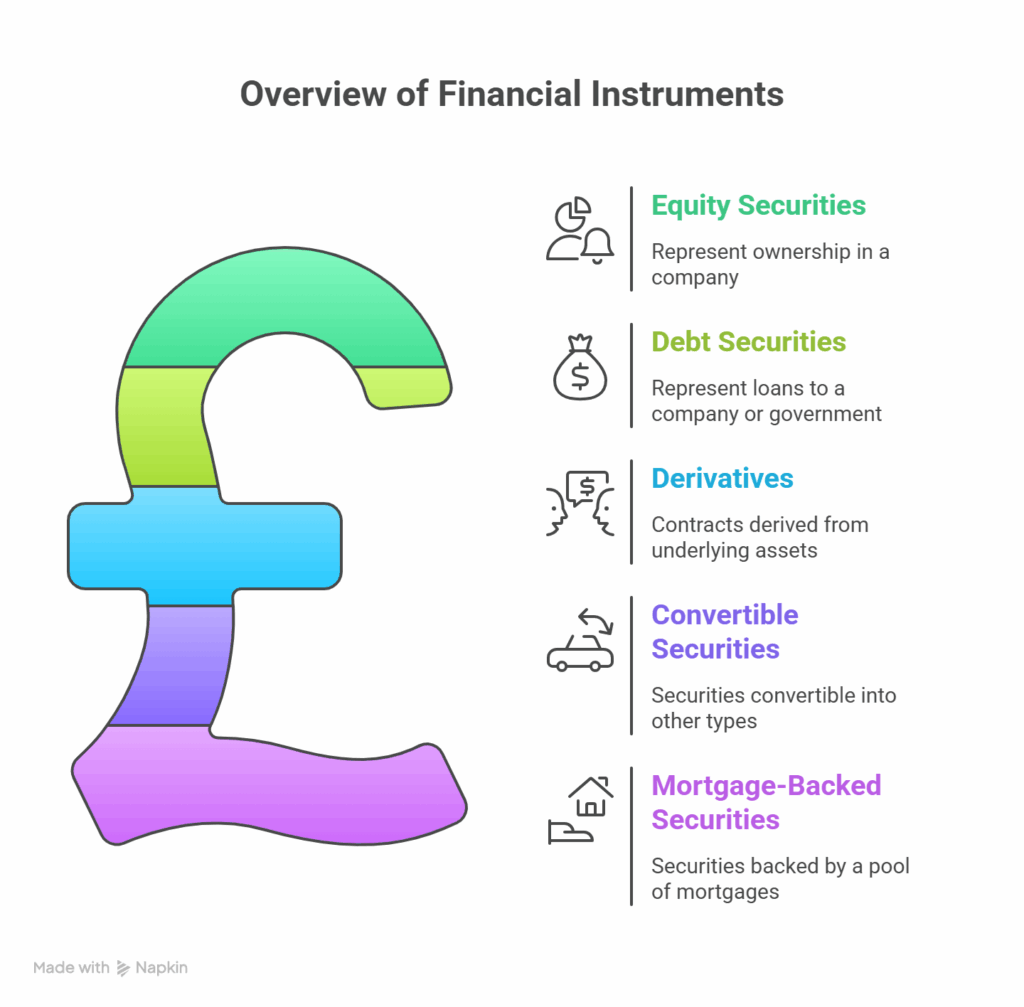

The Basics of Investment Banking

To make sense of the roles, firms, and career paths that follow, it helps to first understand what is investment banking? and why it carries so much weight in a city like Bangalore. At its core, investment banking is the service that helps companies raise capital and make high-impact financial decisions. These decisions range from entering new markets and acquiring businesses to preparing for a public listing. In a fast-growing city, these moments happen often, creating a steady and continuous flow of work for investment banking in Bangalore.

I like to think of it as a translator between two sides of the market. On one side, there are companies that need capital. On the other side, there are investors who want to invest money. The investment banker stands in between and ensures that both sides understand the value, the risk, and the opportunity.

What Investment Bankers Actually Do

The work becomes clearer when broken into simple tasks that you would see in day-to-day business situations.

- Help a startup raise funding from investors

- Advise a company that wants to acquire another business

- Estimate how much a company is worth before selling shares

- Prepare documents for companies planning to go public

- Support investors in choosing where to invest

These tasks form the backbone of work handled by investment banks in Bangalore across global firms, domestic firms, and boutique advisory teams.

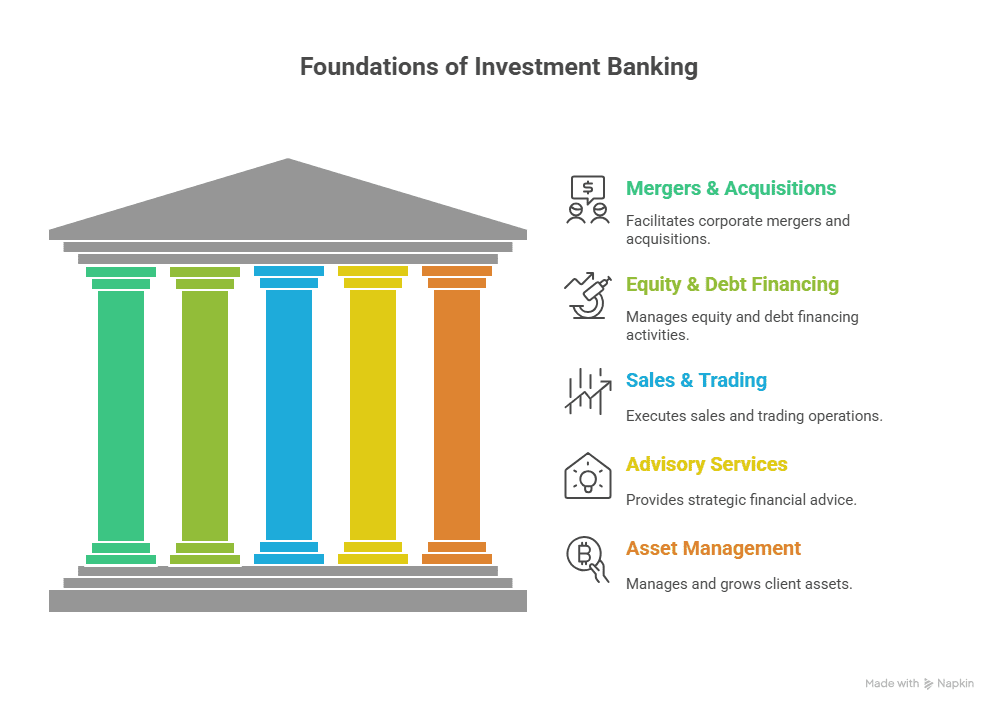

Core Functions in Investment Banking

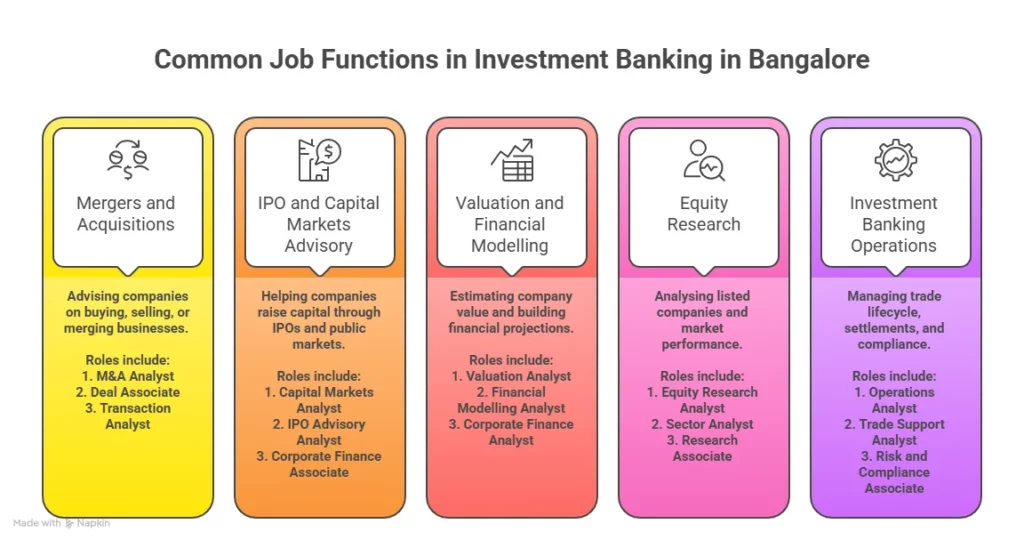

Below is a simple breakdown of the main functions handled by investment banking companies in Bangalore.

| Function | What It Means | Example in Bangalore Context |

| Capital Raising | Helping companies get funds | Startup raising venture capital |

| Mergers and Acquisitions | Buying or selling companies | Tech firm acquiring a smaller startup |

| Valuation | Finding a company’s worth | Pricing shares before an IPO |

| Financial Advisory | Strategic finance decisions | Expansion into a new market |

Each of these functions creates roles such as analysts, associates, and advisors, which later appear as investment banking jobs in Bangalore.

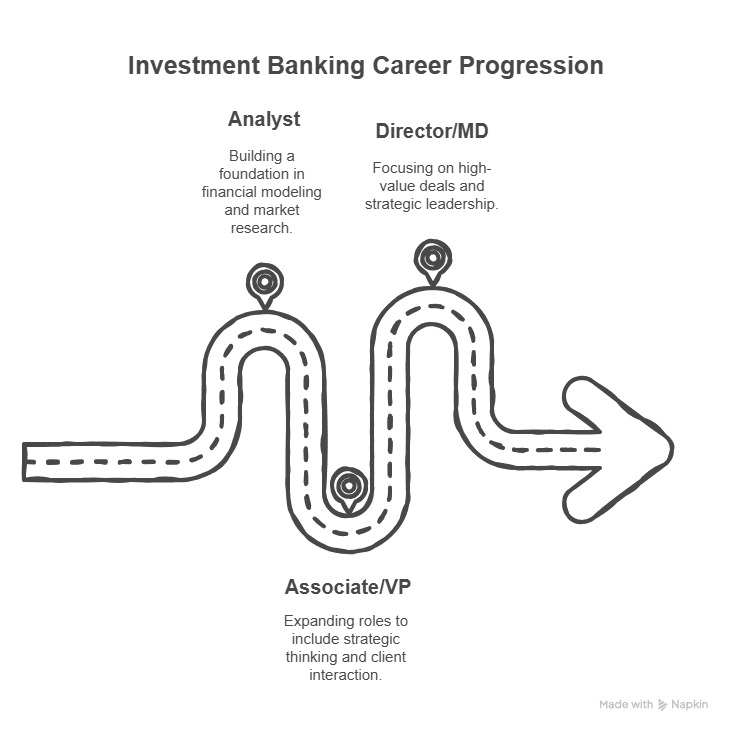

Types of Investment Banking Roles

To connect this with career paths, here are the common investment banking roles you will find across investment banking firms in Bangalore.

- Analyst

- Associate

- Vice President

- Director

Entry-level roles such as investment banking analyst jobs in Bangalore focus on research, modelling, and data analysis. Senior roles focus on client relationships and deal execution.

A clear understanding of what investment banking involves and how an investment banker contributes to deals makes the rest of the career path easier to grasp. A simple breakdown of roles, responsibilities, and day-to-day tasks helps connect the concepts of capital raising, valuation, and advisory work to the actual functions performed inside investment banking teams.

The Role of Investment Banking in a City Like Bangalore

At a basic level, investment banks help companies raise money and make strategic decisions. In Bangalore, this includes:

- Startups raising venture capital

- Companies planning IPOs

- Firms merging or acquiring others

- Businesses expanding to global markets

Because Bangalore has a large startup ecosystem, the role of investment banking companies in Bangalore is closely tied to venture capital and growth funding.

What Investment Bankers Actually Do

Think of a person buying a house. They need a loan, they compare options, they negotiate the price, and they complete documentation. Now scale that up to a company that wants to raise ₹500 crore. That is where investment bankers step in. Here are the core functions handled by investment banks in Bangalore.

Core Functions

- Capital Raising: Helping companies raise funds through equity or debt

- Mergers and Acquisitions: Advising on buying or selling businesses

- Valuation Services: Estimating the fair value of companies

- Financial Modelling: Building Excel models for the financial forecasting of company performance

- IPO Advisory: Preparing companies to go public

Each of these functions creates a wide range of investment banking jobs in Bangalore across analyst, associate, and operations roles.

Did you know?

According to a report, Bangalore hosts one of the highest numbers of funded startups in India. This directly increases the demand for deal advisory and financial modelling roles. (Source: 91SpringBoard)

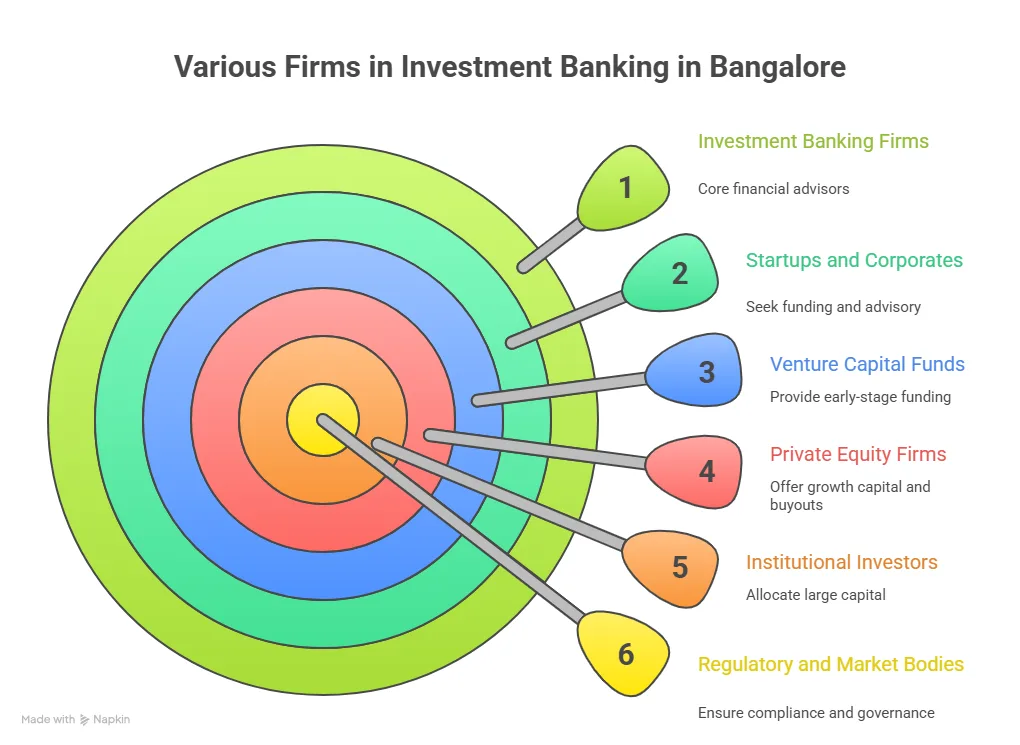

Types of Investment Banking Firms in Bangalore

The ecosystem of investment banking firms in Bangalore is diverse. You will find global banks, domestic firms, boutique advisory firms, and even investment banking startups in Bangalore.

- Global Investment Banks: These are large institutions with offices in Bangalore for research, analytics, and deal support. Examples include global firms that support M&A modelling and transaction research.

- Domestic Investment Banks: These firms focus on Indian markets and mid-market deals. They handle corporate finance, IPO advisory, and restructuring deals.

- Boutique Investment Banks: These are smaller firms that specialise in niche sectors such as technology, healthcare, or manufacturing. They are a key part of the list of boutique investment banks in Bangalore.

- Investment Banking Startups in Bangalore: These are new-age advisory firms that work closely with startups and founders. They often support seed funding, growth rounds, and investor relations.

List of Investment Banks in Bangalore

Before choosing an investment banking career path, it helps to understand the landscape. Below is a structured overview of the types of firms that make up the list of investment banks in Bangalore. This table shows categories of firms along with the kind of work they handle and the typical roles they hire for.

| Category | Nature of Work | Typical Roles |

| Global banks | Deal research, valuation, and modelling | Analyst, Associate |

| Domestic banks | IPO, M&A advisory | Analyst, Associate, VP |

| Boutique firms | Sector-focused deals | Analyst, Deal Associate |

| Startups | Fundraising and VC support | Analyst, Financial Associate |

This diversity is why the list of investment banking companies in Bangalore continues to grow year after year.

Top Investment Banking Companies in Bangalore

Many learners often search for the top investment banks in Bangalore before starting their career path. The city hosts both global and Indian firms that offer strong exposure. Below is a broad representation of the top 10 investment banking companies in Bangalore based on market presence and hiring activity.

- Global bulge bracket banks with research hubs

- Large Indian financial services firms

- Mid-size advisory firms

- Boutique M&A advisory firms

- Startup-focused financial advisory firms

These collectively form the top investment banking companies in Bangalore and contribute to a strong hiring ecosystem.

Also Read: Top Analytical Skills for Investment Banking Roles.

Investment Banking Jobs in Bangalore

One of the biggest reasons people explore investment banking in Bangalore is the variety of roles available.

Entry Level Roles

- Investment banking analyst jobs in Bangalore

- Investment banking operations jobs in Bangalore

- Financial modelling roles

Mid-Level Roles

- Associate roles

- Deal execution roles

- Corporate finance advisory

Senior Roles

- Vice President

- Director

- Partner roles

Because of the wide range of firms, there are steady investment banking job openings in Bangalore throughout the year.

Investment Banking Jobs in Bangalore for Freshers

Freshers often wonder if they can enter this field without experience. The answer is yes, but preparation is key. Typical entry paths include:

- Financial analyst roles

- Equity research analyst roles

- Deal support roles

- Internship conversions

Many students start with an investment banking internship in Bangalore and then transition into full-time roles.

Investment Banking Jobs in Bangalore for Experienced Professionals

Professionals with 2 to 5 years of experience can move into:

- Associate roles

- Transaction advisory

- Valuation consulting

- Corporate finance teams

There is a strong demand for candidates with modelling and valuation skills in investment banking openings in Bangalore.

Also Read: Who Earns More: Chartered Accountant or Investment Banker?

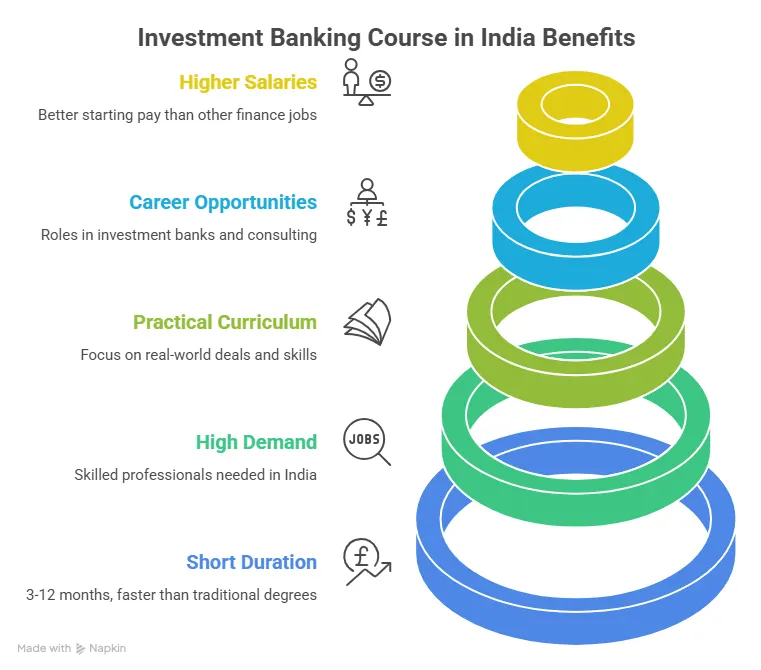

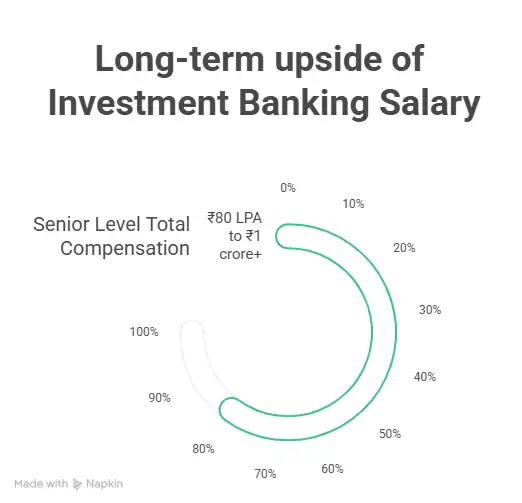

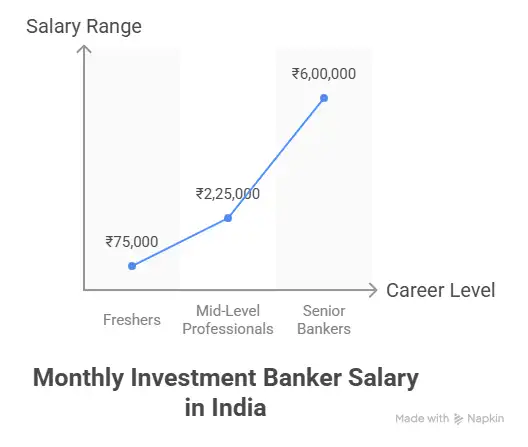

Investment Banking Salary in Bangalore

Salary is a major deciding factor for most career decisions. Investment banking salary in Bangalore depends on experience, skill set, and the type of firm.

The table below shows a realistic salary progression across roles.

| Role | Average Salary Range |

| Analyst | ₹8 -15 LPA |

| Associate | ₹15-30 LPA |

| Vice President | ₹30-70 LPA |

| Director | ₹70 LPA and above |

Bonuses can range from 20% to 100% of base pay, depending on deals. This makes investment banking salary in Bangalore one of the most attractive in finance careers.

Also Read: How Investment Banking Salaries Compare to Other Finance Jobs

How to Build a Career in Investment Banking in Bangalore

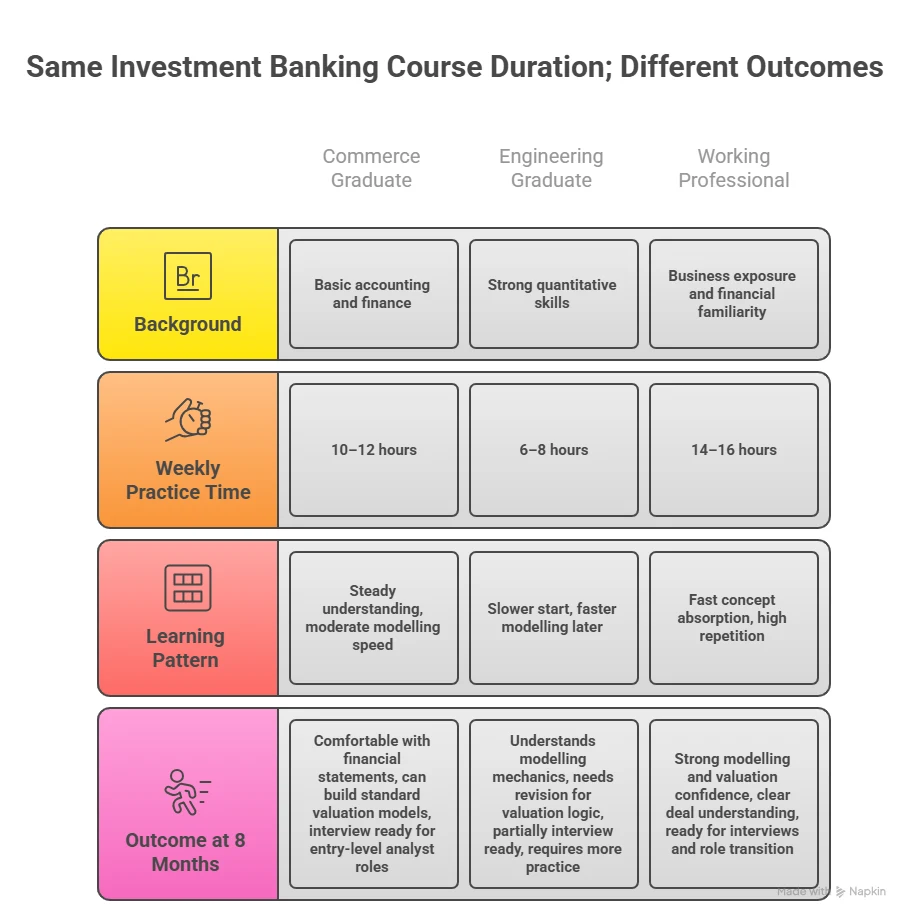

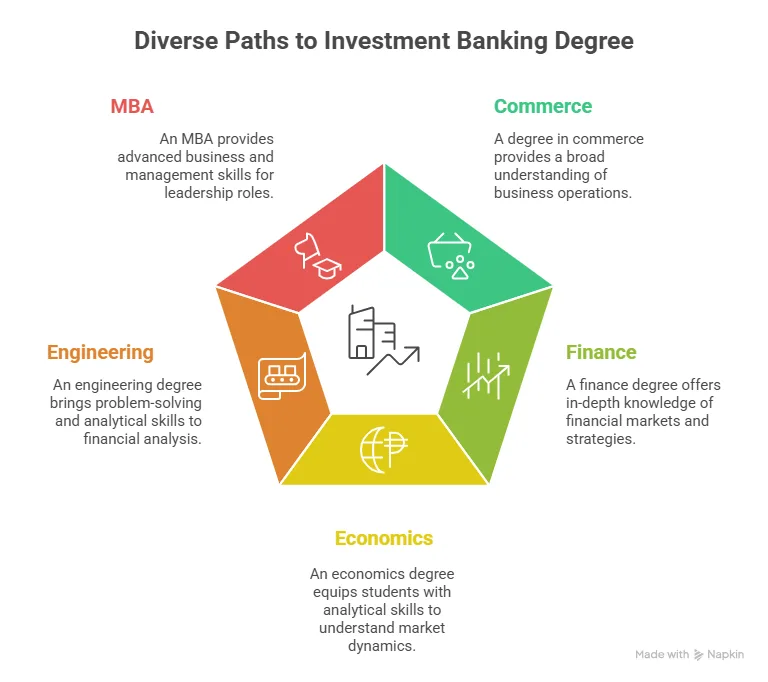

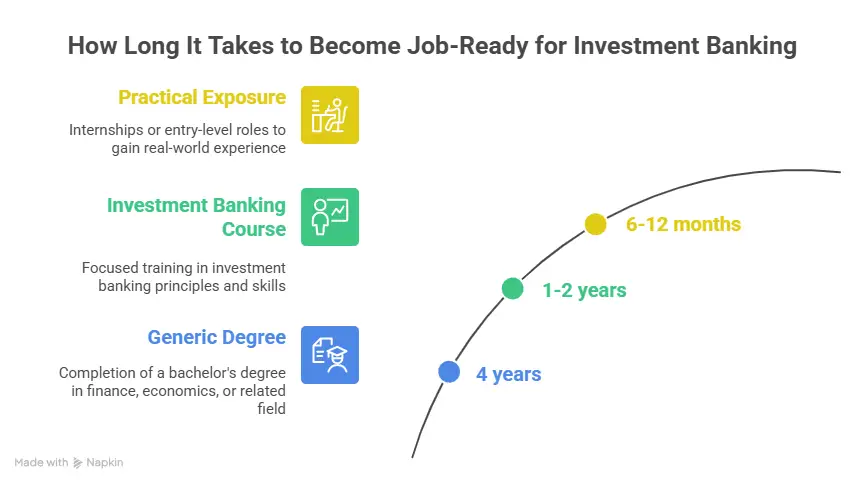

A career in finance often starts with a simple question. What path should I take after graduation? When I think about investment banking in Bangalore, I see a clear path that blends education, skill building, and exposure to real deals. I break this journey into four simple stages. Each stage builds on the previous one and moves you closer to investment banking jobs in Bangalore.

Step 1: Build the Right Academic Foundation

Most roles in investment banking companies in Bangalore look for graduates from:

- BCom

- BBA

- BA Economics

- BSc Finance

- Engineering with a finance interest

A strong base in financial accounting, corporate finance, and economics helps you understand business decisions. I often compare this to learning the rules of a sport before playing the match. Without the rules, the game feels confusing.

Step 2: Learn Core Investment Banking Skills

To work in investment banking firms in Bangalore, a candidate needs technical skills that are directly used on the job.

Key Skills

- Financial modelling in Excel

- Valuation methods such as DCF and comparable companies

- Accounting analysis

- Pitchbook preparation

- Data interpretation

These skills are used daily by analysts across investment banks in Bangalore when working on deals.

- Building revenue projections

- Estimating company value

- Preparing presentations for investors

- Supporting transactions for mergers and acquisitions

Learning these skills makes you ready for investment banking analyst jobs in Bangalore.

Step 3: Gain Practical Exposure

Theory alone does not create job readiness. Practical exposure builds confidence and understanding.

Ways to Gain Exposure

- Intern with a finance firm

- Work on live case studies

- Participate in valuation competitions

- Assist with startup fundraising projects

An investment banking internship in Bangalore is often the turning point for many candidates. Internships help you understand real deal timelines, client communication, and financial data handling.

Step 4: Apply for Entry Level Roles

After building skills and experience, candidates can apply for:

- Investment banking jobs in Bangalore for freshers

- Financial analyst roles

- Deal support roles

Many of these opportunities are listed under investment banking job openings in Bangalore across job portals and company websites.

Getting started in this field often feels overwhelming, especially when you are unsure about the exact steps to follow. A focused look at how successful candidates prepare, build their profiles, and approach applications can help simplify the path and show what it really takes to move from learning to landing an investment banking role.

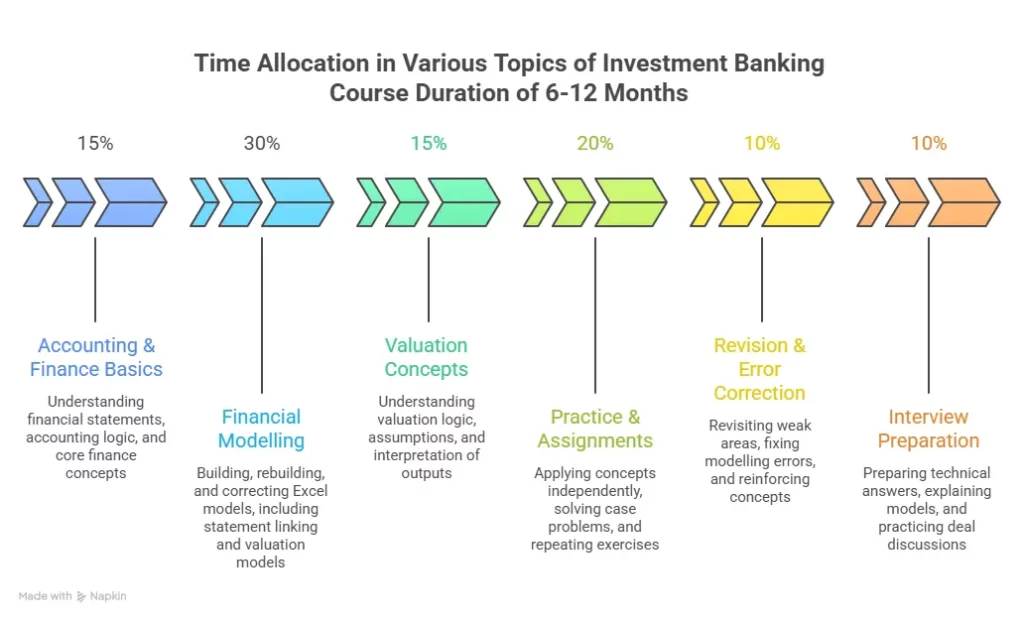

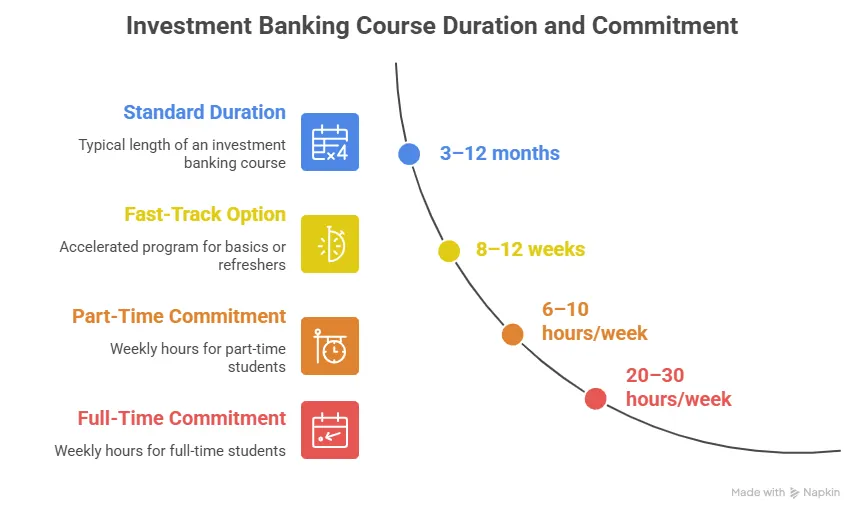

Investment Banking Courses in Bangalore

For those who want structured preparation, several investment banking courses in Bangalore focus on job readiness. These courses are designed to cover both theory and practical applications. I usually explain them as guided roadmaps that save time and reduce confusion.

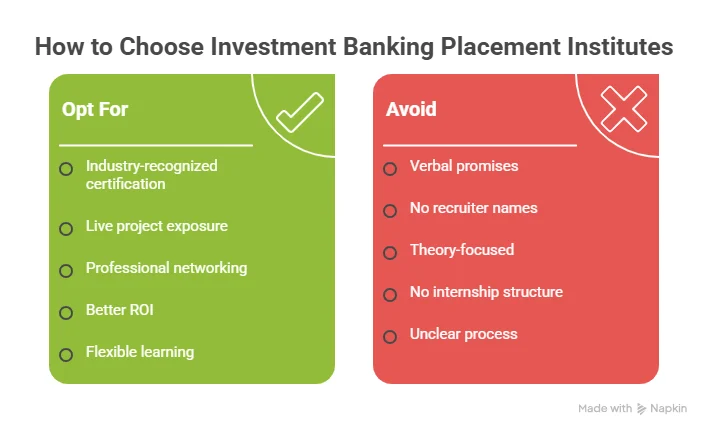

What to Look for in an Investment Banking Course

Before enrolling in any investment banking institute in Bangalore, it helps to check the key features. These features ensure that the course prepares you for real roles in investment banking companies in Bangalore.

- Industry-relevant curriculum

- Financial modelling training

- Live case studies

- Placement support

- Internship opportunities

Courses that offer investment banking training and placement in Bangalore tend to provide a smoother transition into jobs.

Investment Banking Training in Bangalore

Training programs focus on building hands-on skills that are used by analysts and associates.

Key Training Modules

- Excel for finance

- Financial statement analysis

- Company valuation

- Mergers and acquisitions modelling

- Pitchbook design

These modules prepare candidates for both front office and investment banking operations jobs in Bangalore.

Investment Banking Training and Placement in Bangalore

Placement support is one of the most important factors for students. Good institutes connect students with:

- Investment banking firms in Bangalore

- Boutique advisory firms

- Corporate finance teams

- Financial consulting firms

Programs that provide investment banking training and placement in Bangalore often include resume workshops, mock interviews, and company referrals.

Investment Banking Courses Fees in Bangalore

Course fees can vary based on duration, depth, and placement support. The table below gives a general idea of investment banking courses’ fees in Bangalore across different program types.

| Course Type | Duration | Approx Fees |

| Short-term certification | 2 to 3 months | ₹40,000 to ₹80,000 |

| Advanced certification | 4 to 6 months | ₹80,000 to ₹1.5 lakh |

| Diploma programs | 6 to 12 months | ₹1.5 lakh to ₹3 lakh |

The value of a course depends on placement support and practical exposure.

Also Read: Is an Investment Banking Course Worth the Fees?

How to Choose the Right Investment Banking Institute in Bangalore

Choosing the right institute can influence your career direction. I usually suggest evaluating institutes based on five parameters.

- Curriculum relevance

- Faculty experience

- Placement track record

- Industry connections

- Alumni outcomes

An investment banking institute in Bangalore that scores well on these factors can significantly improve your chances of landing investment banking jobs in Bangalore.

Daily Life of an Investment Banking Analyst

To understand the career better, it helps to know what a typical day looks like. I like to explain this with a simple daily schedule. A day in investment banking jobs in Bangalore usually includes:

- Reviewing financial statements

- Updating Excel models

- Preparing presentations

- Attending client calls

- Coordinating with senior bankers

Work hours can be long, especially during active deals. At the same time, the learning curve is steep, and the exposure is strong.

Interview preparation in this field often comes down to how clearly you can think through real-deal scenarios and explain financial logic in simple terms. A quick walkthrough of the most commonly asked investment banking interview questions helps you understand the kind of problems recruiters expect you to solve, the technical areas they test, and the way they evaluate your approach under pressure.

Investment Banking Operations Jobs in Bangalore

Not all roles involve front-end deal-making. Operations roles are also important. These include:

- Trade support

- Transaction processing

- Compliance

- Risk monitoring

Investment banking operations jobs in Bangalore offer stable career paths with structured work hours and steady growth.

Certifications That Support Investment Banking Careers

Some certifications can add value to your profile:

- CFA

- FRM

- Financial modelling certifications

- Corporate finance programs

These certifications improve your chances of getting shortlisted for investment banking analyst jobs in Bangalore.

Networking for Investment Banking Careers

Networking plays a key role in finance careers. Many investment banking openings in Bangalore are filled through referrals and industry connections.

Simple Networking Methods

- Attend finance events

- Connect on LinkedIn

- Join finance communities

- Participate in webinars

Building genuine relationships can lead to interview opportunities.

Also Read: Top Investment Banking Jobs for Freshers You Shouldn’t Miss

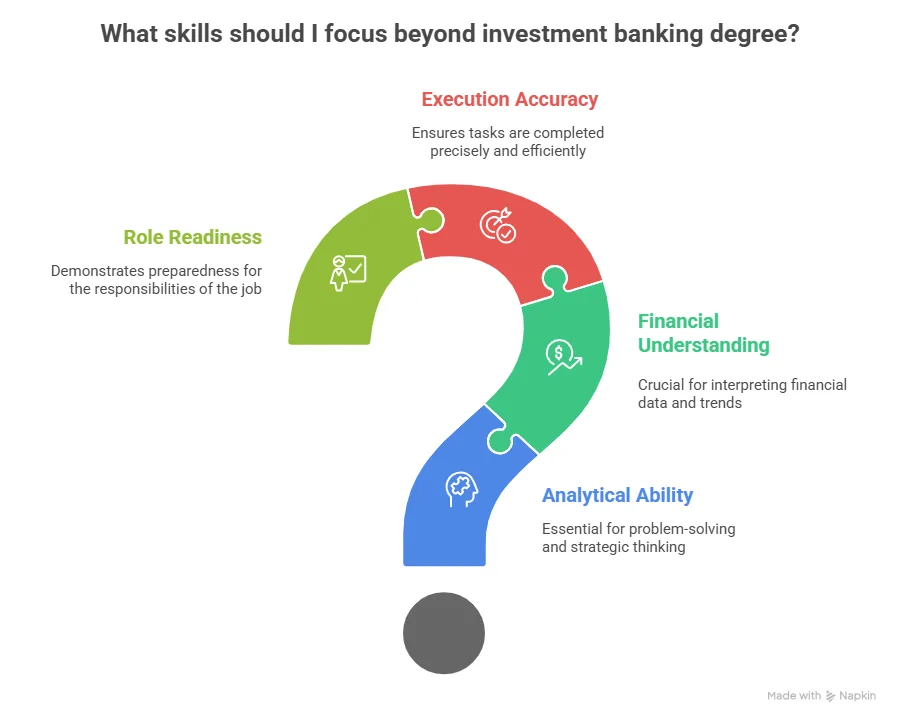

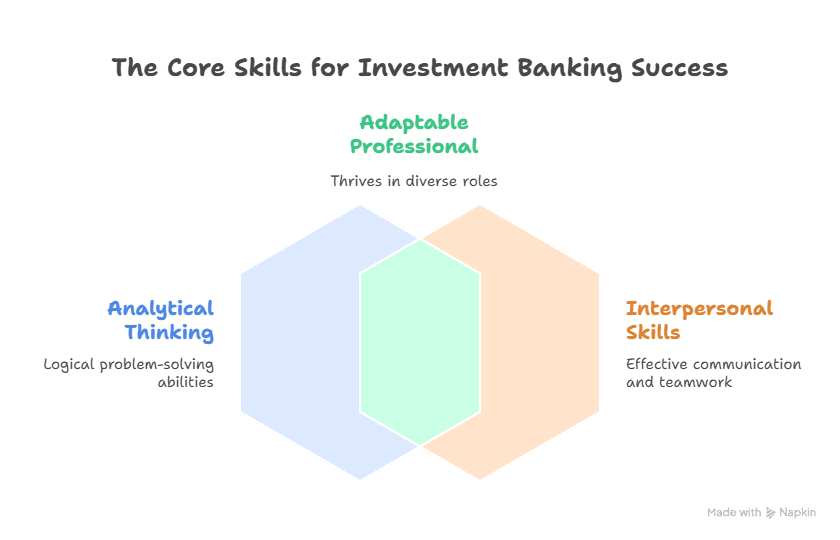

Key Skills for Long-Term Success

To grow in investment banking firms in Bangalore, certain skills become important over time.

Core Skills

- Financial analysis

- Business understanding

- Communication

- Negotiation

- Attention to detail

Advanced Skills

- Deal structuring

- Strategic thinking

- Leadership

- Client management

These skills help professionals move from analyst roles to leadership positions in top investment banking companies in Bangalore.

Building a Sustainable Career in Investment Banking

A long-term career in investment banking in Bangalore requires continuous learning.

Ways to Stay Relevant

- Learn new financial tools

- Stay updated with market trends

- Build professional relationships

- Work on diverse deals

This approach ensures steady growth across different roles.

Also Read: What is the Starting Salary Of An Investment Banker In India?

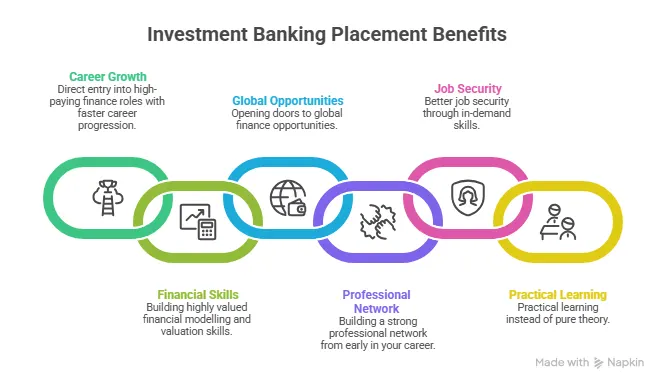

Why Imarticus Learning Stands Out for Investment Banking in Bangalore

Choosing the right training partner matters as much as choosing the right career. When someone is serious about building a future in investment banking in Bangalore, they usually look for a program that moves beyond theory and prepares them for real roles in financial institutions. This is where Imarticus Learning has built a strong reputation with its Investment Banking Course in Bangalore.

The program is designed to mirror the way work actually happens inside investment banks. It focuses on the trade lifecycle, securities, risk management, and operations that are used daily across investment banking companies in Bangalore. The structure is practical, structured, and aligned with hiring expectations.

Key Features of the Investment Banking Course

- 100% job assurance with interview opportunities: The program includes placement assistance with at least 7 guaranteed interview opportunities to help learners begin their careers with leading investment banking companies in Bangalore.

- Strong placement track record and salary outcomes: The course reports an 85% placement rate with salaries going up to ₹9 LPA for investment banking operations roles.

- Industry-aligned curriculum designed by experts: The curriculum is built by industry professionals and covers securities operations, wealth and asset management, financial markets, risk management, and AML concepts used in real jobs.

- Specialised learning pathways: Learners can choose focus areas such as securities operations or wealth and asset management operations, helping them specialise early in their career.

- Short-duration, high-impact program: The program is structured across 3 to 6 months, allowing learners to enter investment banking jobs in Bangalore quickly with focused skill training.

- Job-relevant skill development for operations roles: The program trains learners in trade lifecycle, financial markets, derivatives, and compliance, which are core skills for investment banking operations jobs in Bangalore.

This kind of structured preparation makes the transition from learning to working much smoother. For students who want to build a stable and well-defined entry into investment banking firms in Bangalore, a program like this offers a clear starting point.

FAQs on Investment Banking in Bangalore

Clear answers to the most frequently asked questions around investment banking in Bangalore help you make better career choices. This section brings together those doubts students and professionals often ask, with simple and practical explanations to guide your next steps.

Which college is best for investment banking in Bangalore?

When someone searches for the best college for investment banking in Bangalore, they are usually looking for a place that combines finance education with job readiness. A strong choice is an institute that focuses on practical finance skills, case studies, and placement support. Programs that include financial modelling, valuation, and deal exposure tend to create better outcomes. Imarticus Learning offer structured programs that align with the hiring requirements of investment banking companies in Bangalore.

What is the average salary of an investment banker in Bangalore?

Entry-level analysts usually earn between ₹8 lakh and ₹15 lakh per year, while associates and senior professionals can earn significantly more through bonuses and deal incentives. With experience and strong performance, professionals in top investment banking companies in Bangalore can see rapid salary growth over time, especially in deal-intensive roles.

Which are the best Investment Banks to work for in India?

The best investment banks to work for are usually those that offer strong deal exposure, learning opportunities, and growth paths. Global banks, domestic advisory firms, and boutique firms all provide different types of experience. For candidates interested in investment banking in Bangalore, many leading firms offer roles in deal advisory, research, and corporate finance. Training programs from Imarticus Learning can help candidates prepare for recruitment processes followed by these firms.

How do I get into investment banking as a fresher?

A fresher can enter investment banking in Bangalore by building a strong base in finance, learning financial modelling, and gaining internship experience. Completing a structured program from an investment banking institute in Bangalore helps in developing practical skills. Internships and case study projects improve employability. Imarticus Learning also provide placement support, which helps freshers access entry-level investment banking jobs in Bangalore for freshers.

Is 27 too late for investment banking?

Age is not a barrier to starting a career in investment banking in Bangalore. Many professionals switch careers after gaining experience in accounting, consulting, or corporate finance. What matters more is skill readiness, commitment, and willingness to learn. Candidates who build strong technical skills and industry knowledge can successfully transition into investment banking roles even in their late twenties.

Is a 3.6 GPA bad for investment banking?

A 3.6 GPA is generally considered a good academic score. For investment banking in Bangalore, recruiters evaluate a combination of academics, technical skills, internships, and communication ability. A strong profile with good grades, practical exposure, and certifications can improve chances of getting shortlisted for investment banking jobs in Bangalore.

Who earns more, CA or Investment Banking?

Income levels vary based on role and experience. Chartered Accountants and investment bankers both have strong earning potential. In investment banking in Bangalore, compensation often includes bonuses linked to deal performance. Over time, professionals in top investment banks in Bangalore may earn higher variable pay due to deal-based incentives.

What skills are needed for investment banking?

A successful career in investment banking in Bangalore requires a mix of technical and soft skills. Technical skills include financial modelling, valuation, and accounting analysis. Soft skills include communication, attention to detail, and problem-solving. Structured training programs from Imarticus Learning can help candidates build these skills in a practical way that matches the hiring expectations of investment banking firms in Bangalore.

Building a Strong Future in Investment Banking in Bangalore

Investment banking in Bangalore offers a unique combination of opportunity, exposure, and growth. The city’s startup ecosystem, global financial presence, and strong talent base create a dynamic environment for finance professionals. A career path in investment banking in Bangalore jobs builds step by step through knowledge, practice, and real exposure to how deals move from idea to execution. The city offers the right environment for this journey.

The path can feel complex at first. Once the basics of finance are clear, the direction becomes easier to follow. Learning financial modelling, understanding valuation, and gaining deal exposure creates a strong base. From there, internships and entry-level roles open the door to deeper experience across investment banking companies in Bangalore.

For students and early professionals, the smartest move is to combine learning with practical application. Structured programs, guided projects, and placement support can shorten the learning curve and make the transition into Investment Banking in Bangalore more direct. This is where choosing the right learning partner makes a difference. A program that aligns with industry expectations and offers real case exposure can help you move from theory to job readiness in a clear and focused way.